Section 234F of IT Act: Know The Penalty For Late Filing of ITR

If you fail to file your income tax return within the due date, the income tax department levies penalties under section 234F of the IT Act.

This blog will discuss everything related to this section, the penalties associated with it, and how filing ITR timely can save you thousands of bucks.

What is Section 234F of Income Tax Act?

Section 234F was introduced in The Finance Act, 2017 as“Fee for default in furnishing return of income.”

Effective from April 1, 2018, Section 234F imposes a fee on taxpayers who fail to file their ITR within the stipulated due date under Section 139(1).

Who Does Section 234F Apply To

Section 234F of the Income Tax Act covers the following entities:

- Indian residents with taxable income

- Companies

- Firms

- Association of Persons (AOPs)

- Hindu Undivided Families (HUFs)

Penalties for Late Filing of ITR Under Section 234F

The fee structure for the late filing of ITR u/s 234F is as follows.

-

If Total Annual Income is Above ₹5 Lakh

|

If the return is filed after the due date but on or before December 31st of the relevant assessment year (AY). |

₹5,000 |

|

If the return is filed after December 31st of the AY, i.e., between January 1st and March 31st Latest Update: In the Union Budget 2021, the timeline for filing belated and revised ITRs was reduced by three months. With the new deadline, filing after December 31 is no longer permissible. So, section 234F was amended in The Finance Act, 2021, effectively eliminating the applicability of the ₹10,000 fees. |

₹10,000 |

-

If Total Annual Income Does Not Exceed ₹5 lakh

The late filing fee is capped at ₹1,000.

-

If Total Annual Income is Below Exemption Limit

No penalty is applicable.

Examples for Better Understanding

Let’s understand how the fee structure under section 234F applies to taxpayers with different annual income for FY 2024–25 (AY 2025–26).

|

Total Annual Income |

Due Date |

Actual Filing Date |

Late Fee under Section 234F |

|

₹4,50,000 |

July 31, 2025 |

December 15, 2025 |

₹1,000 |

|

₹8,00,000 |

July 31, 2025 |

August 25, 2025 |

₹5,000 |

|

₹6,00,000 |

July 31, 2025 |

June 15, 2025 |

No Fee |

How to Pay Section 234F Penalty Online

To pay the penalty under Section 234F for ITR late filing, you can use the e-Pay Tax facility on the Income Tax Department's e-filing portal. Here's a step-by-step guide:

