Why are F&O Positions Squared Off Automatically

At Groww, we want your trading experience to be smooth and stress-free. If your Futures and Options (FnO) positions ever get squared off (automatically closed), we understand that it can be frustrating. However, this is done to protect your funds, manage risk, and comply with exchange regulations.

To help you stay prepared, let’s go over why Groww might square off your FnO positions—and how you can avoid it.

1. You Exited One Leg of a Hedged Position, Increasing Margin Requirement

Why Does This Happen?

If you hold a hedged position (where one trade offsets the risk of another), the margin required is lower. But if you exit one leg of the hedge, the risk increases, and so does the margin requirement (SPAN margin).

If your account does not have sufficient funds to meet the extra required margin, a margin shortfall occurs. Positions are squared off to reduce the margin requirement and clear the shortfall

Example:

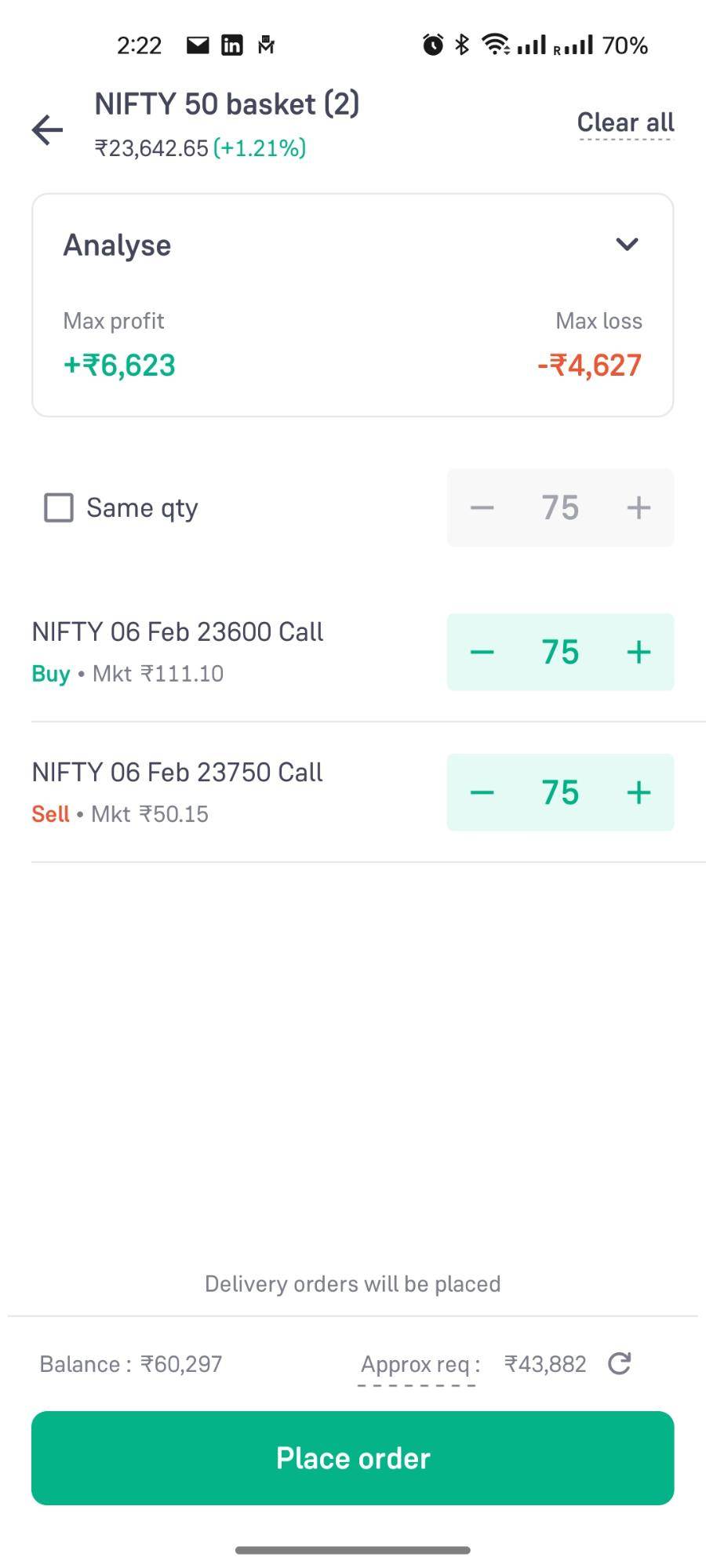

- You have a Bull Call Spread with:

