A 5-Step Approach to Reach Your Financial Goal!

‘Beware the Ides of March’-The Romans were wary of March, especially the 15th of March for one reason.

However, children and parents alike in India are stressed about March for an entirely different reason altogether.

March signals the start of the exam season.

It’s a stressful period for students as well as for parents. Results aside, parents would also have to allocate funds towards meeting higher education expenses of their children.

In many cases, they fall short of funds when it comes to the important goal of paying for children’s education. This is where a goal-based investment plan comes into the picture.

Goal-based investing ensures that funds are available to the investor in the right amount at the right time for meeting specific financial goals.

However, the fund’s shortfall could be for other purposes as well, like real estate, vacation planning, marriage etc. This is a common occurrence when one invests without earmarking funds towards planned objectives.

Goal-Based Investing: Easy Approach to Reach Your Goal

Goal-based investing uses the future value of a goal as a benchmark, as against evaluation of the investment performance by a variable like index.

This strategy entails factoring in one’s age group, risk profile, financial position, and investment horizon.

We all know there is no shortcut to success. By the same logic, there should be no shortcut to wealth creation either. However, goal-based investing is an exception.

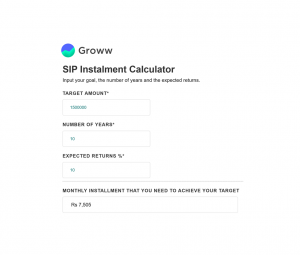

With a monthly investment, one can build a sizeable corpus to meet a specific goal. Let’s consider an example of Groww’s SIP Calculator.

Example 1

Assume that a target lump sum maturity value of Rs. 15 lakhs is required in 10 years’ time to meet a financial milestone.

Considering an expected return of 10%, one would have to invest a monthly amount of Rs. 7505.

This sizeable amount can be conveniently channelized towards achieving financial goals like funding education, interior decoration for new house property, etc.

With the introduction of goal-oriented schemes, fund houses appear to be replicating the strategy adopted by insurance companies.

The main benefit of such schemes is that it strikes an emotional chord with investors and helps them relate to the investment product easily, rather than a classification based on market capitalization, like a mid-cap or a small-cap.

There are certain other advantages of goal-driven investing. It instills financial discipline in investors and helps them to identify, prioritize and focus on the important personal finance goals, rather than attempting to time their earnings with the market forces.

Annual rebalancing of one’s asset allocation can also be done to ensure that the nearer one gets to your goal in value terms, one can lower the equity exposure.

Now that we have delved into the importance of goal-based investing, lets look at the 5-step approach to attain one’s goals.

1. Identification of Specific Financial Goals

It is crucial to draw a proper plan to link each investment with a specific goal. This can be ensured by the prioritization of goals with an estimation of the monetary value required to fulfill them.

While this cannot be exact, the figure should broadly cover the costs of achieving the financial goal.

2. Categorize Goals into Buckets i.e. Short-Term, Medium Term or Long Term

Short-term goals span between a few months to 2 years. For instance, buying a product that would result in a decent corpus to fund a vacation would be a short-term financial goal.

Medium-term goals have a time frame that ranges from 3-to 8 years. Examples would include the acquisition of house property or the commencement of a business venture.

Long-term goals work on time horizon of 10 or more years. For instance, a child’s marriage or retirement planning can be a long-term financial goal.

3. Asset-Allocation

Identification of asset mix of one’s investment portfolio suited to one’s risk appetite is crucial.

Further, one must clearly determine one’s financial goals and the time frame of investment. One can choose between debt, equity, or hybrid instruments.

Diversification of one’s portfolio works best to generate optimal returns.

Ideally one should allocate funds in multiple asset classes. This would ensure that in case equity markets are in the red, one can earn from the debt instruments and vice versa.

Since gold is an all-time favorite, especially amongst Indian women, one could also consider investing in Gold ETFs.

4. Selection of the Right Investment

One should evaluate the risk-return trade-off and accordingly select the right asset class in the correct proportion. Mutual funds are a good choice as they offer the opportunity of investing in a basket of asset classes.

Thus, the diversification strategy is in-built. Since financial goals vary from individual to individual and the timing of the financial assistance also vary, it is imperative to have a customized portfolio based on goal setting.

For a long-term goal, it is best to focus on return maximization and wealth creation with asset allocation mainly tilted towards equity as well as fixed-income securities.

Given below are some common medium to long-term goals and suggested financial strategies for each of them:

Long-Term: Child’s Marriage

Invest in equity-oriented mutual funds via SIPs and transfer the funds through STP to short-term liquid funds when the date of expenditure is near.

Medium-Term: Acquisition of House Property

For someone who is keen to fund their home purchase with their own funds, rather than opting for a home loan, mutual funds can help create a corpus to buy a residential property.

Create SIPs in target mutual funds and invest in equity and fixed income securities.

Long-Term: Retirement Planning

The sunset years are the most important phase of one’s life, where financial sufficiency is of paramount importance. This is because of the lack of regular earning by way of monthly income.

Hence early pension planning in advance is crucial. One could start SIPs in equity mutual funds early say in the 25-30 years age group.

As retirement approaches, shift to debt funds gradually. The final accumulated corpus can be moved to less risky debt mutual funds.

5. Review Your Portfolio Frequently and Redraw One’s Strategy

One cannot adopt an ‘invest and forget approach’.

One must frequently track the performance of one’s portfolio, regularly review one’s financial goals and reallocate their funds accordingly.

Certain investment products may seem tailor-made and customized for specific needs, but they may not be useful for one’s portfolio.

A one size fits all will never work in investing. One must also be well aware of the investment products available for each type of goal-based investing.

Conclusion

In conclusion, whichever way one plans to invest, the principles of investing remain constant. If one wishes to invest in equity, it must be for the long haul.

As one approaches one’s financial goal, gradually the debt exposure can be enhanced. Finally, one must take a look at the tax aspect as well as the returns before deciding where to invest.

Happy Investing!