Groww Mutual Fund Introduces Multicap Fund to Capture India’s Diverse Growth Opportunities

India is entering an exciting phase of economic growth, with its GDP approaching $4 trillion and projections to more than double to $10 trillion by FY2032. The country is on track to become the world’s third-largest economy by 2027, driven by a combination of demographic strength, infrastructure development, and digital transformation.

This growth isn’t just limited to large, established companies—mid and small-cap businesses are also playing a crucial role in driving India’s economy forward, offering investors a wide array of opportunities.

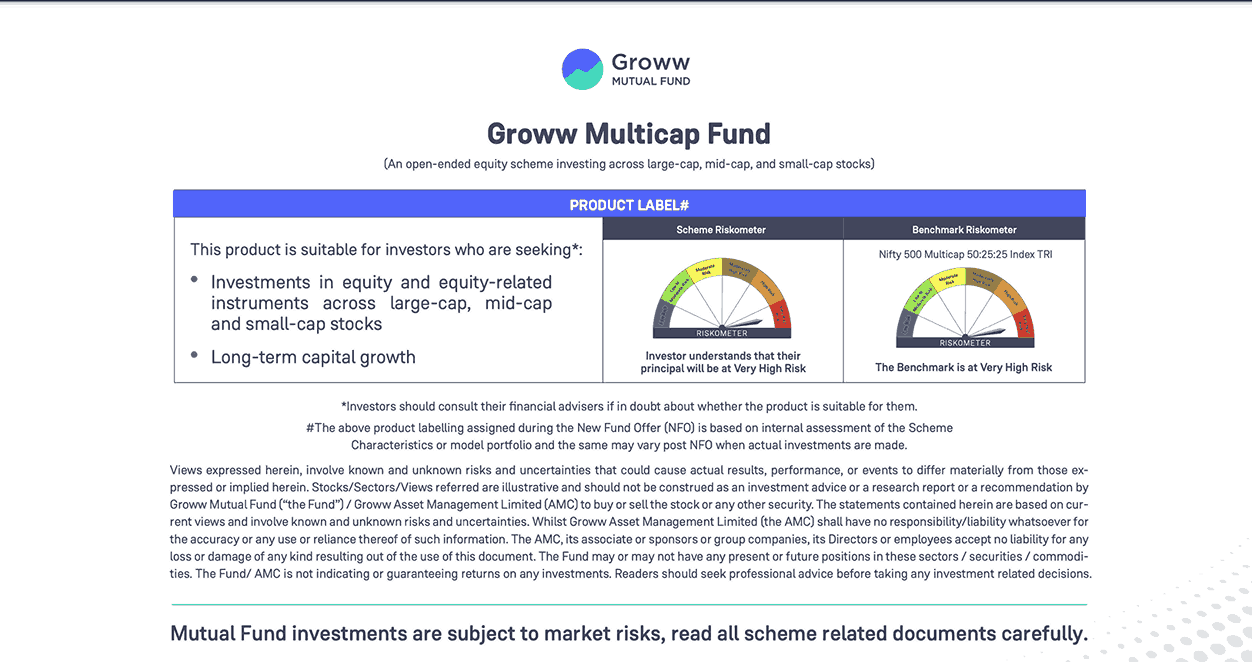

Recognizing these opportunities, Groww Mutual Fund has introduced the Groww Multicap Fund, an open-ended equity scheme designed to capture growth across large-cap, mid-cap, and small-cap stocks.

|

The NFO period is from November 26 to December 10, 2024. |

The fund aims to offer broad-based exposure to India’s diverse economic landscape, enabling investors to tap into growth across multiple market segments.

Key Drivers of India’s Economic Growth

- Infrastructure Development:

The ₹111 lakh crore National Infrastructure Pipeline (NIP) is focused on modernising India’s infrastructure, including highways, ports, and railways. With over 11,000 kilometres of highways being constructed annually, logistical efficiency is improving rapidly. - Export Growth:

Initiatives like Production Linked Incentive (PLI) schemes and Make in India are helping sectors like defense, electronics, and chemicals expand into global markets, significantly boosting India’s export potential. - Digital Transformation:

India’s vast and growing internet user base is helping to fuel the digital economy. This is transforming industries like payments, e-commerce, and IT services, driving digital adoption across the nation. - Premium Consumption:

Rising disposable incomes are increasing demand for luxury goods across sectors such as real estate, automotive, and jewellery, reflecting a broader shift toward premium consumption in India. - Import Substitution:

Policies aimed at reducing reliance on imports are strengthening domestic production, particularly in niche industries such as speciality chemicals, ceramics, and precision manufacturing.

The Multicap Approach: A Broad-Based Investment Strategy

The multi-cap strategy involves investing across a mix of large, mid, and small-cap stocks, ensuring diversified exposure to India’s economic growth. This approach allows investors to capture opportunities across different segments of the market rather than focusing on a single category.

- Large Caps: Market leaders in industries like financial services, FMCG, pharmaceuticals, and automobiles, typically benefiting from broad macroeconomic trends.

- Mid Caps: Emerging companies in sectors such as logistics, financial technology, healthcare analytics, and industrial gases, driven by strong domestic demand and innovation.

- Small Caps: Niche businesses in areas like specialty chemicals, ceramics, and BPO services, benefitting from government initiatives like “Make in India” and PLI schemes.

Why Choose the Groww Multicap Fund?

