What is Balance Sheet?

A balance sheet is a company's financial statement that provides information about a company's assets, finances as well as the amount invested by its owners.

In simple words, a balance sheet of a company is supposed to have in and out of the company’s financial status including how much has it earned, how much has it spent from the earnings, how much of it is left, or have they spent more than they have earned.

Covered ahead are the technical aspects of balance sheets and their significance in the stock markets.

Importance of a Balance Sheet

Balance sheets are the A-to-Z of a company’s financial status. They contain detailed information on the company’s assets (what it owns) and liabilities (what it owes). Companies generally publish their balance sheets on the last day of the fiscal quarter.

It is imperative in conducting fundamental analysis or calculating financial ratios and is used along with other important financial statements such as the income statement and statement of cash flows.

Difference Between Consolidated and Standalone Balance Sheet

Whenever a company publishes its quarterly results, you will see two types of balance sheets that a company publishes: standalone and consolidated. The difference between them is very simple.

Standalone balance sheets are those that have collated the statement of only the holding company whereas consolidated balance sheets indicate the financials of the holding company along with its subsidiary companies as well.

Is it Mandatory for Companies to Publish Balance Sheets?

Yes. According to the Companies Act, 2013, every company has to publish its audited balance sheet annually. In practice, companies may do it at the end of every quarter and once annually.

Fundamentally, if a company wants, it can publish its balance sheet daily as well. Some companies, especially banks, are required to publish it (audited or unaudited) quarterly.

What Does a Balance Sheet Entail?

The balance sheet accounts for whatever money that comes into the company stays and leaves the company in any form: be it tangible or intangible.

Given below are the major subheads of the same which will make it easier for you to grasp the balance sheet format and help you understand how to analyze balance sheet.

|

Assets |

Liabilities |

|

Current Assets: Current assets are those assets that can be liquidated in a short period of time. In other words, assets for those you can get money/income faster by selling or liquidating them in any manner fall under this heading. Examples of such assets include inventories, trade receivables, cash and more.

Non-current assets: Broadly, non-current assets are those that are there with the company for a fairly long period of time. Examples of non-current assets include fixed assets. Fixed assets have few categories under it like tangible assets (machinery, vehicles and likewise), intangible assets like goodwill, long term loans and many others.

|

With liabilities, there are two broad categories and one of the most important ones that carry a lot of significance in a company’s balance sheet is shareholder’s equity. Shareholders equity: Shareholder’s equity is the shareholder’s residual claim to a company’s value after the company has paid off its liabilities. Shareholder’s equity= Assets-Liabilities SE basically can indicate the book value of a company. Current Liabilities: These are financial liabilities that will become due in a shorter period of time, maybe within a year. These could include payments pending to suppliers and vendors within a short time period. Taxes payable to the government, salaries, dividends payable also fall under current liabilities. Non-current liabilities: Non-current liabilities are those payments/liabilities that are due over a longer duration. Longer-term borrowings and deferred taxes are examples of non-current liabilities. |