✅ A long 23,600 Nifty call option

✅ A short 23,750 Nifty call option

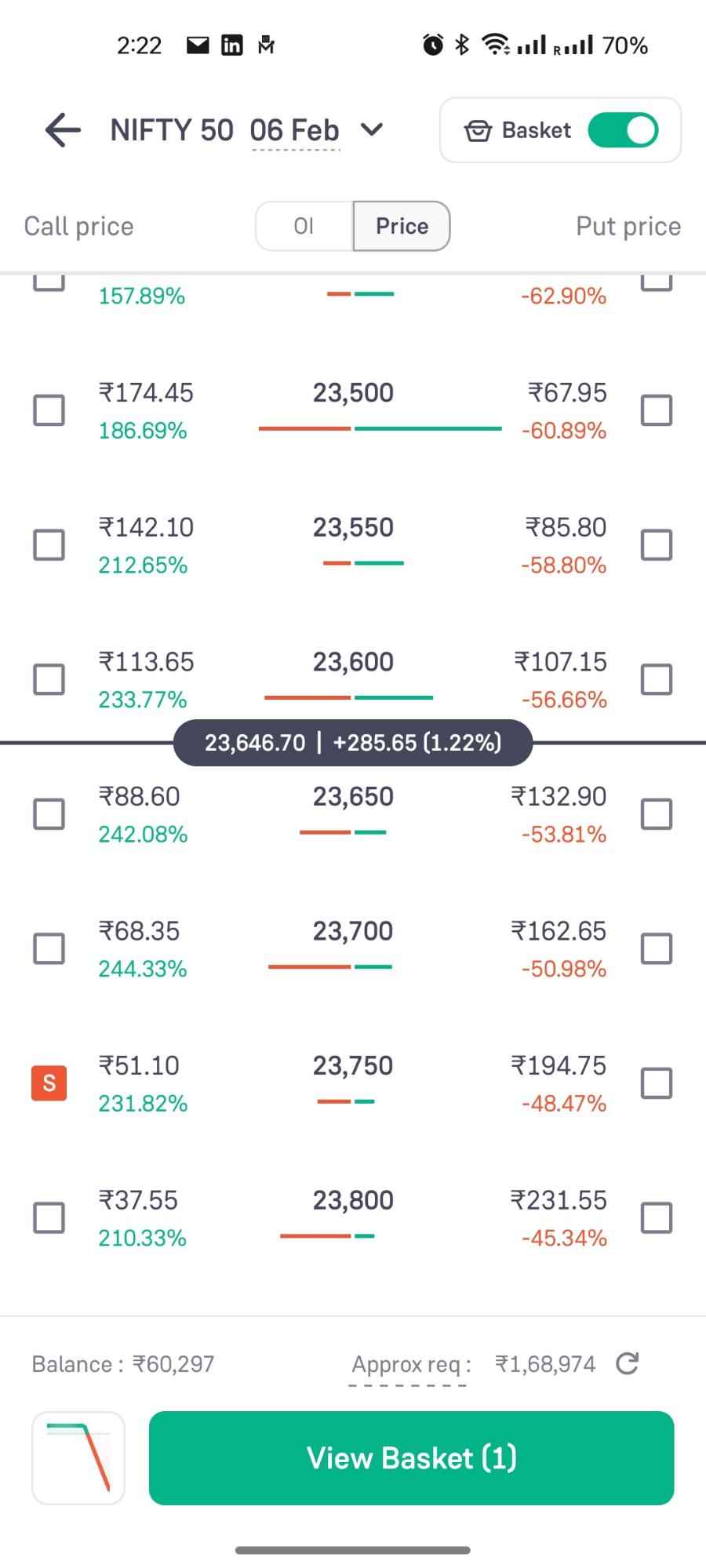

- This strategy requires a lower margin since the risk is limited. As you can see below, the margin