7 Things to Do When Losing Money in Mutual Funds

When mutual fund investors seek higher returns, they invest in equity mutual funds. These are mutual funds that invest in the stock markets. Since they are market-linked, these funds get affected when the market goes down and this is why there are chances of loss in mutual funds too.

Now many times when the markets are down, such as now, investors panic and take decisions that may not be in their best interests. If you are an investor and wondering what to do with your investments in this situation, here are 7 things you can do instead.

Keep Calm

This is the absolute first step to successful investing.

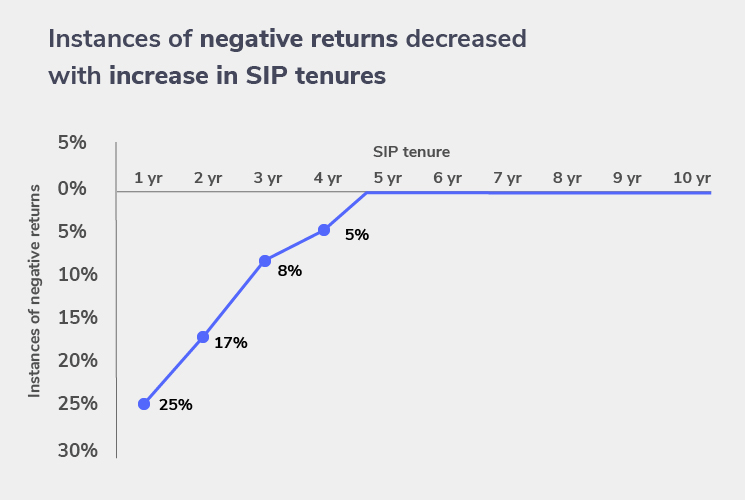

The stock markets usually perform well over a long period. In the short term, volatility causes the price to go up and down. While there is loss in mutual funds due to short term market disturbances, if you look at the long term, instances of negative returns drastically reduce after 3-4 years of holding.

Source: CRISIL Research.

As you can see, if you have a longer time horizon of say 7-10 years, you need not get disturbed by the news around and lose your calm. Don’t let the noise get to you.

Avoid Redeeming In Haste

Can you lose money in mutual funds in falling markets? Yes. But does this mean you should redeem your investments? No. Think twice before redeeming your money the moment you see the markets perform poorly.

Equity mutual funds that are redeemed a year before investing attract an exit load of 1% in most cases. Even after that, LTCG tax may be applicable if your gains from that investment are above Rs 1 lakh for any given financial year.

Certain investors believe they can take their money out of a mutual fund when its value goes down and then invest again when the value starts climbing up again.

This sounds good in theory but usually does not turn out well. What happens most of the time is that people take out their money from a mutual fund and wait for it to stop falling and start climbing again.

But more often than not, the timing isn’t perfect. What ends up happening is that people sell when the price falls. And then, when they plan to invest again, they invest at a price higher than what they sold their mutual funds for. This hurts the long term wealth creation process.

So decisions like redemption should not be a factor of current market conditions. Investing in equity mutual funds via the SIP route is what comes to rescue in such cases since SIP frees you from market timing. It also leverages rupee cost averaging to buy you more units when the markets are down.

Also Read : Markets are falling- what to do with my investments?

Compare Performance With Other Funds in the Same Category

You may feel the mutual fund you have invested in is not performing very well. This may or may not be a time when the markets are doing well.

A good strategy at this point is to check your mutual fund’s performance with similar mutual funds.

When I say similar mutual funds, I mean mutual funds that are in the same category. For example: a small cap mutual fund should be compared with another small cap fund only and not a large cap fund. Check the mutual funds that have the highest ratings in any given category and see how your mutual fund fares.

Also, mutual funds are long-term investment options. If you observe your mutual fund’s performance is only slightly poor when compared to the best-rated funds, switching might not be necessary.

Over a short period, various mutual funds perform in different ways. In the long run, the best mutual funds belonging to the same category usually give similar returns.

P.S : Here’s how you can compare funds on Groww

Compare Performance With Other Funds From Different Categories

If you are wondering can mutual funds lose money, then the answer is yes as some mutual fund categories are more volatile. This means, while they might offer great returns, they can also offer higher risk.

If you feel you are not up for the risk, you should look at the performance of mutual funds from other categories.

For example, small-cap mutual funds give very high returns. But they also have a higher risk. Relative to small-cap equity mutual funds, large-cap equity mutual funds have been less risky.

Also, you might want greater returns and be willing to take the risk. In that case, too, you should explore the best funds in the other category for investment.

Research the Sector

Another reason why your mutual funds are falling could be because your investments are sector focused. This point is relevant to you only if you have invested in a sector fund. Sector funds invest only in a specific sector or industry.

Even when the markets, in general, are doing well, certain sectors can suffer.

If a certain sector is underperforming, you must research the sector carefully.

Sector funds are considered the riskiest for a reason – they are even harder to predict when compared to other equity mutual funds.

So if you have invested in a sector fund and are losing money, pay attention to the health of that industry and its prospects.

If you think the industry has a good future, continue to remain invested. If on the other hand, you think the industry isn’t doing well, you should plan to redeem your money.

Diversify

This is perhaps the only way to counter your mutual fund loss at the moment. If your portfolio is exposed only to equity, then add some liquid funds to the mix. They will not only balance out your losses due to equity but will also allow you to raise money for short term goals.

Even within equity mutual funds, diversify among small-, mid- and large-cap funds.

Also, diversify across asset classes. Gold is considered as an excellent hedge against market volatility as gold prices usually go up when the markets are done.

Your Take

Can you lose money in mutual funds? The answer is YES. Should you have a knee-jerk reaction at seeing a red portfolio and make big decisions? Probably not. While the situation is uncomfortable, this too shall pass. Markets have bounced back before and they will do so again.

From temporary events like elections and geo-political tensions to recessions to pandemics, the economy has seen it all and thrived nevertheless. Investing is a long term game and should be treated like one. Stay calm, invest with a vision, keep your self updated and you are good to go!

Happy investing!

Disclaimer: This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory.

|

Check More AMCs |

|