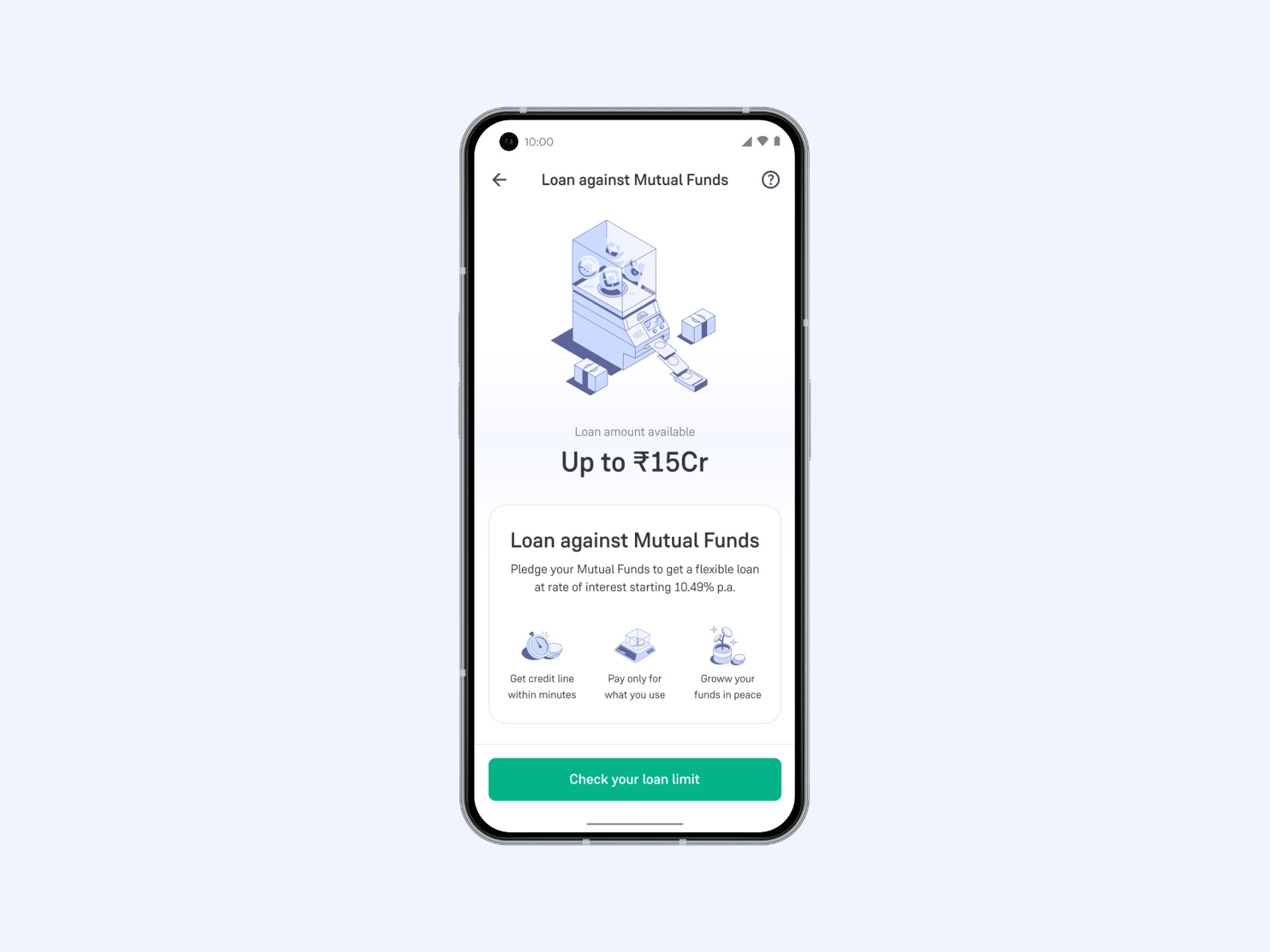

Now Live: Loan against Mutual Funds on Groww Credit

Hello users,

Have you ever been in an emergency situation where you need a quick source of funds? Maybe a sudden medical bill, your child’s education fee, a home renovation or maybe capital needs for your business.

There are multiple scenarios where we all can end up in need of an urgent emergency fund.

During such times, many investors consider redeeming their mutual funds to meet urgent financial needs. But doing so can may trigger capital gains tax (STCG of 20% or LTCG of 12.5%) on your redeemed units, and if the market happens to be low, you might have to sell your investments at an unfavourable time, missing out on potential future gains.