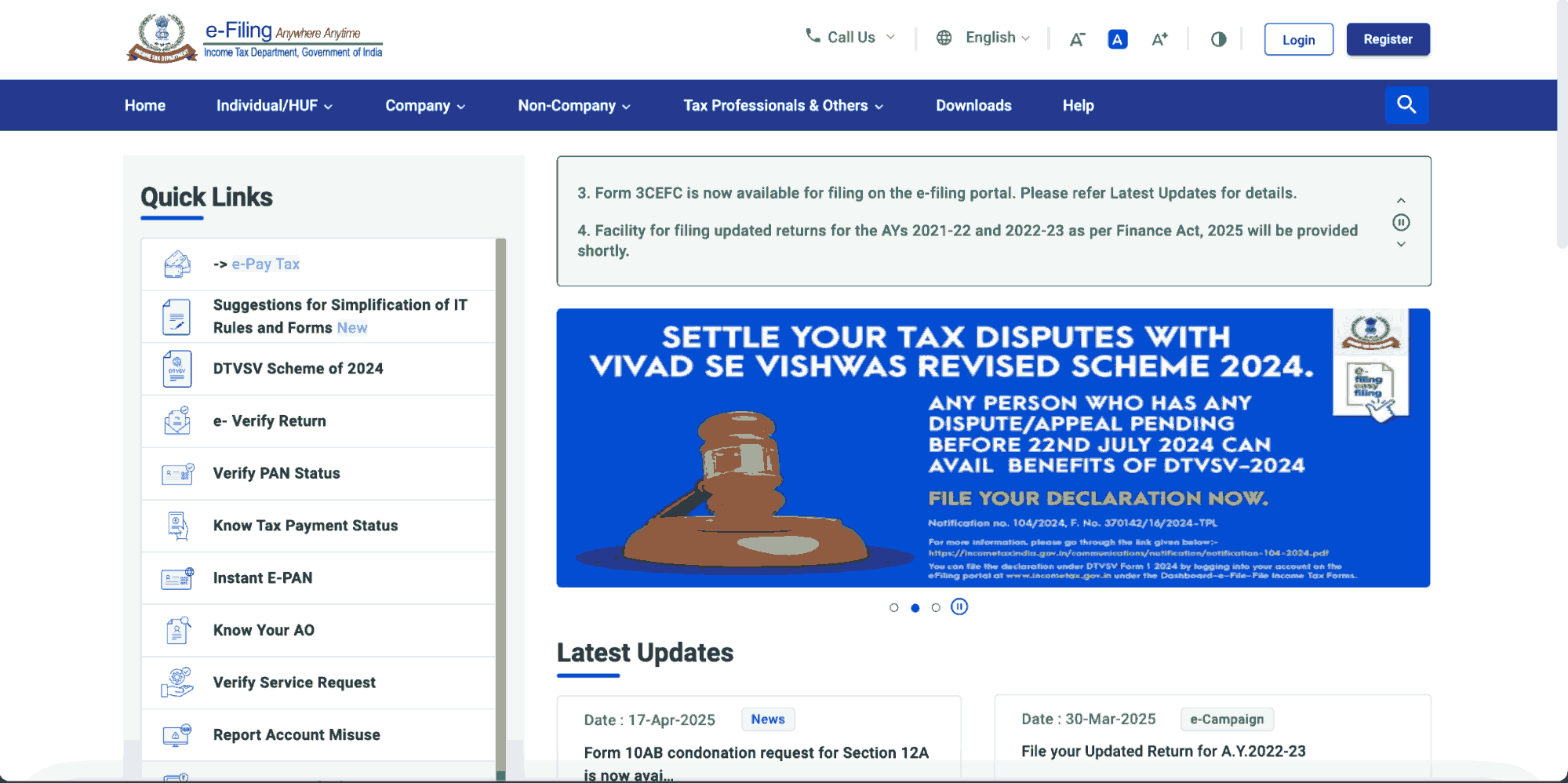

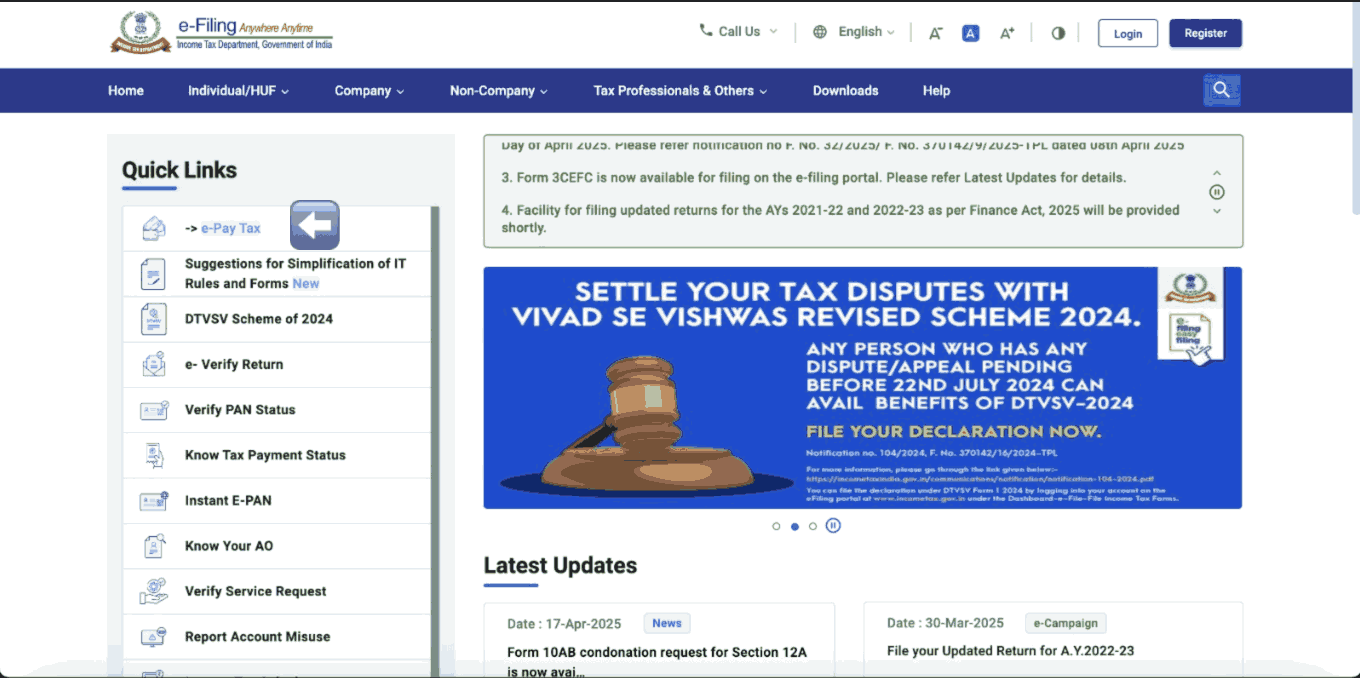

- Visit the Income Tax Portal