Format of a Balance Sheet

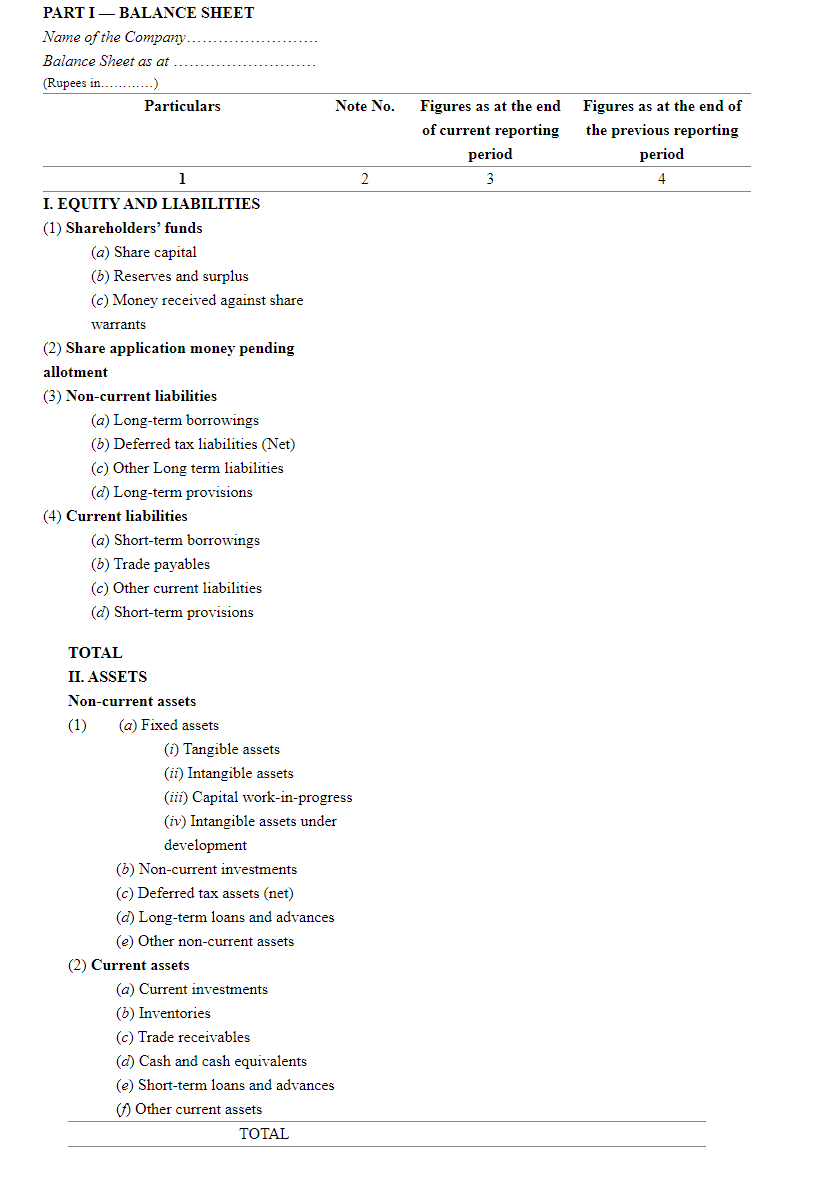

Here’s a balance sheet example as per schedule III of the Companies Act.

Why are Balance Sheets Essential for Stock Market Investors?

-

Shareholders Equity

Shareholders equity represents the amount that the shareholders of the company will receive if all the assets of the company were sold and liquidated and all the liabilities were paid off. Shareholder’s equity is an essential figure for you if you want to stay invested in a company.

-

Assets

Assets give you a snapshot of whatever the company owns: both tangible and intangible formats. It will help you to realize the worth of the stock and if the company is giving you the right worth or not, if the company is overvalued or undervalued itself.

-

Liabilities

Liabilities are basically whatever the company owes. Once you know what the company owns if it owes more than that you know the company is under debt. You should keep in mind such parameters and have an idea of such information before you invest in a stock.

-

Audited Balance Sheets

Audited balance sheets give you the assurance that the numbers may not be fudged and they are authentic.

What Will a Balance Sheet Not Tell You?

We have understood what a balance sheet has, what it tells us and what does the information it contains imply. We also need to understand what the balance sheet will not tell you.

-

Daily Trading Transactions

Balance sheets will only give you a financial snapshot but they will not tell you about the business transactions that a company gets into. Here the PROFIT AND LOSS ACCOUNT comes in very handy.

-

Income and Expense

The amount that shows up as cash in the bank in the balance sheet will be a part of the income and expenses column in the P&L account. You will know which category of income or expense it is that a balance sheet will not tell you.

-

Interest Payments

If a business takes a loan, the loan will appear in the balance sheet but the regular interest payment will show up in a P&L account.