Call and Put Options: Meaning, Types, Difference & Examples

If you’re new to options trading, you'll often hear two important terms:

“Put options and Call options.”

The whole theory of how traders profit when the market is bullish and bearish revolves around these options.

If you want to know how, read the blog till the end, as we’ll make a thorough comparison between Put vs Call Options.

What is a Call Option?

A Call option gives the investor/trader the right (but not obligation) to buy an underlying asset at a strike (target) price. The quantity is purchased for a premium and in lots. Every option contract has an expiry date, on which it becomes invalid.

Those who buy the call option contract are known as “Option Buyers.”

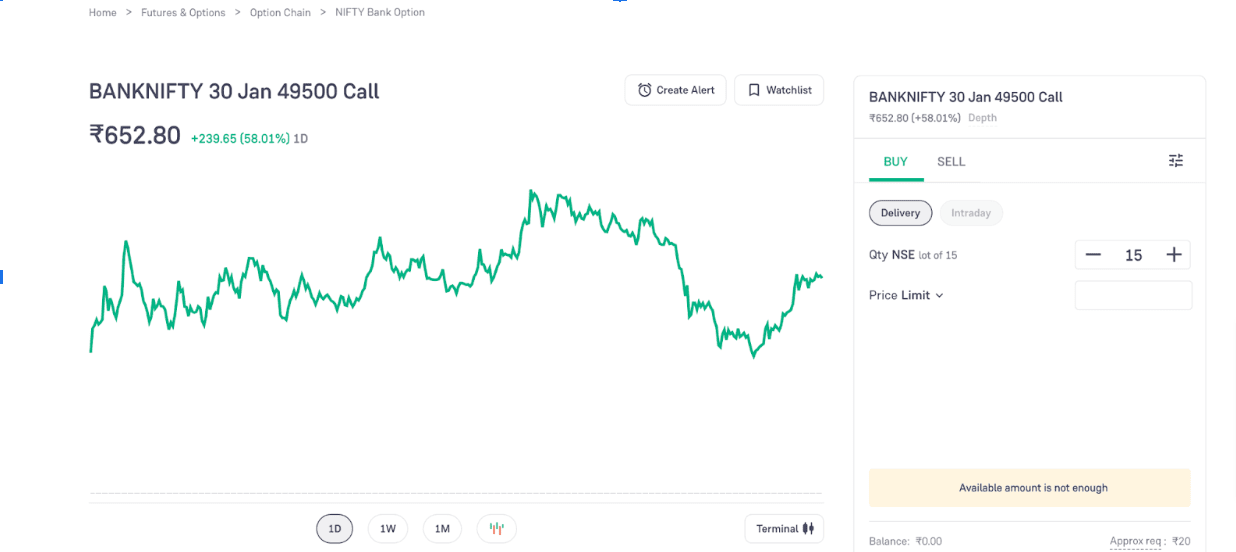

Below’s an example of the Call Option.

Here,

- Index: BANKNIFTY

- Expiry Date: 30 Jan

- Premium: 652.80

- One Lot Size: 15

Strike Price: 49500

What is Put Option?

A Put Option gives the holder the right to sell an underlying asset at a target price (called the strike price). The seller (also called the writer) of a put option is obligated to buy the asset at the strike price if the buyer exercises the option.

Like CE, PE also has an expiry date on which the contract expires and becomes invalid. The ones who sell put option contracts are known as “Option Sellers.”

