SBI Net Banking - Activation, Login and Services

State Bank of India (SBI) provides the benefits of SBI Net Banking to both its retail and corporate customers. Many personal banking services can be availed through SBI Internet Banking or net banking services. These include downloading account statements, online bill payments, printing Passbooks, cash withdrawals, creating Demand Drafts, applying for chequebooks, etc.

In this article, we will discuss the different services offered by SBI online banking and the registration and login process.

Features and Services of SBI Net Banking

Through SBI Internet Banking, an account holder can access the following services:

- Check Bank Account Details.

- Download SBI Bank Account Statements to track previous transactions.

- Update Profile details, Nomination & PAN card details.

- Check CIBIL Score and credit card statements.

- Change the SBI Login Password.

- Link Aadhar Card to Bank Account.

- Make NPS Payments, Mobile Recharges, Tax Payments and SIP Registration.

- Transfer funds within SBI bank accounts and other bank accounts.

- Request for a Demand Draft.

Documents Required for SBI Net Banking

SBI online banking or net banking service does not require many documents. However, one must keep the following details handy during the registration process:

- Registered Mobile Number

- SBI Account Number

- CIF Number

- SBI Branch Code

- Country Name

- SBI ATM Card Information.

SBI Net Banking Registration Process

Once the user has created a bank account with SBI, they can register for the SBI Online Banking services by filling out the net banking application form and submitting the required documents. The user will be provided with a temporary user ID and password, which can be used to activate net banking services.

How to Activate SBI Net Banking Services?

Here are the steps to activate SBI e-banking:

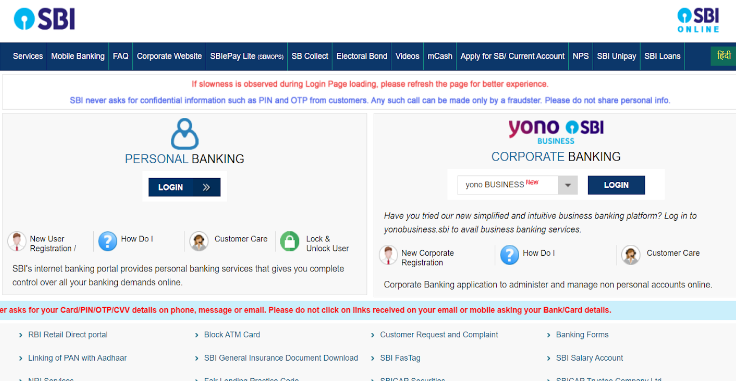

Step 1: Visit the SBI Internet Banking portal.

Image Source: SBI official website

Step 2: Select ‘Personal Banking Login’ or ‘SBI YONO Corporate Banking’ as required.

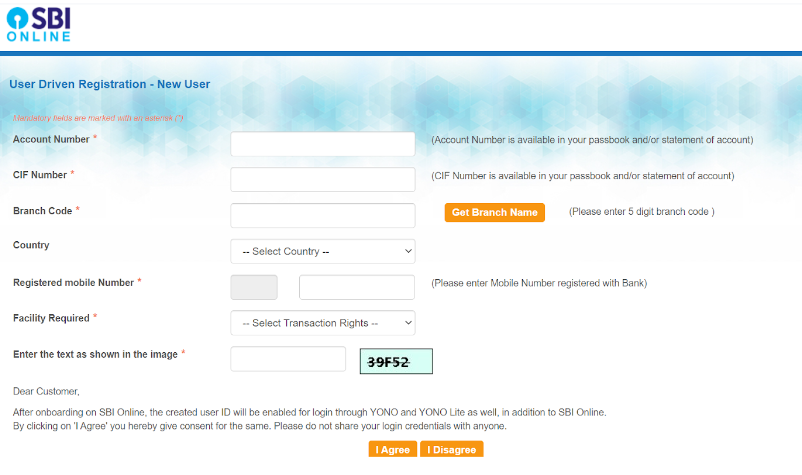

Step 3: Click the ‘New User Registration/Activation’ option on the next page.

Step 4: Fill out the Account Number, CIF Number, Branch Code, Country, Registered Phone Number, and the Banking Facility.

Image Source: SBI official website

Step 5: Choose between ‘View Transactions’, ‘Restricted Transactions’, and ‘Full Transactions’ from the ‘Facility Needed’ section.

Step 6: Enter all the details and click ‘I Agree’ to proceed.

Step 7: Enter the OTP and click the ‘Confirm’ button.

Step 8: Choose the ‘I Have My ATM Card’ option and click ‘Submit’. (Online Banking services will be authorised by the branch if you do not have an ATM card.)

Step 9: Verify the ATM card credentials. Click ‘Continue’ after entering the ATM Card details.

Step 10: Create a permanent Username and a Login Password. (Upper and Lowercase Alphabets, a Number, and a Special Character must be included in the password.)

Step 11: Enter the password again to confirm. Click ‘Submit.’

Step 12: The user will be notified once the registration is successful.

SBI Internet Banking Login Process

We have explained the SBI Online Banking login process for both SBI personal and SBI Corporate Banking users.

SBI Personal Banking Login

Step 1: Go to the official website of SBI.

Step 2: Select the ‘Login’ button under the Personal Banking section.

Step 3: Enter your Username and Password in the fields provided and click ‘Login.’

SBI Corporate Login

SBI Corporate Banking users can go through these steps to log in to their net banking portal:

- Go to the official website of SBI e-banking.

- Go to the YONO State Bank of India Corporate Banking section.

- Select ‘Corporate’ from the drop-down menu and click the ‘Login’ button. Refer to the picture below for better understanding.

Image Source: SBI official website

- On the next page, enter your User ID, Password and Captcha. Click the ‘Login’ button to access the net banking portal.

How to Reset SBI Net Banking Login Password?

State Bank of India has made it mandatory to change the Internet Banking password after 365 days for security reasons. Users can change their net banking password anytime by following the steps mentioned below:

Step 1: Log in to SBI online banking.

Step 2: Choose ‘Continue to Login’ on the next page.

Step 3: Click on ‘Forgot Username/Login Password’. A pop-up window will be displayed on the screen.

Step 4: Select ‘Forgot My Login Password’ from the drop-down list. Press ‘Next’ to continue.

Step 5: Enter your Username, Bank Account Number, Date of Birth, Mobile Number, Country, and CAPTCHA code. Click ‘Submit’.

Step 6: Enter the OTP received on your registered phone number.

Step 7: Set the net banking password by choosing ‘Using Profile Password’ from the drop-down box. You may also visit an SBI branch or use your ATM card information to update your net banking password.

Step 8: To continue, enter your net banking account password.

Step 9: Input the New Password now, then initiate the request.

Step 10: The ‘Reset Password’ process is complete, and the user can now log in to the SBI net banking portal using the New Password.

SBI Net Banking Transaction Limits

The transaction limitations that may be applied to the SBI Online Banking service are mentioned in the table below:

|

SBI Transaction Limits for Net Banking |

|

|

Transaction Type |

Per Day Limit |

|

IMPS |

₹2,00,000 |

|

Quick Transfer |

Limit Per Transaction: ₹10,000 Overall Daily Limit: ₹2,00,000 |

|

NEFT |

₹10,00,000 |

|

RTGS |

₹10,00,000 |

|

UPI |

₹1,00,000 |

|

Transfer Between Self-Accounts |

₹2,00,000 |

|

First 4-Day Transaction Limitations for a New Recipient |

₹1,00,000 |

|

Transfer to Third Parties Within SBI |

₹10,00,000 |