Meet the New ETF Screener on Groww: A Smarter Way to Explore Your ETFs

Ever looked at a long list of ETFs and thought, “Which ETF has the highest returns?”

“ Which one is the most liquid?”

“How close is the ETF tracking the respective index?”

You are not alone because picking the right ETF can feel tricky.

At Groww, we want to make this journey simpler and smarter.

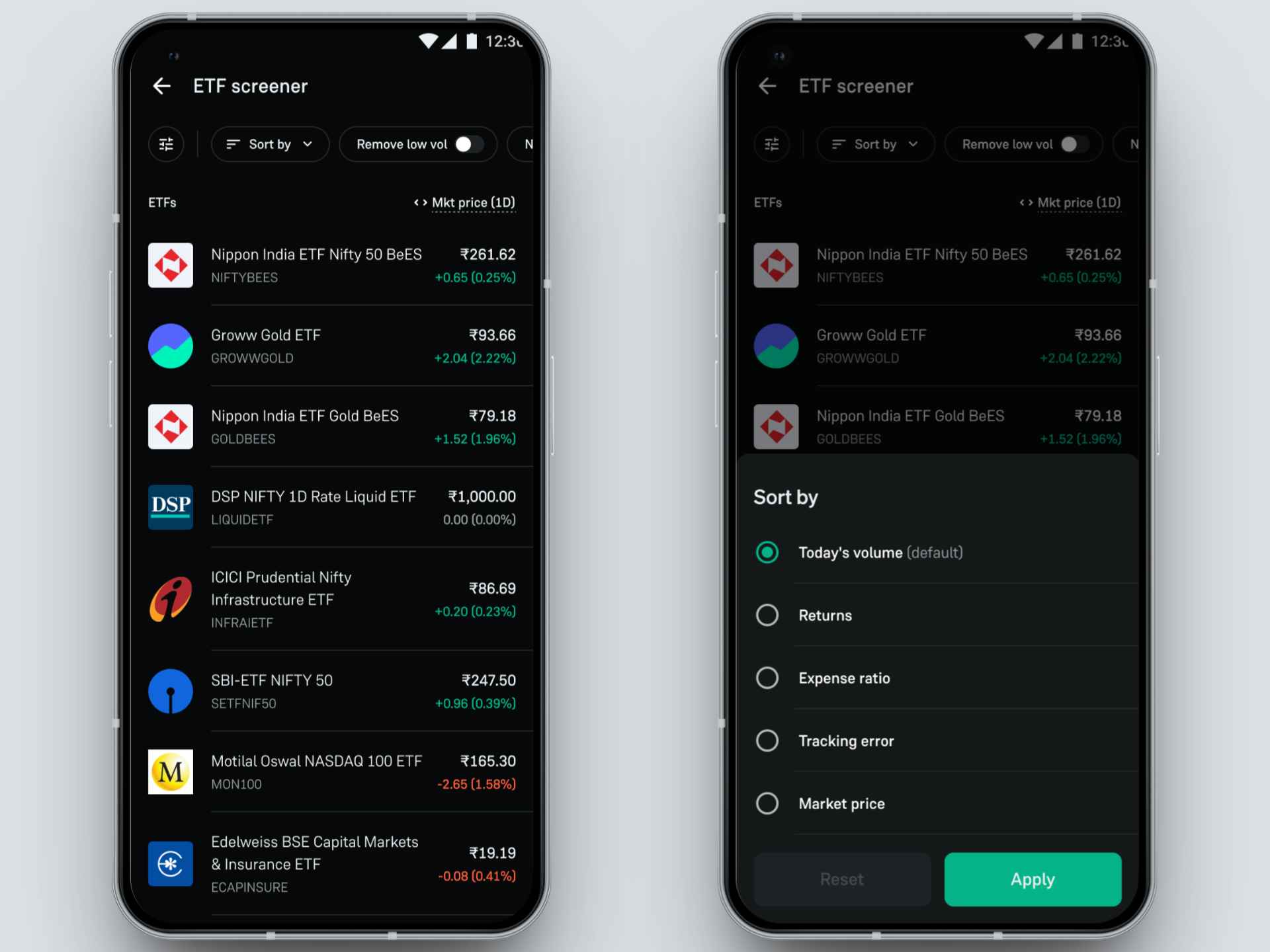

Introducing the all-new revamped ETF Screener, where you get advanced filters, smarter sorting, and powerful insights. All designed to make ETF investing simpler, faster, and clearer.

Why We Revamped the ETF Screener?

The revamped ETF Screener aims to provide users with advanced filtering and sorting capabilities, enabling them to choose ETFs aligned with their investment goals across parameters like performance, risk, liquidity, and diversification.

