Invest Lump Sums the Smart Way: Use STP on Groww

Have you ever received a bonus, or a lump sum and wondered how to invest it wisely? Or maybe you have thought about moving from one mutual fund to another but worried about market volatility? Investing all at once can feel risky, and switching funds in a single step may expose you to sudden market swings.

That’s where a Systematic Transfer Plan (STP) comes in. Introducing STP on Groww, where you can transfer money gradually from one mutual fund scheme to another, making your investment journey smoother.

What is STP?

A Systematic Transfer Plan (STP) allows you to transfer an approximately fixed amount at regular intervals from one mutual fund scheme (the source fund) to another (the target fund) — both of which must belong to the same AMC. The transfer amount is not always exactly the same, because it depends on the NAV (Net Asset Value) of the source scheme on the transfer date.

Instead of moving your money in one go, STP breaks it into smaller instalments. This helps in:

- Rupee cost averaging: Buying more units when prices are low and fewer when prices are high.

- Managing volatility: Reducing the risk of entering the market at the wrong time.

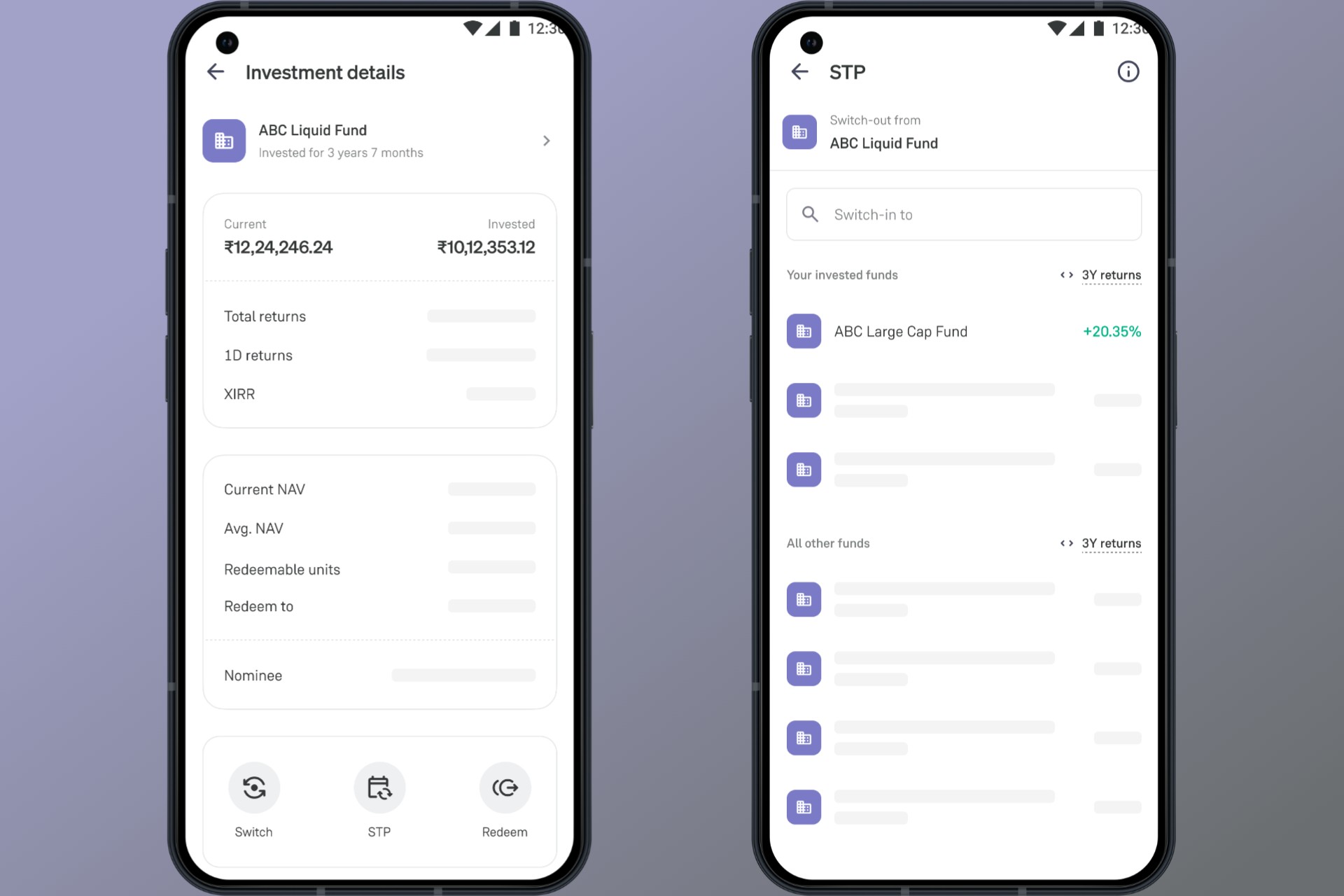

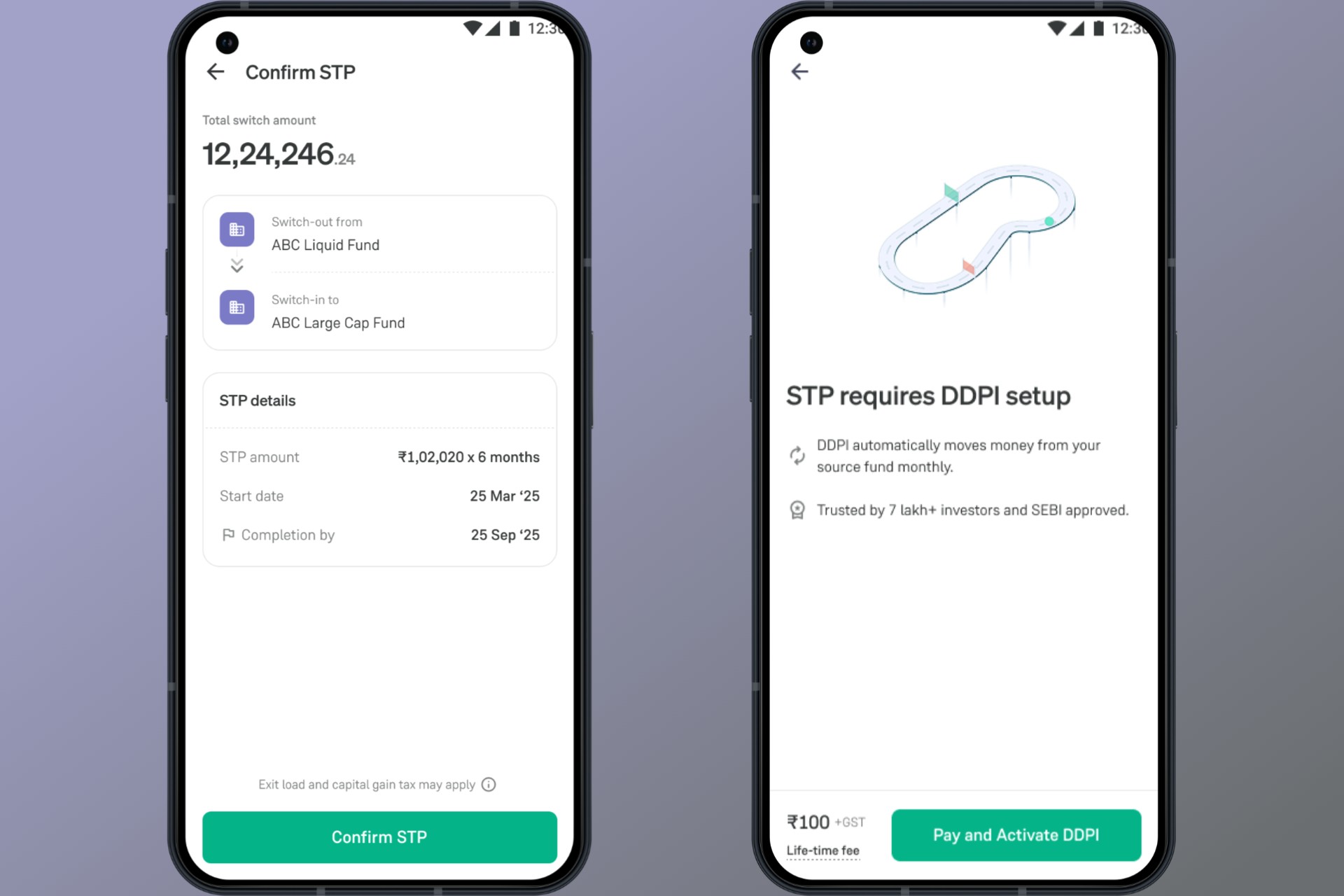

How to Set Up an STP on Groww?

