HDFC Top 100 Fund – A Detailed Review

HDFC mutual fund has been one of the most reputed asset management companies in India since its launch in the year 2000.

It is the largest asset management company (AMC) in the country (as per average assets under management.

HDFC top 100 (erstwhile HDFC Top 200 Fund) has been one of the top performing funds from the HDFC mutual fund house and is categorized as a large-cap fund. In regards to this fact, in this article we will discuss this fund in detail for our investors.

Let’s begin!

HDFC Top 100 – Review

Key Details

| Particulars | HDFC Top 100 |

| Fund House | HDFC Mutual Fund |

| Scheme | Open Ended |

| Class | Equity |

| Inception Date | 01/01/2013 |

| Benchmark | NIFTY 100 Total Return |

| NAV (As on 08/03/2019) | ₹491 |

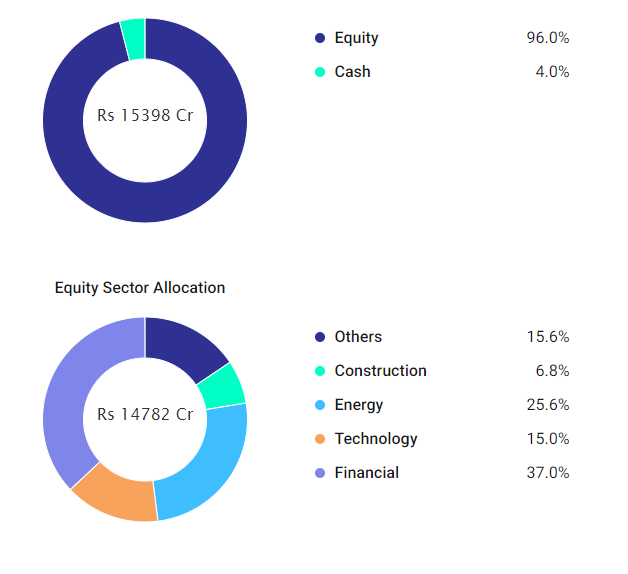

| Fund Size | 15,398 crores |

| Minimum SIP Amount | ₹500 |

| Minimum Lump sum Amount | ₹5000 |

| Expense Ratio | 1.44% |

| Risk Level | Moderately High |

| Fund Managers | Prashant Jain |

| Exit Load | Exit Load is 1% if redeemed between 0 to 12 Months |

Returns generated by the fund have been shown below:

Portfolio

While investing your hard earned in any fund, it makes sense to have a look at the portfolio of the respective fund. This gives confidence and insight to the investor as to where the fund manager has invested the corpus of the fund.

We can look at the portfolio by judging two major parts:

- Top 10 holdings;

- Allocation

Top 10 Holdings

| Name | % of Assets | Sector | Instrument |

| ICICI Bank Ltd. | 8.6% | Financial | Equity |

| Reliance Industries Ltd. | 8.2% | Energy | Equity |

| State Bank of India Ltd. | 8.2% | Financial | Equity |

| Infosys Ltd. | 7.9% | IT | Equity |

| HDFC Bank Ltd. | 7.1% | Financial | Equity |

| Larsen & Tubro Ltd. | 5.8% | Construction | Equity |

| ITC Ltd. | 4.6% | FMCG | Equity |

| TCS Ltd. | 4.2% | IT | Equity |

| Axis Bank Ltd. | 3.9% | Financial | Equity |

| NTPC Ltd. | 3.5% | Energy | Equity |

Investors can observe that this fund has invested across different industries in order to diversify its risk. This is the hallmark of a very good fund.

Moreover, the fund is heavyweight on the financial services sector, with major investments in the top banks of the country. At this point in time, the banking industry is performing very well. Moreover, banks are at the forefront of the growth of the country.

This puts the fund at a good stead to reap future benefits.

Allocation

As mentioned and discussed above, investors should realize the importance of the major part of the fund allocation towards the financial sector (roughly 38 percent).

This percentage is allocated amongst top names in this sector such as SBI, ICICI Bank, HDFC Bank and others.

The fund managers have been able to capitalize on these stocks and therefore, the returns have been better as compared to the benchmark and other funds in the category.

Investment Objective

To provide long-term capital appreciation/income by investing predominantly in large-cap companies.

Expense Ratio

One important factor to look into while choosing a fund is its expense ratio.

Expense ratio is the amount which is deducted from the fund as maintenance and fund management fees. To cut the long story short, lower the expense ratio, better it is for investors.

HDFC Top 100 Fund has one of the lowest expense ratios amongst its peers. A slight difference in expense ratio can make a huge impact on our returns if we invest for the long term.

When HDFC Top 100 fund is compared with other funds in the same category, it is seen that it has an edge because of the decent 1 and 3-year returns that it provides. Also because this fund has strong allocation and a comparatively lower expense ratio.

Fund Manager Details

Mr. Prashant Jain is the fund manager of HDFC Top 100 Fund. He has experience of more than 25 years.

Education

Mr. Prashant holds the prestigious CFA degree. He has also earned a PGDMIIM along with a B.Tech degree from IIT Kanpur.

Prior Experience

Prior to joining HDFC Mutual Fund, Mr. Prashant Jain has worked in Zurich Asset Management Company (India) Private Limited in the capacity of a Chief Investment Office.

Some of the other funds managed by him are HDFC Equity Fund, HDFC Prudence Fund (Proposed HDFC Balanced Advantage Fund w.e.f. June 2, 2018 post-merger with HDFC Growth Fund), HDFC MF Monthly Income Plan – Long Term Plan (Equity Assets).

Conclusion

HDFC Top 100 Fund has beaten its benchmark index consistently. It is one of the go-to funds in the large-cap equity category.

Investors who have a moderate risk appetite and do not want to venture into the small and mid-cap space can surely consider investing in this fund.

It is important for all investors to understand that investing in the equity asset class in general and mutual funds, in particular, is risky. It is advisable to do proper research and invest according to your risk appetite.

Also investing for long-term is a critical virtue. It saves us from market volatility in the short-term and prevents the potential loss from timing the market.

Happy Investing!

Disclaimer: The views expressed in this post are that of the author and not those of Groww.