So, what if you could get access to funds without selling your investments?

That’s exactly what Loan against Mutual Funds makes possible.

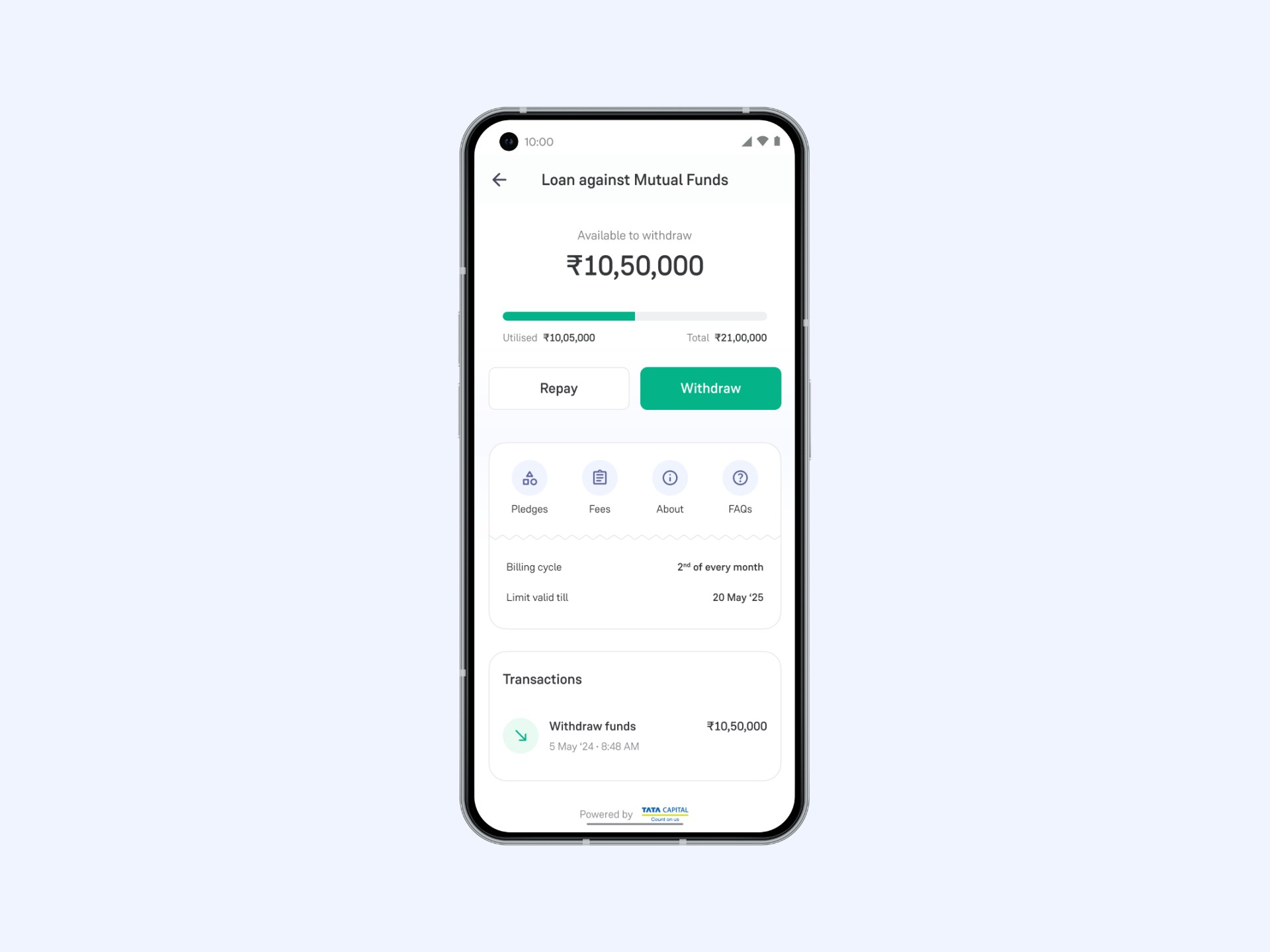

With Loan against Mutual Funds on Groww Credit, you can now pledge mutual fund holdings to get a line of credit, while your investments continue to stay active and earn returns.

What is Loan against Mutual Funds?

