How to Place a Stop Loss Order on Groww

There are two common types of orders in the stock market – market order and limit order. Each of these orders has specific characteristics that are suitable for certain types of transactions.

Additionally, there is another option that might help you handle your trades better – a stop loss (SL) order feature. This can help you set a trigger price for your market and limit orders.

In this blog, we will discuss in detail about stop loss orders and how they can be beneficial to you.

What is a Stop-Loss Order?

To place a stop-loss order, you need to understand the concept of the Stop Loss (SL) Trigger Price. Since you can place a stop loss order for both market and limit orders, we will explain the SL trigger price for both these orders.

Where Can I Find the SL Feature?

When you place a regular buy or sell order ( Market or Limit), you would be able to access the SL feature by clicking on ‘Advanced Options’.

Select the ‘ SL -Stoploss Order’ option and then mention the ‘SL trigger Price’ value. Your order will executed when the live price of the stock hits the tigger price.

Stop Loss for Delivery Orders

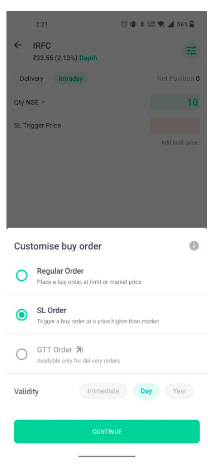

- Click on the desired stock, enter the Qty. and then click on the top right icon. Here select the 'SL Order' option. Press 'Continue' to go ahead.

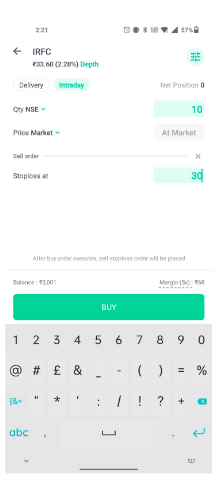

Stop Loss in Intraday Orders

- From Order Card

- Open the relevant stock and enter the desired Qty. in the given field.

- Enter the desired amount at the given stop loss field under the 'Sell Order'.

- Click on SL Order.

- Adding Stoploss to a Position

Let us see how the SL Trigger option can be used while placing market and limit orders.

Market Order

When you place a regular market order, you don’t specify a price, and the order is executed at the current market price. However, let’s say that you don’t want to buy or sell at the current market price. Here are two scenarios:

BUY Order

Let’s say that the live price for a stock is Rs.100. Say, for some reason, you want to place a buy order for the stock only when the market price reaches Rs 110.

In case of a regular market order, this will get executed immediately as you are willing to pay a higher price for the stock than its current market price, however, if you want to wait for the market price of the stock to rise till Rs. 110, you can place a market SL Trigger Order at trigger price of Rs.110. This order will become a regular market buy order in the market once the live price hits Rs. 110

SELL Order

Let’s say the live price of a stock is Rs.100. You want to place a sell order for the stock when the market price reaches Rs.95.

Now a market sell order will get executed immediately as you are selling less than the current stock price. However, say you want to sell the stock the moment it hits a threshold value of Rs 95 (market price), then, you can place a market SL Trigger Order at trigger price of Rs.95. This order will become a regular market sell order once the live price hits Rs. 95.

Limit Order

When you place a limit order, you specify a price at which you want the order to be executed. This allows you to determine a limit on the price that you buy or sell the stock. Now in case of a buy limit order, the orders get executed at the specified limit price or a value that is lower, so that you get the best price. Similarly, when it comes to a sell limit order, the order gets executed at the limit price or at a higher price so that your losses if any are minimised.

Now that we know how to limit orders work, let’s see how SL trigger price comes into the picture. Here again, there could be two possible scenarios.

BUY Order

Let’s say that the live market price for a stock is Rs.100. You want to place a limit buy order at Rs.110. For some reason, you want to buy the stock only when it hits the Rs 110 mark. However, in the case of limit order, as explained above, it would get executed at the best buy price, which would be Rs 100.

So to ensure that the buy price remains Rs 110 only and nothing below that, you can place a limit SL Trigger Order at trigger price of Rs.109.50. This order will become a regular limit buy order in the market once the live price hits Rs. 109.50 and will get executed at Rs.110 or a better buy price.

SELL Order

The same concept would apply here as well, say the live market price for a stock is Rs 100. You want to place a limit order at Rs 90.

This means the order would get executed immediately at the market price because, for a limit sell order, the order gets executed at the limit price or more. However, if you specifically want the order to be executed when it hits the Rs.90 threshold, then you can place a limit SL Trigger Order at the trigger price of Rs.90.50.

This order will become a regular limit sell order in the market once the live price hits Rs.90.50 and will get executed at Rs.90 or a better sell price.

Regular orders – both market and limit orders are placed in the market book directly. A stop-loss order, on the other hand, is placed in the stop-loss book and moved to the market book when the live price hits the trigger price.

When is SL Trigger Order used?

As the name suggests, an SL trigger order is an instruction given by the investor to trigger a market/limit order at a predetermined price. SL orders can be placed if you want to take a buy/sell position, only when the market reaches the desired trigger price.

Alternatively, SL orders also limit losses and reduce risk exposure. When you place a stop-loss order, you try to curb your losses by exiting a trading position at the desired stock price. This works as a good way to protect yourself against potential losses when the market suddenly moves against you.

Let’s look at some examples to understand these scenarios –

Case 1: SL Order when you have a Long Position

Let’s say that you have purchased a share at Rs.100 (net position is +1 ) and are hoping for the stock price to rise. However, you don’t want to suffer a huge loss and decide to sell it if the price falls below Rs.95. To ensure this, you can follow these steps –

- Select SELL option

- Select Stop Loss in the Advanced Options

- In case of –

Market Order – Set SL Trigger Price = Rs.95.10

Limit Order – Set SL Trigger Price = Rs.95.10 and Limit Price = Rs.95.00

This would mean that once the live market price reaches Rs.95.10 the SL order would become open in the market. SL Limit/Market sell order would get executed based on order conditions.

Case 2: SL Order When you Have a Short Position

Let’s say that you have sold a share at Rs.100 (net position is -1 ) and are hoping for the stock price to fall. However, you don’t want to suffer a huge loss and decide to sell it if the price crosses Rs.105. To ensure this, you can follow these steps –

- Select BUY option

- Select Stop Loss in the Advanced Options

- In case of

Market Order : Set SL Trigger Price = Rs.104.90

Limit Order : Set SL Trigger Price = Rs.104.90 and Limit Price = Rs.105.00

This would mean that once the live market price reaches Rs.104.90 the SL order would become open in the market. SL Limit/Market buy order would get executed based on order conditions.

A stop-loss order is a tool that helps you place an order at the desired price beforehand in the market. Use it wisely to manage your trades!

Hope this was helpful.

Happy Investing!

Disclaimer: The views expressed in this post are that of the author and not those of Groww.

Check More Stocks

|

Shares Name |

Annual Revenue (in Cr) |

||||

|

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

687 |

630 |

655 |

864 |

954 |

|

|

-- |

-- |

6479 |

6835 |

7307 |

|

|

14402 |

13325 |

15485 |

16030 |

15294 |

|

|

-- |

32.49 |

48.42 |

52.29 |

66.03 |

|

|

4225 |

4214 |

5645 |

7373 |

4717 |

|

|

244 |

225 |

232 |

223 |

272 |

|

|

43.57 |

48.32 |

46.48 |

50.08 |

53.05 |

|

|

127 |

144 |

102 |

139 |

148 |

|

|

11563 |

10345 |

11268 |

13439 |

11329 |

|