2. Under “Quick Links”, click on “e-Pay Tax.”

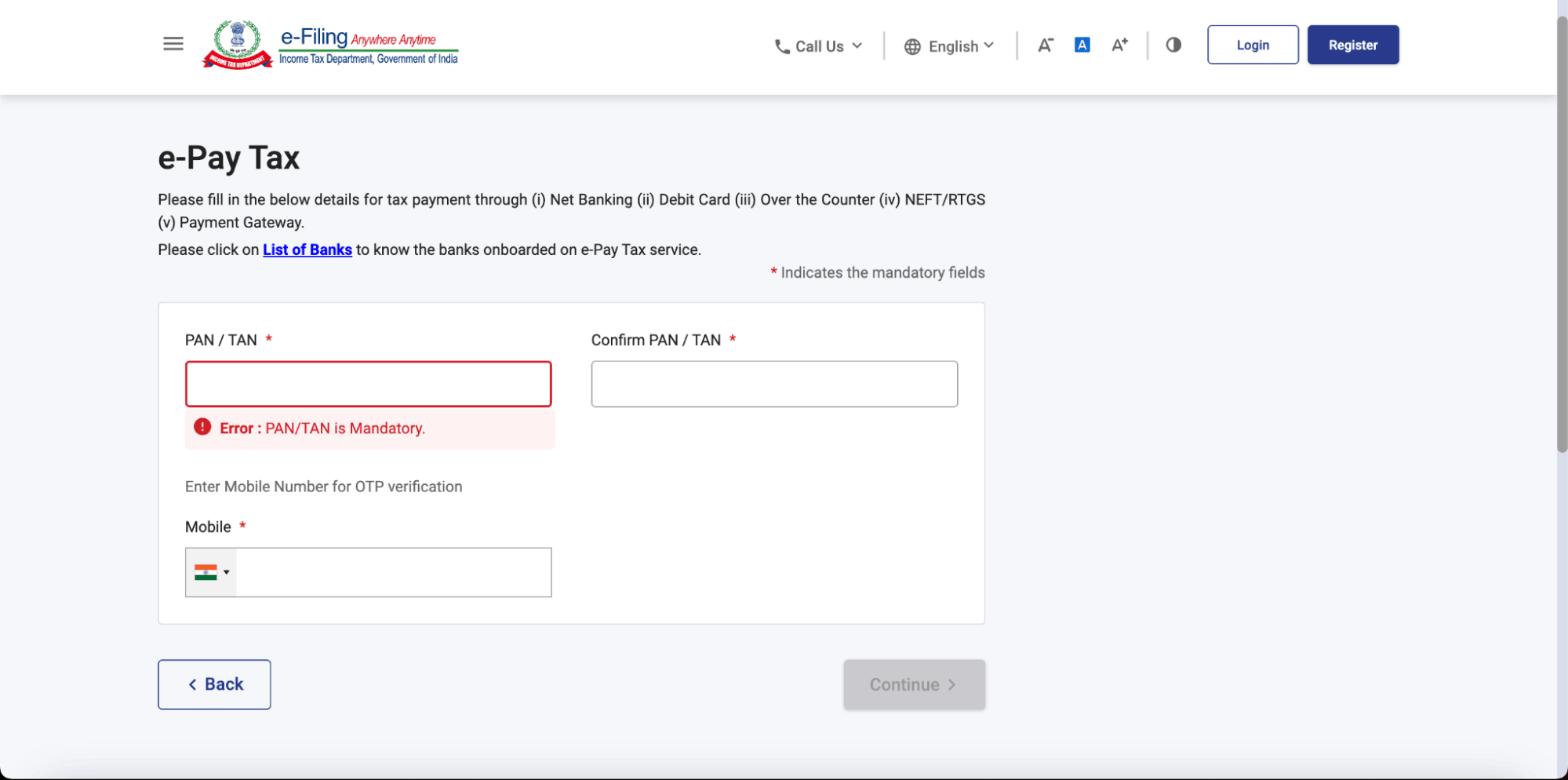

3. Enter “PAN” and “Mobile Number.” Click on “Continue.”

