Form 16

Form 16 is a certificate that denotes the fine breakup of salary income and the Tax Deducted at Source amount deducted by the employer. It is associated with Income tax and is used by companies to provide their salaried individuals’ information on the tax deducted.

In simple words, Form 16 means a document provided by your employer that certifies the salary details earned during a particular year and how much TDS has been deducted. Form 16 is among the necessary forms for salaried individuals when it comes to taxation.

It comprises all crucial information related to one’s salary and accumulated tax amount deducted by the issuer. What makes the said form so important is its role in filing ITR, among others.

What is Form 16 in Income Tax

Form 16 is a certificate that contains vital information required to file income tax returns. An employer issues it every year on or before 15 June of the next year, immediately after the financial year in which the tax is getting deducted. This certificate is issued according to Section 203 of the Income Tax Act 1961.

Form 16 is also known as a salary TDS certificate and comprises details related to the salary paid by an employer to an employee in a given fiscal year. It also has the details of the income tax that has been deducted from the salary of the individual in question.

Suppose the income from your salary for a financial year is more than the basic exemption limit of Rs. 2,50 000; then your employer is required to deduct TDS from your salary and deposit it with the government.

Those who have worked with more than one employer at the same time or have changed jobs in a financial year will receive Form 16 from all the employers. It must be noted that it is not issued to an employee whose income for a particular year is below the threshold of tax exemption with no provision for TDS.

Significance of Form 16

Now that you understand the form 16 meaning, let's learn its importance. These points below highlight the importance of income tax Form 16 for employees –

- The information contained in this form comes in handy for filing ITR.

- It helps taxpayers to prepare their ITR easily without seeking the help of any financial planner or CA.

- The said certificate helps to verify the deposited tax amount by comparing the same with Form 26AS.

- It serves as proof of TDS.

- Form 16 also serves as proof of income.

- It is an important document that is used in the verification process while availing of a loan.

- Several organisations require individuals to submit Form 16 issued by their previous employers as a part of the onboarding process.

- It also serves as a visa checklist and comes in handy while planning a foreign trip.

How to Download Form 16 From TRACES

The task of downloading Form 16 is limited to employers. Contrary to popular belief, salaried individuals cannot download their form using their PAN at the TRACES website. All employers must issue this form every year to eligible employees before May 31st of the financial year.

Follow the below-given steps to download Form A-

- Firstly, go to the TRACES portal.

- Log in to the portal with your login ID and password.

- Hover over to the downloads tab, where you can find Form 16A.

- Once you have opened the Form, fill in all the required details.

Components of Form 16

In a broader sense, Form 16 is divided into 2 distinct parts, namely –part A and part B. Both components are discussed in detail below -

