Assets and Liabilities

Assets and liabilities tend to play a vital role in ensuring the profitability of a business or its long-term viability. It depends on how well a company can manage them effectively.

Assets are what a company owns, and liabilities are what the company owes. Both assets and liabilities are reflected in the balance sheet of a company, depicting its financial health and soundness.

The difference between the assets and liabilities of a company determines its Equity.

What are Assets and Liabilities?

Here is a detailed explanation of assets and liabilities meaning-

-

Assets

The term ‘asset’ signifies all kinds of resources that help generate revenue as well as receivables. Assets may generate robust cash flow as they help convert raw materials or can be converted into cash or cash equivalents.

Notably, such resources are reported on the left side of the Balance Sheet that is maintained by any entity involved in commercial practice.

Generally, the sum of total liabilities and equities owned helps compute the value of assets. Consequently, it can be said -

|

Total Assets = Liabilities (Accounts Payable) + Owner’s Equity |

-

Liabilities

The term liability signifies all types of account payables. It can further be defined as a financial obligation that individuals must meet.

Usually, liabilities tend to play a significant role when it comes to financing expansion or ensuring the smooth processing of everyday operations of commercial practices.

The obligations of a commercial entity are reported on the right side of the Balance Sheet.

|

Total Liabilities = Assets (Accounts Receivable) - Owner’s Equity |

Different Types of Assets and Liabilities

The following offers a detailed explanation of the different types of assets and liabilities.

-

Types of Assets

Most assets are classified based on 3 broad categories, namely -

|

Convertibility |

Depending on their extent of convertibility, they are further divided into fixed assets or current assets. |

|

Physical existence |

Comprise assets that are both tangible and intangible. |

|

Purpose |

Depending on their purpose of use, they are categorised as operating and non-operating assets. |

Following are the 6 different types of assets-

-

Current Assets or Short-term Assets

Current assets are the types of assets that can be readily converted into cash or its equivalent resources typically within a year and are known as liquid assets. For example, cash equivalents, stock, marketable securities and short-term deposits are some of the most common current assets.

- Fixed Assets or Long-term Assets

Also known as hard assets and fixed assets, these resources are not easy to convert into cash or its equivalent kind. Generally, land, machinery, equipment, building, patents, trademarks, etc. are considered as fixed assets.

- Tangible Assets

Assets with a physical existence are categorised as tangible assets. Resources like stock, land, building, office supplies, equipment, machinery and marketable securities, among others are functioning examples of tangible assets.

- Intangible Assets

On the contrary, assets which do not possess a physical existence come under the category of intangible assets. The best examples of such assets would be market goodwill, corporate intellectual property, patents, copyrights, permits, trade secrets, brand, etc.

- Operating Assets

Assets like cash, building, machinery, equipment, copyright, goodwill, stock, etc. are termed as operating assets. Typically, such assets are used to generate revenue and to maintain daily operation.

- Non-operating Assets

Though these assets are not used for performing daily operations, they tend to help generate significant revenue. Some of the best examples of non-operating assets are short-term investments, vacant land, income generated through fixed deposits, etc.

-

Types of Liability

In a commercial setup, liabilities can be divided into 2 broad categories of internal and external liability.

|

Internal Liability |

Comprises obligations like capital, accumulated profits and salaries, among others. |

|

External Liability |

Includes payables like taxes, overdrafts, creditors and borrowings. |

Further, liabilities are divided into more separate categories as per their function, namely –

Relationship between Assets and Liabilities through Financial Ratios

Typically, fine-tuning the proportion of total assets and liabilities is a necessity for maintaining a company’s profitability.

It helps to analyze the company’s ability to manage its external and internal liabilities as well as how readily it can convert assets into cash equivalent. It also help figure out the liquidity ratio of a particular business venture.

