What is a Contract Note and How to Interpret It?

You must have been receiving a contract note from Groww every time you execute an order through our app or portal. Before you trash it as just a bill for your purchase, hold on; it actually holds much importance.

A contract note is the legal document that presents the summary of all the trades executed during the trading day. The one that Groww sends you contains details of trades executed by Groww on your behalf on both of the stock exchanges, i.e., NSE and BSE, for equity and derivative investments.

Traders can view their transactions, time, trade, profit, loss summary, charges, taxes summary, and much more from this one piece of document. A contract note is your legal shield from fraud and provides you with every sort of information you need about your trades.

At first, a contract note may appear as a complex document; however, it’s relatively simple to interpret. Let us help you break it down.

Contents of a Contract Note

Before we get around to what is contract note, note that when you try to open the contract note delivered to you by email, you will need a password.

The document is password-protected to trade in stocks or derivatives – Groww, or others. Given the sensitive nature of this document, it makes sense to protect it with a password.

For Groww, the password is always your complete PAN in capital letters.

Starting 1 February 2025, the contract note format has been revised as per SEBI guidelines. The new contract note consolidates all trades in security (across exchanges) in a single row, represented with a single Weighted Average Price (WAP) for all orders.

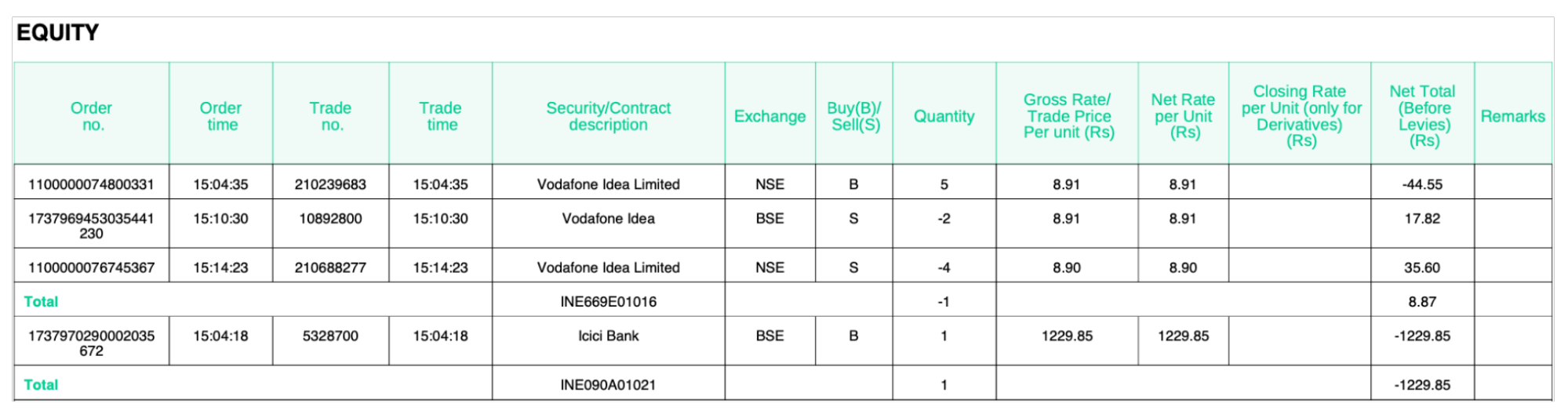

Here’s an example of how a typical contract note in stock market looks like:

For Equity Segment

- ISIN: A unique 12-character alphanumeric code used to identify a specific security.

- Security Name/ Symbol: The name or symbol of the security that was bought or sold.

- Quantity: The number of shares or units of the security bought/sold.

- WAP per Share (Rs): It is the singular weighted average of all the prices at which different orders were executed in a particular ISIN.

WAP across exchanges is calculated using the formula below:

|

(Total buy/sell trade value for ISIN across exchanges) / (Total number of shares bought/sold across exchanges) |

- Brokerage per Share (Rs): The brokerage fee charged by Groww for buying/selling the shares.

- WAP per Share after brokerage (Rs): The weighted average price per share, including the brokerage fee.

- Total Value after Brokerage (Rs): The total value of the transaction, including brokerage.

Net Obligation per ISIN

- Net Quantity: The net quantity of shares after considering buy and sell transactions.