requirement for 23750 Call Sell alone is ₹1.68 Lakhs.

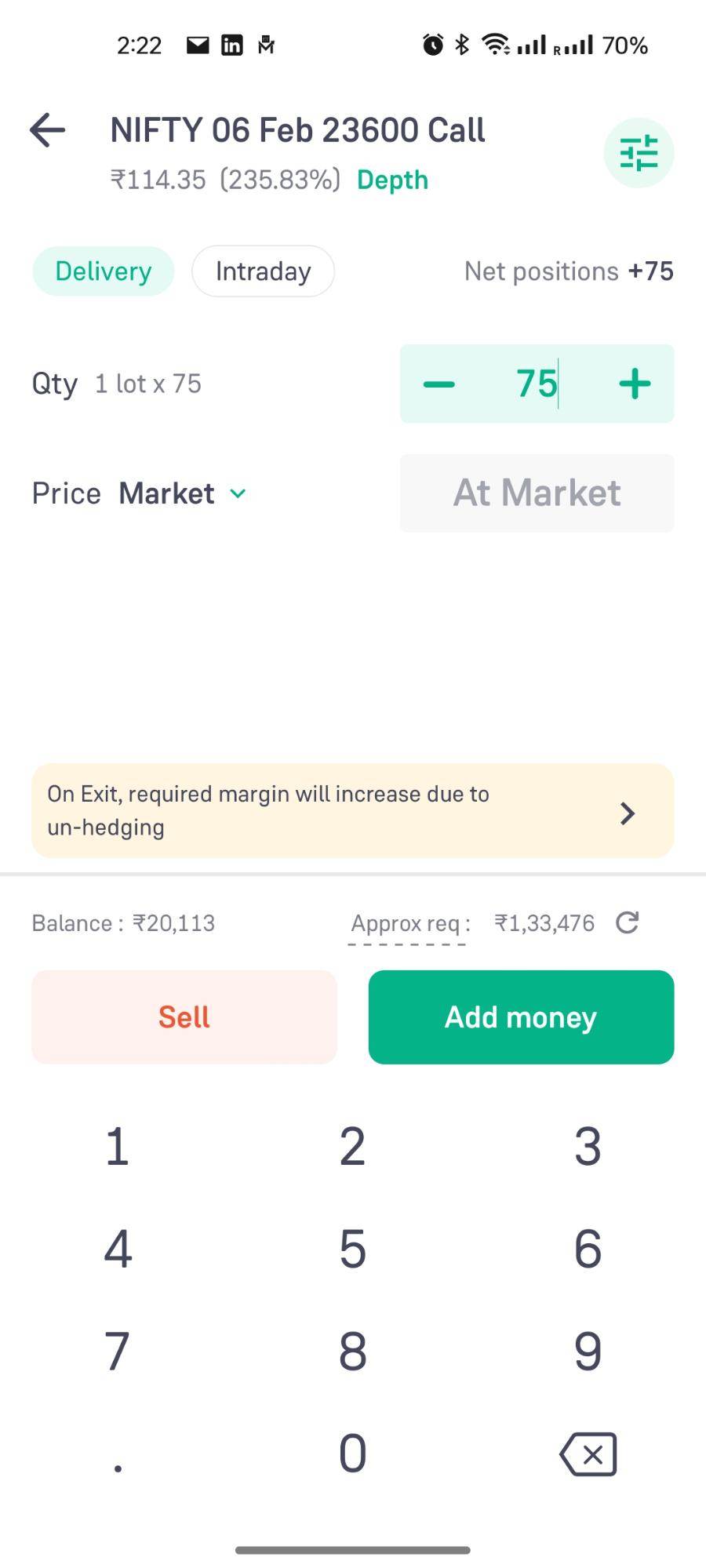

- If you exit the 23,600 call first, you now hold an uncovered short position on the 23,750 call, which needs a higher margin.