The Groww Multicap Fund follows a disciplined strategy, allocating a minimum of 25% to each of the three market cap segments, with the flexibility to allocate the remaining 25% based on market conditions. This approach ensures broad exposure to India’s economic growth and positions investors to potentially benefit from opportunities across various sectors and market caps.

The fund adheres to the Quality & Growth at Reasonable Price (Q-GaRP) philosophy, which focuses on:

- Quality: Investing in companies with strong governance, competitive advantages, and robust financial health.

- Growth: Identifying companies that are positioned to scale and benefit from long-term demand and favourable sectoral trends.

- Reasonable Price: Ensuring investments are made at valuations that offer strong potential for compounding returns.

How the MultiCap fund Operates?

- Large Caps: Uses a top-down approach, analysing macroeconomic conditions and sector trends, with a focus on companies in growth phases.

- Mid and Small Caps: Uses a bottom-up approach, focusing on companies with strong management, sustainable business models, and resilience to market cycles.

- Dynamic Rebalancing: The fund adapts its allocation based on market conditions to maximize growth potential.

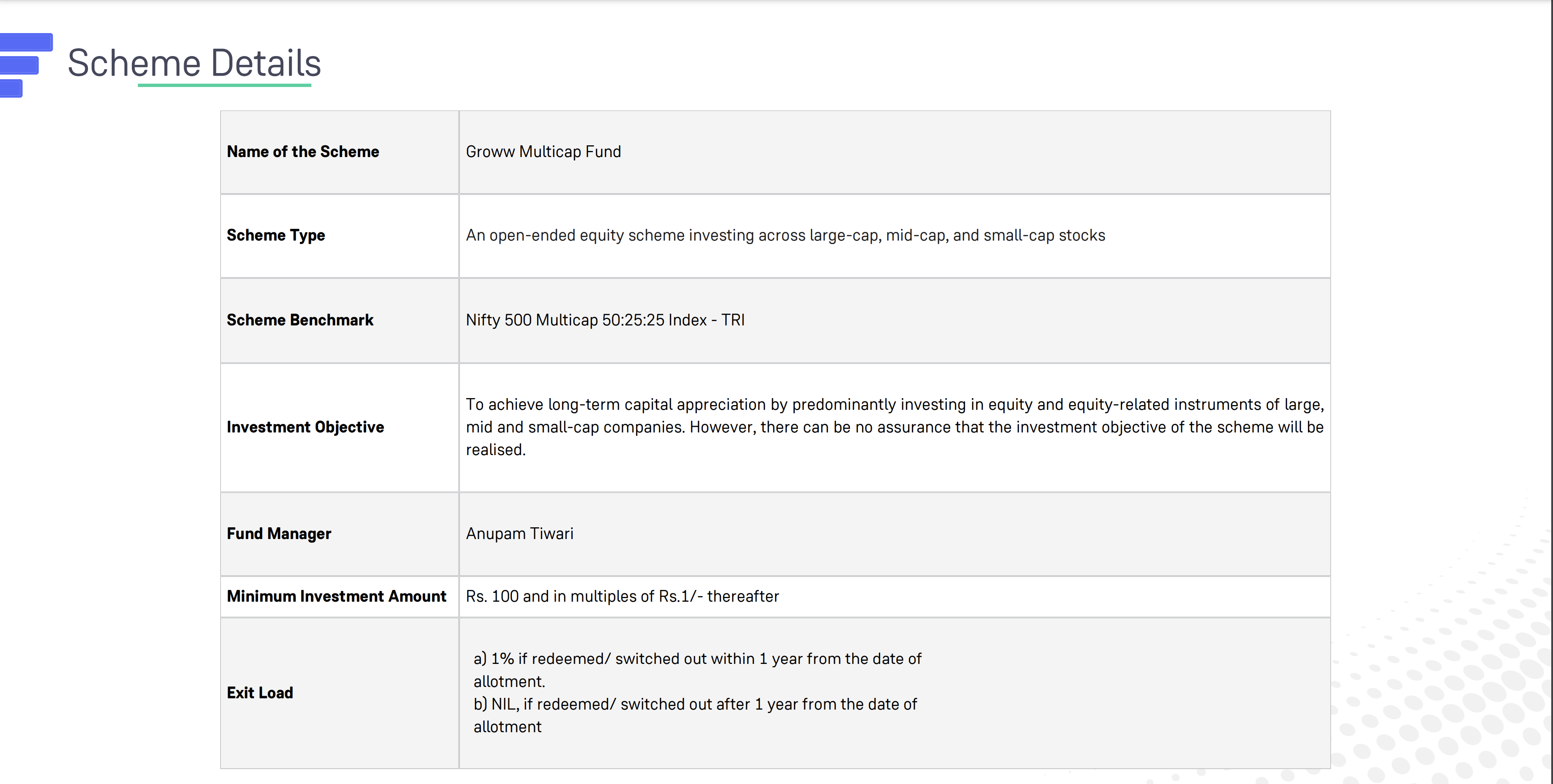

Key Details of the Scheme

India’s Growth Offers Diverse Opportunities

India’s growth trajectory offers a broad spectrum of opportunities across sectors and market segments. The Groww Multicap Fund is designed for long-term investors seeking to capture this growth while navigating the complexities of a rapidly evolving market.

Before investing, please read the scheme information document and consult a financial advisor. For more details, visit growwmf.in