GTT Orders on Groww

Buying and selling a stock at a particular price usually requires a person to track the buy/sell price constantly. Regular intraday orders are only valid for a day and get cancelled if the stock doesn't reach your desired limit price.

To avoid this tiring process, you can use the GTT (Good Till Triggered) feature which will enable you to buy or sell stocks at their desired price without having to track the prices throughout.

Read on to know more about the feature.

What is ‘GTT’ ?

GTT (Good Till Triggered) is a feature that allows users to place buy or sell orders of any stock at market or limit price. These orders are executed (triggered) once the market price of the stock reaches your desired price i.e the price you mentioned in the GTT Order. GTT orders are valid for 1 year.

GTT orders cannot be placed for intraday trades because of the year long validity.

How does GTT Help You?

If you have already invested in a stock or are going to invest, GTT can help you buy or sell the stock at your desired price. As soon as the stock's market price matches the GTT trigger price, the order will get executed. As mentioned, GTT has a validity of one year and the order will expire if the stock fails to reach your desired level within a year’s time.

For example:

Tata Motors is trading at Rs 441. You are willing to invest in the company but at a lower price of Rs 420. You can place a GTT buy order at Rs 420. So whenever the stock price falls to Rs 420, the GTT order will get triggered and the stock will be bought at this price.

Note: If your buy order gets triggered and you don’t have sufficient funds in your Groww wallet balance, it will fail. Similarly, when your sell order is triggered and you haven’t verified your holdings on the day of trigger, your sell order will fail.

How to use GTT Feature on Groww:

