How to Track Your External Investments on Groww

Consider a scenario in which you are a novice investor who started a SIP of a certain amount in a mutual fund for the first time. A couple of years later, a friend recommended a well-performing mutual fund to you, and you invested a portion there as well.

A few years down the line, more short-term or long-term goals come into the picture, and you invest in some more schemes. Ultimately you may reach a stage where you have several ongoing investments, varying in investment amounts and time periods, but you have lost track of them.

If you are someone facing a similar situation, Groww’s tracking feature will make your life super easy, but first, let us see why you need to have all your investment information in one place.

How Can I Track My External Investments On Groww?

Groww enables tracking external investments on the platform using your mobile number. Let’s explore how to do so.

The process is simple. Once you enable auto-tracking at Groww, Groww takes your request to MFCentral and places a request for your CAS or consolidated account statement. The consolidated account statement generated shows all your mutual fund investments against your PAN. By enabling auto-tracking, you give permission to Groww to read your CAS, pick all your investments and collate them on your dashboard. To activate the feature, follow the steps below.

Step 1: Log in to your Groww account. Sign up if you haven’t made an account yet (It’s super easy!)

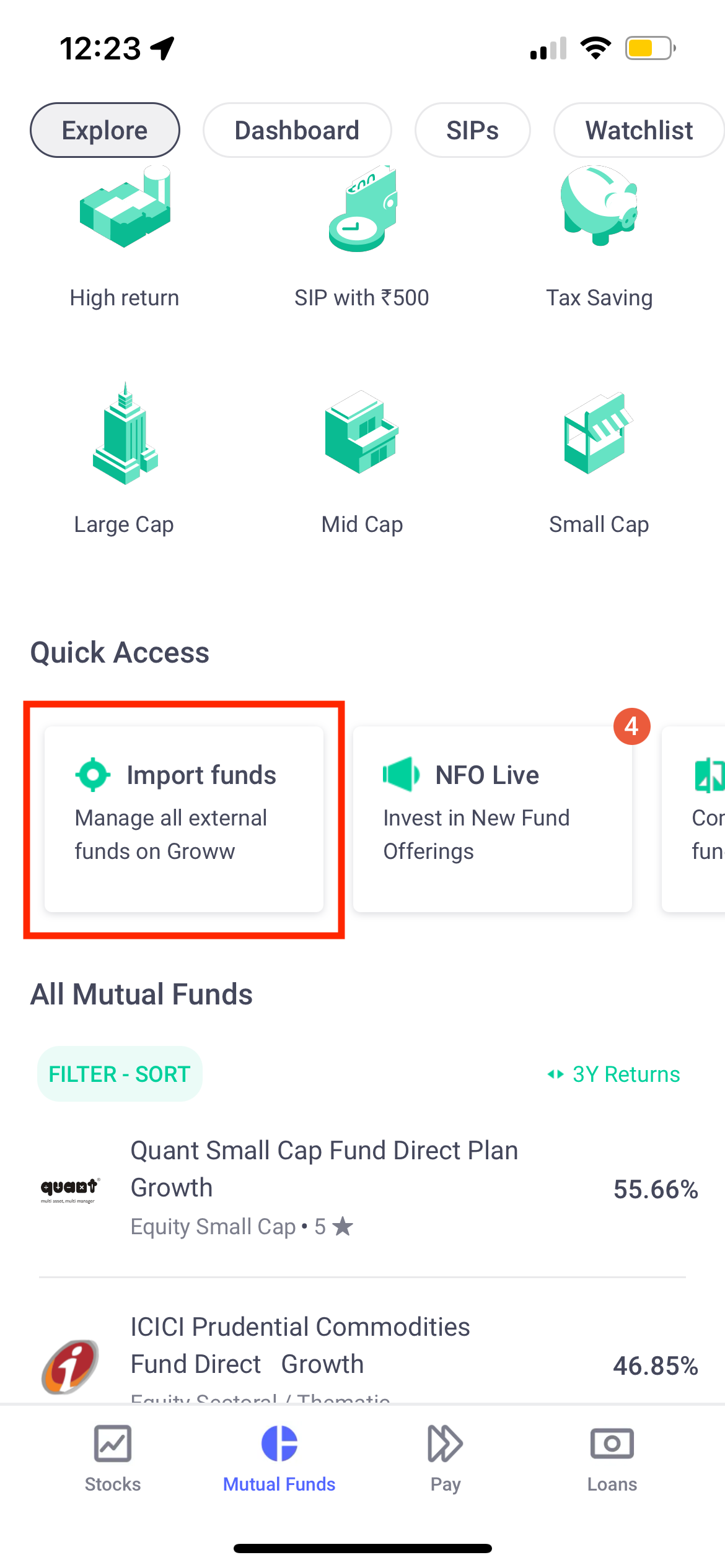

Step 2: On the MF Explore page, under ‘Quick Access’, you will be able to find the ‘Import Funds’ tab. Click on it.

