Steps to Upload KYC for EPF UAN

The UAN EPFO portal now allows individuals to update their EPFO KYC records online.

One will need a UAN (Universal Account Number) credential to go through the process of upgrading or modifying KYC (Know Your Customer) data on the UAN EPFO site. To do so, the individual must log in to the EPFO UAN portal and upgrade their KYC by uploading the required documents online.

PAN card number, Aadhar card number, and bank account details are all required KYC details. If the EPF KYC update has not yet been made, it must be done immediately. There are many advantages of updating the KYC in the EPF.

If the account is in good standing (i.e. the KYC document has been completed), the user will not experience any delays when transferring or withdrawing funds. There is a possibility that the petition will be denied if the bank account information is out of date. In addition, if the KYC records are not sent, the EPF account holder would lose the ability to receive SMS updates.

Steps to Enable EPFO KYC Update Online

Following are the detailed steps required for KYC for UAN

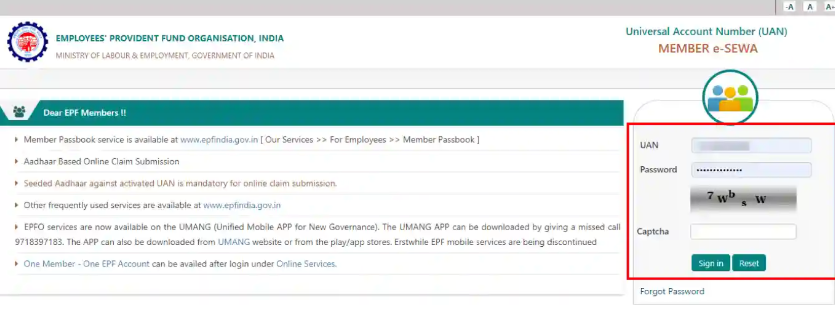

Step 1: Log in to your EPF account with your UAN and password, by visiting https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Once you have successfully logged in, to the tab that says "manage" on the top menu bar and click on it.

Step 3: After that, click on the "KYC" option from a drop-down menu.

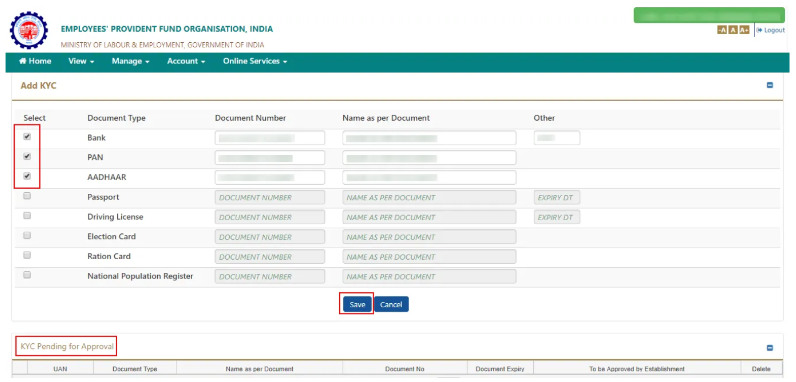

Step 4: After the KYC option has been clicked, you will automatically be redirected to a new page that contains a list, which says “Document Type” and represents fields next to it, which you need to fill with all of the details.

Step 5: The next step would be to click on the checkbox that is next to the document type that you want to update and fill the "Document Number" and "Name as per Document" fields respectively.

Step 6: After updating all the above-mentioned details, you can click on the "save" option.

Step 7: Once you've updated your document's information, the status of your KYC document will be shown in the column labeled "KYC Pending for Approval." The status of your document will be shown under "Digitally Approved KYC" after it has been checked and approved by the employer.

Step 8: After this, the final step would be to receive an email to confirm the same.

Documents Required to Update KYC for EPF UAN

- NPR (National Population Register)

- Aadhaar Card

- PAN Card

- A Valid Bank Account's Details

- A Valid Passport Number

- A Valid Driving License

- A Valid Election Card

- A Valid Ration Card

EPFO KYC Track Status Via

|

1. Through UAN Card |

Login to your account on Member e-Sewa Portal and select the option "UAN card" under the "View" tab. If the KYC of your EPF account has already been completed, then the UAN card will show a "Yes" in front of the KYC information row. |

|

2. Documents Approved Under KYC Tab |

Checking the papers that have been accepted and checked in the EPFO archives is another way to see if the EPF account is KYC-compatible. This can be reviewed in the Member e-Sewa Portal's 'KYC' choice under the 'Manage' tab. The records can be viewed under the 'Digitally Authorized KYC' tab by EPF account holders. The tab will show a list of accepted and validated documents. For example, Aadhaar is required for any online claim submission. As a result, make sure Aadhaar is mentioned and checked in the list of records. Similarly, the bank statement and IFSC information in the records must be right in order for the EPF funds to be credited on time. |

|

3. Checking on the EPF India Website |

The third option is to go to this website - https://iwu.epfindia.gov.in/eKYC/ to see if your EPF account is KYC compatible. Select the 'Track EKYC' option from the drop-down menu. You will then be prompted to enter your UAN and captcha code. The following message will appear on your computer screen if your account is KYC compliant: "Greetings, Member! Your Aadhaar Details XXXX XXXX against UAN XXXX XXXX has been checked successfully. EPFO resources related to Aadhaar can be accessed online." |

Benefits of PF KYC Update

- If the KYC records are up to date and connected to the UAN, it is simple to submit a claim withdrawal online.

- The arguments are dismissed if the KYC is not up to date.

- There is no time lag between withdrawal and transition.

- The seamless transition of employee provident fund EPF accounts is ensured by having a modified KYC.

- Users who complete the KYC process successfully get updates about their monthly PF balance and account operation.

- If the KYC records are not changed, the user will not be able to get SMS updates.

- If a person withdraws their PF before completing five years of service, a ten percent tax is deducted from the total. The PAN info in the EPF account must be revised for this. Furthermore, the TDS ratio is 34.608 percent if the PAN data is not changed.