UAN Registration

UAN or Universal Account Number is a 12-digit unique number issued to every employee contributing to the EPF (Employee Provident Fund). When a person is employed for the first time, the employer has to get the UAN generated for the employee. The basic criteria for the company to generate UAN is that the organization has to have 20 or more employees.

In case an employee has been assigned a UAN number in the previous organization, he/she has to share the details of the same with the new employer before a new UAN gets generated.

Nowadays, everything related to EPF has become online, and once the UAN login is done, one can easily find all the features under the EPFO portal.

How To Find Out Your UAN?

To understand how to find out UAN numbers, there are two ways, i.e., through employers or through the UAN portal.

Through Employer

Usually, employees are allotted a Universal Account Number by their employer under the EPFO. Some employers also mention the UAN number in the salary slips.

Via UAN Portal using PF Number or Member ID

If one cannot get the Universal Account Number from their employer, it can also be obtained through the UAN portal. Just follow the steps below:

Step 1: Visit the UAN Portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Click on the tab which says ‘Know your UAN’.

Step 3: Select the state and the respective EPFO office from the dropdown menu and enter the PF number/member ID along with the other required details such as name, date of birth, mobile no, and captcha code. PF number/member ID can be obtained from your salary slip. Next, Enter the tab ‘Get Authorization Pin’.

Step 4: A PIN will be received on your mobile number. Provide the PIN and click on the ‘Validate OTP and get UAN’ button.

Step 5: Finally, your Universal Account Number will be sent to your registered mobile number.

How to Activate UAN Online?

Please note for UAN registration, you must have your UAN and PF numbers with you. The online UAN Activation process has the following steps:-

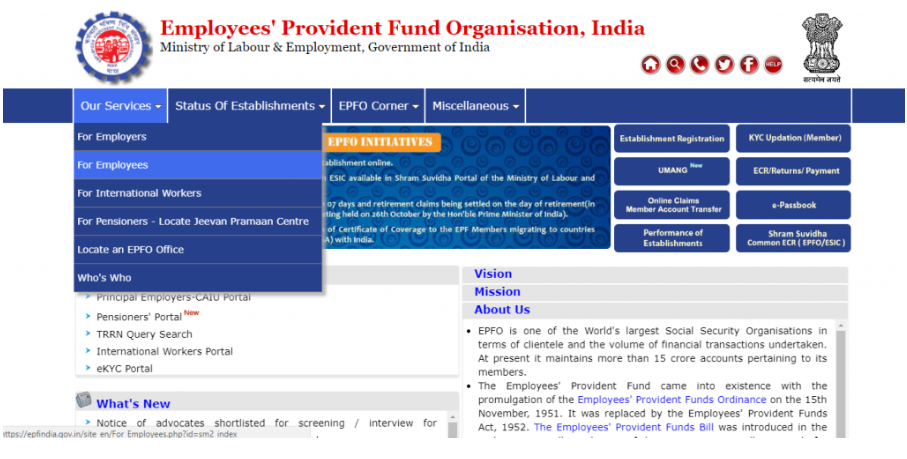

Step 1: Visit https://www.epfindia.gov.in/site_en/ and then click on “Our Services”. Under that, select “ For Employees”.

Step 2: Select “Member UAN/Online services“ under the services section. With this, you will be able to enter the UAN Portal.

Step 3: Enter the required details like UAN, PF member ID and your mobile number. Enter the correct Captcha code and then click on “Get authorization PIN Button”. The PIN will be sent to your registered mobile number.

- Tick the “I agree” checkbox under the disclaimer. Enter the OTP that was sent to you earlier and click on “Validate OTP and Activate UAN”.

- Upon EPF UAN registration, a password will be sent to your registered mobile number, which you can use to access your EPF account.

How To Download Your UAN Card?

First of all, make sure you have an active EPF number and UAN with a valid password for logging into the EPFO portal.

Then, you can begin-

- Visit the EPFO official website and go to - https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

- Enter your UAN number on the Member e-Sewa page for EPFO member login.

- Enter your password along with the Captcha Code displayed.

- For UAN member login, click on the ‘Sign in’ option to view the EPF account page.

- Once the UAN login is done, under the ‘View’ section, select ‘UAN Card’.

- You will then see a page which displays the card which is linked to your account.

- Click on ‘Download’ UAN card from the options displayed on the top right-hand side of your screen, and you are good to go.

Step-by-Step Process to Transfer Accounts Using the UAN

The following is a description of how to transfer a PF UAN number and account using the portal-

Step 1: Check your PF eligibility and make sure all of your current and former employers’ records are online at EPFO.

Step 2: Upload the digital signature to the internet.

Step 3: To file a transfer online, you must first register on the UAN EPFO portal.

Step 4: Select the option to transfer your account after logging into the EPF member portal.

Step 5: Fill out all three sections of the form.

Step 6: Click “Get OTP” after selecting the attesting authority and member ID/UAN.

Step 7: Your registered mobile number will receive an OTP. To proceed, enter this OTP.

Step 8: Your form will be submitted, and you will be provided with a tracking ID.

Step 9: Take a print of the transfer form and give it to your current employer.

How Can You Reset Your UAN Password for Login

- Go to https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Click on the ‘Forgot Password’ option.

- Enter your UAN.

- Press Verification Key in the captcha code bar.

- Then you will receive an OTP on your registered mobile number.

- Enter the OTP as asked.

- Click on the ‘Submit’ option.

- Reset your password.

Documents Required for UAN Activation

The following documents have to be provided at the time of UAN Activation

- Aadhaar card

- PAN card

- Bank account details and IFSC

- Any other proof of identity or address, if required.

Explore Related Calculators