What is a Synthetic Call Strategy?

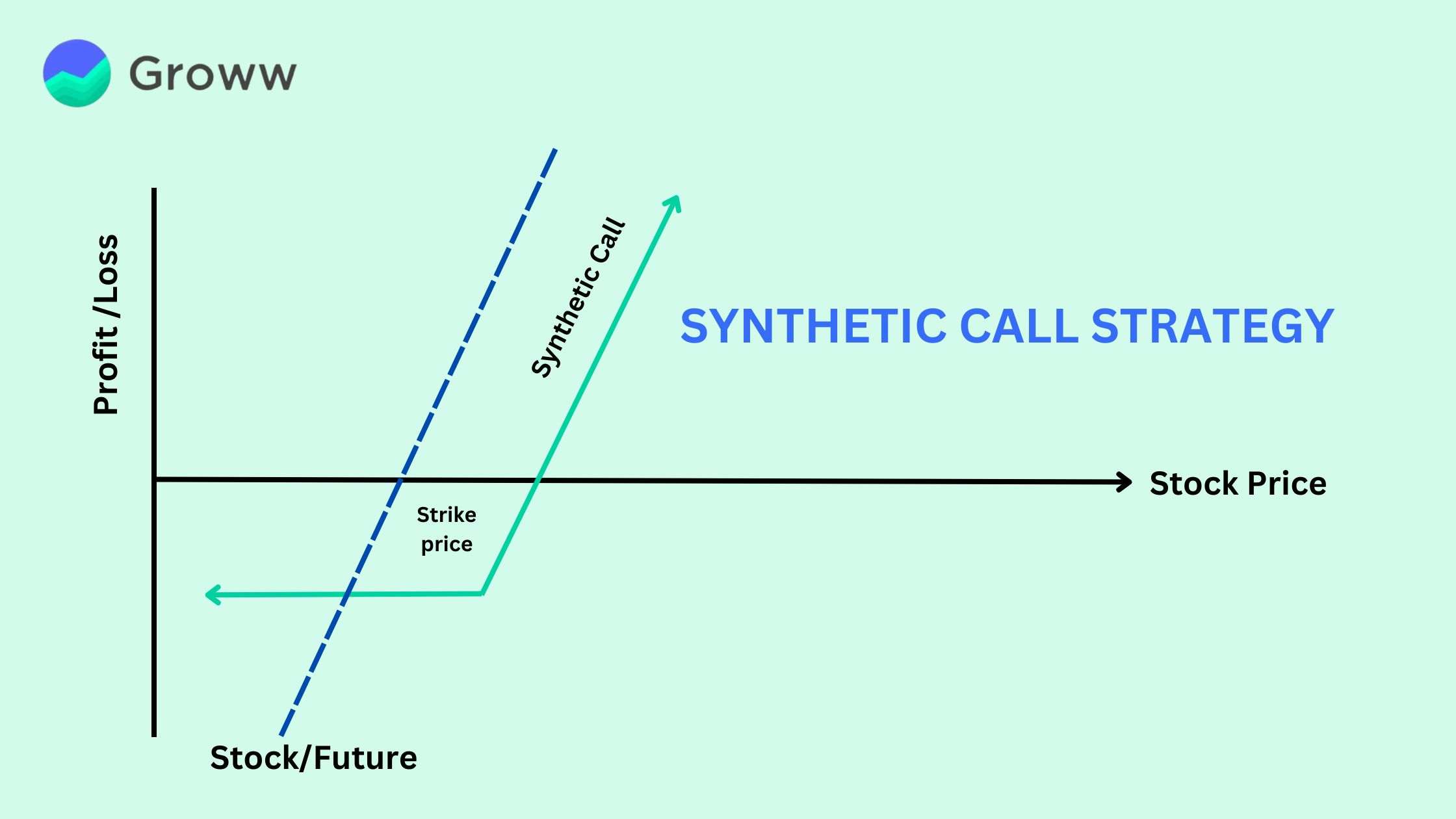

A synthetic call strategy is ideal for traders who are bullish on an asset, such as a stock, they already hold but want protection against short-term declines in its price. This approach involves purchasing a put option on the owned asset. If the price rises, the trader benefits from the asset's appreciation. However, if it falls, the potential loss is limited to the premium paid for the put option, reducing the overall risk while keeping upside gains open.