- If your account doesn’t have enough funds, the other position gets auto-squared off to reduce the margin requirement

How to Avoid This?

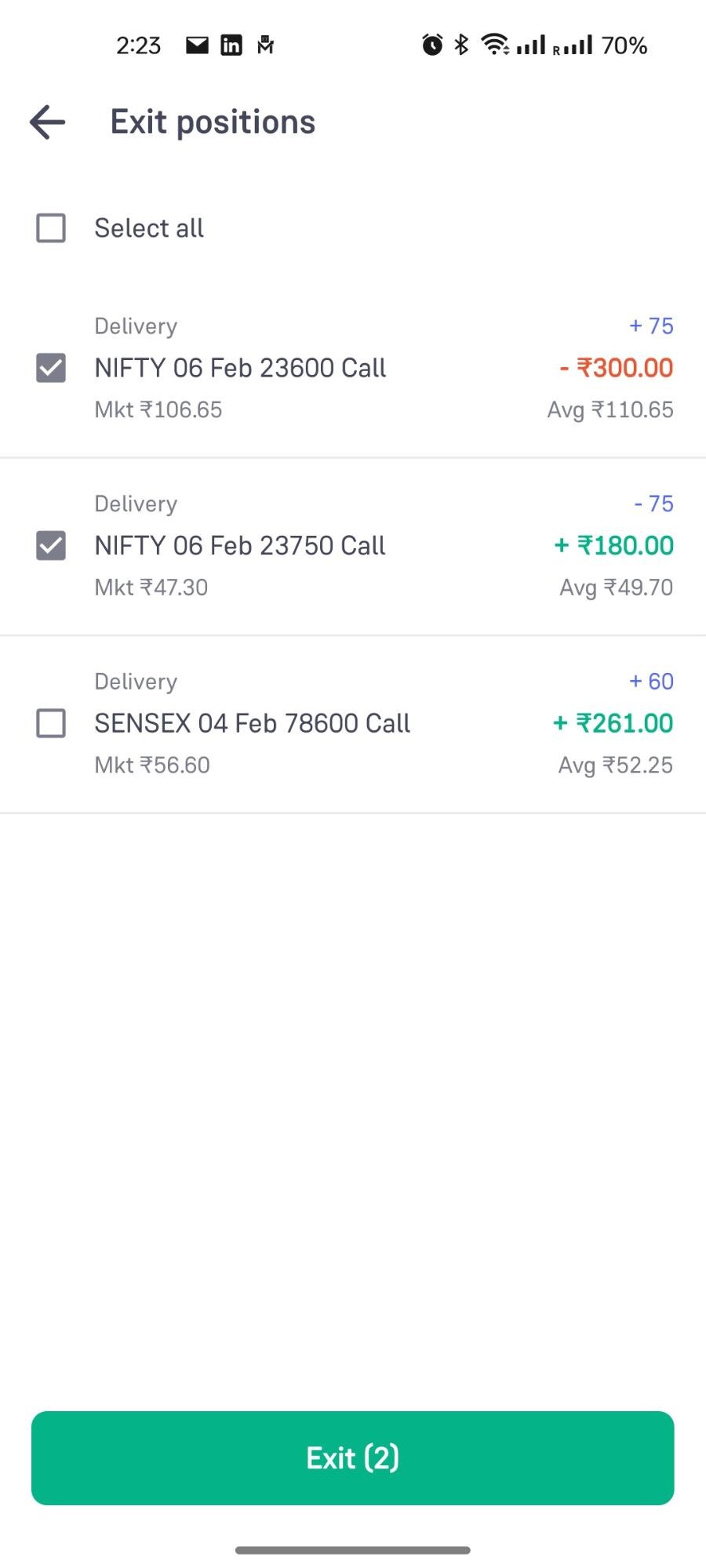

✔ Close the position with the higher margin first

✔ Use exit all to close hedged positions together

✔ Keep extra funds in your account to handle margin increases.