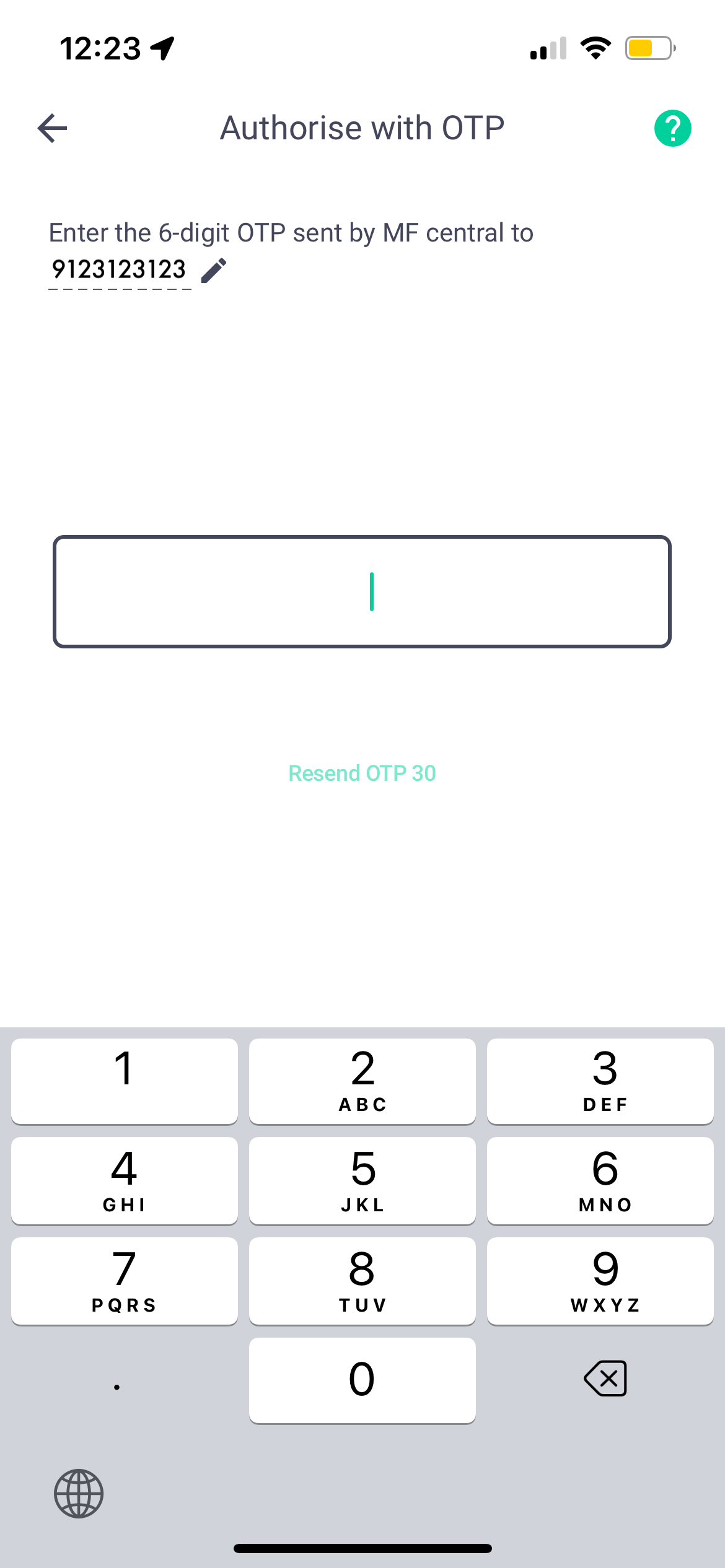

Step 3: Enter the OTP received.