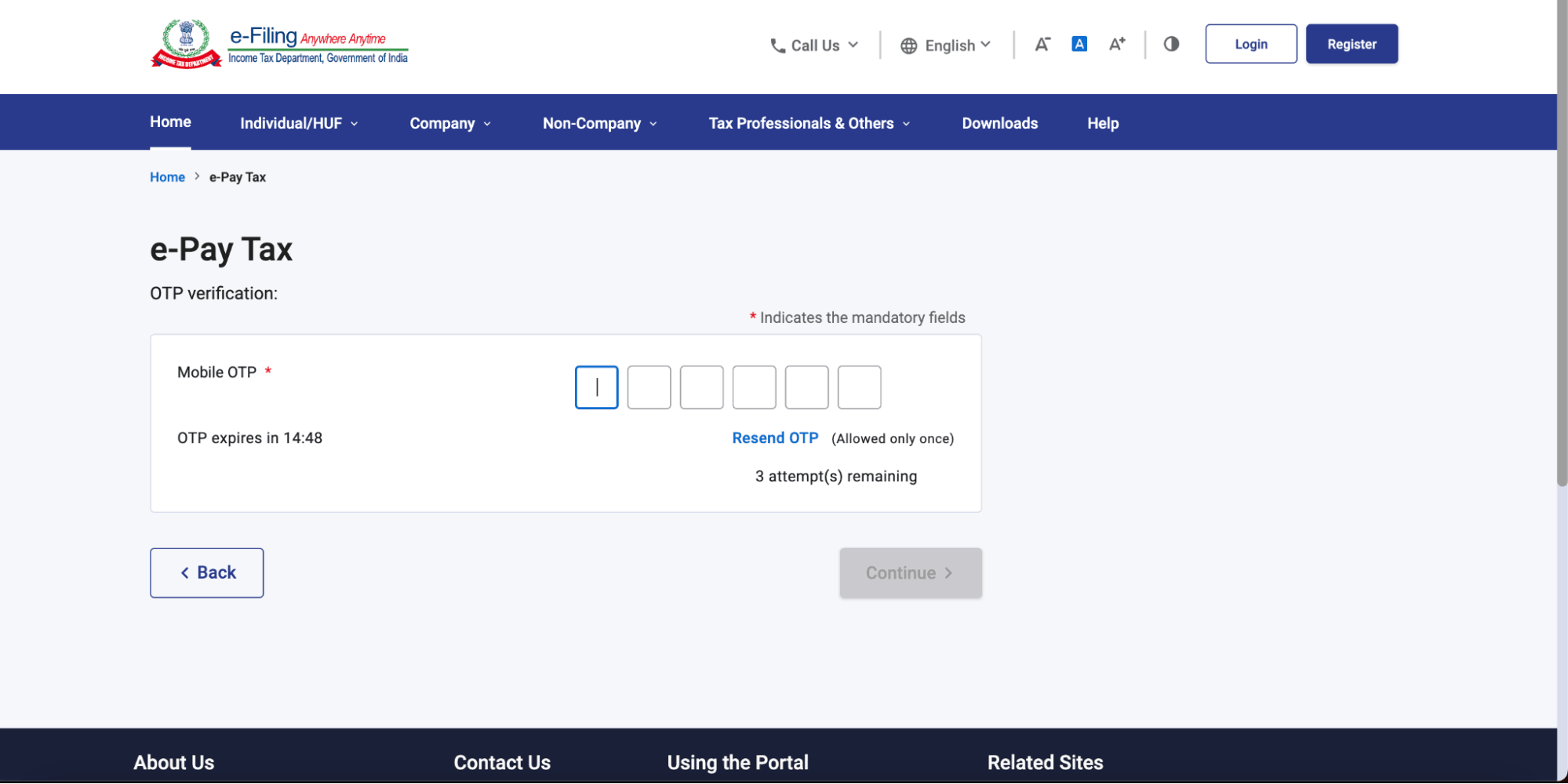

4. Enter “Mobile OTP” and Click “Continue.”

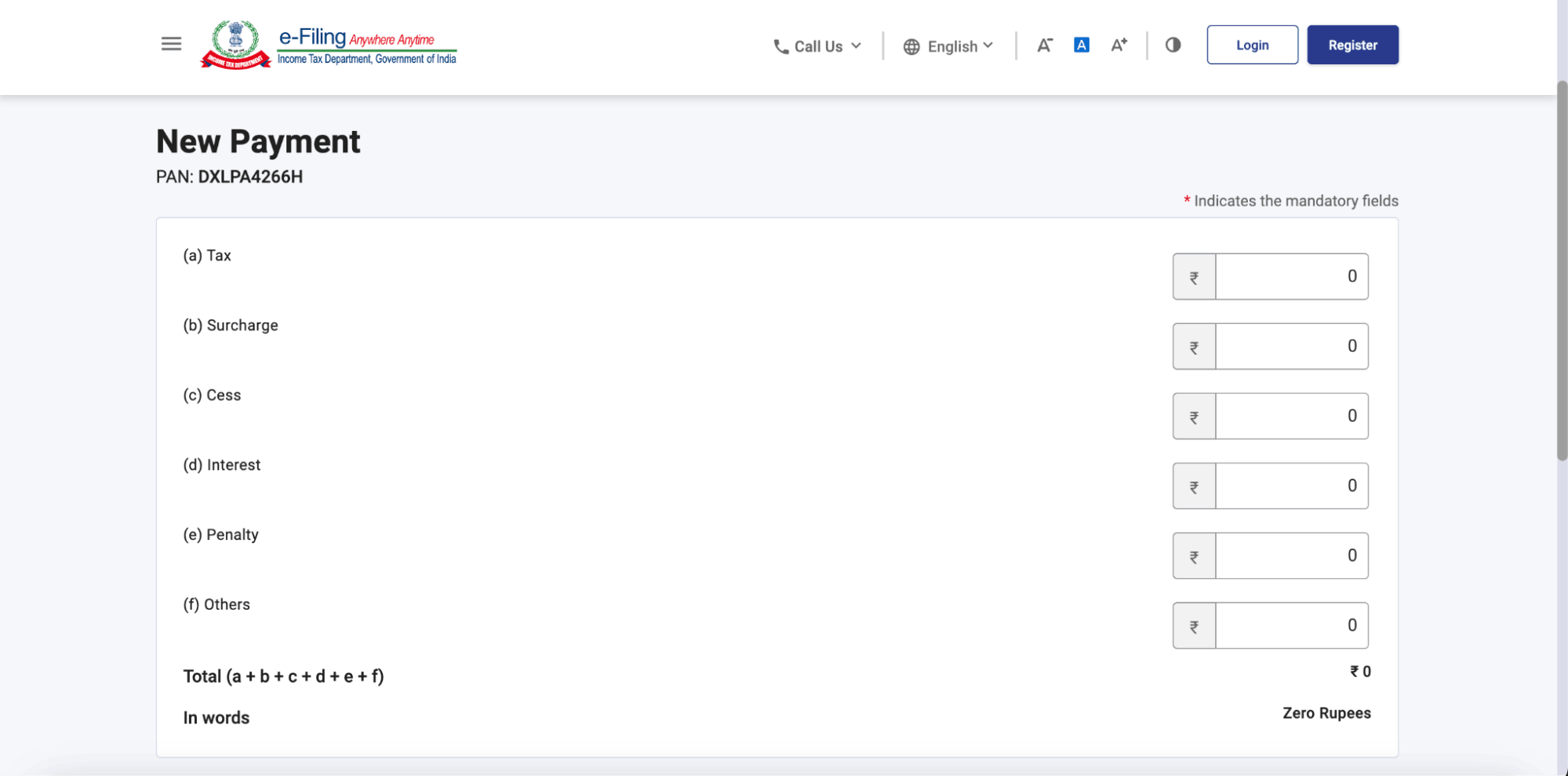

