SBI Balance Enquiry Toll Free Number

Individuals who have an account with the State Bank of India can check their account balance with the SBI Balance Check Numbers. SBI Balance enquiry can be made using ATM, missed call, online banking or mobile banking services. Customers can use the respective SBI Balance Enquiry Numbers to check their account balance using these services.

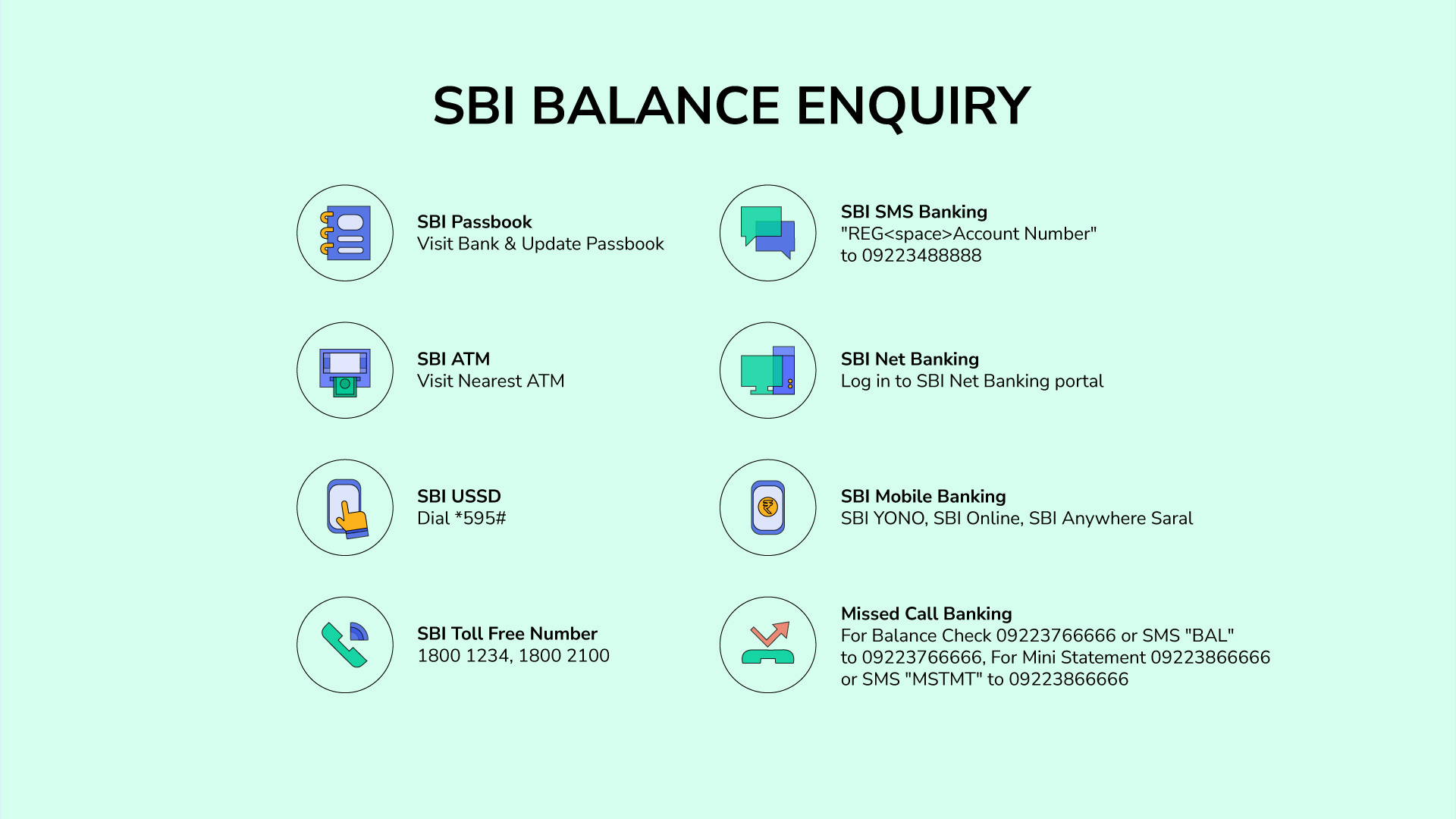

Different Methods for SBI Balance Enquiry

Customers with an account with the State Bank of India can check their account balances through the following methods-

- By Toll-free Numbers

- Through Missed Call

- By SBI ATM

- Via Net Banking

- Through Quick SMS

- Through SBI Passbook

- Via Mobile Banking - SBI YONO, SBI Online, SBI Anywhere Saral

- By using USSD

- By SBI WhatsApp Banking

- By UPI

1. SBI Account Balance Check Through SBI Toll-free Numbers

SBI account holders who has their number registered for the balance enquiry process can call on the SBI Balance Check Toll-free numbers that are mentioned below:

- 1800-2100

- 1800-1234

2. SBI Account Balance Check through Missed Call Banking

SBI customers can get their account balance or their mini statement details by dropping a miss call to the following SBI Balance Check Number:

|

SBI Missed Call Balance Check Number |

09223766666 |

|

SBI Account Mini Statement |

09223866666 |

- In order to check the SBI account's balance, you can give a missed call to the toll-free SBI balance check number - 09223766666

- You could also send an SMS that says "BAL" to the same number to check the balance.