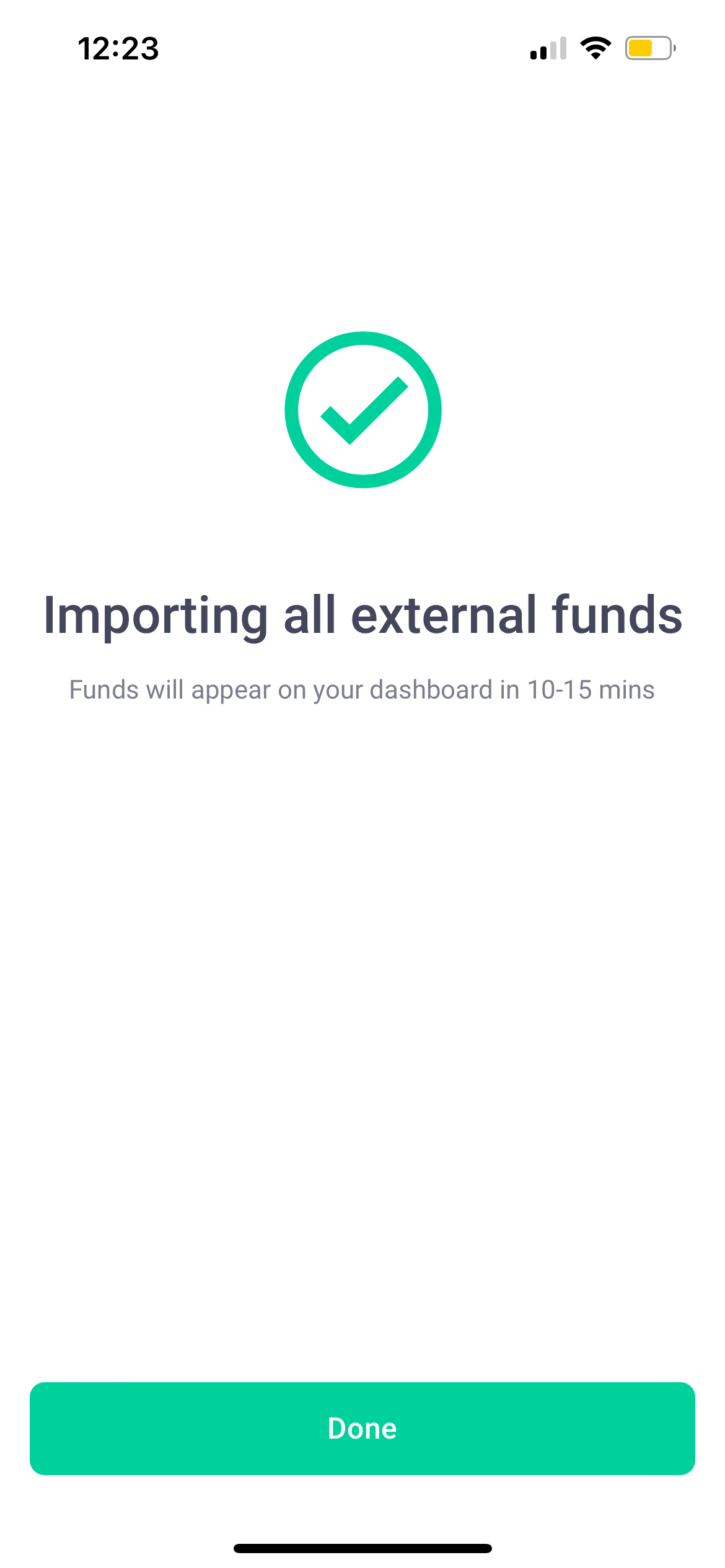

After this step, we will fetch the funds in the background in 10-15mins.

How Can Groww Help You?

To ease investing woes such as yours, Groww has launched a feature where you can track all your external investments in one place.

The track feature solves 3 major pain points that investors may face while managing their investments. Let’s see what they are and how the app features resolve them.

1. Investment Management

With multiple investments made over the years, you tend to lose count of the total amount that you have invested in MF schemes as well as what amount goes into which fund. For instance, you may have 5 ongoing SIPs from different platforms and tracking them can be cumbersome.

Undoubtedly, it is tedious to remember the login credentials of each website and then individually go and check the performance of the fund. Many times, you may have had doubts about your investment’s performance but couldn’t get your query resolved due to less-than-satisfactory customer service from the fund house.

Not only is this inconvenient and time-consuming but also doesn’t allow you to take decisions regarding your overall portfolio. Since the track feature aggregates all your external investments, you get a bird’s eye view of your portfolio on a single dashboard. In short, Groww’s track feature :

- Collates all your investments in one place where you can see details like the invested amount and the current value of your investments, along with the expenses associated with the fund.

- The dashboard gets updated daily so you can see the current NAV status of your funds.

- You can invest more in these funds (irrespective of whether they are direct or regular)

- You can redeem funds from the dashboard too!

2. Overview of Fund Performance

Once you are aware of how your investments are distributed across schemes, it is also vital to understand the current performance of your investments. In the absence of such a feature, investors find it difficult to track the performance of individual funds. With the tracking feature, you can see the change in the value of individual funds and also gauge the overall performance of your portfolio in terms of the net returns you are achieving.

The feature not only consolidates your investments and shows overall returns on your portfolio, but also gives insights regarding how your capital is allocated across debt and equity. It further drills down to allocation details between large-cap, mid-cap, and small-cap. It also tells you sector-wise asset allocation details. This information can help you make decisions regarding rebalancing your portfolio if need be.

Why is it Important to Track all Investments in One Place?

Selecting a mutual fund and then investing in it is only half the job done. It is important to know whether the fund you have invested in is on track to achieve your investment objectives. Tracking involves checking how the fund has been performing against the benchmark as well as other funds in the same category over a monthly, quarterly or yearly basis.

If you are able to see all your ongoing mutual fund investments in one place, you will be able to check the individual performances of the funds as well as the collective performance of your portfolio.

Accordingly, you will be able to take a call on portfolio rebalance, whether you should continue investing in the funds or switch to a better-performing fund to get maximum return on investment.

Happy Investing!