What is a Daily Margin Statement and How to Read it?

When you start investing in stocks, your stockbroker sends you several emails with various statements, reports, etc.

While a new investor might find it overwhelming to understand all these documents, it is important to remember that the Securities and Exchange Board of India (SEBI) has mandated stockbrokers to send certain documents to investors to ensure transparency.

And so, it is important to know what these documents mean and what action you need to take (if any).

Today, we are going to talk about one such document that your broker sends you every day – the Daily Margin Statement (DMS).

We will be focusing on the DMS sent by Groww (Nextbillion Technology Pvt.Ltd). So we will not talk about features currently not offered on Groww.

To help you understand the DMS, we will take you through the concept of margins and read a sample DMS.

Margins

Theoretically, there are two ways to understand margins:

- The margin rate prescribed by the stock exchange/clearing corporation

- Margins offered by few brokers for trading in stocks

Since Groww does not offer margin trading currently, we will focus our discussion around the first point – the margin rate prescribed by the stock exchange or clearing corporation.

In a circular dated November 19, 2019, SEBI mandated all trading members (stockbrokers) to collect margin from all retail investors in the cash market. This includes Value at Risk (VaR, Extreme Loss Margin (ELM), and Mark to Market (MTM).

While investors trading in derivatives would be aware of the margin requirement, for cash segment investors, this is a new concept.

In simple terms, stockbrokers are mandated to collect an upfront amount from investors for all BUY or SELL orders to ensure the smooth working of the markets. If you fail to provide the margin required, then your trade might not go through or you might be liable to pay a penalty.

SEBI also feels that investors must be informed about the status of their margins on a daily basis so that they can avoid shortfalls and subsequent penalties. Hence, it has mandated all stockbrokers to send a daily margin statement to all investors every day.

Please note : At Groww, no securities are held as collateral as of now. All margins are determined by the amount held by the user in Groww Balance or securities sold but not settled.

Also Read : Understanding the Concept of Margins

The Daily Margin Statement – Explained

The daily margin statement offers a comprehensive view of the margin status including the amount deposited towards margin, amount utilized, etc.

This is a password-protected statement and you can access it by entering your PAN as the password. Further, every trade has a margin requirement. So, if you trade on multiple exchanges, then we will send you a combined daily margin statement.

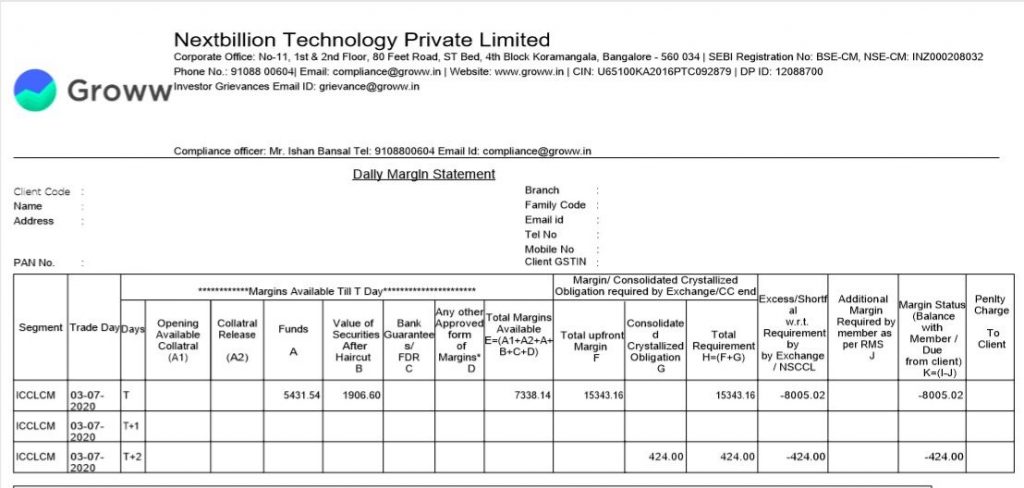

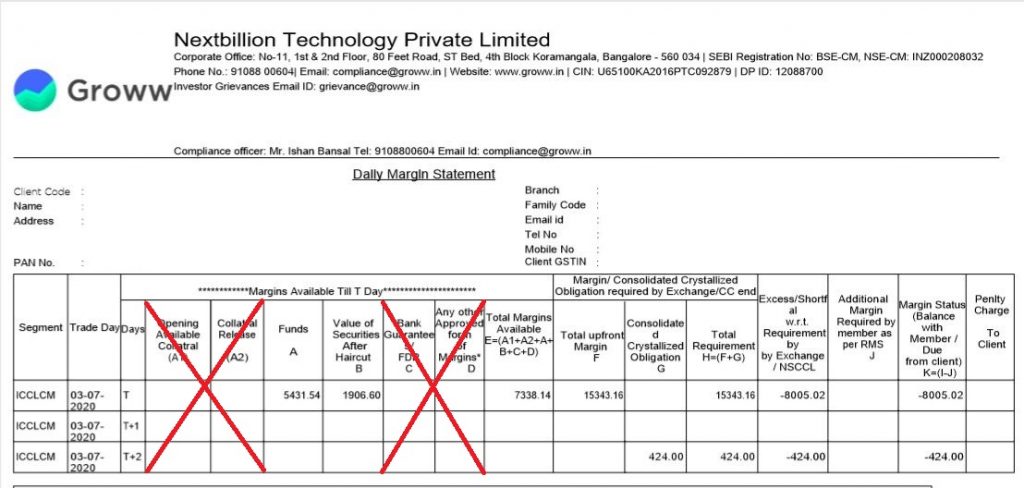

A DMS will look like this:

Image 2

Image 3

Image 4

Looks really complex, doesn’t it? Let’s break it down for you. First, let’s remove all fields that are not applicable since Groww is not offering those services currently.

