What is Strip Option in Trading?

Trading options can be profitable, but it also comes with challenges. To succeed, traders use different strategies based on market conditions. One such strategy is the strip option strategy, which has a bearish bias but can also work in neutral markets. In this blog, you will learn in detail about the strip option strategy, how it works and its key features.

Understanding Strip Option Strategy

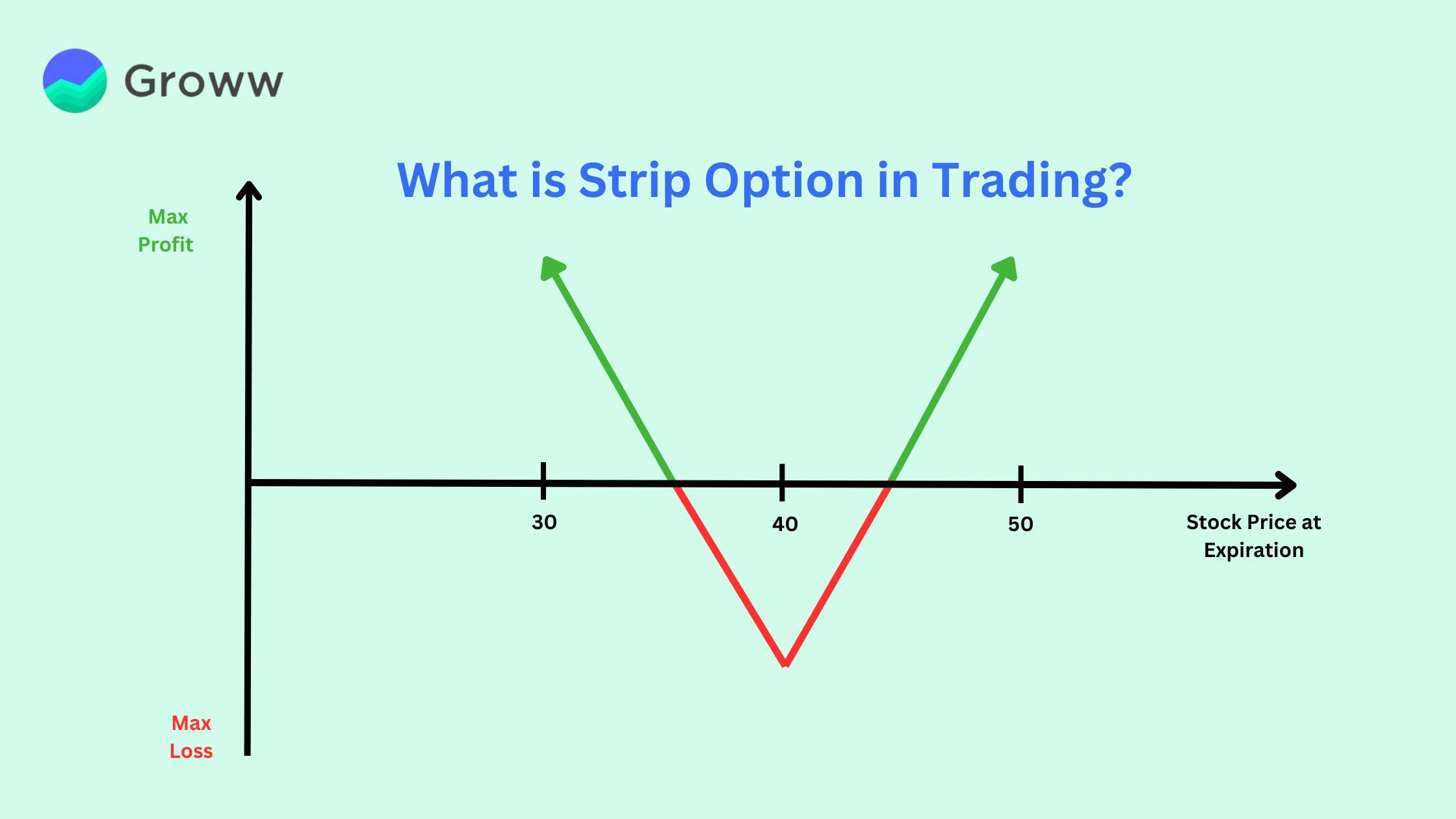

The strip option strategy is a bearish, market-neutral approach designed to perform well in a highly volatile market, especially during a downtrend. It involves purchasing one at-the-money (ATM) call option and two at-the-money (ATM) put options on the same underlying asset, all with the same expiration date.