Here are the list of financial ratios along with their formula that one must know.

|

Financial Ratios |

Description |

Formula |

|

With the help of current ratio, one can successfully figure out a company’s ability to pay off existing debt. |

Current ratio = Current assets/ current liabilities |

|

|

Acid Test Ratio |

Acid-test ratio is used to gauge a company’s ability to repay short-term liabilities with the help of quick assets. |

Acid-test ratio = Current assets – Inventories / Current liabilities |

|

Cash ratio helps decipher a company’s ability to pay off short-term liabilities with the help of cash and cash equivalents. |

Cash ratio = Cash and Cash equivalent / Current liabilities |

|

|

Debt Ratio |

Debt ratio is often a potent way of calculating the total’s assets of a company which was funded by debt. |

Debt Ratio = Total Liabilities / Total Assets |

|

Owner’s Equity |

Assets and liabilities play a pivotal role when it comes to computing the value of existing capital or owner’s equity. |

Owner’s equity = Total assets – Total liabilities |

Difference Between Assets and Liabilities

Understand the assets and liabilities difference with the table mentioned below-

|

Assets |

Liabilities |

|

Assets contribute positively to a valuation of a company |

Liabilities contribute negatively to a valuation of a company |

|

It leads to cash inflow in the company |

It leads to cash outflow in the company |

|

It is a financial resource |

It is a financial obligation |

|

It generates revenue for the company |

It is an expense for the company |

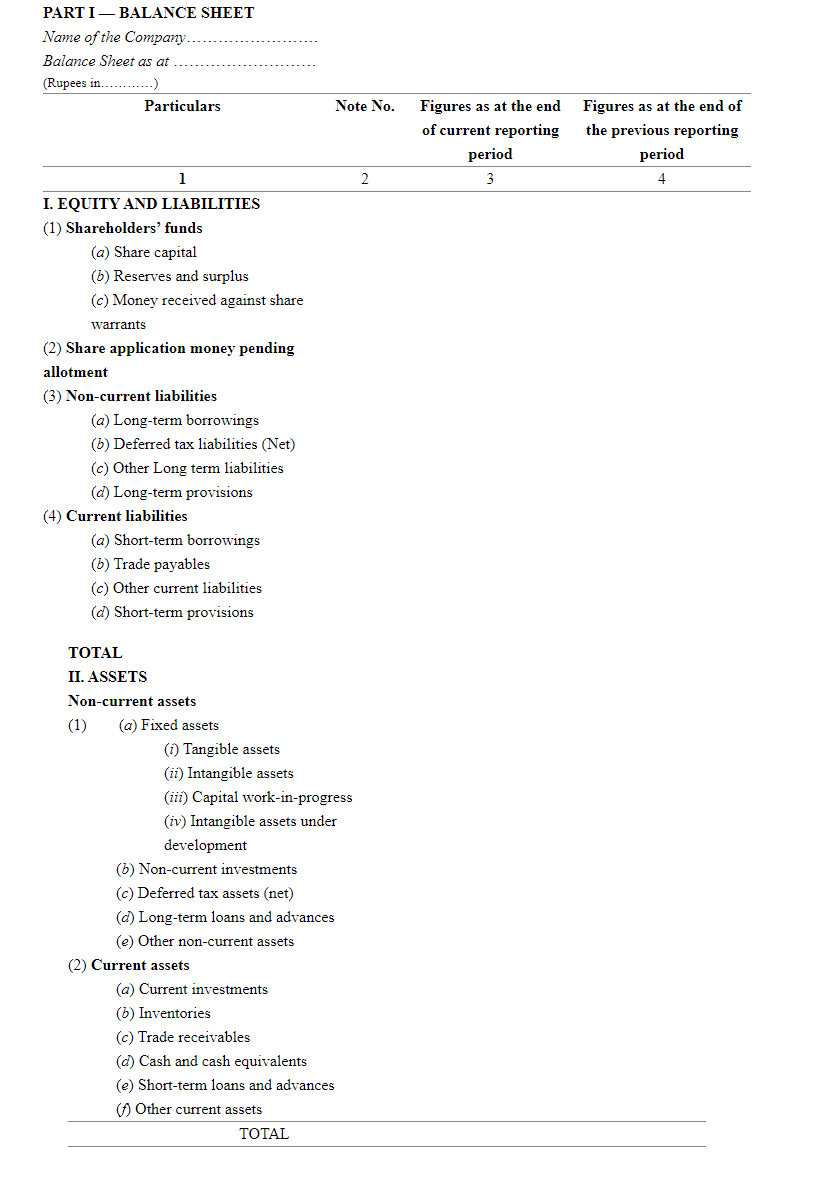

Assets And Liabilities Example On a Balance Sheet

Let’s take a detailed look at the two with a reference to a sample balance sheet here-