Currently, Groww does not provide margin trading. So, the columns A1, A2, C, and D can be ignored. Here is a quick explanation of all the other fields with respect to the mandatory upfront margin requirement:

| Name | Explanation | In the above example |

| Segment | This column will tell you about the clearing corporation and the market segment. You will be able to cross-check these numbers by grouping all your trades based on exchange/clearing corporation. | The segment is ICCLCM. This stands for Indian Clearing Corporation Limited (ICCL) – Cash Market. |

| Trade Day | This is the day on which you had traded in the said segment. Since this is a daily statement, this column will have the date of trade for which the statement is being issued. | This statement is for trades done on July 03, 2020. |

| Days | Since the margin requirement is valid unless the trade is settled by the exchange, this column will tell you about the margin status for three trading days T day, T+1 day, and T+2 day. | The first entry is about margin for today’s trade (T day). The second entry is about margin for trade done yesterday (T+1 day). The third entry is about the margin for the trade done the day before yesterday (T+2 day). |

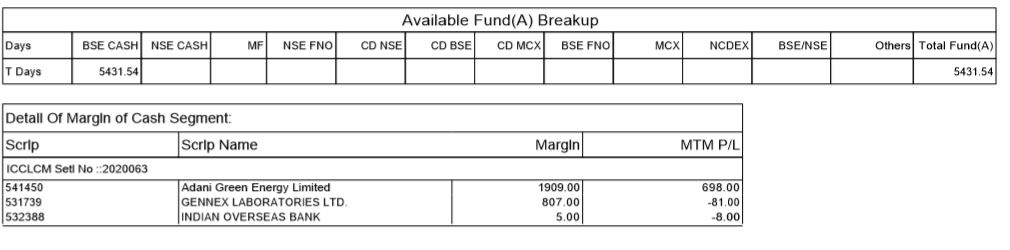

| Funds (A) | This is the balance that features under the “available to invest” section of your dashboard. This data is till 5 pm. Hence, it will not factor in after-market trades. | This is the amount in the Groww balance (currently Rs.5431.54). You can see the breakup of the available funds by clicking on it |

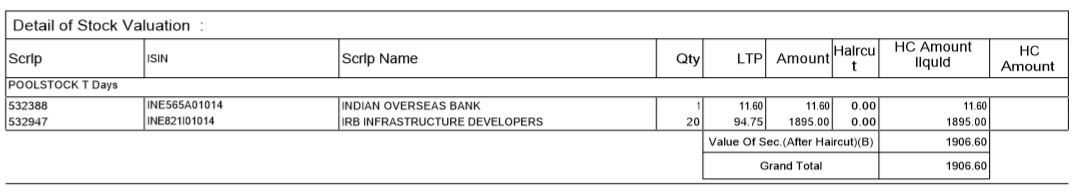

| Value of Securities after haircut (B) | When you sell a stock from your Demat account, we debit your account and credit the shares to our pool account. Since the exchange settles the trade on T+2 day, you receive margin benefit on the stocks lying in the pool account too. This column will tell you the value of the stocks in the pool account. | The value of securities after haircut is Rs.1906.60. |

| Total Margins Available (E) | This is a summation of A and B [Funds + Value of Securities after haircut]. This amount can be used by you as margin for BUY or SELL trades. | The total available margin = 5431.54 + 1906.60 = Rs.7338.14. |

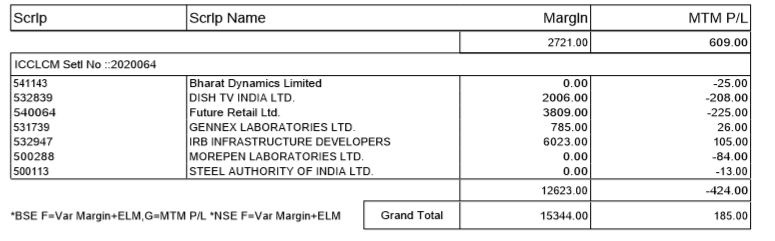

| Total Upfront Margin (required) (F) | This column will tell you about the total upfront margin blocked for all the trades that are yet to be settled by the exchange. This includes VaR and ELM. You can click on it to see the list of trades made. | The total margin (VAR + ELM) requirement for trades done on July 03, 2020, plus any previous margin requirement adds up to Rs.15343.16. |

| Consolidated Crystallized Obligation (G) | This column shows the MTM margin requirement for all the trades yet to be settled. | The MTM margin requirement is Rs.424. |

| Total Margin Required (H) | This column shows the total upfront margin requirement in the top row and MTM margin requirement in the bottom row. | The total upfront margin requirement is Rs.15343.16 and the MTM margin requirement is Rs.424. |

| Excess/ Shortfall (I) | It shows if you have used all your available margin or if you need to deposit more funds to avoid a penalty. If the number is positive, then you have funds available to be used as margin. On the other hand, if the number is negative, then you need to deposit funds to your Groww Balance. | There is a shortfall of Rs.8005.02. |

| Additional Margin as per RMS (J) | This column shows if there is any additional margin blocked by us as an additional surveillance margin. | NA |

| Margin Status (K) | This column shows the balance available for trade on the next trading day. A negative balance implies no balance available and you need to deposit funds to trade. | You need to deposit Rs.8005.02 + Rs.424 to your Groww Balance. |

| Penalty | This column shows if there is any penalty amount levied to your account. | – |

Summing Up

Now that you understand the individual components of a Daily Margin Statement, you can understand the margin amount utilized by you and how much you have available for trade the next day. This statement gives you a bird’s-eye view of the margin balance and helps you plan your trades accordingly.

Happy Investing!