Getting started is quick and simple:

- Go to your Dashboard → open Investment Details of your fund.

- Tap on STP.

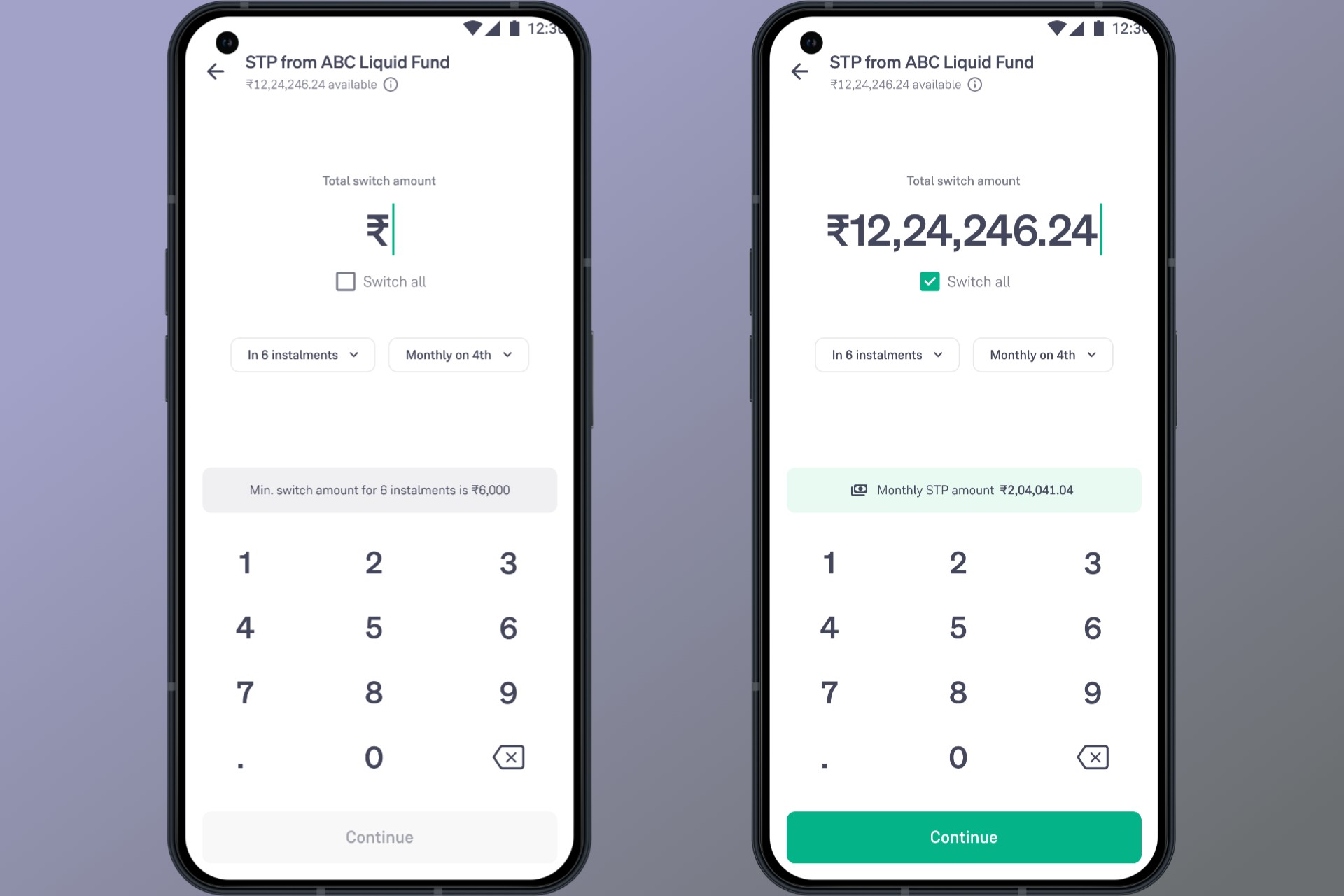

- Select your target fund and enter the transfer amount.