How Does a Synthetic Call Option Strategy Work?

A synthetic call option strategy allows traders to create a synthetic long position by holding a call option while simultaneously short-selling an equivalent number of shares. This strategy also applies to buying stocks and buying puts. This approach replicates the behaviour of the underlying asset but at a lower cost or reduced risk compared to directly buying the stock. Investors use this strategy when anticipating a price increase and want to profit without owning the asset.

This method functions similarly to a long call option but provides greater flexibility. Traders can modify their exposure by adjusting their positions by buying or selling additional shares or options without fully exiting their original trade. It also allows them to capitalise on short-term price fluctuations without committing to a long-term investment.

However, while this strategy helps manage costs and risks, it also has its own challenges. Traders must be aware of market conditions and maintain sufficient margin levels to avoid potential pitfalls.

Example of Synthetic Call Strategy

Imagine an investor who wants to invest in a stock that is currently priced at ₹200 per share. The investor expects the stock price to rise soon and wants to profit from it. To apply the synthetic call strategy, the investor buys the stock at ₹200 and simultaneously sells a put option with a strike price of ₹200 and an expiration date of one month. By selling the put option, the investor receives a premium of ₹5. This combination of buying the stock and selling the put option creates a position that mimics the payoff of a long call option.

The following are the possible outcomes:

Scenario 1: Stock price rises to ₹250

- The investor gains ₹50 per share from the stock price increase.

- The put option expires worthless, meaning no additional obligation.

- The investor keeps the ₹5 premium, increasing the total profit.

Scenario 2: Stock price remains at ₹200

- The put option expires worthless. So, there is no impact from it.

- The investor still keeps the ₹5 premium as profit.

Scenario 3: Stock price drops to ₹150

- The put option is exercised, forcing the investor to buy more shares at ₹200 per share.

- Since the investor had already received a ₹5 premium, their effective cost per share is ₹195 instead of ₹200.

This strategy helps investors benefit from price increases while managing risk with the premium received from the put option. However, if the stock price drops significantly, they must be ready to buy at the agreed price.

Also Read : What is Short Call?

A synthetic call option is an effective strategy for investors seeking to optimise their investment approach. This strategy offers several advantages, such as:

- Lower Investment Costs: Synthetic call options provide a cost-effective alternative to directly purchasing stocks

- Reduced Volatility Risk: Minimises the impact of fluctuations in implied volatility over time

- Profiting from Price Increases: Enables traders to benefit from rising stock prices with a lower initial investment

- Enhanced Portfolio Flexibility: Investors can easily modify their exposure without liquidating their positions

- Managed Portfolio Risk: Helps limit overall portfolio risk while still offering profitable opportunities

- Better Trade Timing Control: Traders have more control over the execution date of their trades.

Drawbacks of Synthetic Call Strategy

The following are some drawbacks of the synthetic call strategy:

- Restricted Profit Potential: The maximum profit is confined to the difference between the stock’s market price and the put option’s strike price.

- Assignment Risk: If the stock price drops below the put option’s strike price, the investor may be required to take ownership of the stock, leading to potential losses.

- Impact of Time Decay: The put option loses value over time, which can reduce the overall returns.

Conclusion

The synthetic call strategy helps investors profit from rising stock prices while limiting the downside risk. This approach involves buying the stock and selling a put option with the same strike price and expiration date as a call option. Before using this strategy, investors should analyse the potential risks and rewards carefully to make informed decisions.

Disclaimer: This content is solely for educational purposes. The securities/investments quoted here are not recommendatory.