What’s New? - Feature Highlights

We didn’t just refresh the interface, we rebuilt the ETF Screener to give you more control, better visibility, and richer data. Here’s a closer look:

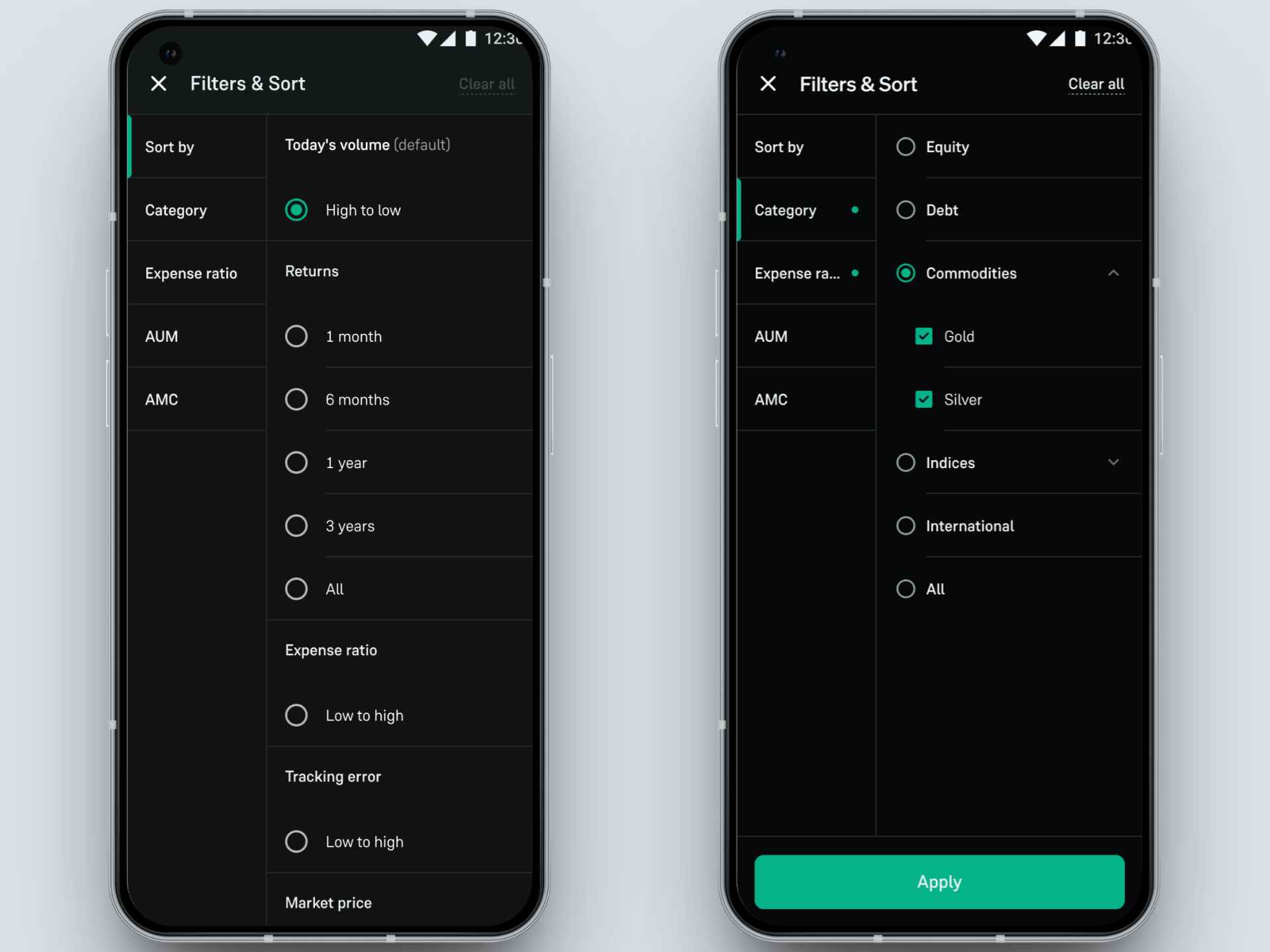

1. Advanced Filters for Smarter Selection

Previously, the ETF screener had no filtering tools, making it hard to narrow down ETFs. Now, you can filter ETFs based on:

- Performance → See returns across multiple timelines (1Y, 3Y, etc.) to compare historical performance.

- Liquidity → Filter by daily trading volume to avoid ETFs with low participation, which are harder to buy or sell.

- Risk metrics → Use filters like AUM tiers and tracking error to understand stability and risk.

- Diversification → Quickly view ETFs by category: Equity, Debt, Gold, or International.