- Net Amount (Rs): The final amount after considering all trades (buy and sell) and brokerage charges. This amount does not include any levies (taxes)

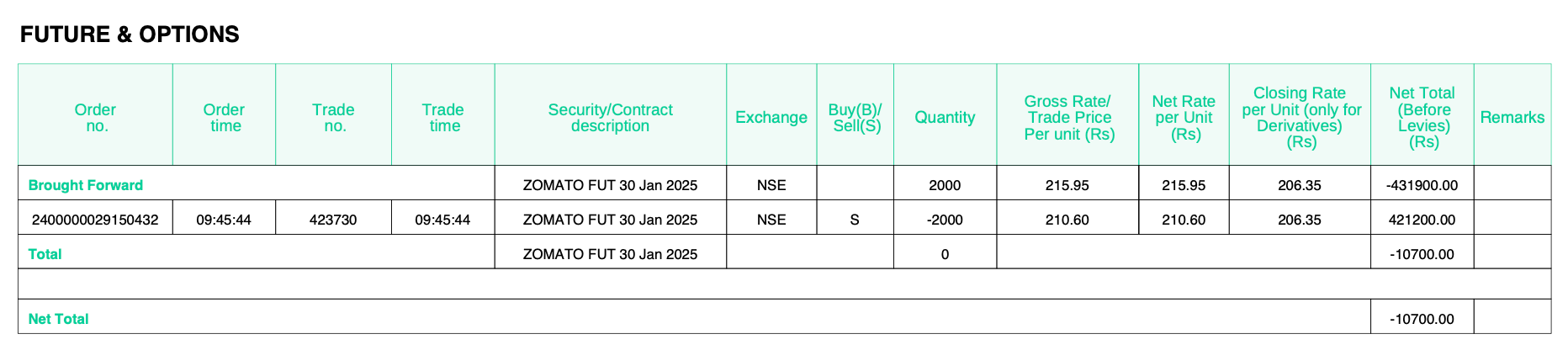

For Derivative Segment

- Security/Contract Description: Describes the specific derivative contract traded, including the underlying asset, contract type, exchange, and expiry date.

- Buy(B)/Sell(S) /BF/CF: Specifies the type of trade executed, whether buy/sell/Bought Forward/Carried Forward.

- Quantity: Represents the number of contracts traded.

- WAP per Unit (Rs): It shows the average price at which the contracts were traded during the session.

WAP across exchanges is calculated using the formula below:

|

(Total buy/sell trade value for common contract across exchanges) / (Total quantity bought/sold across exchanges |

- Brokerage per unit: The effective brokerage cost per unit.

- WAP per Unit after brokerage (Rs): The effective cost per unit, including the brokerage fee.

- Closing Rate per Unit (only for Derivates) (Rs): The official closing price of the derivative contract at the end of the trading day.

- Net Total (before levies) (Rs): The total monetary value (including brokerage) of the trade before adding taxes.

