What is Demat Debit and Pledge Instruction (DDPI)

Selling shares or securities involves the cumbersome process of TPIN-CDSL verification. For traders, this delay can be costly, especially when the market is moving fast and they need to act quickly to avoid losses.

Here, Demat Debit and Pledge Instruction (DDPI) proves to be a saviour. It allows traders to sell shares and pledge securities without the lengthy TPIN OTP verification.

This blog will explain everything about DDPI, its importance and how it makes trading operations easier and more efficient for investors.

DDPI Meaning

DDPI or Demat Debit and Pledge Instruction is a formal document that allows a stockbroker/depository participant (DP) to

- Sell shares

- Pledge shares

- Execute mutual fund transactions

- Tender shares in open offers from a trader’s or investor’s demat account without CDSL T-PIN verification.

DDPI was introduced as the replacement for PoA (Power of Attorney) by the Securities and Exchange Board of India (SEBI) on October 6, 2022.

To know

- What is PoA

- Why PoA has been replaced with DDPI, read on…

In the context of a demat account, a Power of Attorney or PoA is a legal instrument or document that allows one (usually a stockbroker or another person) to manage the demat account.

This includes the ability to:

- Buy

- Sell

- Pledge

- Transfer shares on behalf of the account holder.

Since a POA allows transactions without direct involvement or approval by the account holder, it gives broader authority. This has led to misuse in some cases, where brokers were transferring shares without the account holder's consent.

That’s why SEBI replaced PoA with DDPI (w.e.f July 01, 2022), a controlled, efficient, and secure mechanism that limits the use of certain actions in the demat account and reduces the chance of misuse.

PoA differs from DDPI in several aspects, including:

|

Aspect |

Power of Attorney (PoA) |

Demat Debit and Pledge Instruction (DDPI) |

|

Authority Scope |

Grants broader authority |

Provides limited authority |

|

Level of Control |

Allows the holder to act on behalf of the account holder, often without needing approval for each transaction |

Requires prior approval for specific actions |

|

Risk of Misuse |

Higher risk |

Lower risk |

What Transactions Can Be Facilitated Via DDPI?

According to SEBI’s circular, DDPI allows:

- Transfer of Securities held in a demat account to settle trades executed on the Stock Exchange through the stockbroker. This makes the process of buying or selling shares smoother and more transparent.

- Pledging or Re-pledging of Securities to a trading member (TM) or clearing member (CM) to meet margin requirements for trades. This way, the process of using shares as collateral for trading becomes simpler and more convenient.

- Execution of Mutual Fund Transactions on Stock Exchange platforms.

- Tendering Shares in Open Offers in compliance with SEBI regulations. This means if there is an open offer/public invitation to buy shares from shareholders, the process will be transparent.

In a nutshell, DDPI will work the same as PoA but with less risk of misuse and fraudulent transactions.

Read more: How to Know Your Demat Account Number?

How Can You Activate DDPI On Groww?

The account opening process of DDPI on Groww is completely online and hassle-free. You can either use Groww

- Website or

- App to activate DDPI in a few simple steps.