Example: Looking for a gold ETF with high liquidity and low tracking error? You can now apply multiple filters and find it in seconds.

You also get Quick Filters for one-tap access:

- Remove low-volume ETFs

- NIFTY 50 ETFs

- Gold ETFs

- Debt ETFs

- International ETFs

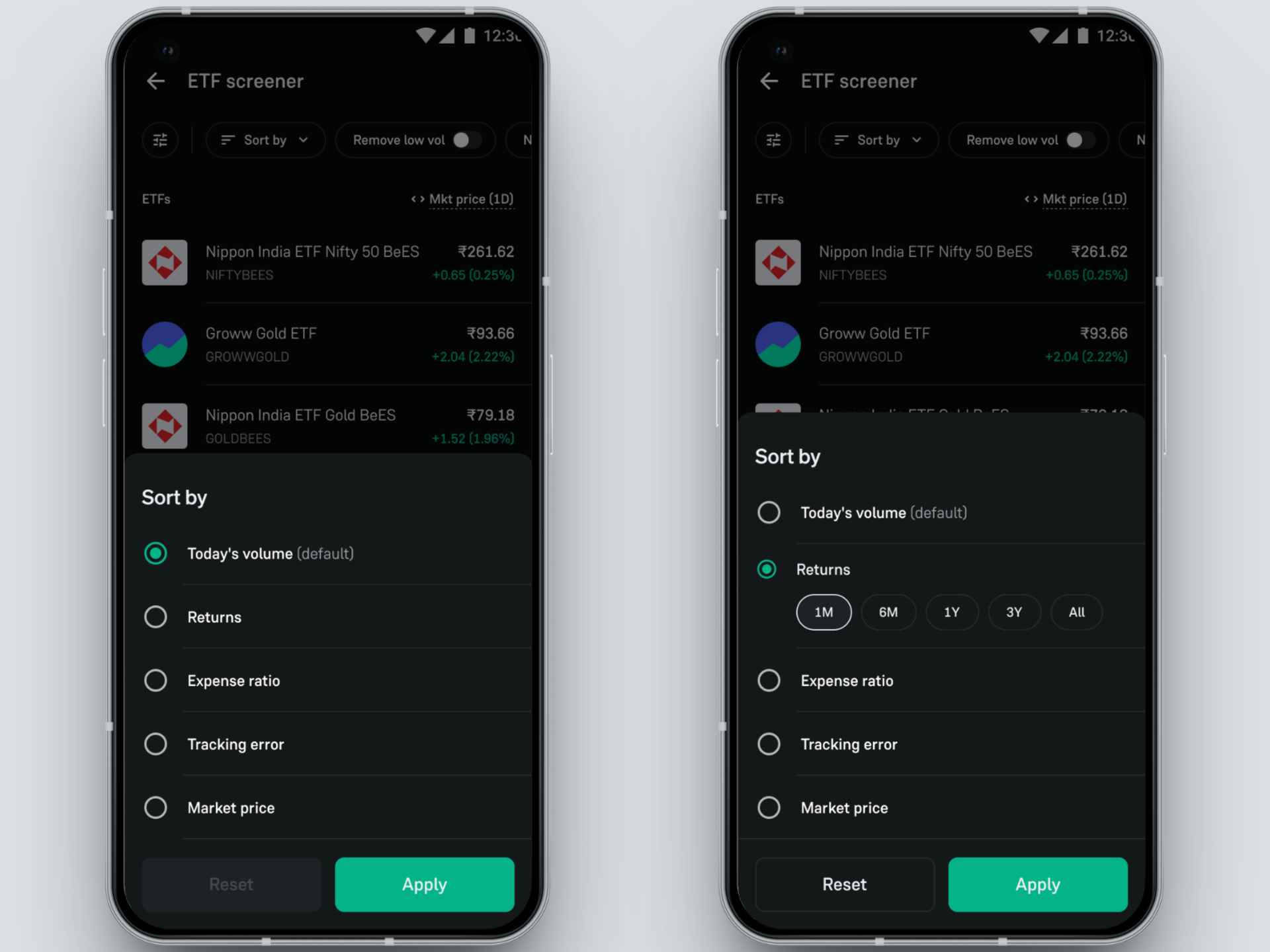

2. Sorting Made Easy

The revamped screener allows you to sort ETFs by:

- Popularity (default)

- Returns (1M, 6M, 1Y, 3Y, all-time)

- Volume (today’s live data, with weekly/monthly in scope)

- Market price: Sort ETFs by their current trading price

- Expense ratio: Find cost-efficient ETFs quickly

- Tracking error (Sort columns override filter columns if same metric is selected)

