Beginner’s Guide to Investing in Gold- India

With the stock markets swinging in the extremes this year due to the economic impact of the pandemic, most investors were prompted to find ways to hedge their portfolios. During this period, one asset started gaining traction – Gold.

If you have been considering investing in gold but are unsure about how to begin, here is a quick guide to acquaint you with gold investing in India. Read on!

Why Should You Consider Investing in Gold?

While people in India have brought gold over for various reasons, usually cultural or religious, it has found appeal as an investment option as well. Here are a few things that work in favor of gold:

-

Long-term Store of Value

For centuries, gold has been the best store of value for the long-term(store of value is an asset that maintains its value without depreciating). The fact that it can play the role of money adds to its superiority and its outperformance of the currency value make it attractive.

-

It will Always have Value

Currency is a ‘promise to pay’. Gold, on the other hand, requires no such promise. It is the only financial asset that is not someone else’s liability at the same time. In its 3000+ year history, gold prices have never dropped to zero. Hence, it will always have value and stand strong even if the market collapses.

-

Inflation Hedge

When inflation rates rise, the value of currency drops. However, over the last five years, despite the rise in inflation rates, gold prices have doubled. In India, where inflation rates tend to exceed interest rates, investing in gold is a hedge against inflation.

-

Liquidity

One of the most important features of gold investment is liquidity. Gold can be bought and sold in a very short time.

-

No Specialized Knowledge Needed

When you buy stocks or invest in mutual funds, you need some knowledge of the market and economy to make the right decision. With gold, no such knowledge is needed. It is simple and straightforward making it easy to invest in for all kinds of investors.

-

Helps Diversify your Investment Portfolio

As an asset class, gold has a low/negative correlation with other asset classes. Hence, it is helpful in diversifying or hedging your investment portfolio against market volatility.

What are the Different Ways of Investing in Gold?

Traditionally, the only way to invest in gold was by purchasing jewellery. Over the years, different ways of owning gold have emerged including different variants of physical gold and paper gold along with its variants.

Here are some ways in which you can invest in gold:

1. Digital Gold

One of the most convenient and cost-effective ways of investing in gold online is Digital Gold. This product allows you to buy and sell gold in fractions at any time. You can invest in gold with as little as Rs.10!

Every bit of digital gold purchased by you is backed by physical 24k gold and linked to the real-time gold prices. Here are some features and benefits of buying digital gold:

- Invest small amounts – Gold investment was traditionally associated with a sizable sum of money. With ten grams being sold at close to Rs.50000, investors needed a reasonable sum before they could invest in the precious metal. With digital gold, you can invest as low as Rs.10!

- Maximum security – Most companies offering digital gold ensure that it is stored in secured vaults and is insured.

- Liquidate within two days – If you own digital gold, you can sell it anytime and receive funds in your account typically within two working days.

- Zero making charges – Unlike jewelry or other physical gold options, digital gold has zero making charges.

- View your gold holdings online – If you invest small amounts regularly, you will soon have a sizable amount of gold in your account. With digital gold, most platforms allow you the option of viewing your holdings online.

- Convert to physical gold – Many digital gold platforms also allow you to convert your digital gold holdings into physical gold on demand.

2. Gold Coins or Bars

To save on ‘making charges’ that are applicable to gold jewelry, many investors opt for gold coins or bars. Since these coins/bars do not require skilled artistry, the making charges are not applicable.

Today, you can buy these coins or bars from jewelers, banks, ecommerce websites, and many non-banking finance companies.

3. Gold Savings Schemes

Jewelers across India offer various schemes to help people invest in gold in installments.

Typically, a jeweler allows you to deposit a pre-determined amount every month for a specific period. At the end of the tenure, they can buy gold from the same jeweler at a value equal to the amount deposited plus a bonus (if offered by the jeweler).

The gold can be purchased at the prevalent gold price on maturity.