Step-by-Step Procedure To Activate DDPI On Groww App

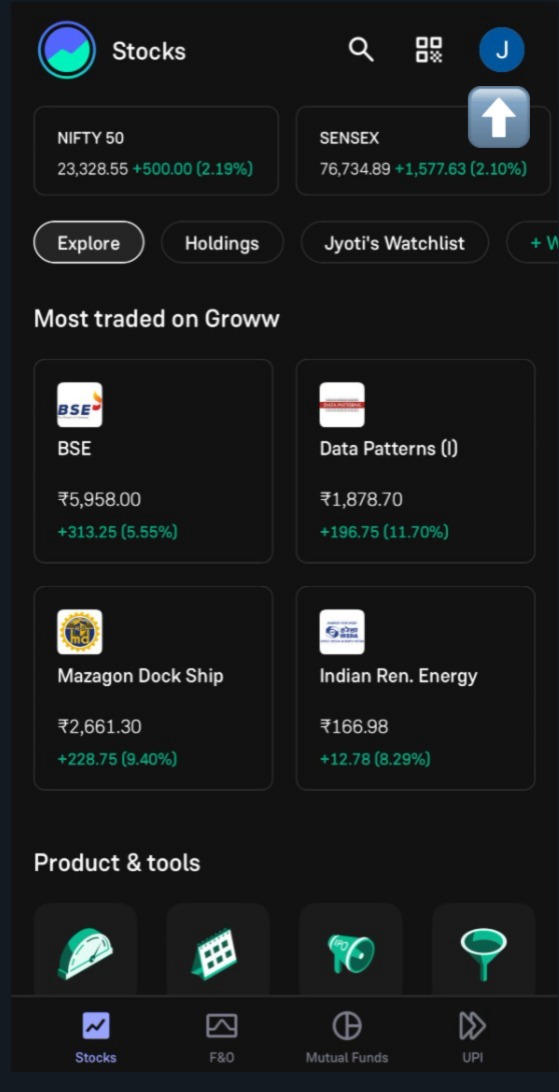

Step 1) Click on the profile section in the top right corner.

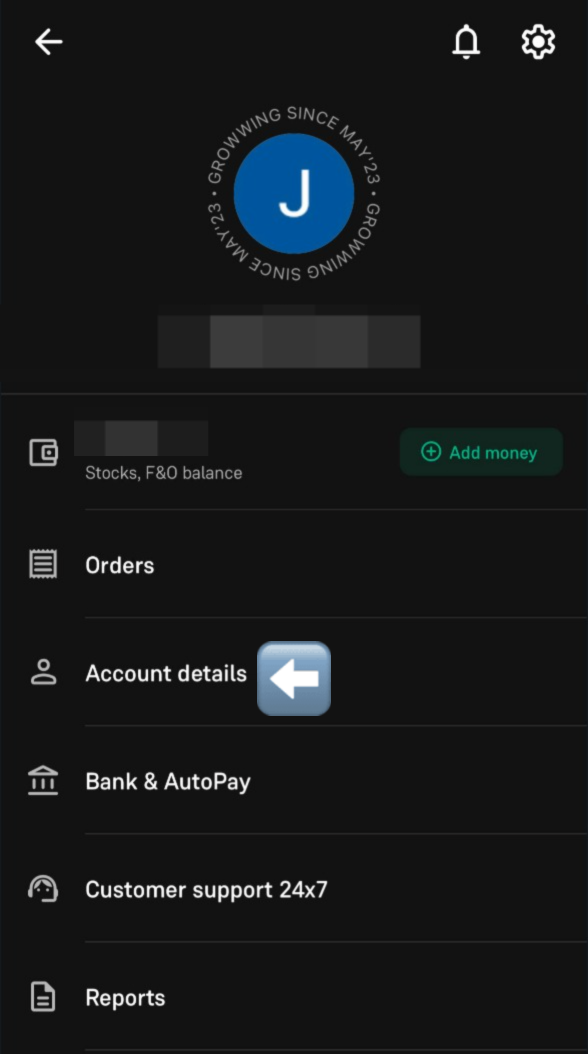

Step 2) Click on “Account Details.”