A Loan against Mutual Funds is a type of loan against securities (LAS) where you pledge your mutual fund units as collateral to borrow money from banks, NBFCs, or financial institutions. Instead of redeeming or selling your investments, you can raise funds quickly while your mutual funds remain invested in the market. This way, you continue to benefit from compounding and potential market growth.

Why Choose Loan against Mutual Funds on Groww Credit?

1. Continue earning returns on your investments

When we need short-term funds, we often tend to sell our mutual fund holdings. But that interrupts the compounding journey. With Loan against Mutual Funds, your mutual funds are pledged (not sold), so you continue earning returns on them.

For a long-term investor, this is crucial as it ensures you remain invested in the market without breaking your portfolio, which is better for long-term wealth creation.

For example: If you have invested ₹5 lakh in equity funds for retirement and need ₹2 lakh urgently, redeeming breaks your compounding and triggers capital gains tax. With Loan against Mutual Funds, you simply pledge and borrow ₹2 lakh, while your entire investment stays intact and keeps growing.

2. Save on capital gains tax

When you redeem a mutual fund, you pay capital gains tax (short-term or long-term depending on holding period). Currently, Short-Term Capital Gains (STCG) on equity mutual funds are taxed at 20%, while Long-Term Capital Gains (LTCG) are taxed at 12.5%. With Loan Against Mutual Fund, there’s no redemption and hence, no capital tax to be paid.

3. Lower interest compared to other loans

Personal loans often start at 13–15% interest rate. While, Loan against Mutual Funds offers funds at a lower rate of interest, helping you save on borrowing costs.