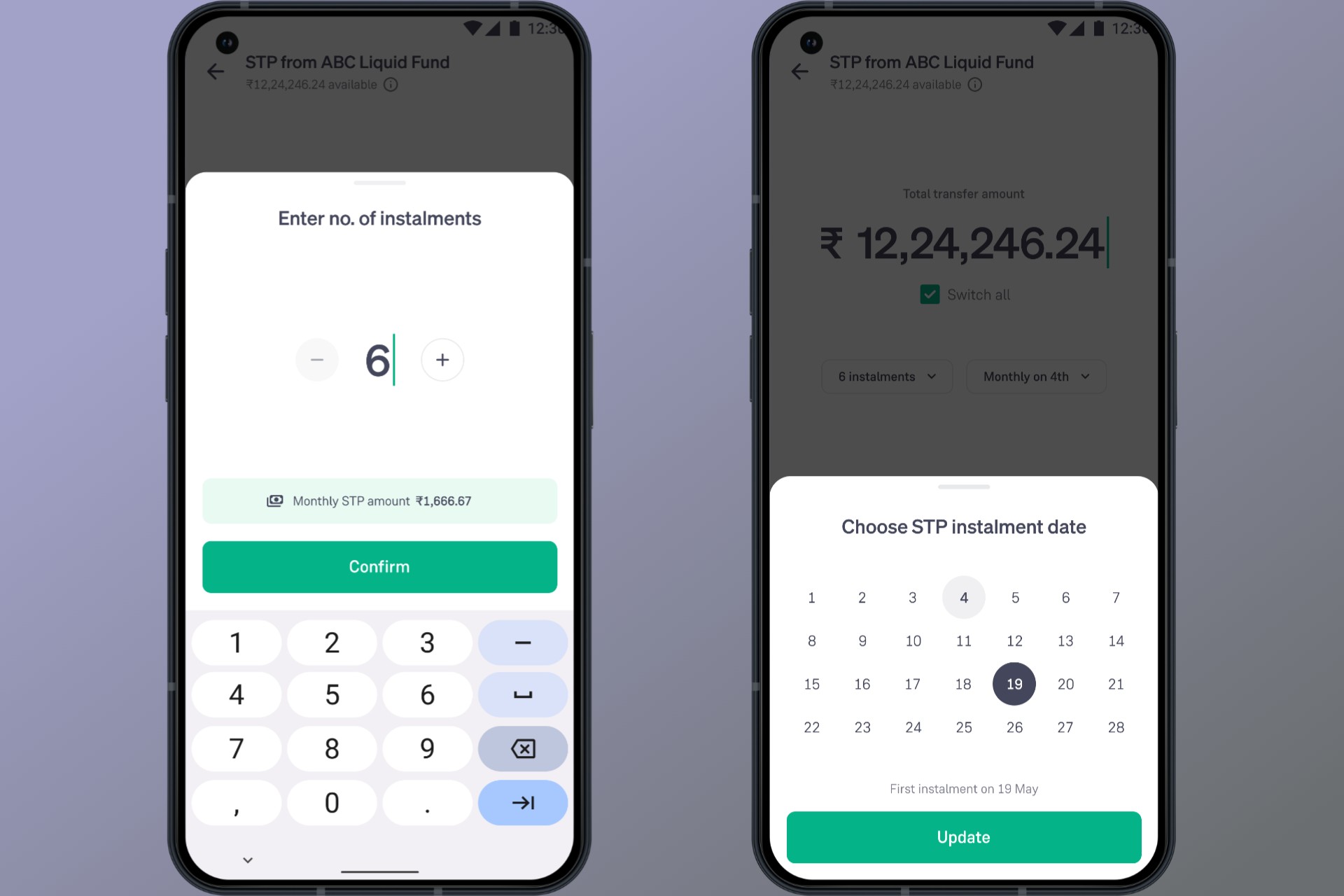

- Choose the number of installments and the transfer date.

- Confirm the setup and enable DDPI (mandatory for STPs).