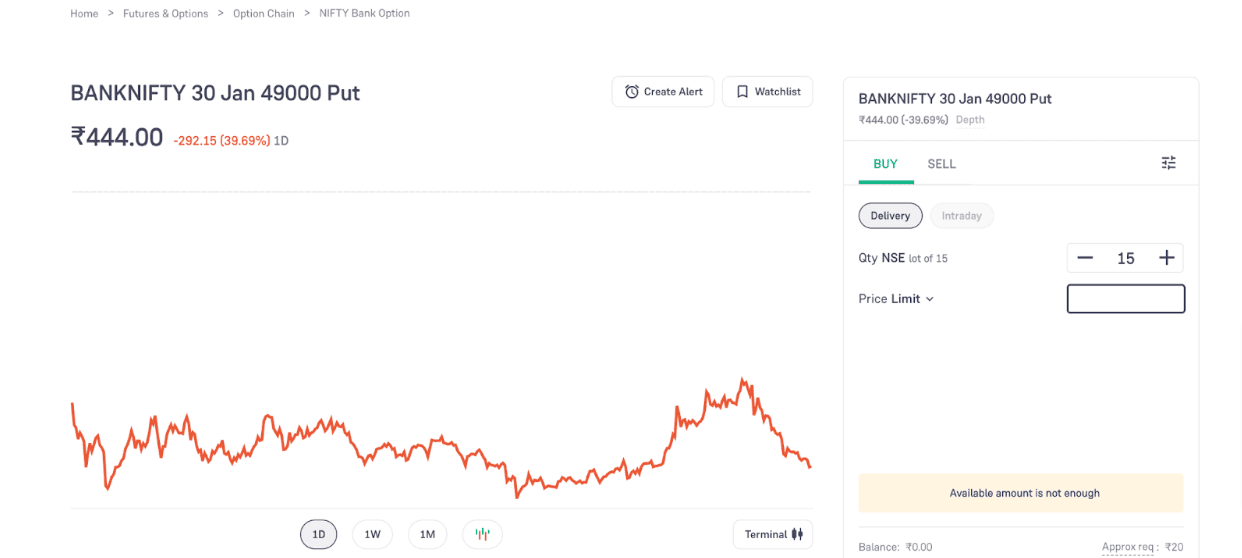

Below’s an example of the Put option.

Here,

- Index: BANKNIFTY

- Expiry Date: 30 Jan

- Premium: 444.00

- One Lot Size: 15

- Strike Price: 49000

That was it for the basics!

Now, let’s look at some of the important terms that you must understand before taking a call or put position.

Types of Strike Price Call & Put Options

For any underlying asset, you can buy different strike price options, i.e.,

- OTM (Out-of-The-Money)

- ATM (At-The-Money)

- ITM (In-The-Money)

For instance, NIFTY is at Rs 20,000, below the types of strike price options you can buy:

For CE:

- 20,000 CE (At-The-Money)

- Less than 20,000, like ₹19,800 CE (In-The-Money),

- More than 20,000, like ₹20,200 CE (Out-of-The-Money).

For PE:

- 20,000 PE (At-The-Money)

- More than 20,000 (In-The-Money), like ₹20,100 PE.

- Less than 20,000 (Out-of-The-Money), like ₹19,900 PE.

The choice between ATM, OTM, and ITM options significantly influences potential profits and risks.

Readers Also Liked: Straddle Chart

Important Terms Related To Call And Put Options

|

It is the difference between the underlying asset’s price and the strike price. |

|

|

Time Value |

The extra amount you pay over the intrinsic value for the potential of future gains before expiration. |

|

Premium |

Premium is calculated using “Intrinsic Value + Time Value.” This is the upfront cost you pay to buy the option. Even if the trade goes against you, the maximum loss you’ll face is limited to this premium. |

|

Theta |

Measures the rate at which an option loses value as it approaches expiration. |

|

Time/Theta Decay |

Time decay refers to the reduction in the value of an option as it approaches its expiration date. |

Example of Call Option

A call option is used when the underlying asset's price is expected to increase, i.e., a bullish sentiment is anticipated.

For instance, NIFTY’s current price is Rs. 20,300, and the target is Rs. 20,600.

Technical analysis suggests an upward movement, and you buy in the money option of 20,200 for a premium of Rs. 150*25=3750

The total premium paid is ₹3,750 (excluding brokerage and other charges).

Scenario 1) Before the expiry if NIFTY reaches the target price of ₹20,600, the intrinsic value of the call option will be:

Intrinsic Value = Target Price - Strike Price = ₹20,600 - ₹20,200 = ₹400

Since the premium paid was ₹150, your net profit per lot would be:

Net Profit = (Intrinsic Value - Premium) * Lot Size

Net Profit = (₹400 - ₹150) * 25 = ₹250 * 25 = ₹6,250

So, your total profit in this trade is ₹6,250.