Traders use this strategy when they expect a significant price movement, either upward or downward. However, the strategy leans towards a stronger bearish outlook, meaning a bigger downward move is anticipated compared to an upward one.

How to Implement Strip Option Strategy?

Here is a step-by-step guide on how to implement a strip option trading strategy:

Step 1: Choose the Underlying Asset

Conduct thorough market research to understand the factors that affect different assets, such as stocks, indices, or ETFs. Then, select an asset with a high likelihood of significant price movement.

Step 2: Analyse the Market Trend

Start by evaluating the market trend for the chosen asset. Strip options work best in highly volatile markets with a bearish bias, where prices are expected to drop more than they rise.

Step 3: Set Strike Price and Expiration Date

Choose a strike price based on your prediction of the asset’s price direction. Pick an expiration date that allows enough time for the expected movement, keeping in mind that time decay impacts option value.

Step 4: Buy Puts and Calls in a 2:1 Ratio

Purchase put and call options with the same strike price and expiration date, ensuring that you buy twice as many put options as call options. This 2:1 ratio aligns with the Strip strategy’s bearish outlook.

Step 5: Track Market Movements

Once the Strip position is in place, monitor market trends closely. Be prepared to exit early if the trade moves in your favour or take action to limit losses if the market moves against your expectations.

Step 6: Plan and Execute Your Exit Strategy

Set a clear exit strategy based on your risk tolerance and investment goals. You can either sell the options when they reach a target profit level or hold them until expiration.

Example of Strip Option Strategy

A trader analyses stock XYZ, which is currently trading at ₹50. After studying market trends, the trader expects the price to stay within ₹48 to ₹53 over the next two months.

To implement the strip strategy, the trader:

- Buys a 2-month ₹48 put for ₹2

- Sells a 2-month ₹53 call for ₹1

This results in a net debit of ₹1, establishing a strip between ₹48 and ₹53.

Over the next 6 weeks, XYZ fluctuates between ₹49 and ₹52, staying within the expected range. At expiration, XYZ closes at ₹51. The ₹48 put expires worthless, while the ₹53 call generates a profit. The trader makes a ₹1 profit which is the difference between the ₹2 call sale and ₹1 put purchase.

This example shows how the strip strategy allows the trader to benefit from XYZ’s price movements within the defined range while ensuring a limited loss. It provides directional exposure up to ₹53 and downside protection below ₹48, all for a net outlay (loss) of ₹1.

Benefits of Strip Options

The strip option strategy plays a crucial role in options trading, offering several advantages for traders. Here are some key benefits:

- Flexibility

The strip strategy allows traders to adjust risk and reward profiles according to their market outlook and risk tolerance. By varying the strike prices and quantities, traders can customise the profit zone. Wider strips offer more profit potential but come at a higher cost, while narrower strips are more affordable but have tighter breakeven points.

- Limited Risk

The long put in the strip strategy limits the maximum loss, while the profit potential is capped at the short call's strike price. This makes the strip a good choice for traders who want directional exposure without worrying about unlimited risk.

- Simplicity

The strip strategy, with its combination of a long put and a short call, is relatively easy to understand and implement, even for newer options traders. The clear risk graph and defined profit zone simplify its application.

- Cost Efficiency

By selling the call option to fund the purchase of the put option, traders reduce the net cost of establishing the strip strategy. This approach offers a more cost-effective way to gain market exposure compared to buying the stock outright.

- Range Trading

This strategy is ideal for markets that are range-bound or consolidating. Unlike strategies that depend on volatility or big price movements, the strip allows traders to profit from price fluctuations within a predictable range.

- Hedging

The long put acts as protection against price declines, making the strip strategy useful for hedging against market corrections. This feature also makes it a valuable addition to portfolios or long stock positions.

- Sensitivity Management

Once the strip position is set, traders can adjust it to manage time decay or optimise exposure. By rolling the call strike or modifying the position, traders can manage how sensitive the trade is to changing market conditions.

Conclusion

The strip option strategy offers traders a unique way to navigate volatile, down-trending markets by allowing for potential profits with controlled risk. By using a combination of call and put options, traders can benefit from significant price movements while managing their exposure. Understanding how to set up and exit a strip option strategy efficiently can be valuable for options traders looking to make the most of market volatility.