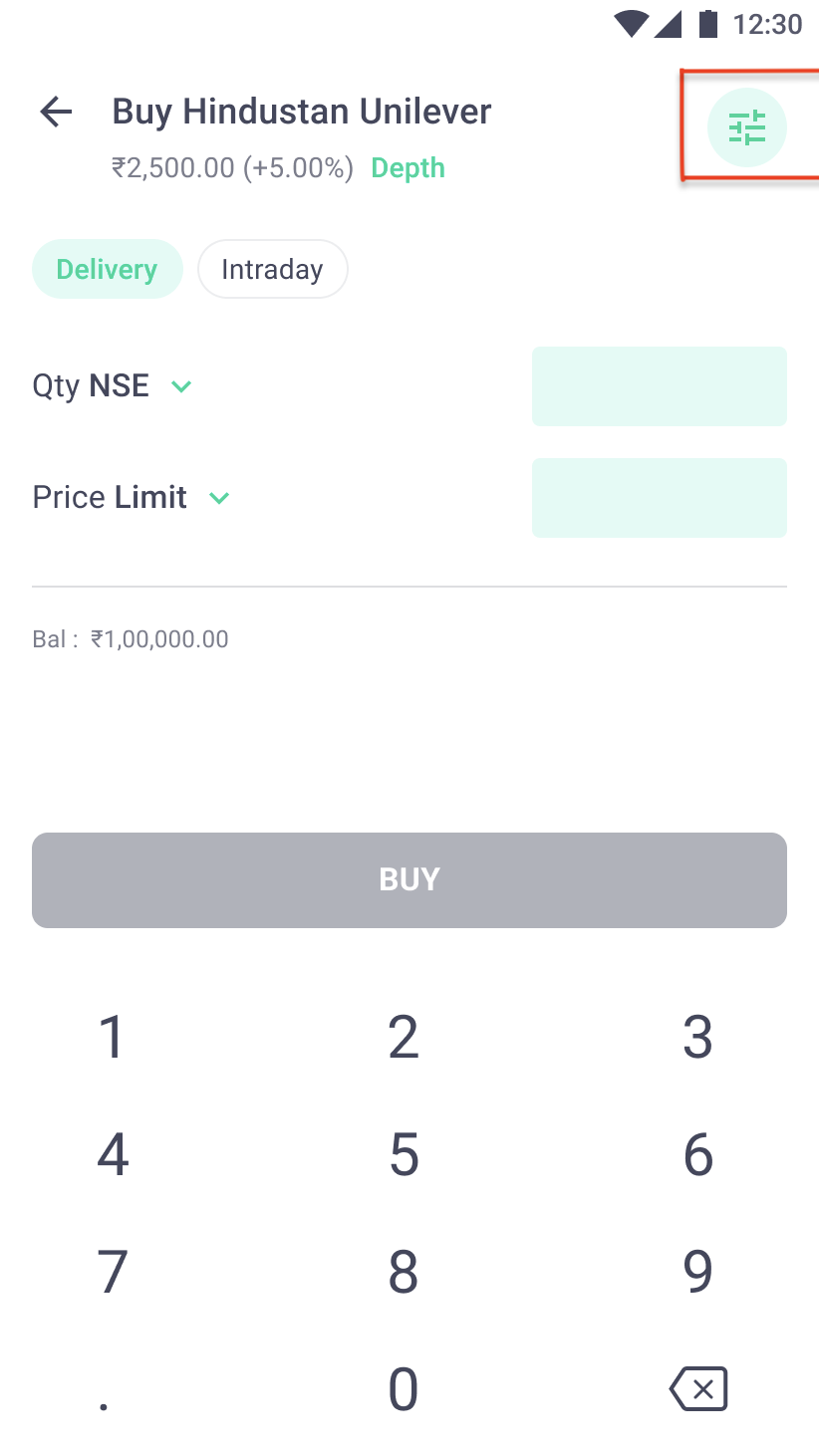

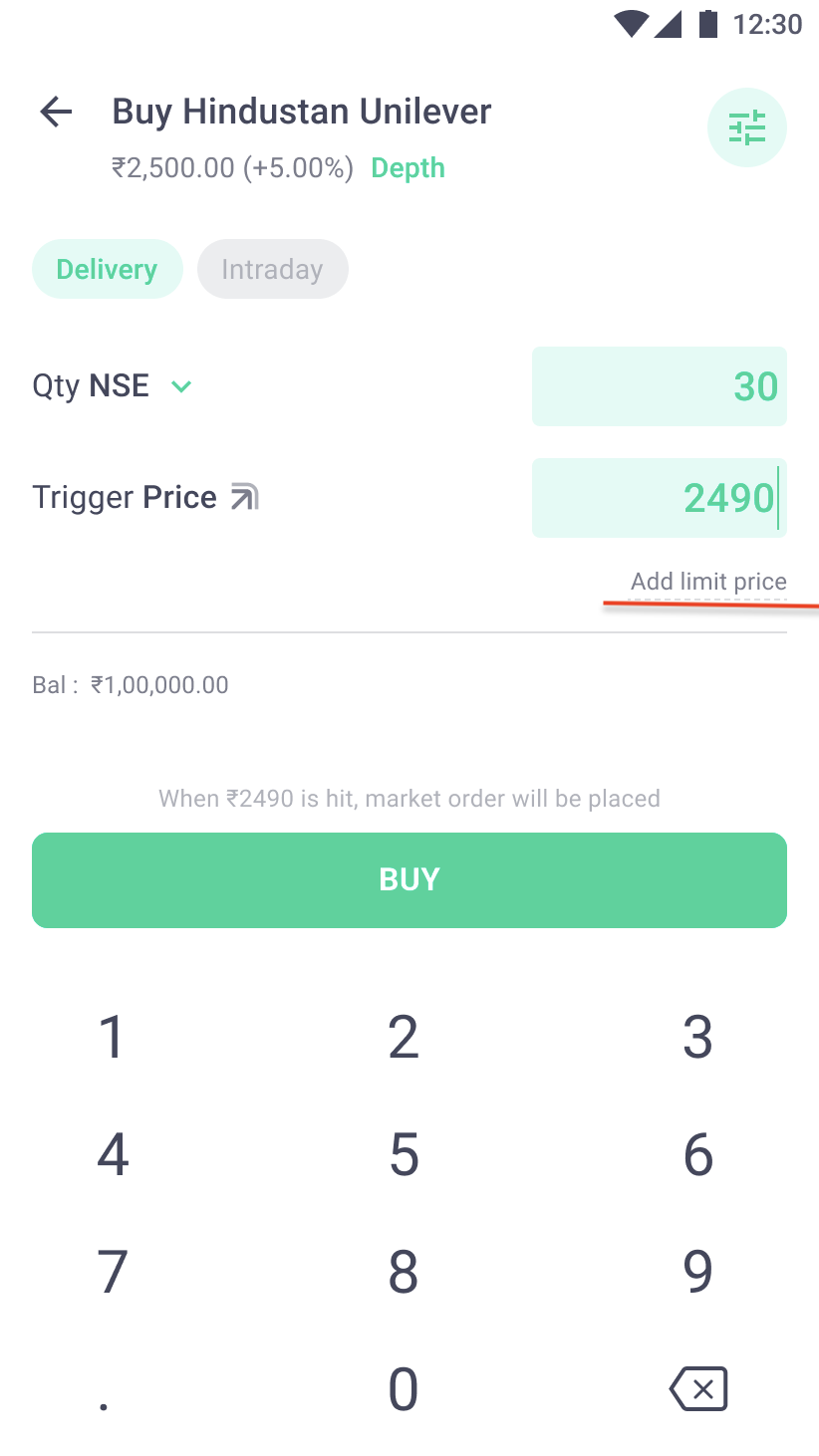

Step:1

Search and select a stock. After selecting the stock, you should now click on the hamburger button in the top right corner.