Scenario 2): If NIFTY doesn’t move up (stays at ₹20,300 or below):

If NIFTY stays below the strike price of ₹20,200, the option will expire worthless. In this case, you lose the entire premium paid, i.e., ₹3,750.

Example of Put Option

A put option is used when the underlying asset's price is expected to decrease, i.e., a bearish sentiment is anticipated.

Let’s say NIFTY is at ₹20,200, and based on your analysis, you expect it to fall to ₹20,000.

You buy an in-the-money (ITM) put option with a strike price of ₹20,300 at a premium of ₹150 per unit. The lot size is 25 units.

Total Premium Paid = ₹150 × 25 = ₹3,750 (excluding brokerage and other charges).

Scenario 1: Before the expiry, If NIFTY falls to ₹20,000

If NIFTY drops to ₹20,000, the intrinsic value of the put option will be:

Intrinsic Value = Strike Price - Underlying Asset Price = ₹20,300 - ₹20,000 = ₹300

Profit per unit: Intrinsic Value - Premium Paid = ₹300 - ₹150 = ₹150

Total Profit = ₹150 × 25 = ₹3,750

Scenario 2: If NIFTY stays at ₹20,200 (No Movement)

If NIFTY stays at ₹20,200, the intrinsic value of the put option will be:

Intrinsic Value = ₹20,300 - ₹20,200 = ₹100

Net profit per unit:

Profit = Intrinsic Value - Premium Paid = ₹100 - ₹150 = -₹50 (Loss)

Total loss: ₹50 × 25 = ₹1,250

Scenario 3: If NIFTY moves above ₹20,300

If NIFTY remains above ₹20,300 (e.g., ₹20,350), the option will expire worthless. In this case, you lose the entire premium paid.

How To Calculate Call and Put Option Payoffs

Payoff refers to the profit or loss an option buyer or seller experiences at expiration, depending on the underlying asset’s price.

|

Call Option Payoff |

Buyer’s Payoff (Long Call) |

max(0, Spot price −Strike Price)-Premium |

Maximum Loss: Limited to the premium paid. |

|

Seller’s Payoff (Short Call) |

min(0,Strike Price−Spot Price at Expiry) +Premium |

Maximum Profit: Limited to the premium received. |

|

|

Put Option Payoff |

Buyer’s Payoff (Long Put) |

max(0,Strike Price – Spot Price)−Premium |

Maximum Loss: Limited to the premium paid. |

|

Seller’s Payoff (Short Put) |

min(0,Spot Price −Strike Price)+Premium |

Maximum Profit: Limited to the premium received. |

Difference Between Call and Put Option

Below’s a quick head-to-head difference between the call and put option.

|

Aspect |

Call |

Put |

|

Market Sentiment |

Underlying asset's price is anticipated to rise (bullish sentiment). |

Underlying asset's price is anticipated to fall (bearish sentiment). |

|

Buyer’s View |

Bullish (expects price to rise). |

Bearish (expects price to fall). |

|

Seller’s View |

Bearish |

Bullish |

|

Maximum Profit |

Unlimited |

Limited to the strike price minus the premium paid. |

|

Maximum Loss |

Limited to the premium paid. |

Limited to the premium paid. |

Common Question Regarding Options

What are the advantages of buying options?

There are various advantages to buying options or doing option trading.

- For example, if a stock is priced at ₹2,000, purchasing a single share in equity will cost ₹2,000. However, you can buy an option for the same stock at a fraction of the cost, often as low as ₹30–₹40, depending on the time decay.

- Options are highly volatile, and their prices can move dramatically within a short period. For instance, in a bullish market, an option priced at ₹30 could jump to ₹300 in a single day.

- Options can also be used to hedge your positions in stocks. For example, you own HDFC Bank shares, and there’s news suggesting a potential decline in the stock price. To protect against this downside:

- You can buy a put option for HDFC Bank.

- If the stock price falls, the profits from the put option will help offset the losses in your stock holdings.

Conclusion

Both put and call options offer opportunities to hedge risks or profit from market movements. However, options trading carries a lot of risk; according to SEBI, 9 out of 10 individual traders in the equity futures and options (F&O) segment continue to incur losses.