4. Create a credit line of Rs. 15 Cr and repay anytime within the tenure

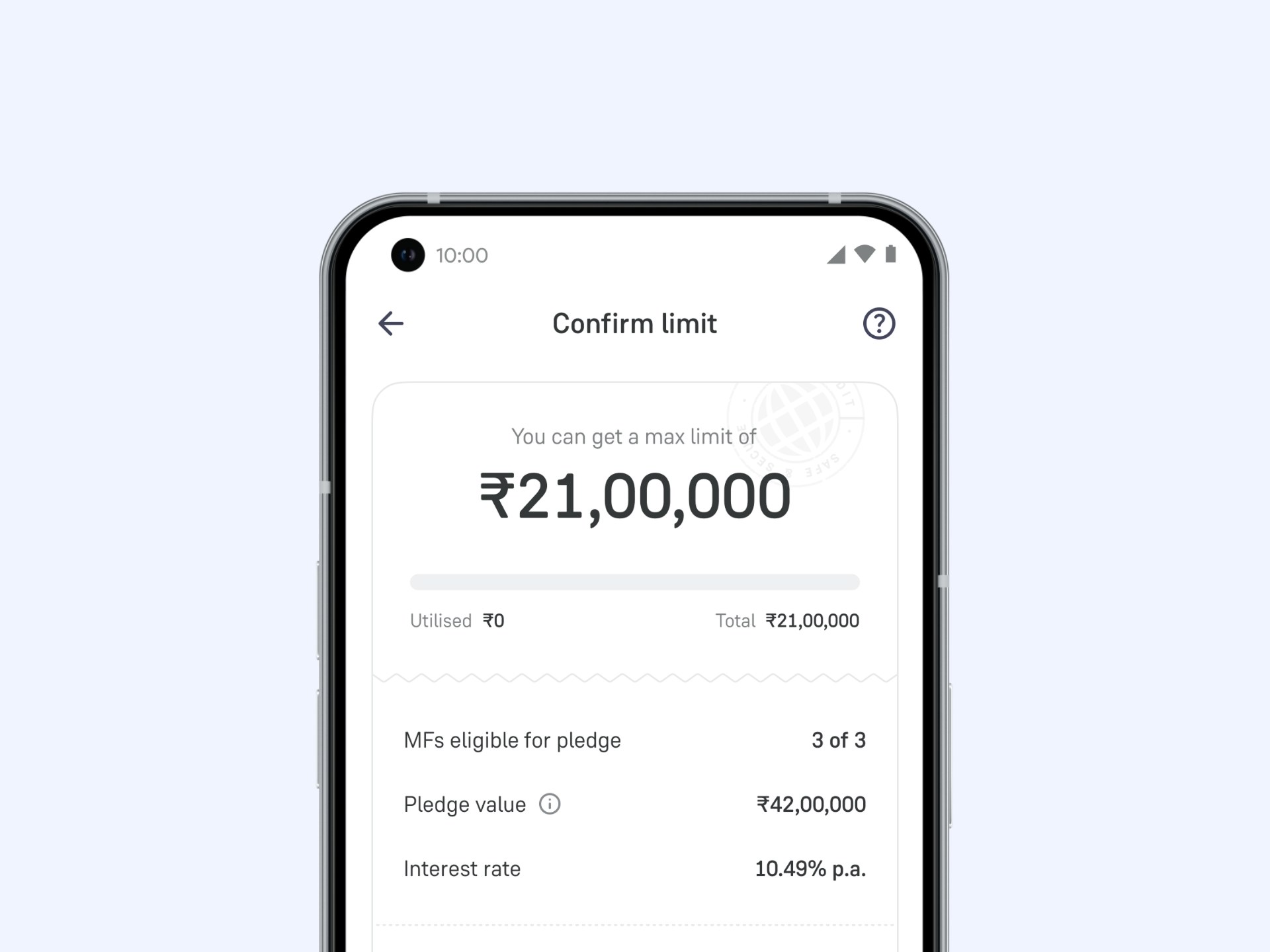

- Groww Credit provides an Loan against Mutual Funds of up to Rs. 15 Cr. However, the credit line that the user gets depends on the amount and type of funds they have.

