Form 15G

Form 15G is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and HUFs) to ensure that no TDS (tax deduction at source) is deducted from their interest income in a year.

As per the income tax rules, it’s mandatory for banks to deduct tax at source (TDS) in case the interest earned on your fixed deposit, recurring deposit, etc. It is more than Rs. 40,000 in a financial year and Rs. 50,000 for senior citizens (form 15H).

Recently, the EPFO Unified portal launched a facility to submit EPF Form 15G for PF, which allows EPF members to withdraw PF online. Also, you can avoid TDS, which is a great benefit.

Where to Get Form 15G?

Form 15G can be easily found and downloaded for free from the website of all major banks in India, as well as the official EPFO portal. Additionally, this form can also be easily downloaded from the Income Tax Department website. Moreover, you also have the facility to submit form 15G online on the website of most major banks in India.

TDS on EPF Withdrawal Rules

Now that you know the 15G form meaning for FD maturity amount withdrawal, it's time to understand where all form 15G can be used. Form 15g can be used to avoid TDS on EPF Withdrawal as well. Before knowing how to submit form 15G, let us first understand the rules related to TDS with respect to EPF withdrawal.

According to section 192A of the Finance Act, 2015, EPF withdrawal will attract TDS (Tax Deducted at Source) if the amount of withdrawal is more than Rs.50 000 and you worked for less than 5 years.

Earlier, the limit of such TDS was capped at more than Rs.30,000 and above the withdrawal amount. In Budget 2016, the limit was further raised to Rs.50,000. One can also use Form 15H to fulfil the TDS exemption; the only difference is Form 15G is for those who are below 60 years of age, whereas Form 15H is for those whose age is more than 60 years.

When is the TDS Applicable?

In case the employee wishes to withdraw his/her EPF amount, which is more than or equal to Rs.50 000 with less than 5 years of service.

1) TDS is deducted at 10% if an employee submits the PAN Card (But the 15G form for EPF/15H is not submitted).

2) TDS will be deducted at the rate of 34.608% if an employee fails to submit the PAN Card. (Also, Form 15G/15H is not submitted).

When is the TDS not Applicable?

1) When one transfers their EPF account to another account.

2) Termination of service happened due to ill-health of the employee, discontinuation of business by an employer, completion of a project or other cause beyond the control of an employee.

3) If an employee withdraws the EPF amount after a total of 5 years of service (Including the service with a former employer).

4) If the EPF amount is less than Rs.50 000, but the employee has rendered service of below 5 years.

5) In case the employee withdraws more than or equal to Rs.50 000, with the employment of fewer than 5 years, but submits Form 15G/15H along with PAN Card.

How to Fill Form 15G for PF Withdrawal

Now that you have an idea about the TDS rules that are applicable to EPF and also what is Form 15G or 15H let’s move on and understand the process of how to fill out Form 15G for online EPF withdrawal.

- Login to EPFO UAN Unified Portal for members.

- Click on the ONLINE SERVICES option – Claim (Form 31, 19, 10C).

- Verify the last 4 digits of your bank account.

- Below the option, ‘I want to apply for, click on Upload form 15G as depicted in the image.

Instructions to fill out Form 15G

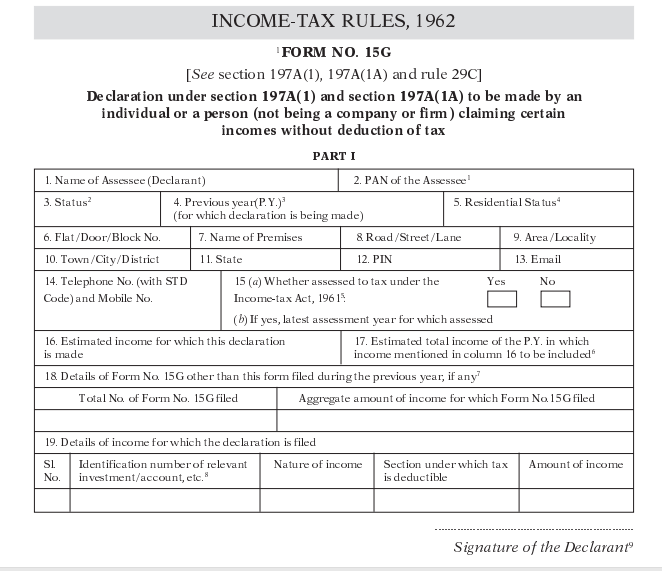

Form 15G has two sections. The first part is meant for individuals who want to claim no deduction of TDS on certain incomes. The following are the fields you need to fill out in the first segment of Form 15G:

Field (1) Name of the Assessee (Declarant) – Name as mentioned on your PAN Card

Field (2) PAN of the Assessee: Valid PAN card is mandatory to file Form 15G. If you don’t have valid PAN details, your declaration will be treated as invalid. Declaration in Form 15G can be provided by an individual but not by any firm or company.

Field (3) Status: Your income tax status, which can be Individual/ Hindu Undivided Family(HUF)/ AOP, whatever is applicable to you

Field (4) Previous Year: You have to select the previous year as the financial year for which you are claiming the non-deduction of TDS.

Field (5) Residential Status: Mention your residential status as a resident individual because NRI is not allowed to submit Form 15G.

Fields (6-12) Address: Mention your communication address correctly, along with the PIN code.

Fields (13-14) Email id and phone number: Provide a valid email ID and contact number for further communications.

Field 15 (a) Whether assessed to tax under the Income-tax Act, 1961: Tick mark ‘’Yes’’ if you were assessed to tax under the provisions of the Income Tax Act, 1961 for any of the previous assessment years.

(b) If yes, the latest assessment year for which assessed: Mention the latest assessment year for which the returns were assessed.

Field (16) Estimated income for which this declaration is made: In this field, the estimated income for which you are making the declaration needs to be mentioned

Field (17) Estimated total income of the P.Y. in which income mentioned in column 16 to be included: Total estimated income for the financial year (which includes all the income)

Field (18) Details of Form No. 15G other than this form filed during the previous year, if any: If you have already filed Form 15G anytime during the financial year, then the details of the previous declaration along with an aggregate amount of income need to be mentioned in the present declaration.

Field (19) Details of income for which the declaration is filed: Last part of section 1 asks you to fill investment details for which you are filing the declaration. You need to provide the investment account number (term deposit/ life insurance policy number/ employee code etc.)

Once you are done with filling the entire fields, cross-check all the details meticulously to ensure there is no error.

Form 15G is immensely helpful in saving the TDS burden in a lot of cases. However, providing a false declaration in Form 15G just for the purpose of avoiding TDS can lead to a fine and even imprisonment under Section 277 of the Income Tax Act, 1961.

There’s a second part of the form, too, to be filled out by the deductor, i.e. the person who is going to deposit the tax deducted at source to the government on behalf of the tax assessee.

Download Form 15G/15H |