4. Gold Sovereign Bonds

Issued by the Reserve bank of India (RBI), Gold Sovereign Bonds are the safest way to purchase digital gold. The RBI issues them on behalf of the Indian Government. These bonds have an assured interest of 2.50% per annum.

The bonds have a lock-in period of five years and an overall tenure of eight years.

5. Gold Mutual Funds

These funds invest in gold reserves directly or indirectly. They invest usually invest in stocks of mining companies, physical gold, and stocks of gold producing and distribution syndicates. The performance of these funds is usually linked with the performance of gold prices in the country.

6. Gold Exchange Traded Funds (ETFs)

These are ETFs that invest in gold as an asset class and allow you to trade the units on the stock exchange. They carry the pros and cons of ETFs with the benefit of investing in gold.

7. Jewelry

As Indians, we love owning gold jewelry. Whether it is for religious, cultural, or financial reasons, gold jewelry has always found a place in most households in our country. However, being a valuable metal, the safety of the jewelry is of high concern to investors.

Further, gold jewelry includes making charges which can go up to 25 percent if the design is intricate. These making charges are irrecoverable once you decide to sell the jewelry

Gold : A Historical Overview

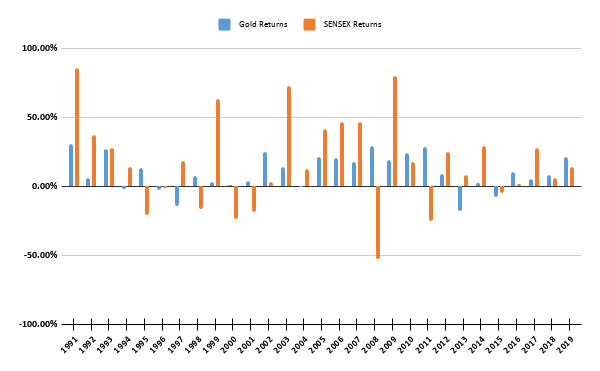

If you turn the pages of history and look at the performance of gold versus a stock market index, you will discover that on most occasions, when the stock markets fall – gold prices rise and vice versa. This inverse relationship between gold and stocks can have many explanations. The most common explanation is that people treat gold as an alternative for currency. Hence, when the stock markets crash, there is an inclination towards a hard asset like gold .

This inverse relationship is important since it makes gold a perfect hedge against market volatility. For instance, here is a quick look at the returns offered by gold and BSE SENSEX over the last three decades (1991-2019)

As you can see in the chart above, when the SENSEX generates good returns, gold offers reasonable returns too. The interesting thing to be observed is that whenever the stock markets have crashed, gold has managed to offer reasonable returns.

Tax Rates for Gold Investments

Keep yourself abreast of the tax rates applicable for profits earned from gold investments. In India, when you sell gold, you attract capital gains tax.

If you have held the gold for three years or less, then the gains made will be called short-term capital gains or STCG and will be taxed at the income tax slab applicable to you.

On the other hand, if you hold the gold for more than three years, then the gains will be called long-term capital gains or LTCG and taxed at 20%.

Things to Keep in Mind Before Investing in Gold

- The performance of gold stocks and mutual funds can differ from that of physical gold. The price of gold is determined by a lot of factors including the demand and supply of the commodity, economic conditions of the country, etc.

While a company belonging to the gold industry gets directly impacted by the change in gold prices, there are other factors that influence the price of stocks of these companies. Hence, before buying gold stocks or mutual funds, ensure that you research the company or the scheme thoroughly. - If you are investing in physical gold, then ensure that it is in a place that is safe and secure.

- Gold prices tend to move inversely to the stock markets. However, it is not always true. Hence, it is important to ensure that you have an investment portfolio that is designed to weather all storms.

Summing Up

If you are thinking of including gold as an asset class in your investment portfolio, then we hope that this article helped get a better grip on gold investing.

Remember, any investment should be made after considering your financial goals, investment horizon, and risk tolerance. Learn more about gold investing and talk to an investment advisor if you need clarification.

Happy Investing!