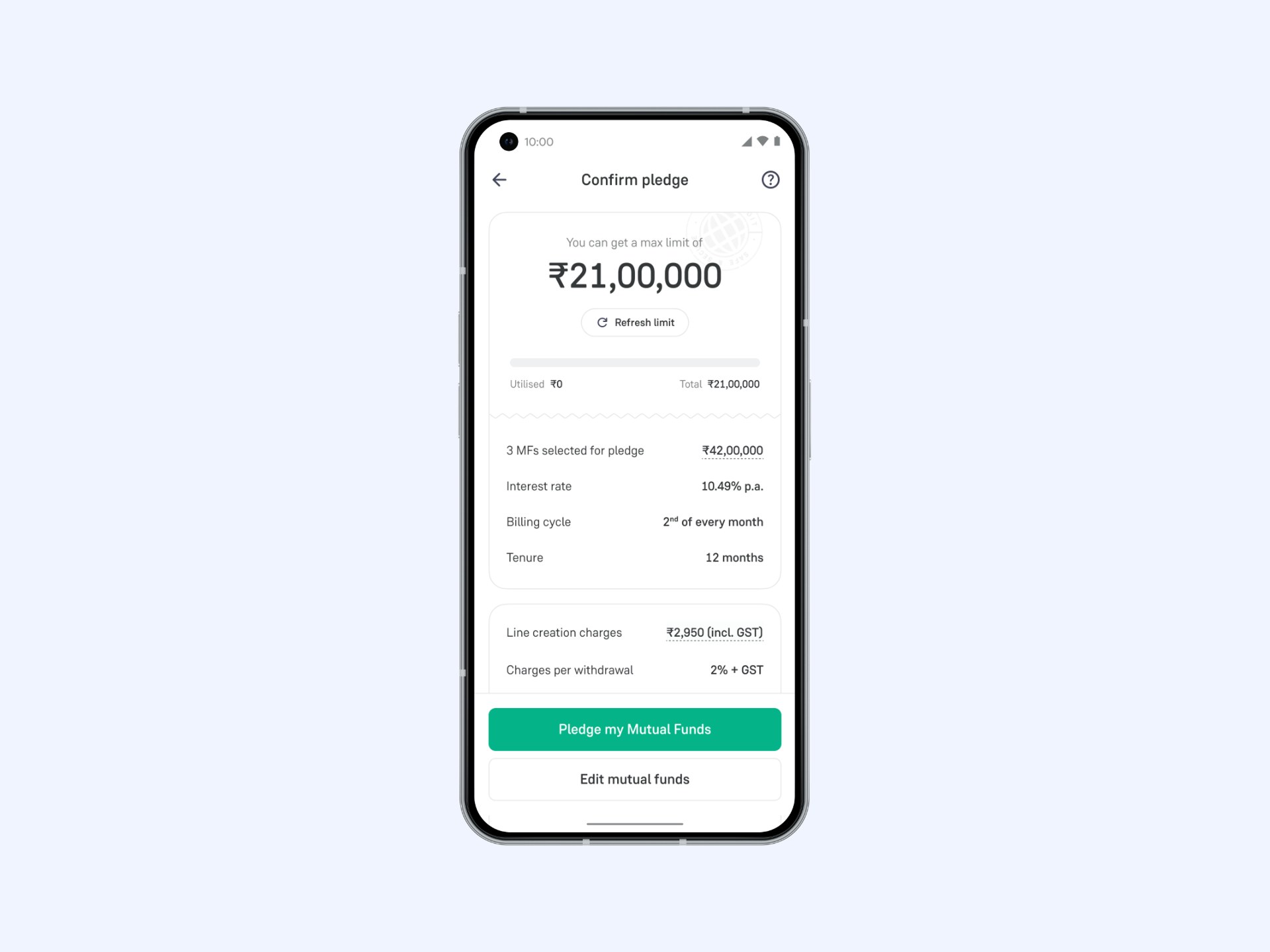

- Withdraw and repay any number of times within a time period, as mentioned in the conditions of your loan. Your credit line stays active.

- Pay interest only on what you withdraw and only for the number of days you use it. Whether you borrow for a day, a month, or longer, you pay interest just for that period and not on your entire approved credit limit.

5. Freedom to pledge only what you choose

You don’t need to pledge your entire portfolio. Pick specific funds and amounts to pledge. Once your credit line is created, you can withdraw from it anytime within the next 12 months. The credit limit is determined by the type of funds you pledge — you can get up to 50% of the value on Debt Funds and up to 95% on Equity Funds.

6. Simple, fast, transparent

- Entire process is 100% digital

- Loan approval and disbursal within minutes

- No hidden charges

How to Get Started?

Applying for Loan against Mutual Funds on the Groww Credit app is quick and seamless. Here’s how it works:

Step 1: Download Groww Credit

Sign-in using your Groww-linked email id. If you don't have a Groww account - Signup.

Fetch your mutual funds to check your eligibility for LAMF. View your loan offer.

Step 2: Select the Mutual Funds you want to pledge

Once your funds are fetched, select the mutual funds you want to pledge. And enter the amount you want to pledge them in.

Step 3: KYC, Bank Mandate set-up & Pledge success

Complete your Video KYC and Bank mandate set-up. Here you will get an option to Pledge your mutual funds.

Step 4: Loan Creation & Withdrawal

After successfully pledging your funds, your credit line is created. Withdraw anytime from this credit line - within the tenure. The interest is charged only on the amount withdrawn - and the time duration it was withdrawn for. Repay the principal amount anytime within the next 12 months - on the Groww Credit app.

With Loan against Mutual Funds on Groww Credit, you don’t need to choose between meeting immediate needs and staying invested. You can do both, get liquidity when required and let your portfolio continue to grow.

Whether it’s for personal needs, business opportunities, or emergencies, Loan against Mutual Funds offers you a smarter, cheaper, and faster alternative to traditional loans.

➡️ Check your loan eligibility today on the Groww Credit app.

Frequently Asked Questions

1. What is a Loan against Mutual Funds?

A Loan against Mutual Funds is a secured loan where you use your mutual fund investments as collateral to borrow money. This allows you to access funds without selling your investments.

2. How much can you borrow against mutual funds?

The loan amount you can borrow against your mutual funds typically ranges from 50% to 90% of their current value. The exact percentage depends on the lender's policies and the type of mutual funds you have.

3. What happens to my funds after taking a loan?

When you take a loan, your mutual fund units are used as collateral by the lender. You still own them and benefit from any growth or income. However, you can't redeem or transfer them until you repay the loan. If the value of your funds drops significantly, you might need to provide more collateral or pay back part of the loan.

4. What types of funds can be used as collateral?

"Typically, you can use the following types of funds as collateral:

- Equity Mutual Funds

- Debt Mutual Funds

- Hybrid Funds

However, please note that ELSS funds or any funds with a lock-in period cannot be pledged as collateral.

5. Do I have to pay interest on the line amount?

You only need to pay interest on the amount you've actually withdrawn or used from the loan. Interest is charged based on the outstanding balance, not the total loan limit.

6. Can I withdraw again once I have repaid the whole amount?

Yes, once you repay the full amount or part of it, your available limit will be updated. You can then withdraw up to the refreshed limit.

7. What is the tenure of a loan?

The loan limit against your mutual funds has a tenure of 12 months. It can be renewed afterward without repaying the principal.

8. What is shortfall?

A shortfall occurs when the value of your pledged mutual funds falls below the required collateral value or the amount outstanding. This means there is a gap between the value of the pledged assets and the withdrawn amount, potentially leading to a need for additional collateral or partial repayment.