-

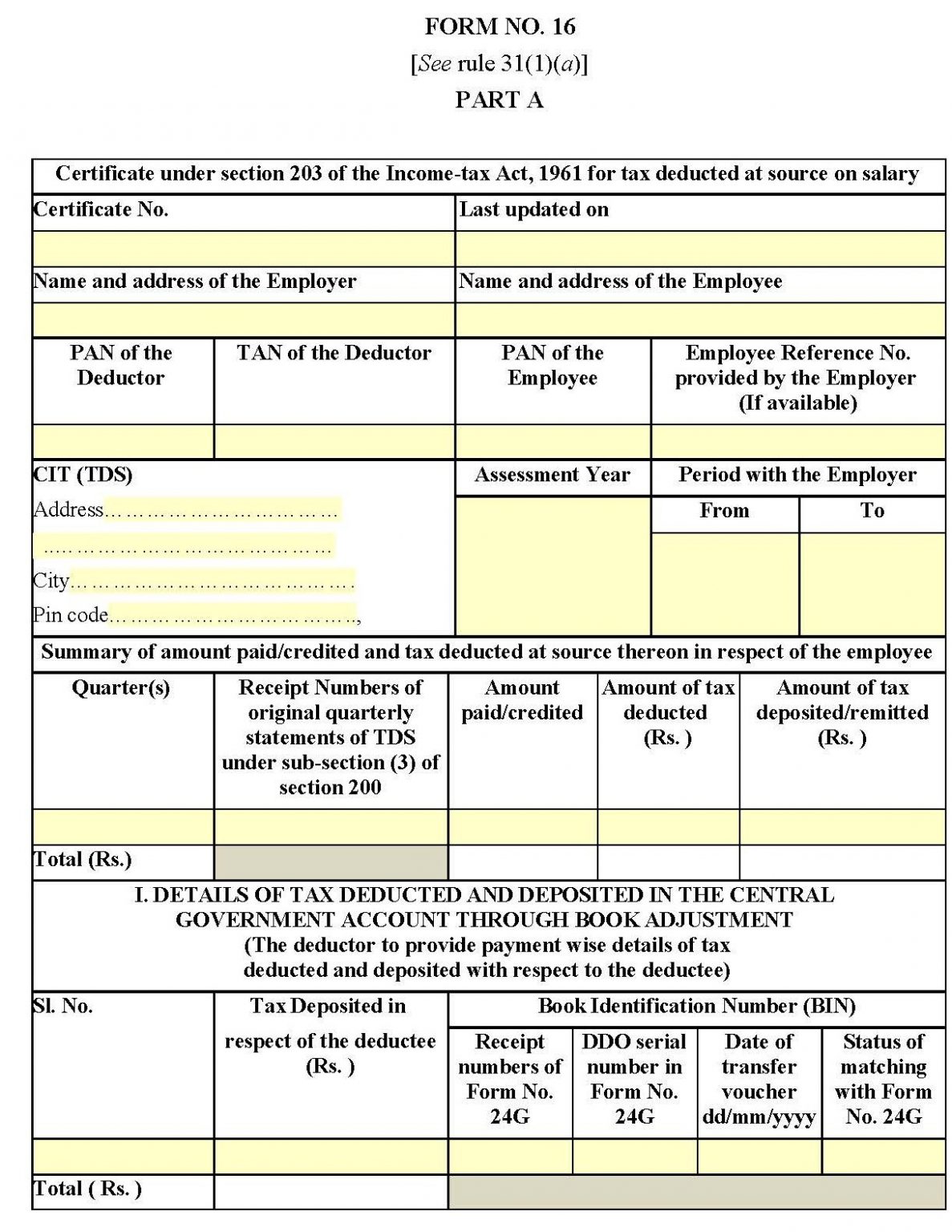

Part A of Form 16

This particular part offers a record of the tax collected by the individual’s employer or organisation from his/her salary income and is subsequently deposited to the government’s account.

It is more like a certificate that is signed by the employers stating that they have deducted TDS from an employee’s salary and have deposited the amount with the IT department.

Form 16 Sample

The primary components of part A of Form 16 include these details –

- The employer and employee’s details, including their name, address, PAN and TAN details.

- The Assessment Year or AY. It indicates the financial year in which the income is assessed.

- The employment period for which he/she was employed with an employer in a particular fiscal year.

- Summary of salary paid.

- Summary of deducted and deposited tax amount with the IT department.

- Date of tax deduction.

- Date of tax deposited.

- Bank’s BSR code.

- Challan number.

- Acknowledgement number of the TDS paid.

Part A of Form 16 can be generated and downloaded through the IT department’s TRACES portal. Notably, the deductor must sign all the pages of this form’s part A.

