National Payments Corporation of India (NPCI)

The National Payments Corporation of India (NPCI) was established by the Indian Banks’ Association (IBA) and RBI (Reserve Bank of India) under the Payment and Settlement Systems Act of 2007. It was developed as an initiative to make a robust payment infrastructure in India.

NPCI was established in 2008 and plays a major role in the Indian financial ecosystem by operating and managing the different payment systems in India. This post covers information on the different services and functions of NPCI and how one can register a complaint with the National Payments Corporation of India.

Services Offered by NPCI

The establishment of NPCI has made it easier for people to access banking and payment services in India, mainly in remote areas. Additionally, NPCI has been a key player in the Indian government's vision of a less-cash economy and promoting digital payments.

- Unified Payments Interface (UPI): UPI is a real-time payment system that allows users to transfer money, make payments, and check their account balances using their mobile phones. It has revolutionised digital payments in India.

- Immediate Payment Service (IMPS): IMPS enables instant fund transfers and is available 24/7, making it a convenient way to send money.

- National Electronic Funds Transfer (NEFT): NEFT is a system for transferring funds from one bank to another, typically used for non-urgent, high-value transactions.

- Real-Time Gross Settlement (RTGS): RTGS is used for high-value, time-sensitive interbank fund transfers. It settles transactions on a real-time basis.

- Bharat Bill Payment System (BBPS): BBPS facilitates the payment of various utility bills, such as electricity, water, gas, and more, through a single platform.

- National Financial Switch (NFS): NFS connects ATMs across India, ensuring interoperability and accessibility for customers of different banks.

Functions of NPCI

The National Payments Corporation of India (NPCI) plays a major role in the Indian financial system. Some of its key functions include:

- Retail Payment Systems: NPCI manages and operates various retail payment systems in India, including the Unified Payments Interface (UPI), Immediate Payment Service (IMPS), and National Electronic Funds Transfer (NEFT), among others.

- Unified Payments Interface (UPI): UPI is one of NPCI's most significant innovations, enabling real-time, peer-to-peer and peer-to-merchant digital transactions.

- NFS and interbank transactions: NPCI manages the National Financial Switch (NFS), which connects ATMs across the country, facilitating interbank transactions.

- Aadhaar Enabled Payment System (AePS): NPCI oversees the AePS, which allows financial transactions using Aadhaar authentication, promoting financial inclusion.

- BHIM (Bharat Interface for Money): NPCI developed and maintains the BHIM app, a UPI-based mobile payment application.

- National Automated Clearing House (NACH): NPCI manages NACH, an electronic payment service that facilitates bulk transactions, such as salary payments and utility bill collections.

- Bharat Bill Payment System (BBPS): NPCI operates BBPS, a centralised bill payment system that allows consumers to pay various bills through a single platform.

- Rupay Contactless Card: NPCI introduced contactless payment technology through RuPay cards, making transactions faster and more convenient.

How to Register a Complaint with NPCI?

One can make an NPCI complaint online by registering their issue through the official website. Below are the steps that need to be followed to make a UPI-related complaint or any product-related complaint:

1) Process to Register a UPI Complaint with NPCI

Customers can raise a complaint to the National Payment Corporation of India for UPI-related transactions or errors by following the steps given below:

- Go to the NPCI official website.

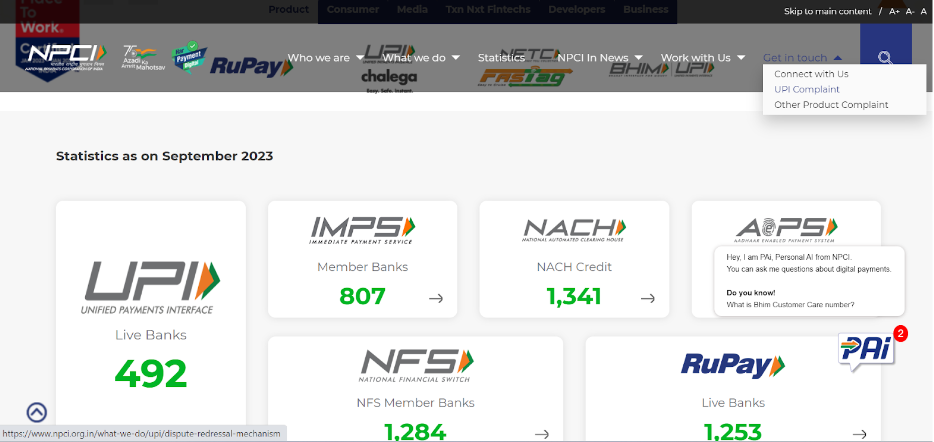

- Select the ‘Get In Touch’ option and click on ‘UPI Complaint’ from the drop-down menu.

Image Source: https://www.npci.org.in/

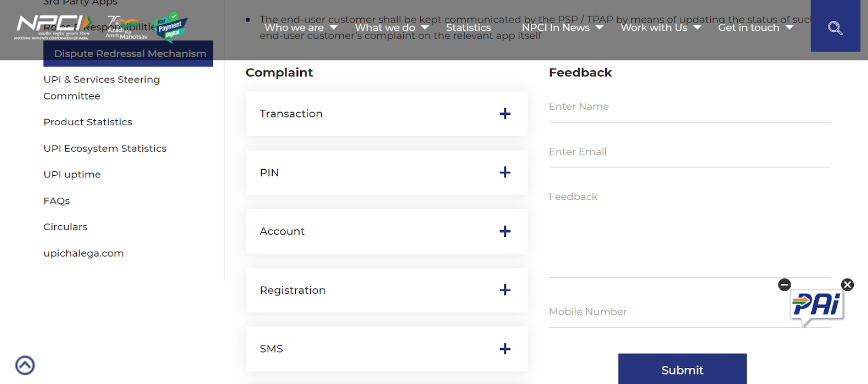

- On the next page, enter your name, mail ID, mobile number and feedback. Select the type of complaint - Transaction/PIN/Account/Registration/SMS/Login/Others. Refer to the image shown below.

Image Source: https://www.npci.org.in

- Click on ‘Submit’ to register your complaint. Soon, the customer support team will reach out to you on your registered mail ID or mobile number to resolve the issue.

2. Process to Register a Product Complaint with NPCI

Here are the steps that should be followed to register a product complaint with the National Payments Corporation of India:

- Go to the NPCI website.

- Select the ‘Product Type’ from the list of options - NFS ATM, RuPay, IMPS, AePS.

- Enter the transaction type, the first six digits of the card number, and the last four digits of the card number.

- Now, select your bank name, transaction ID, date, account number and transaction amount.

- Provide your contact number, name, and email address.

- Enter the Captcha code and click on ‘Save and Proceed’ to register your complaint successfully.

NPCI Helpline Number

Customers can also reach out to the NPCI helpline number - 1800-120-1740 to address any issues or queries related to the BHIM app and transactions.

You can also use the DigiSaathi feature introduced by NPCI. It is an automated response system and provides information 24x7 on payment-related products and services, such as Cards (Debit/Credit), UPI, NEFT, RTGS, IMPS, AePS, BHIM apps, ATM transactions and online banking.