✔ Pledge your stock holdings to get additional trading margin at no extra cost.

2. Exchange Increased the Margin Requirement

Why Does This Happen?

When you enter a trade, an initial margin is blocked from the account as per the requirements at that time.

To maintain the positions, you are required to maintain margin requirements at all times. Margin requirement changes based on market fluctuations. The exchange updates margin requirements based on market conditions multiple times in a day.

If the required margin increases and your account doesn’t have enough balance, a shortfall can occur. And to clear this shortfall, Groww may square off your position.

Example:

- You hold a Nifty Future Contract with a margin requirement of ₹1,50,000 (SPAN and EXPOSURE margin).

- Due to increased volatility, the requirement for the same position increases to ₹1,60,000.

- If your Groww account doesn’t have the extra ₹10,000, a shortfall occurs, and if it is not cleared, the other position gets auto-squared off to reduce the margin requirement.

How to Avoid This?

✔ Keep a margin buffer (extra funds) in your trading account.

✔ Pledge your stock holdings to get additional trading margin at no extra cost.

✔ Keep track of your margin requirement and available funds through the Groww balance section

3. Your Losses Reached 80% of Your Available Funds

Why Does This Happen?

Groww has a risk management system in place to protect traders from extreme losses. If your Mark-to-Market (MTM) losses reach 80% of your available funds, your position might be squared off to prevent further losses.

Example:

- You deposit ₹1,00,000 and take a position in Bank Nifty Futures (margin requirement: ₹60,000).

- If the market moves against you and your losses hit ₹80,000 (80% of ₹1,00,000 1Lac), your position may be squared off to prevent your account from going negative.

How to Avoid This?

✔ Set stop-loss orders to limit potential losses.

✔ Monitor your MTM loss regularly and add sufficient funds if needed.

4. Your Stock Option Moved from OTM to ITM During Expiry Week

Why Does This Happen?

As stock FnO contracts are physically settled, exchanges start applying physical delivery margins on ITM (In the money) stock options contracts from four days before expiry. This margin requirement keeps increasing as expiry approaches.

When you take an OTM (out of the money) stock option contract, only the option premium margin is blocked. However, if the contract becomes ITM, an additional margin is required. If your account lacks sufficient funds to cover this additional requirement, Groww squares off the position to prevent margin shortfall.

Example:

- You buy a TCS Call Option expiring on 27 February, with a strike price of 5000 on Monday, 24 February.

- TCS is trading at ₹4,700, so the contract right now is OTM (out of the money)

- Premium margin is ₹50 and lot size of TCS is 175, so you pay ₹8,750.

- Your account has ₹9,000, so the order gets executed.

- Later in the day, the TCS price changes to ₹5,100, and your OTM option becomes ITM.

- Which leads to an additional Physical delivery margin requirement of ₹55,781.

- If your Groww account doesn’t have the extra balance, the position gets auto-squared off to reduce the margin requirement.

How to Avoid This?

During the expiry week, keep additional funds along with the premium margin in your Groww account to account for the physical delivery margin requirement.

Learn more about physical delivery margin requirements here.

Final Thoughts: Stay in Control of Your Trades!

At Groww, auto-square-offs are a last resort to shield you from heavy losses or penalties. By staying alert to margins, losses, and expiry rules, you can trade smoothly.

Need help? Chat with us on the Groww app—we’re here 24/7!

Disclaimer: Margins and regulations are subject to exchange guidelines. Prices and examples are illustrative.