-

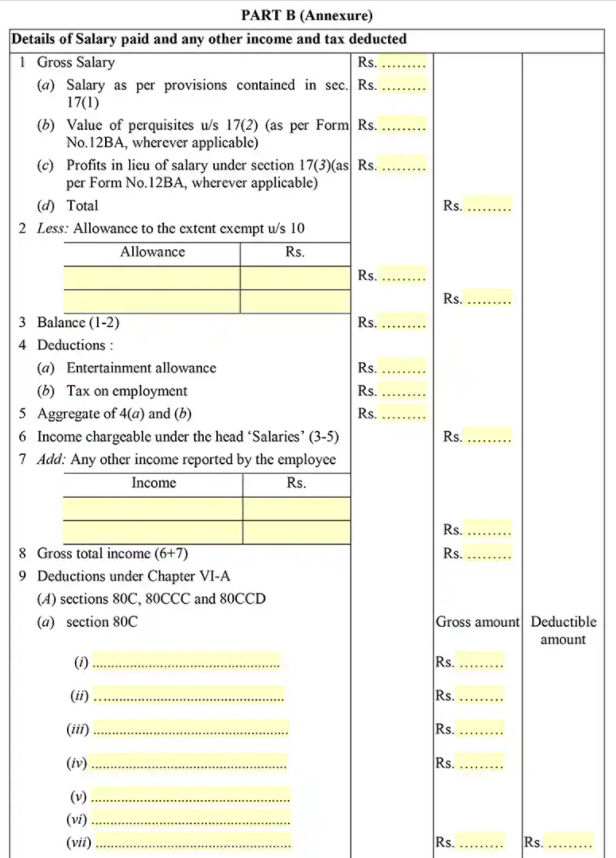

Part B of Form 16

Form 16B is an annexure to Part A of Form 16. In case you switch jobs in the same financial year, you need to decide if you want Part B of the form from the last employer or from both your previous and current employer.

The components of Form 16B are enlisted below:

- Relief under section 89

- Detailed salary breakup

- Detailed breakup of exempted allowances under Section 10

- Deductions allowed under the Income Tax Act (under chapter VIA)

- Specific fields are notified for deductions mentioned below-

- Deduction under life insurance premium, PPF contribution etc., under Section 80C

- Deduction for the contribution made towards pension funds under Section 80CCC

- Deduction for employee’s contribution towards pension scheme under Section 80CCD(1)

- Deduction for taxpayer’s self-contribution to a notified pension scheme under Section 80CCD(1B)

- Deduction for employer’s contribution to a pension scheme under Section 80CCD(2)

- Deduction for health insurance premium paid under Section 80D

- Deduction for interest paid on higher education loan under Section 80E

- Deduction for donations under Section 80G

- Deduction for interest income earned on savings account under Section 80TTA

What is the Eligibility Criteria for Form 16?

Salaried individuals whose annual income is included under the taxable slabs are eligible for Form 16. Regardless, an employee must issue Form 16 to an employee if he/she has deducted tax at source from salary.

The said form comes in handy for salaried employees and helps them file an ITR when they have no other income source other than their salary.

What Details are Required from Form 16 When Filing IT Return?

You can take the reference from the image shared above and get some information for filing your income tax return. These details from the said Form no 16 online are used to file ITR –

- Taxable salary

- Exemption on allowance under Section 10

- The breakup of applicable deductions under Section 16

- The breakup of applicable deductions under Section 80C

- Profit or loss resulting from housing reporting made by the employee

- Income generated from ‘Other Sources’ applicable for TDS

- Total deductions under Section 80C

- Outstanding refund or tax payable

- TAN and PAN of an employer

- PAN of an employee

- Taxpayer’s name and address details

- Current Assessment Year

- TDS amount

Difference Between Income Tax Return Form 16, Form 16A and Form 16B

Individuals often confuse Form 16 with Form 16A and Form 16B. The table below offers a fair idea about the fundamental points of differences between them -

|

Type of Form |

Form 16 |

Form 16A |

Form 16B |

|

Purpose of issuance |

It is issued for TDS on salary. |

It is issued for TDS on any earnings that are generated outside salary income like – returns on investment or FD, rent, etc. |

It is issued for TDS on income generated through the sale of immovable assets or property. |

|

Issuer |

Form 16 is issued by an employer. |

Tenants, financial institutions and others issue Form 16A. |

A property buyer issues Form 16B to the property seller. |