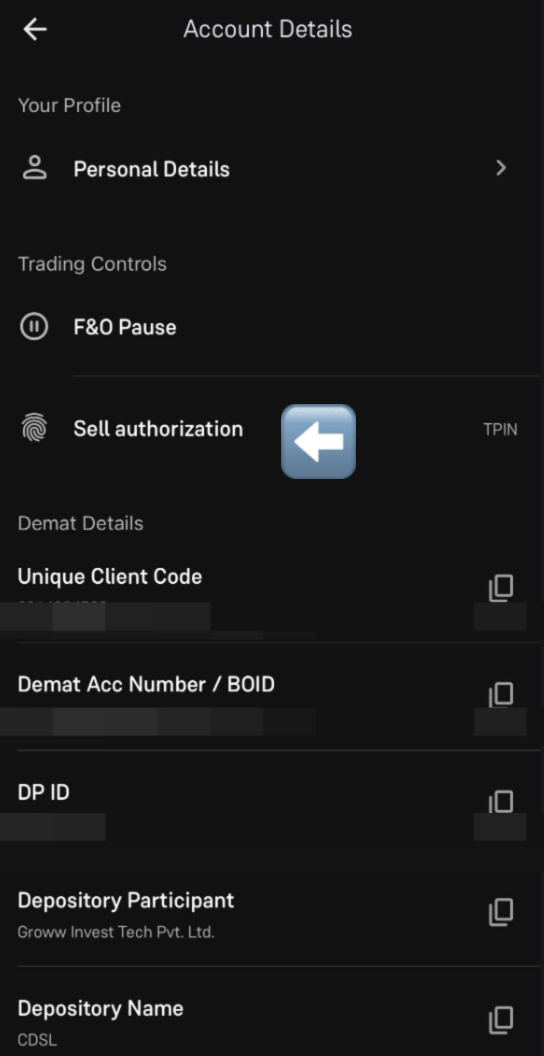

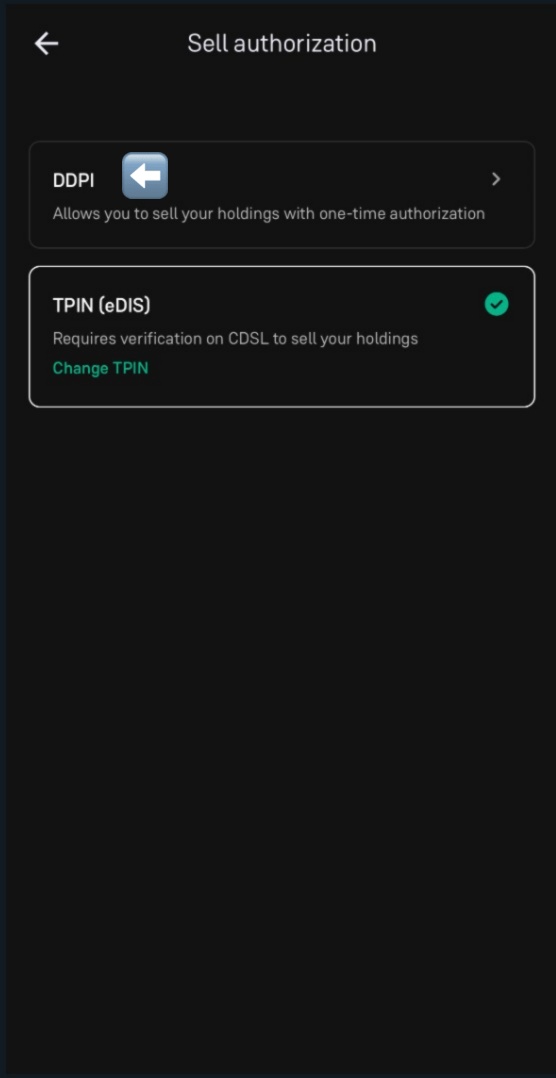

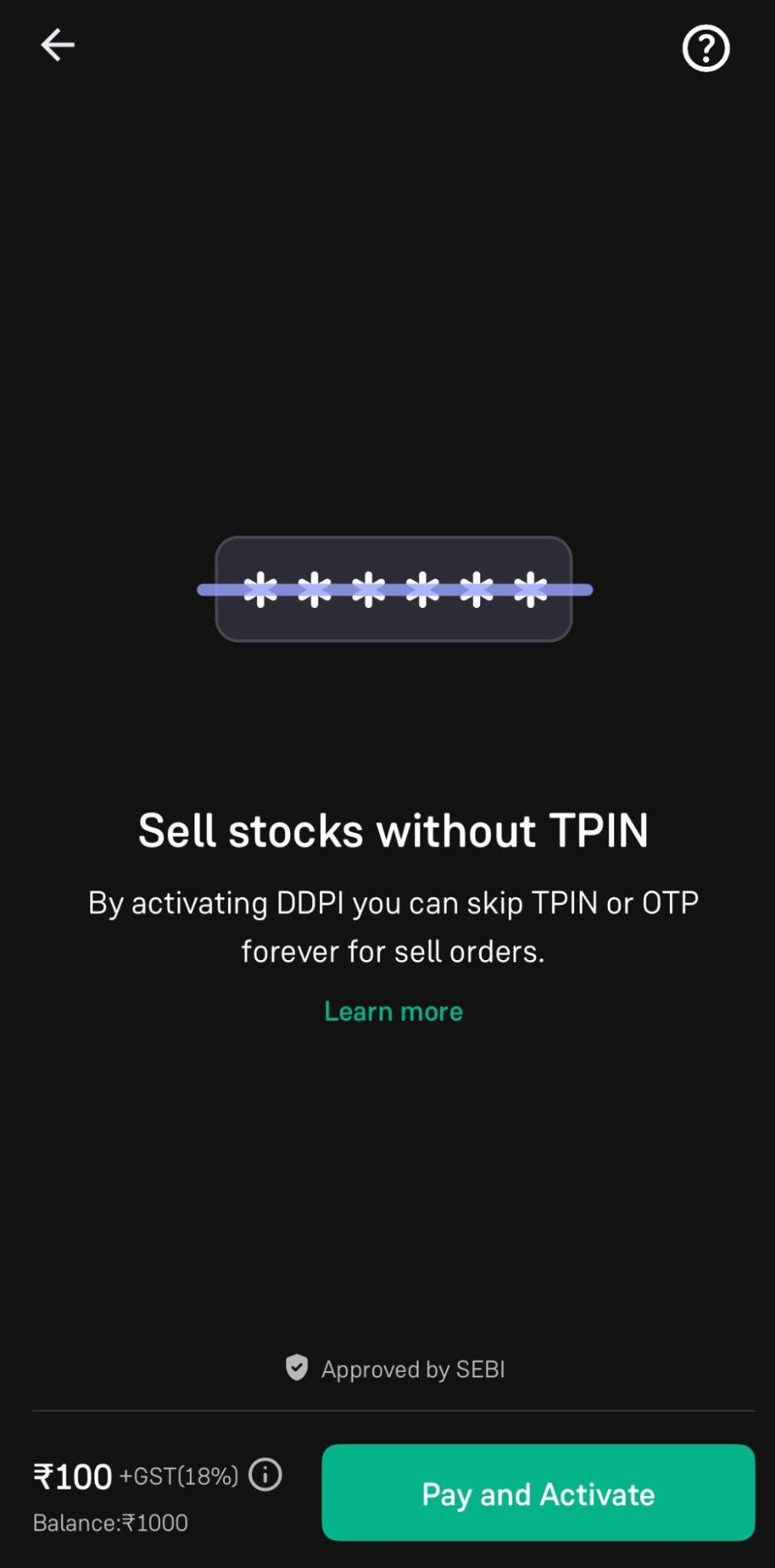

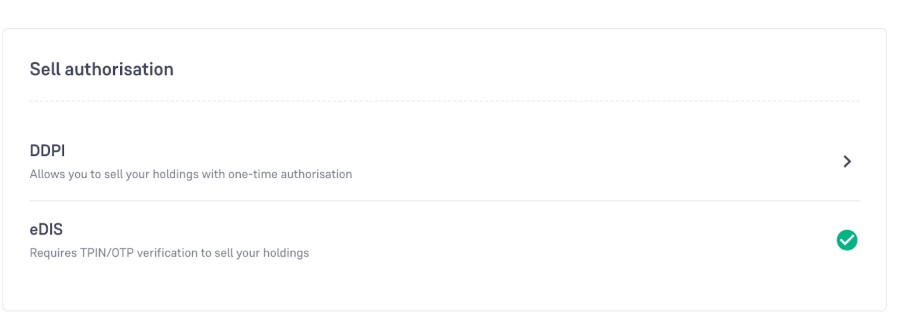

Step 3) Click on “Sell authorization.” By default, the method is set to TPIN (as shown in the screenshot below).

Step 4) Click on “DDPI.”

Step 5) Click on “Pay and Activate”, and you’ll be redirected to e-sign the DDPI form.

Once you have successfully completed the DDPI Aadhar e-sign and the payment, the DDPI will be activated within 24 hours.

Step-by-Step Procedure To Activate DDPI On Groww Website

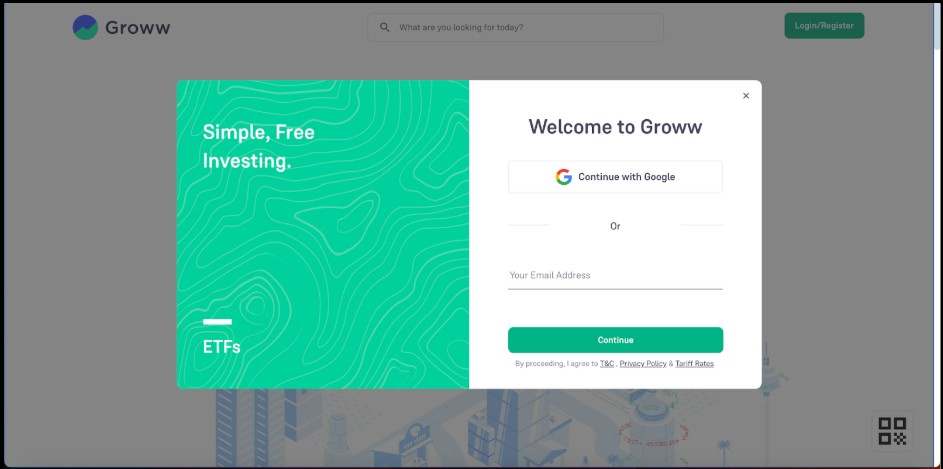

Step 1) Visit groww.in

Step 2) Login using your email address and Groww PIN.

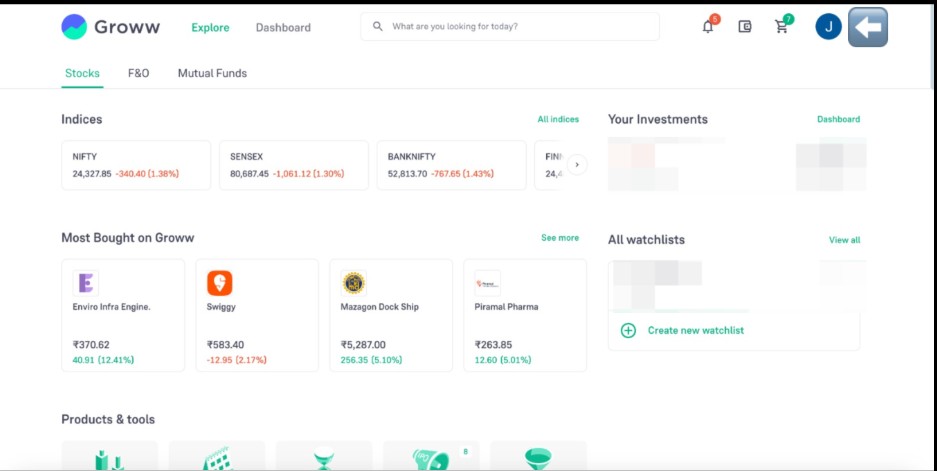

Step 3) In the top-right corner, click on your profile section.

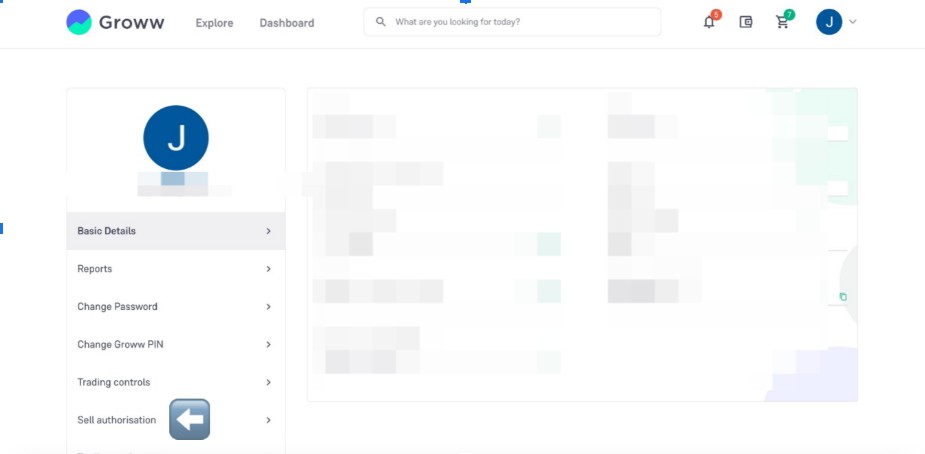

Step 4) In the left corner, click on “Sell authorisation”.

Step 5) Click “DDPI”.

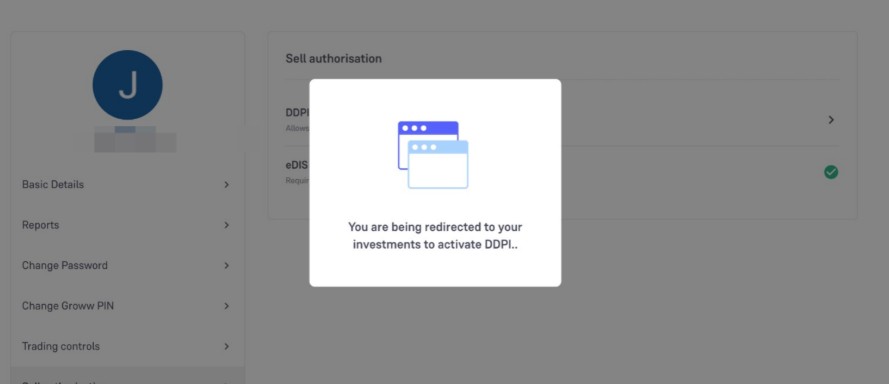

Step 6) The pop-up (below) will appear and you’ll be redirected to a new webpage.