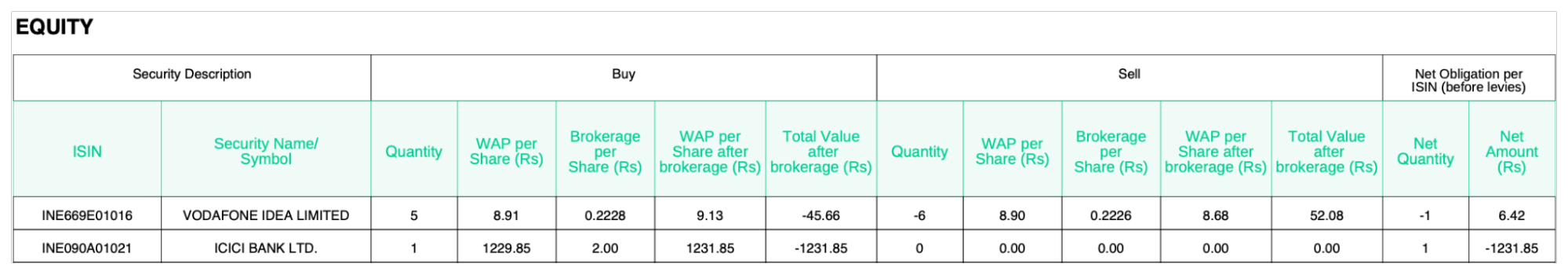

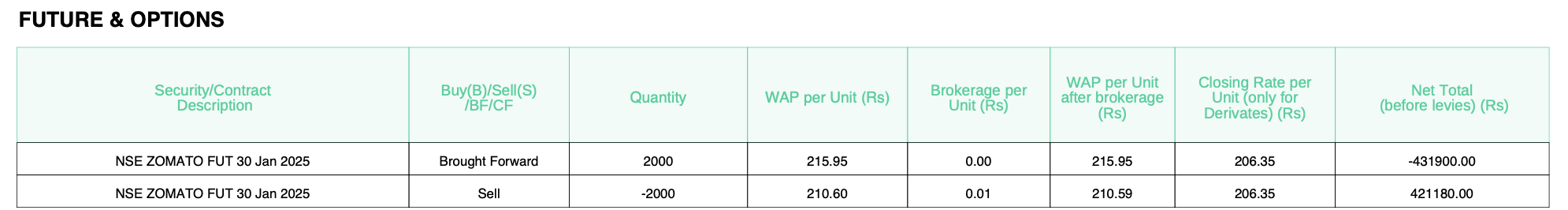

The trade level details of all orders executed taken on a particular day are given in Annexure A of the contract note as follows:

For Equity Segment

For Derivative Segment

- Order No.: For each successfully executed order, a unique order number is assigned by the exchange. This number will be different for each of the orders you execute on the platform.

- Order Time: in the second column, you can find the exact time when your order was placed on the exchange.

- Trade Time: here, you will get to know the exact time when the order was ‘executed’ on the exchange. Order time and trade time can vary. For example, a limit order will only get executed when the underlying conditions for the order are met.

- Security/Contract Description: find the name of the stock you traded.

- Buy(B)/Sell(S): Stocks you bought will be represented by ‘B,’ and stocks sold will be represented by ‘S’ indicating the type of trade and transaction undertaken.

- Quantity: This represents the number of securities (in case of stocks) or number of lots traded (in case of derivatives). For sell orders, quantities will be represented in negative.

- Gross Rate/Unit: here, you will find the price at which your order was executed. That is, the column represents orders that are executed at the market price of the stock.

- Net Rate/Unit: This is usually the same as gross rate/unit. In case of brought forward, carry forward futures transactions and expired options contracts, there is only net rate/unit.

- Closing Rate/Unit: This is available only for futures contracts. It represents the price at which the futures contracts you chose to trade closed at the end of the market session. The contract note will show this value, as futures contract’s MTM settlement is on a daily basis.

- Net Total Before Levies: This column details the amount you need to pay or are liable to receive for all the trades you undertook in your Demat through the broker. However, this figure does not take into account the statutory fees such as brokerage and taxes that are charged separately. If this amount is negative, you will have to pay this amount to Groww as it’s due from your side. Should this amount be positive, Groww will pay it to you. It will be credited to your trading account.

Beneath this vertical table, you will find a horizontal row containing the description of your buy and sell quantities. Your buy summary is generally on the left side while the sell summary appears on the right. The second half of the contract note covers all the monetary aspects, including net payable/receivable, taxes, brokerage, and STT.