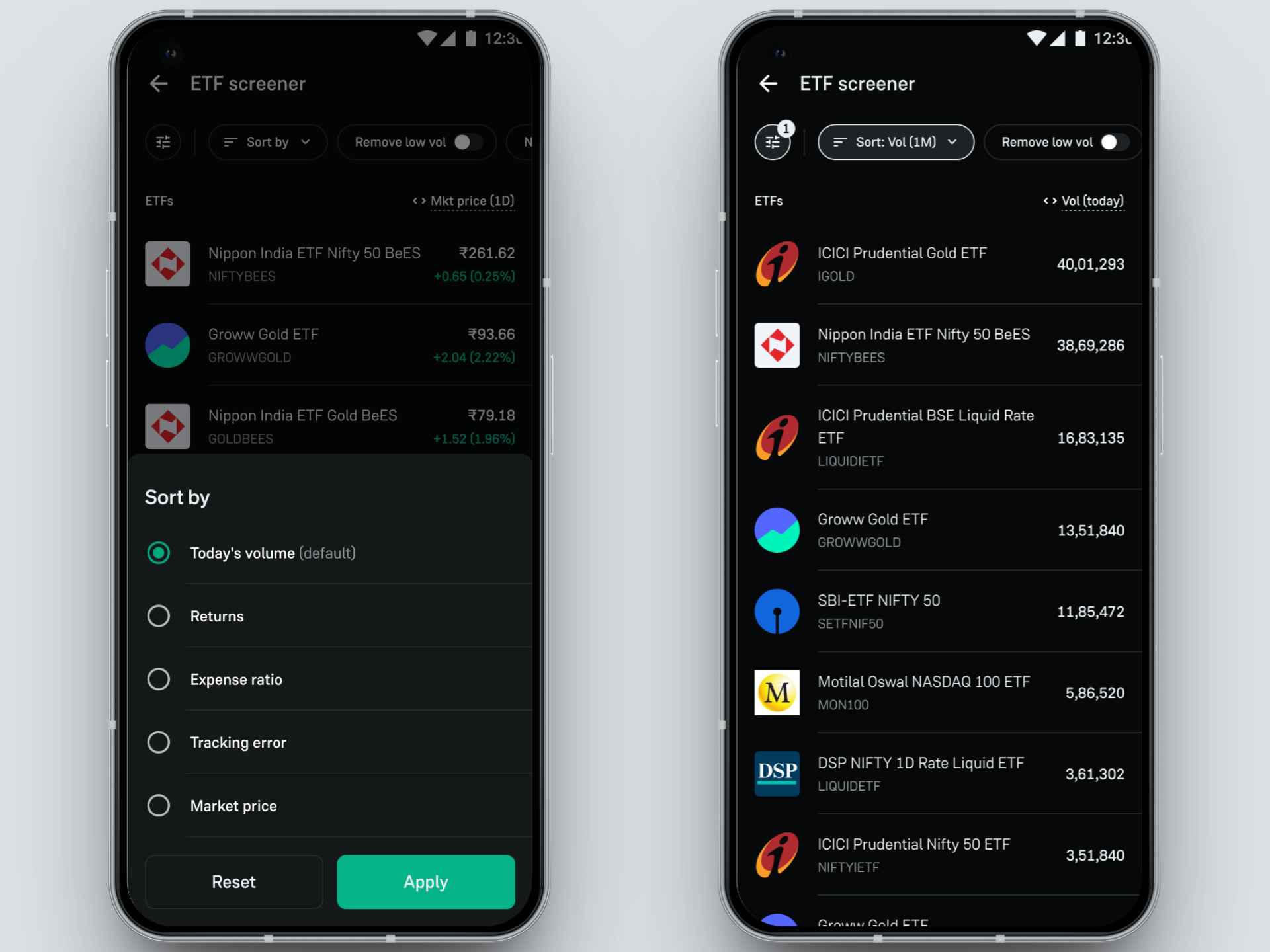

3. Get Deeper Insights at Your Fingertips

Earlier, you could only see basic details like market price and 52W high/low. Now, the screener gives you deeper insights such as:

- Trading volume (today) → Helps spot liquid ETFs.

- 1Y returns → Quickly compare past performance.

- NAV vs Market Price delta → Check if an ETF is at a premium or discount.

- Market price (1D movement) → Track daily trends.

Why This Matters for Investors?

With the revamped ETF Screener, you get:

- Transparency → No more confusion around ETF names or unclear groupings.

- Efficiency → One place to evaluate multiple ETFs quickly.

- Confidence → Data-backed decisions across asset classes.

Explore ETFs Smarter on Groww.

Head to the ETF Screener today and take charge of your investing decisions.