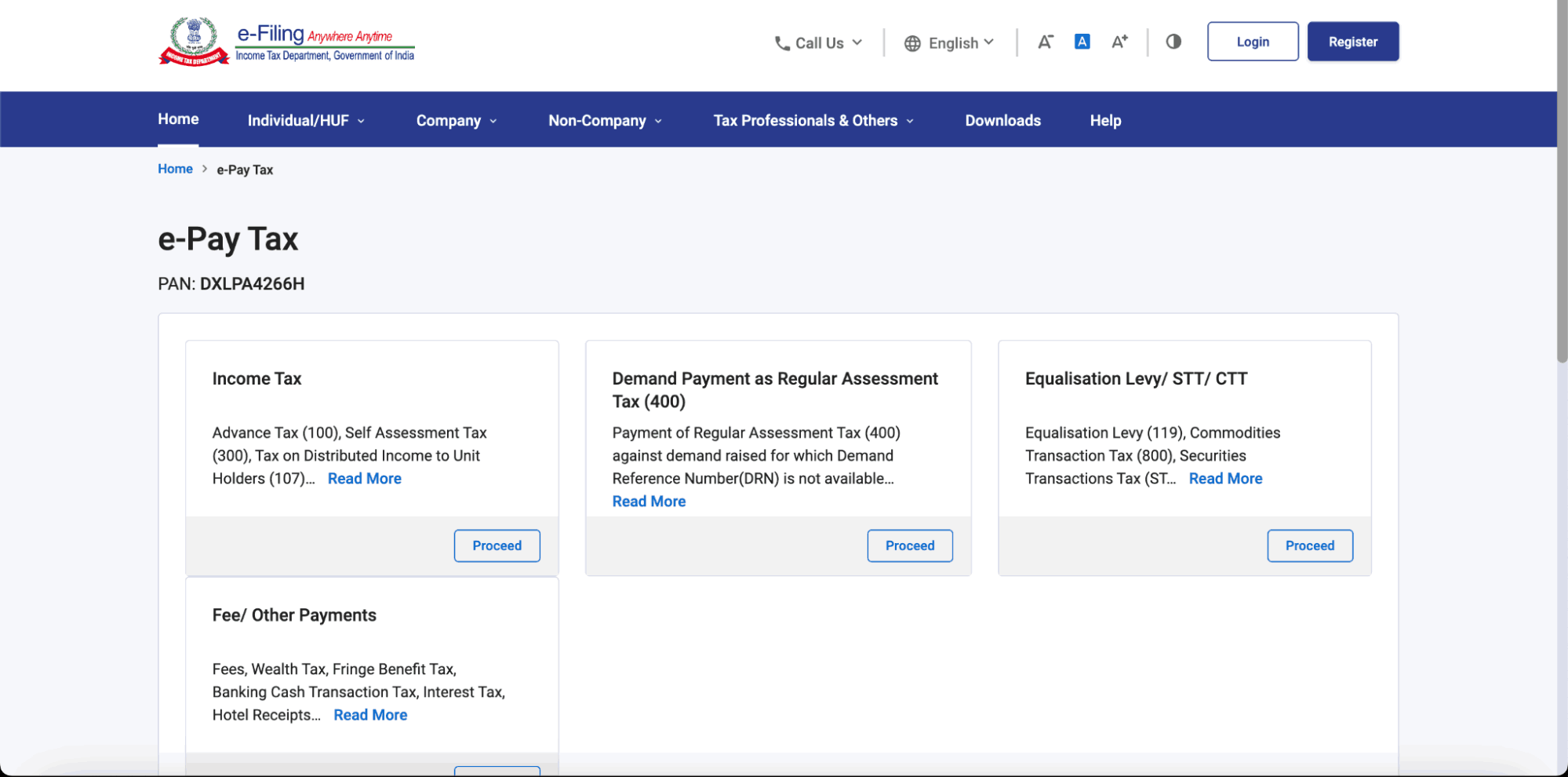

5. In the “Income Tax” tab, click “Proceed.”

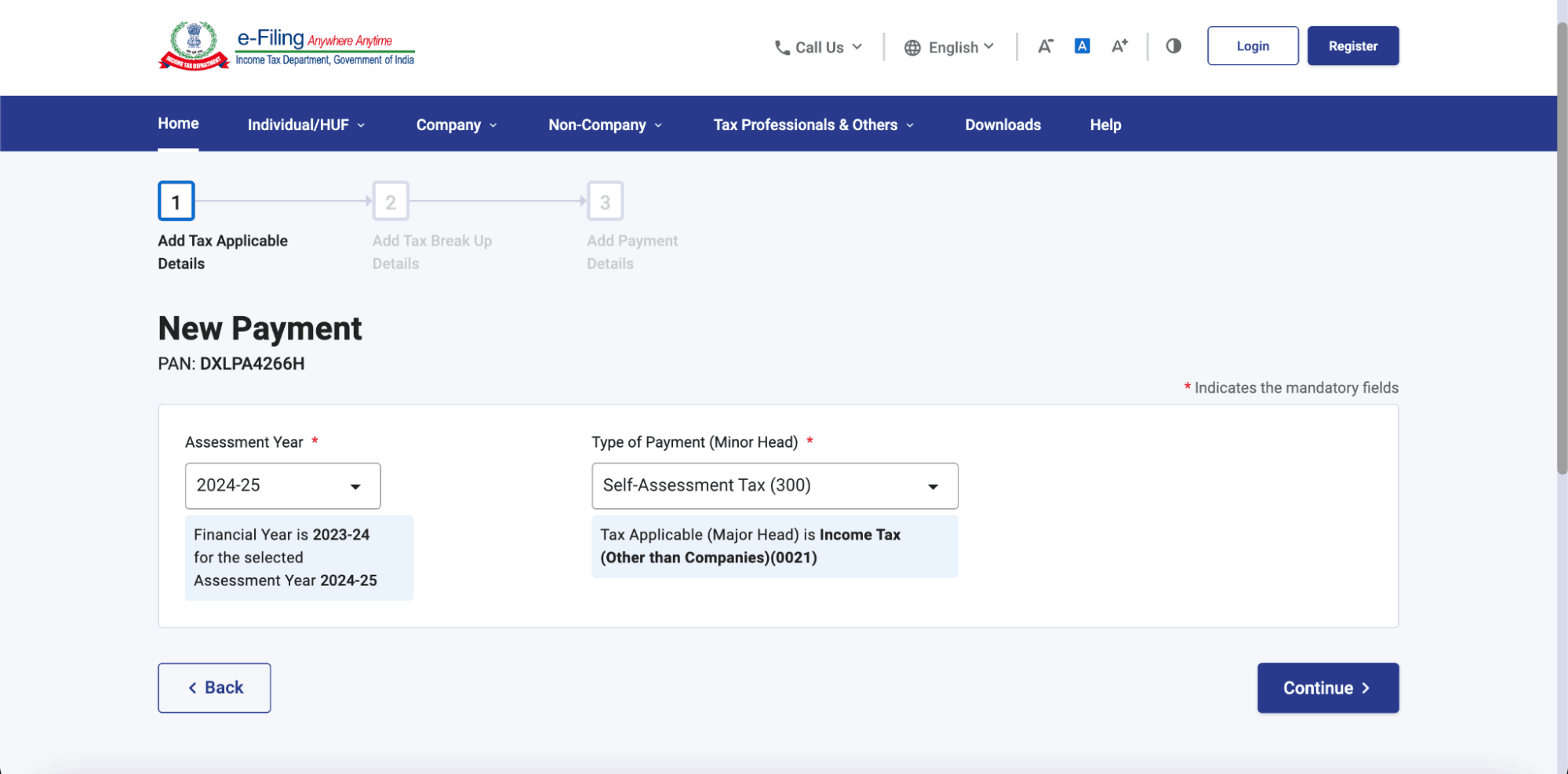

6. Select Assessment year under the tab “Assessment Year”, and Self-Assessment Tax (300) under “Type of Payment (Minor Head).” Click “Continue.”

7. Fill all the necessary details and make the payment through your preferred payment method (e.g., net banking, debit card, NEFT, etc.)