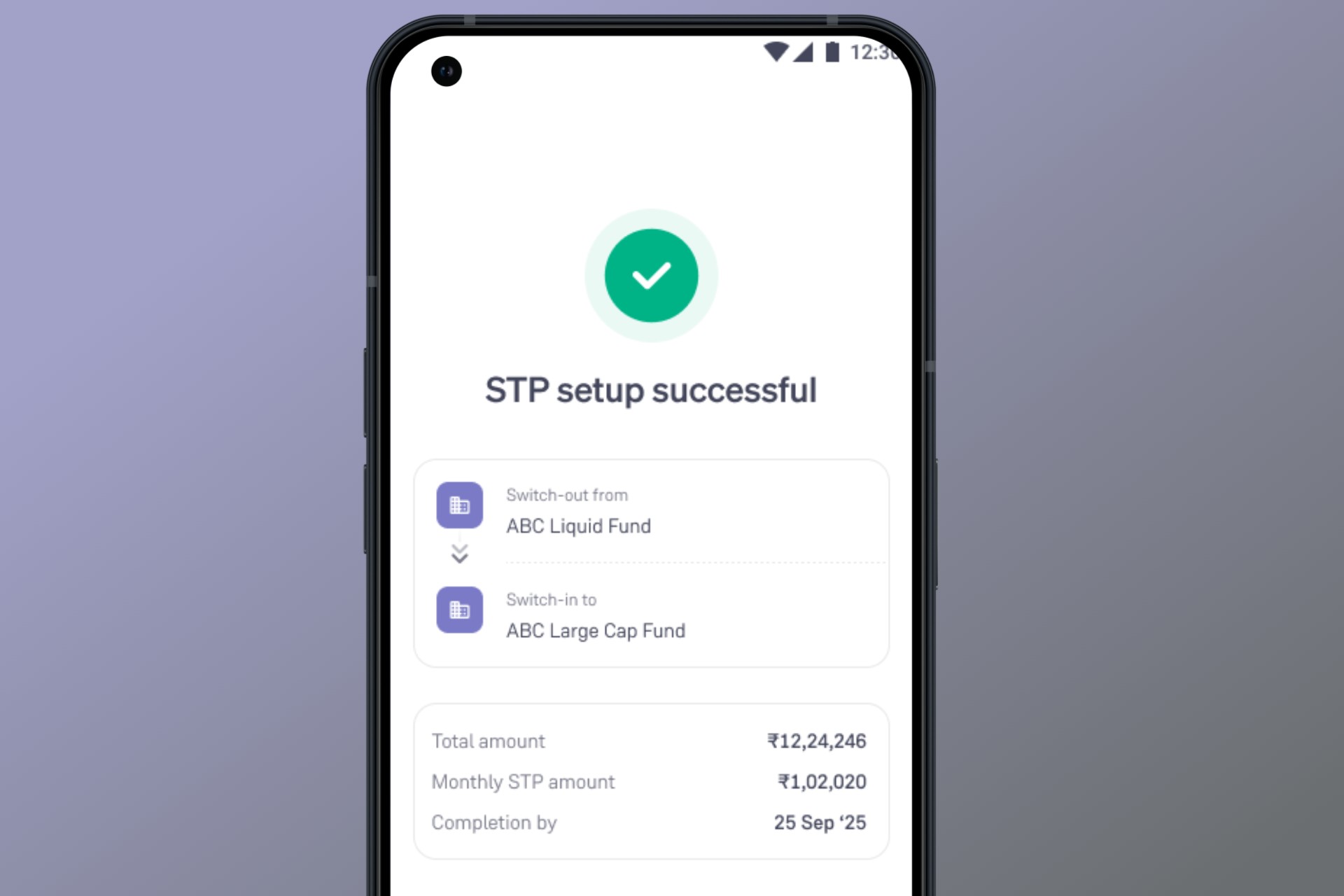

- Done. Your STP is now active.

Charges for Using STP

While setting up STP, here are the costs to keep in mind:

- Exit load & STT: Levied by the AMC on each transfer from the source fund (depends on scheme rules and how long you’ve held units).

Which Funds Can Be Used for STP?

- Both source and target funds must belong to the same AMC.

- You must already hold units in the source fund.

- Not all schemes allow STPs—the availability depends on AMC policies.

When Should You Use an STP?

You can opt for an STP in situations like these:

- Investing a lump sum: Park money in a debt/liquid fund and move it gradually into equity.

- Post lock-in transfers: When units from locked-in schemes (like ELSS) become free, transfer them systematically into another scheme.

- Switching schemes: Shift from a poor-performing fund to a better one without exposing your full investment to sudden market fluctuations.

Investing isn’t just about choosing the right fund, it is also about how you enter and exit the market. STPs on Groww give you a smarter way to move your money, protect against market volatility, and ensure timely allocation over time.

So, whether you have received a lump sum, want to rebalance your portfolio, or simply prefer a gradual approach—STP is here to make your investing journey smoother.

Set up your first STP on the Groww app today!

Happy Investing!

- Team Groww