How to Select Stocks for Intraday Trading

In intraday trading, traders buy and sell a security on the same day to book profits from small price movements. The theory of profit-making depends on various factors, one of which is the stock chosen for trading.

With thousands of stocks listed on exchanges, selecting the right ones for intraday trading is vital. We have curated this blog to help you understand how to select stocks for intraday trading.

Let's understand a few suggestions to help you hone your Stock Selection Strategy.

Please note that every investor has their own profile and investment objectives. You can consider this blog as a starting point to develop your strategies further. Please consider your own risk appetite and conduct the necessary due diligence before selecting a stock.

Before we talk about how to select a stock for Intraday, it is important to note that as a day trader, since you don't have the luxury of holding on to the stock, one wrong decision can lead to heavy losses. Typically, if you want to buy and sell any commodity within one day, it should have certain features.

These include:

- High demand (liquidity)

- Price fluctuations so that you can buy low and sell high (volatility)

- Market trends

- Sector trends

- Momentum stocks

- Technical Analysis

Here is an example to help understand this:

Let's say that you want to buy and sell onions for profit. You will succeed if there is a constant trade happening in onions throughout the day, with prices going up and down based on the demand and supply of the commodity (onions).

Also, there should be enough data to support the fact that the overall market is doing good, the business and the onion sector are booming. Further, recent momentum should be in favour of trading in onions.

If these factors are in place, you can be in a good position to earn profits. The same approach applies to Intraday Stocks selection for Trading.

▶️ You may also want to read Intraday Trading Guide for Beginners

How to Pick Stocks for Intraday Trading

Here are the things to consider before selecting stocks for Intraday and finding answers for how to select stock for intraday one day before.

Liquidity

Always pick liquid stocks for intraday trading. These have high trading volumes, meaning the stocks are actively traded, and there are enough buyers and sellers in the market at any given time.

This ensures you can quickly buy and sell the stock without significant price fluctuations.

Now, the question is “how to identify liquid stocks.”