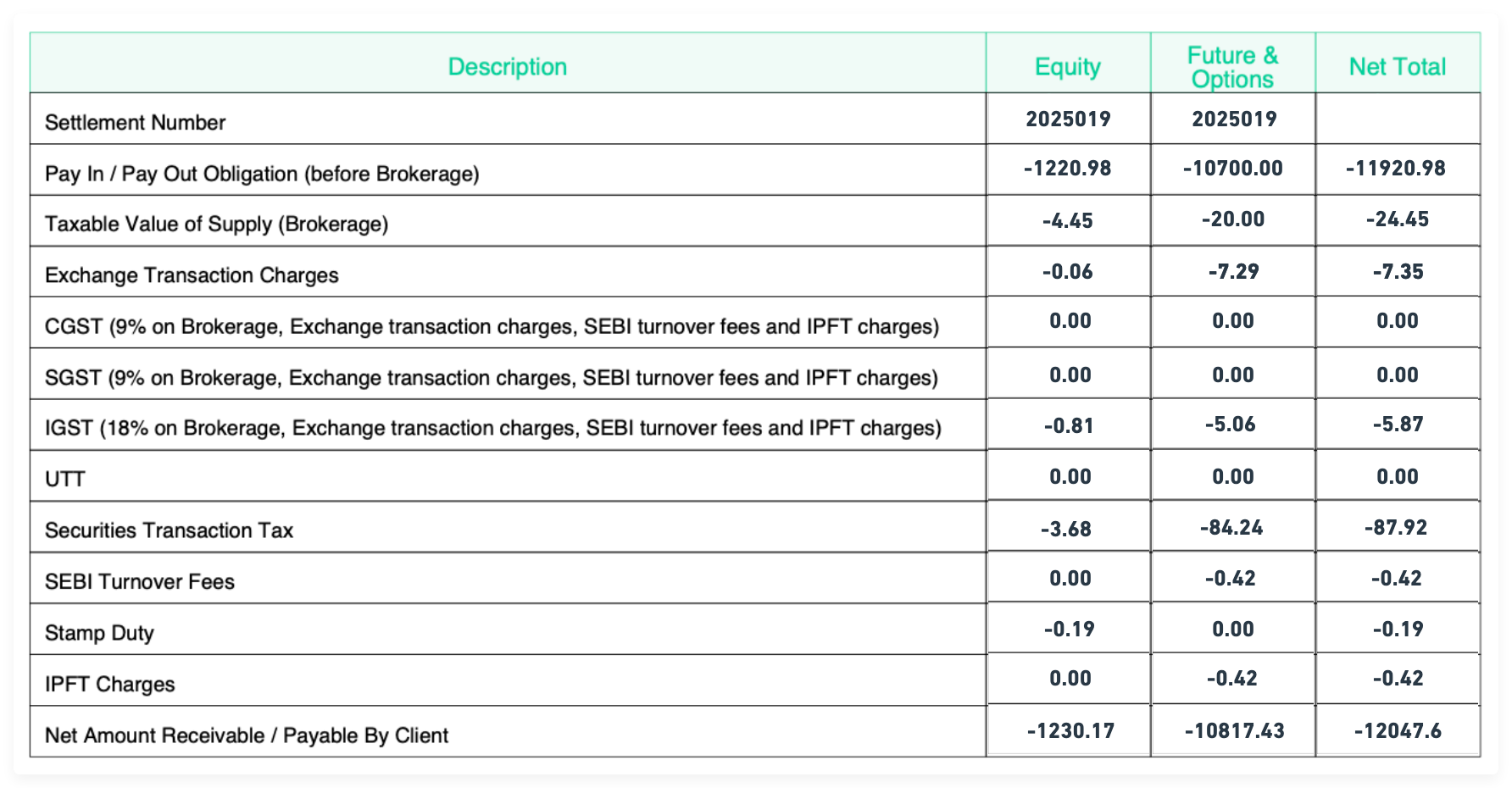

Pay in/Payout Obligation:

Pay in/Payout Obligation refers to the total of the Net Amount before Levies and the Brokerage Charged.

- A positive (+) amount means you will receive this amount.

- A negative (–) amount means you need to pay this amount.

Note: The net total (before levies) might not match the Payin/Payout Obligation (before Brokerage) as the former includes brokerage charges.

The amount indicated here will show debit and credit transactions. Note that, in case of debit, the transaction is denoted with a negative sign.

The next row is for brokerage, charged by Groww for executing your trades at the exchange. Groww charges a flat Rs 20 or 0.1% per executed order, whichever is lower on equity transactions, and a flat Rs 20 per executed order on F&O trades through the platform. So this row simply calculates the total brokerage due on the trades you have executed in the day.

The row after that accounts for regulatory fees, Stamp Duty, SEBI turnover fee, and Exchange Transaction Tax.

In the next row, you will find the details of GST, i.e., IGST, or CGST and SGST.

Note that since Groww is registered in Karnataka, you will be charged CGST and SGST as applicable if you’re from Karnataka. If you’re from any other state, a respective IGST will be levied. For all states except Karnataka, IGST is levied, and CGST and SGST are only applicable in Karnataka.

Finally, there is a row for “Net amount payable/receivable by the client.”

Here too, in the case of debit transactions, the amount is denoted with a negative sign. Debit indicates the amount payable by you (the client), while credit is the amount receivable by you.

Note here The DP charges are listed in a separate statement within the same PDF as the contract note. For margin details, users should refer to the ledger.

For more details, head to: Pricing

Why is a Contract Note Important for You?

- A contract note is a summary of all the trades and transactions undertaken in the day.

- Contract note makes the trading experience transparent by giving the clients a point of reference to cross-check their trades and transactions.

- Should you be wondering why you have received a (marginally) lower amount than the price you sold your stocks at or why you are being asked to pay a higher amount for your purchase than the trading price of the stock, you will find the details of this on the Contract note.

- All the brokerage charges and taxes deducted can be found in one place.

- Contract note serves as a legal document in case of any dispute due to non-delivery of stocks.

- While calculating capital gains, users can refer to contract notes to know the exact amount received.

|

You May Also Be Interested to Know |

|

|

1. |

|

|

2. |

|

|

3. |

|

|

4. |

|

|

5. |

How do Mergers and Acquisitions Affect Stock Prices |

Disclaimer: This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory.