PAN Verification

PAN card verification is an essential and simple step that can be done online. Online PAN verification is a feature that is accessible on specific government websites and can be completed easily, provided you have all of the necessary information.

The Income Tax Department has authorized NSDL e-Governance Infrastructure Limited to validate and verify these PAN Cards. Thus, one can verify their PAN card online by using this NSDL e-Governance service.

Pan Card Verification Online Process

You can verify pan card online using the following steps outlined below:

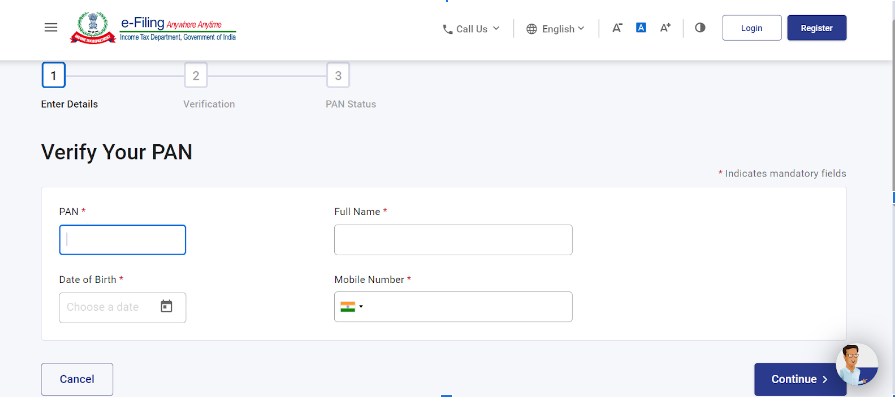

- Log in to the NSDL or income tax e-filing website (https://eportal.incometax.gov.in/iec/foservices/#/pre-login/verifyYourPAN) for the NSDL PAN verification process.

Image Source: https://eportal.incometax.gov.in/

- Fill in the data, including your complete name, date of birth, and your PAN number.

- After that, enter the captcha code provided by the portal and press the submit button.

- Your PAN card will then be shown, along with the PAN number verification status.

- You must verify the verification status within 5 days of getting the acknowledgement.

Online Pan Verification by Pan Number

You can also do your PAN verification online using the PAN card number. Here are the steps that should be followed for online pan verification by pan no.

Step 1: Visit https://eportal.incometax.gov.in/iec/foservices/#/pre-login/verifyYourPAN.

Step 2: Fill in the details such as your full name, date of birth, and mobile number along with your PAN number.

Step 3: Click on ‘Continue’.

Step 4: Enter the OTP that is sent to your mobile number and click on ‘Validate’.

Step 5: Follow the steps on the next page to complete the process.

How to Verify Pan Online Under Section 194N?

The following are the actions that must be taken to verify the pan card under Section 194N:

Step 1: Go to the Income Tax Portal and log in.

Step 2: Enter your PAN and cell phone number.

Step 3: Accept the terms and conditions by clicking the ‘Continue' button.

Step 4: Complete the instructions on the following page to obtain information on the verification of application under Section 194N.

How to Verify PAN Details Issued by the Company?

UTI Infrastructure Technology And Services Limited is one of the country's largest financial services companies. They are owned by the Government of India and provide financial technology to the government's financial sectors. UTIISL, like NDSL, issues PAN cards to Indians who apply through their website.

To verify, go to the UTIISL PAN website and log in with your credentials. After that, you must pick the option to validate your PAN card by entering the necessary information. The results will subsequently be shown on the website.

How to e-verify your Returns Using Aadhar Card?

The following is the procedure that must be undertaken to e-verify your returns using the Aadhaar OTP:

Step 1: Go to the E-Filing Portal and sign in.

Step 2: Log in to your account by providing your PAN, password, and captcha information.

Step 3: Go to ‘My Account.'

Step 4: Select ‘e-verify return.'

Step 5: Next, choose the ‘I want to generate an Aadhaar OTP to e-verify my return' option.

Step 6: A one-time password (OTP) will be provided to the registered cellphone.

Step 7: To finish the verification procedure, enter the OTP.

Entities Eligible for PAN Verification

A list of persons and organizations that are eligible for verification is provided below. This service is available to the following entities-

- RBI-approved payment banks

- Central Vigilance Commission

- Stamp and Registration Department

- Reserve Bank of India

- Income Tax Projects

- Central and State Government Agencies

- Depositories

- Goods and Service Tax Network

- Commodity Exchanges/Stock Exchanges/Clearing Corporations

- Entities that must submit a Statement of Financial Transactions/Annual Information Return

- Companies that must file a Statement of Financial Transactions/Annual Information Return

- Regulatory Bodies that have founded educational institutions

- Central KYC Registry

- RBI-approved credit information agencies

- Depository Participants

- Authorities who issue the DSC

- National Pension System’s Central Recordkeeping Agency

- Credit card institutions

- Mutual Funds

- Insurance Repository

- Insurance Company

- Housing Finance Companies

- RBI Prepaid Payment Instrument Issuers

- RBI NBFCs

- SEBI Investment Advisor