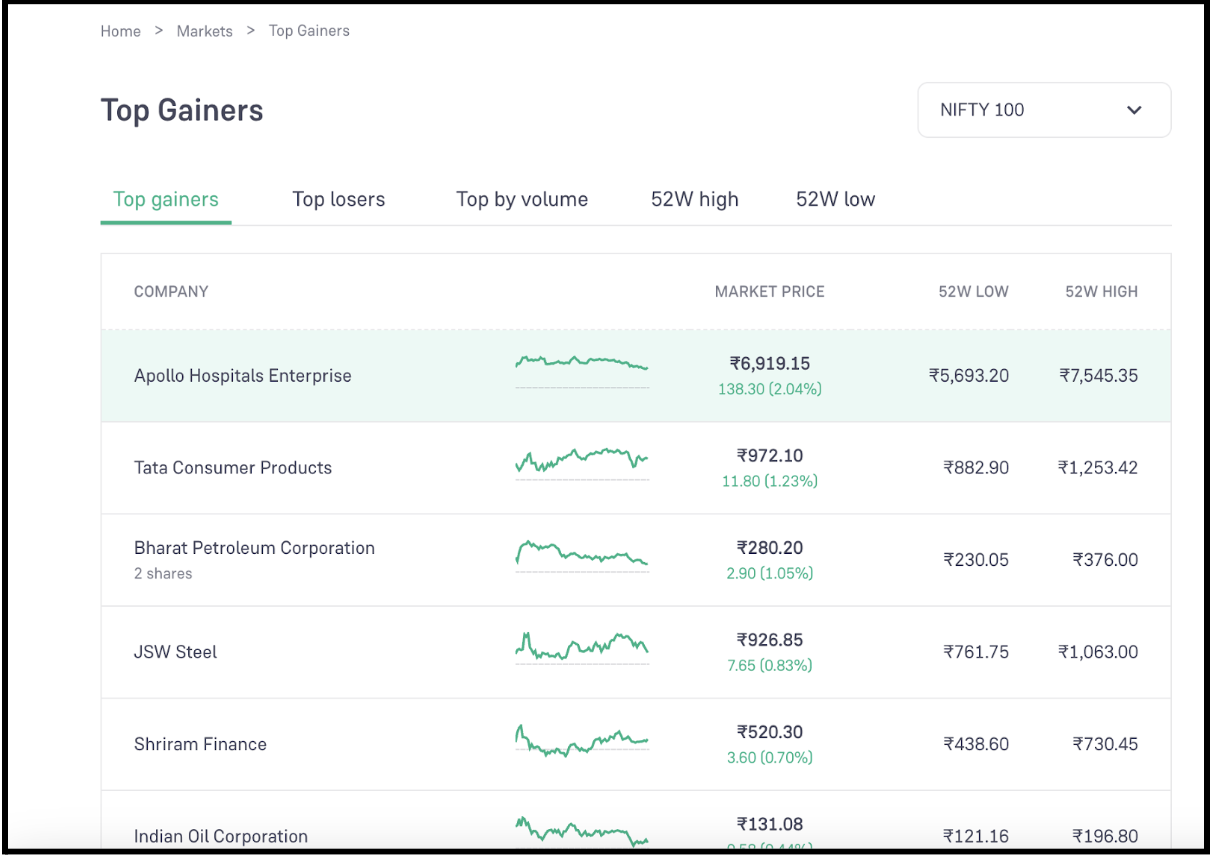

You can simply filter the stocks according to Top Gainers, Top Losers, Top by Volume, etc, whether you have a bullish or bearish view. The 15-minute pre-market session opens at 9:00 AM and closes at 9:15 AM. This is the best time to create your watchlist and start trading as soon as the market opens.

Assess Stock Correlation with Indices

Choose stocks that closely correlate with broader indices, such as the Nifty 50 or Sensex. They tend to follow broader market trends, and their movement is more predictable.

When NIFTY 50 or Sensex rises, stocks with high correlation often experience a rally, reflecting positive market sentiment. Conversely, these stocks will likely face downward pressure if the index declines.

For instance, if the Sensex is gaining due to bullish sentiment in the banking sector, trading liquid bank stocks can be a profitable move.

Choose Stocks With Calculated Volatility

Choose volatile stocks as they show regular price fluctuations and create opportunities for buying and selling.

Their frequent price changes allow traders to capitalize on short-term trends, which is best for intraday trading, where traders can only profit from short-term price movements.

|

Pro Tip: “How to find the best volatile stocks?” |

You need to be extra cautious when buying volatile stocks. Here’s the one important thing you must be mindful of!

Differentiate between calculated volatility and unpredictable price swings caused by external factors like sudden news or market shocks.

Volatile stocks require careful monitoring, so aim to choose the ones with predictable and stable volatility patterns.

Avoid Penny Stocks

The prominent reason why most traders choose penny stocks is because they are available at low prices. But, doing intraday trading in penny stocks is very risky as they lack liquidity and are prone to manipulation.

Volatility (Medium-to-High)

Day traders benefit only when the price moves up or down as per their expectations. Sometimes traders can book losses if the price moves against expectations. If the stock price is volatile, then they can place more intraday orders and benefit from favourable price movements.

But note that buying stocks that are highly volatile can be counterproductive if the drop/rise is too steep.

While there is no rule, most Intraday Traders prefer stocks that tend to move between 3-5% on either side.

Market Trends

Based on economic, political, social, and other factors, markets tend to move either upward or downward. Stocks have a positive or negative correlation with the markets. This means that if the markets rise, the stock prices can rise or fall respectively.

Hence, keeping this correlation in mind is important while buying stocks for intraday trades.

Sector Trends

The market can be divided into various sectors, including technology, pharmaceuticals, automobile, oil & gas, FMCG, and banking.

As an intraday trader, it is important to keep abreast of the performance of all sectors in the economy. If you identify any sector(s) that have been consolidating over months and are ready to break out, then you can look for companies from the said sector to invest in.

Also, if you identify any stocks that have made substantial gains, but you missed capitalizing on the rise, then you can look at peer stocks from the same sector that is in the possible breakout area.

Momentum of Stocks

The speed of change in the price of a stock over time is known as the momentum of the stock. This can help you determine the strength of an upward or downward trend in the price of the stock.

If the stock price moves with the strength of the momentum, then the said stock is called a momentum stock. Such stocks are used by day traders for going long (upward trend) or going short (downward trend) and earning a profit.

Technical Analysis

All the tips explained above for stock selection will only work if you know technical analysis.

Apart from the momentum of stocks, there are various strategies that can help you conduct the technical analysis of stocks to identify buy or sell signals. You can look at stocks that display gaps in the stock prices in either direction.

These gaps can be earning opportunities for day traders. You can also use technical analysis to find stocks that are breaking their support and resistance levels.

Summing Up How to Choose Stocks for Intraday

Remember, buying the right stocks is important to generate profits in Intraday Trading. While the above pointers can help you find them, with time, you will discover ways in which stock selection works best for you.

Ensure that you stay objective and data-driven and avoid emotion-driven decisions to make money via intraday trading.

Happy Investing!