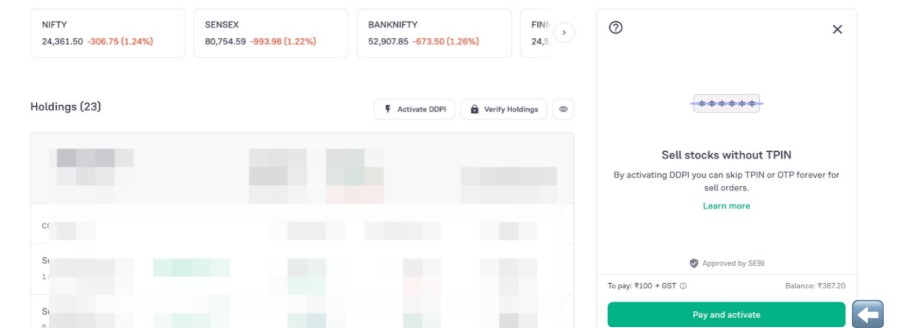

Step 7) Click on “Pay and activate” to activate DDPI at a nominal fee of ₹100+ GST.

Common Questions Regarding Demat Debit and Pledge Instruction (DDPI)

-

Is setting up DDPI mandatory?

No. Setting up DDPI is not mandatory; it depends on you whether to activate DDPI or not. No broker can force you to activate DDPI.

-

I have activated DDPI. Will the existing PoA still work?

The existing PoA will work until you revoke it. Once done, it becomes null and void; then you can use DDPI.

-

Which is better: DDPI or e-DIS OTP based mechanism?

Both DDPI and e-DIS OTP-based mechanisms are used for authorising transactions related to securities. However, they are slightly different.

Once set up, DDPI allows pre-authorisation for specific actions. It doesn't require OTP verification each time. On the contrary, an e-DIS transaction requires an OTP, which ensures that the account holder’s consent is obtained each time.

Choose DDPI if you want

- Faster, predefined transaction approvals

- To avoid the delays that come with OTP verification.

Choose e-DIS if you want to

- Have greater control over each transaction

- Manually approve each action.

Conclusion

Demat Debit and Pledge Instruction

- Secures and streamlines demat account transactions

- Provides enhanced control

- Reduces the risk of misuse

- Makes the process more transparent compared to traditional methods like Power of Attorney (PoA).

By activating DDPI in a few clicks, you can ensure a safer, quicker, and more efficient way to handle transactions.

Disclaimer: This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory.

To read the RA disclaimer, please click here

Frequently Asked Questions (FAQs)

1. What is DDPI?

DDPI is a formal legal document that allows for the pre-authorisation of specific demat transactions, such as transferring, pledging, execution of mutual fund transactions, and tendering shares/securities in open offers, directly from a demat account.

2. How much does Groww charge for DDPI activation?

Groww charges ₹100+ GST for DDPI activation. This includes providing an e-stamp and DDPI form.

3. How does DDPI differ from e-DIS (electronic Delivery Instruction Slip)?

Once set up, DDPI allows specific transaction from the demant account to be executed without OTPs; while e-DIS requires the account holder to authorise each transaction individually through an OTP.

4. How does DDPI differ from Power of Attorney (POA)?

PoA provides broad authority for various transactions without the account holder’s approval, which often leads to misuse and fraudulent activities. DDPI is limited to specific demat account actions which makes it more secure and transparent.

5. Is setting up DDPI a complex process?

Not at all. Setting up DDPI is straightforward and can be done in a few clicks via your stock broker.

6. How does DDPI enhance security compared to traditional methods?

DDPI limits the scope of authorisation to specific predefined actions which ultimately reduces the risk of unauthorised transactions.

7. Can DDPI be revoked if needed?

Yes, DDPI can be revoked by the account holder at any time.