EPF Form 11

EPF form is a self-declaration form that has to be filled and submitted by an employee at the time of joining a new organization that offers the EPF Scheme (Employees Provident Fund) if he/she is not a member of the EPFO.

If the employee is already a member of the EPFO, the employer has to continue his/her PF obligations.

What is Form 11?

Form 11 PF is a self-declaration form that contains the EPF history of the employee and is mandatory for an employee to fill out upon joining an organization. It can also be used to transfer the PF account automatically.

Who Needs to Fill EPF Form 11?

EPF Form 11 is mandatory for any individual to fill out at the time of joining a new organization that is registered under the EPF Scheme of 1952. However, existing members also need to fill out this form after switching their job as it contains all the details related to the contribution made by the employee. Furthermore, this form is also used to transfer your PF account.

Key Points for EPF Form 11

|

Purpose |

For New Members of EPF Scheme: It is a PF Declaration Form 11 of their basic EPF details For Existing Members: automatic transfer of PF details to a new account |

|

Where to Download? |

|

|

Eligibility |

When the employee’s salary is more than ₹ 15,000 and the organization he/she is working in has more than 20 employees. |

|

Mandatory |

Yes |

|

When to Fill |

At the time of joining a new organization which is covered under the Employees Provident Fund (EPF) scheme as per the EPF Act, 1952 |

In the past, employees had to fill out Form 13 to make the transfer to the new EPF account. However, with the introduction of form 11, the automatic transfer request has been included in this form itself.

The EPF form no 11 can be used to make the declaration for both the provident fund and pension scheme.

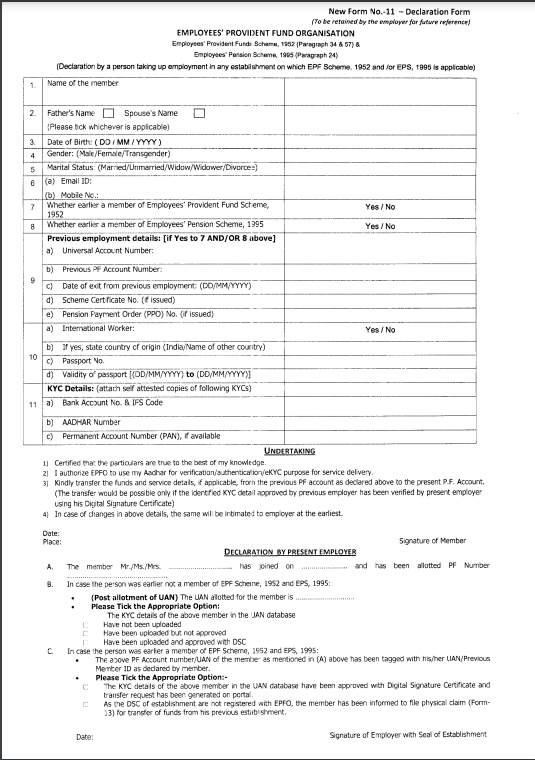

Structure of PF Form 11

The Employee Provident Fund form 11 has a total of 11 fields to be filled by the employee and a section called ‘Declaration by Present Employer’ which is to be filed by the employer.

While EPF Form 11 online submission, you will be asked to submit the following details-

- Name of the employee

- Date of birth of the employee

- Father’s/Husband’s name

- Gender

- E-mail id

- Mobile Number

- Relationship of the employee with EPS and EPF schemes

- Previous employment details such as the UAN, last working day, scheme certificate number

- Educational details

- Marital status

- KYC details including bank account number, Driver’s license, etc.

- Passport (in case of foreign employees)

Also, the following documents must be provided by the employer-

- Employee’s Date of Joining

- Universal Account Number (UAN) of the employee

- Provident Fund ID number assigned to the employee

- Verification of the employee’s details

How to Fill PF Form 11?

The following details need to be filled in Form 11-

Personal Information such as-

- Name of the member

- Father’s Name or Spouse’s Name (whichever is applicable)

- Date of Birth

- Gender (Male, Female, and Transgender)

- Marital Status

- Contact Details – Email ID and Mobile Number

Details Related to Previous Employer and EPF and EPS Participation

- Whether the employee is an existing member of Employee’s Provident Fund Scheme, 1952

- Whether the employee is an existing member of the Employee’s Pension Scheme, 1995

- If the employee has marked the answer as ‘YES’ regarding participation in any of the two schemes, some additional data points are required to be furnished:

- UAN or Universal Account Number

- Previous PF or Provident Fund Account Number

- Date of exit from previous employment in the format dd/mm/yyyy

- Scheme Certificate No. (if issued)

- Pension Payment Order (PPO) No. if issued

In the case of international workers, the following details need to be provided:

- Country of Origin

- Passport Number

- Validity of passport

KYC Details

Self-attested copies of the following documents also need to be attached along with this form:

- Bank Account and IFSC

- Aadhaar Number

- Permanent Account Number (PAN)

Undertaking by the Employee

Read the declaration points that are mentioned in the form and sign the undertaking and mention the date and place of signing the undertaking on the left side.

Declaration by Present Employer

The present employer, i.e. the newly joined organization, is required to take necessary actions as mentioned below and fill up the concerning details, and sign and seal the same. It also has to provide a declaration containing details regarding the information provided by an employee.

This declaration contains the following details:

- Date of joining of the employee

- PF ID number/Member ID assigned to the employee

- UAN of employee

- Verification of KYC credentials

EPF Form 11 Submissions

After you have filed Form 11, you will need to submit it to the employer. The employer will sign the form and stamp it. Then, the employer will submit the form to the regional EPF office. The transfer is made much easier if you possess UAN and the transfer procedure can be easily done online.

What are the Responsibilities of the Employer?

- Make all the new joiners fill out the declaration form (New format of Form No. 11) within a time period of one month and upload the information on the UAN portal within a time period of 25 days from the end of every month.

- Share the UAN details as generated by EPFO to all existing members of the fund within 15 days from the receipt of UAN and get their acknowledgement on the same.

- Seed KYC details (PAN, Aadhaar Card, and bank account details) of such members within a month of the receipt of UAN.

- In case the member does not have an Aadhaar card, the employer should get the Aadhaar Acknowledgement Slip submitted within a month from the time of receipt of UAN.

- Once the employer receives Aadhaar information from the employee, he/she is required to upload the Aadhaar details on UAN Portal within 15 days of receiving such information.

- Claim forms should be meticulously checked by the employer before sending them to the EPFO from the end of the employer. The employer should check whether it is completed from all aspects such as all relevant KYC information should be linked to the UAN.

EPF Points for International Workers

The term "international workers" refers to two groups of people-

- An Indian employee who is presently working or has previously worked in another nation with whom India has signed a Social Security Agreement, also known as the SSA or Social Security Agreement.

- Any person who is not an Indian and works in India for a company covered by the Employees' PF and Miscellaneous Provisions Act.

Previously, multinational workers in India were not eligible for the Employees' Provident Fund Scheme. However, every qualified overseas worker (i.e. non-excluded members) is now obligated to join and contribute to the EPF Scheme.