Franklin Templeton’s 6 Funds Get Back Rs 1,252.44 Cr. What does this mean for you?

Franklin India has received Rs 1,252.44 Cr from Vodafone as repayment. Some of Franklin India’s wound down funds will get this refund. In this blog post, we’ll see what this means for the investors of these funds.

Which Funds are Involved in This?

The funds that are being referred to in this case are:

-

Franklin India Ultra Short Bond Fund

-

Franklin India Low Duration Fund

-

Franklin India Short Term Income Plan

-

Franklin India Credit Risk Fund

-

Franklin India Dynamic Accrual Fund

-

Franklin India Income Opportunities Fund

Background

Earlier this year, Franklin had marked down its investments in Vodafone’s papers. Vodafone was going through rough times and its future prospects were looking uncertain.

You can read about this episode in greater detail here: Vodafone Idea AGR Issues an Impact on Debt Fund Investors

On 12th June, Vodafone paid back its interest in full. This amount was Rs 102.71 Cr. This amount has already been paid back to investors.

The interest for the period of June 12 – July 9 was Rs 7.88 Cr.

Now, the principal amount has been paid back too – Rs 1,245 Cr.

How Much Money Will I Get?

Check how many units you have in your segregated portfolio. Note, this is not the number of units you have in the mutual fund. It is the number of units you have in the segregated portfolio.

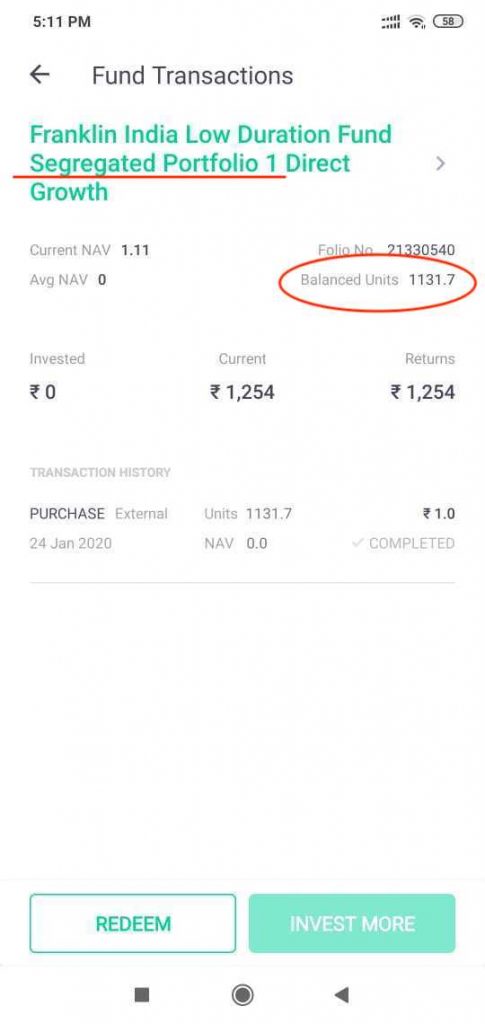

On Groww, this will appear like this:

Go to your Dashboard on Groww, and then select the segregated portfolio (not the actual fund). Example: Select Franklin India Low Duration Fund Segregated Portfolio 1 – Direct Growth.

Don’t select Franklin India Low Duration Fund – Direct-Growth.

Here, the amount visible is Rs 1,254. This is the amount due to you.

What Should I Do to Receive the Amount Due

You do not have to do anything to get this amount.

It will be delivered to your linked bank account automatically. We’re not fully sure by when this amount will be deposited to your bank. Some media reports say it would be done by 20th July 2020.

You will not be able to redeem from the segregated portfolio as the fund has wound down. But it will reach your linked bank account automatically.

For your investments on Groww, the unit value will be taken as of 10th July 2020.

To read the full details of this payback of the segregated portfolio, please check out this release by Franklin India Official Site – https://www.franklintempletonindia.com/.

Note: as this story is fresh, all details are not fully clear to us yet. We will continue to update this blog as we get more info.