- You can also get a mini statement of your SBI account by giving a missed call to 09223866666 or by sending an SMS that says - "MSTMT."

3. SBI Account Balance Check through SBI ATM

Customers with an SBI account can use their ATM/debit card to access their account balance. They need to go to the State Bank of India ATM and complete the following steps-

- Step 1: Swipe or insert your SBI ATM/Debit Card on the machine.

- Step 2: Use your four-digit ATM PIN.

- Step 3: Select the option that says, 'balance inquiry.'

- Step 4: Your balance will be displayed.

4. SBI Balance Enquiry by Net Banking

SBI account holders who have registered for net banking can access their SBI account by logging into SBI Online Banking website (https://www.onlinesbi.sbi/) with their SBI net banking login id and password. After logging in, they can go to the ‘My Accounts’ section and click on ‘View Account Balance’.

5. SBI Balance Check through SBI Quick SMS Service

SBI Customers can use their mobile numbers to register for the SBI SMS service for balance enquiry. To register for the process, they need to send a text to the SBI Balance Check Number in the following format:

|

"REG<space>Account Number" to 09223488888 |

The bank will send a registration confirmation message, and the customers can hereafter check the account balance, get a mini statement, chequebook request, and get an e-statement, loan interest certificate, and home loan interest certificate through the same number.

6. SBI Credit Card Balance Enquiry Through SMS

SBI credit card users can check their balance and other information through the SMS service, and you can get various details by sending a message to 5676791. The format of the text is mentioned below.

Required Services and Format of the SMS-

- Duplicate Statement - DSTMT XXXX MM

- Reward Points Summary - REWARD XXXX

- Blocking a Lost or Stolen Card - BLOCK XXXX

- Balance Enquiry - BAL XXXX

- e-Statement - ESTMT XXXX

- Status of the Last Payment - PAYMENT XXXX

- Credit and Cash Limit - AVAIL XXXX

7. SBI Account Balance through SBI Passbook

When consumers open their bank account with the State Bank of India - they are given a passbook. They need to keep their passbooks up to date at all times to ensure that they have accurate data on all transactions.

The customers could check their current balance and see a record of both their debit and credit activities through their passbook entries. Customers must visit the bank location to update their passbooks.

8. Find SBI Balance Check through Mobile Banking

All the registered customers of SBI Bank can do the SBI Balance Enquiry Check through these online applications:

- SBI YONO -

Customers can use a variety of banking services via SBI YONO, including balance inquiries, account statement checks, and money transfers, among others. - SBI Online -

Account holders of the State Bank of India can utilize the SBI web portal on their smartphones to perform SBI banking services such as funds transfers, balance checks, account statements, NEFT, IMPS, and more. - SBI Anywhere Saral-

SBI corporate net banking customers can use this application to perform banking transactions. With this app, they can easily do balance enquiry, mobile recharge, fund transfer, avail of a mini statement, check the last ten transactions, etc. Note that retail SBI customers cannot use this application to check or do any balance enquiry.

9. Check SBI Balance Enquiry using USSD

Unstructured Supplementary Service Data (USSD) is a GSM communication protocol that lets data be sent between a phone and a network application software. The service is accessible to SBI customers with current or savings accounts.

The process to check your balance using USSD is mentioned below:

- Step 1: Enter the User ID by dialling *595#.

- Step 2: Choose 'Option 1' from the 'Answer' menu.

- Step 3: Select 'Balance inquiry' or ‘Mini statement' are the options.

- Step 4: Send ‘Enter’ after entering the MPIN.

10. Balance Enquiry using SBI WhatsApp Banking

For balance enquiry through SBI Whatsapp Banking services, customers need to follow these steps:

- Send ‘Hi’ from the registered mobile number to +919022690226.

- Follow the further instructions provided by the Chatbot. Select the option ‘Check Account Balance’.

- Your current SBI account balance will be sent to you through whatsapp.

11. Check SBI Balance via UPI

To check your SBI account balance via UPI, you can follow these steps-

- Open your UPI-enabled mobile banking app on your smartphone.

- Select the 'Balance Check' or 'View Balance' option from the main menu.

- Select your bank account.

- You may need to enter your UPI PIN to authenticate the transaction.

- The app will display your SBI account balance on the screen.