(Please note that HUL has only been chosen as an example and the prices indicated on the screenshots are just for illustrative purposes. This is not an advisory)

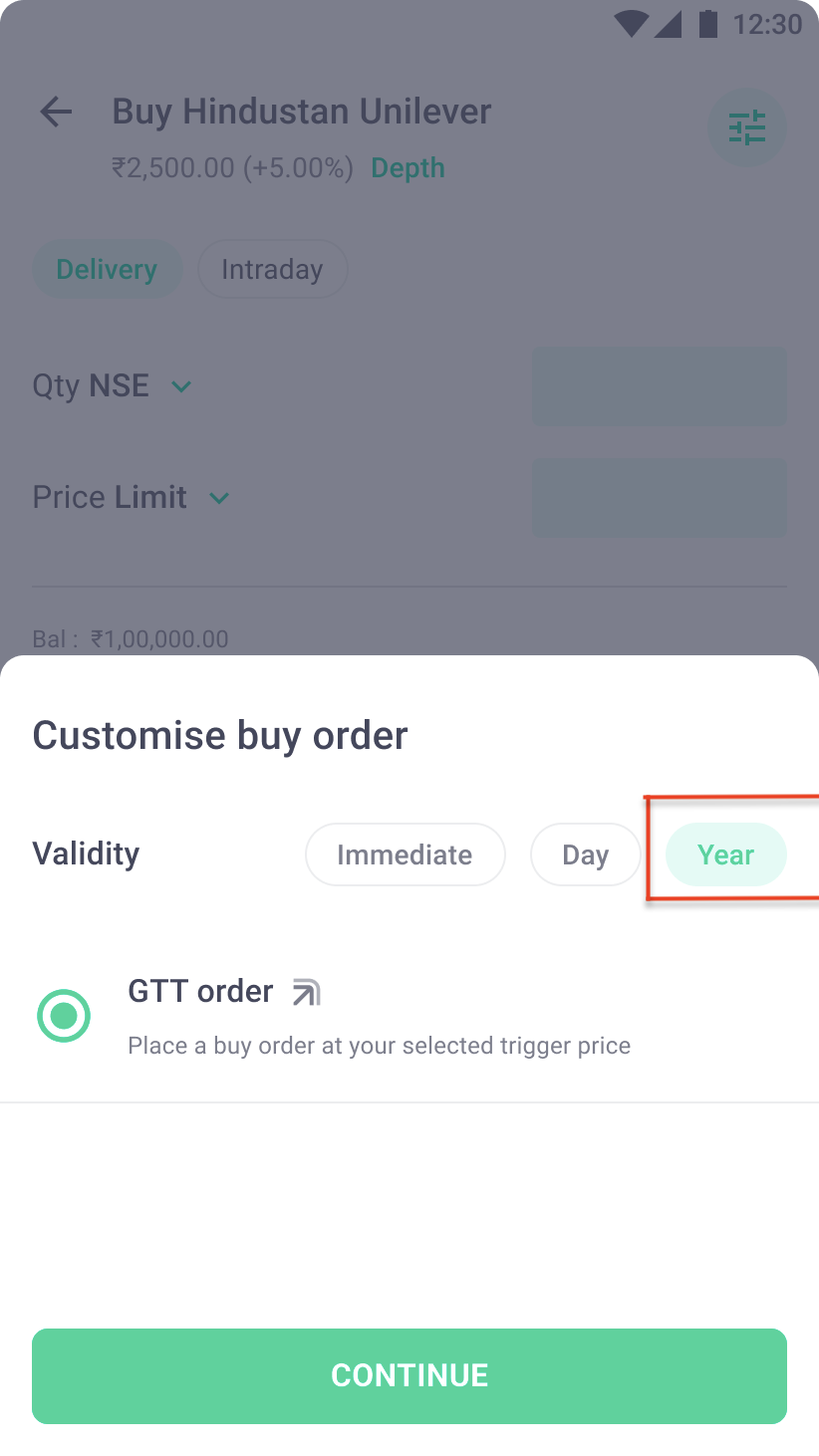

Step 2:

Choose the year option from the validity toggle

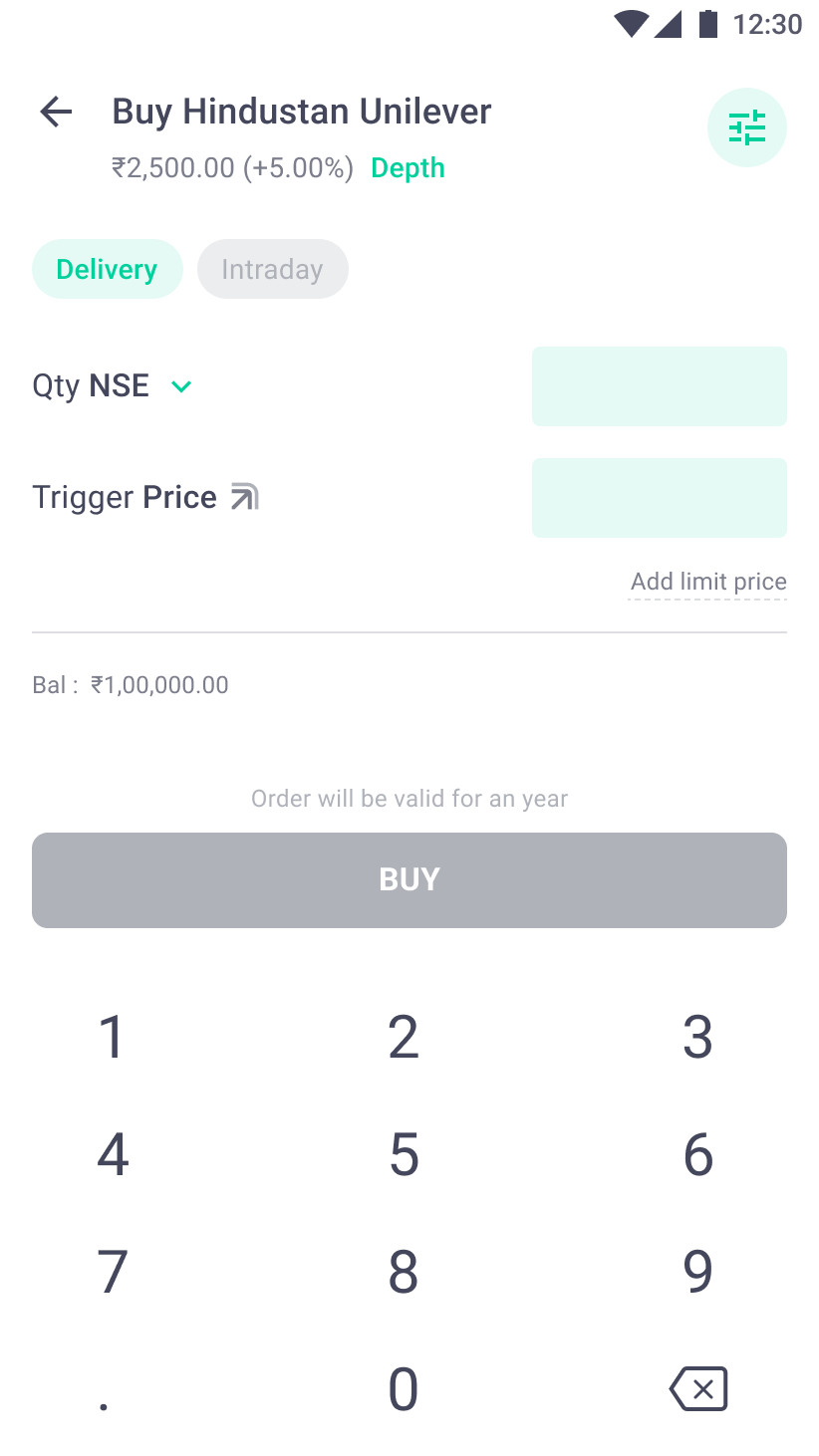

Step 3:

After selecting the year option, you will have to enter the quantity of the stock you want to buy and then enter the trigger price. Once the market price of the stock matches your trigger price your buy/sell order will be placed.

Step 4:

If you want to place a limit order in GTT, you can do so by clicking on the limit price button right below the trigger price. Once you click on the limit price you can now enter the quantity and the price at which you want to buy the stock.