The $1B War Chest: Zomato’s Plan to Stay on Top

Just a handful of companies listed on the Indian bourses rake up news as much as Zomato does. So much so that it wouldn't be an overstatement to say that Modern MBA is incomplete without a marketing lesson from their antics. Even a plain vanilla product feature launch seems to be a full-blown affair.

So what’s the latest scoop? The food delivery giant’s $1bn QIP perfectly timed after the mammoth listing of it’s arch rival Swiggy.

A few things must be clearly established at this point- Zomato is the undisputed market leader. It’s market capitalization of 2.5 lakh crores gives it the crown of being India’s 33rd most valuable company. Swiggy, a distant 97th with a market capitalization of 97k crores.

Zomato had a series of eureka moments this month. First came its induction into the Futures and Options (F&O) segment by NSE India effective 29th November, 2024.

It was time BSE played catch-up and it went on to introduce stock futures on 43 stocks amongst which Zomato found a place. Just two days later, the exchange went on to announce its inclusion in the Sensex 30 index, replacing iron and steel behemoth JSW Steel.

This move was significant and might be a harbinger of the times to come. As multiple data points have evinced- India remains primarily a service led/ consumption driven economy. The share of private consumption as a percentage of Nominal GDP stood at 60.4% as of June 2024.

The passive inflows on account of index inclusion should not be missed either.

Now onto the business, At the end of Q1FY25, Zomato extended it’s lead over Swiggy in the food delivery business with a market share of 58%, says a report by Motilal Oswal. That business is maturing well and the growth in GOV terms although strong enough (Q2FY25- 20% YoY, 5% QoQ) has tempered from its heyday.

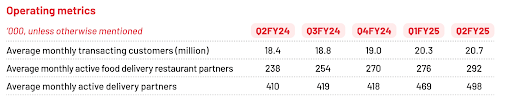

The business has been fairly profitable on the adjusted EBITDA level at ₹341 crs. The numbers are big bang too- 20.7 million avg monthly transacting users, close to 3 lakh avg active food delivery partners and 5 lakh avg active food delivery partners.

Source- Zomato Q2FY25 Investor Presentation

The quick commerce biz aka the beacon of rapid growth is in animal spirits. There too, Blinkit commanded the pole position with a 46% market share followed by Zepto at 29% and Swiggy Instamart at 25%. Analysts at Goldman Sachs have gone ahead to say that valuation wise Blinkit has eclipsed the food delivery business.

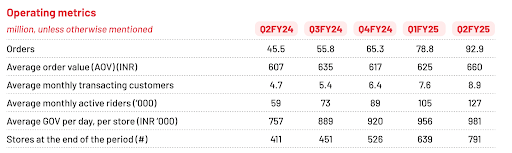

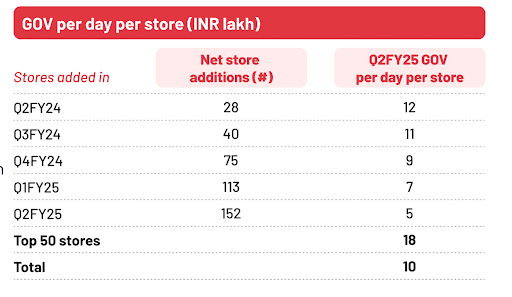

Numbers in the table below are self explanatory and go on to show the strong undercurrent. Two data points that shouldn't be missed- the growth in orders and the number of dark stores.

Source- Zomato Q2FY25 Investor Presentation

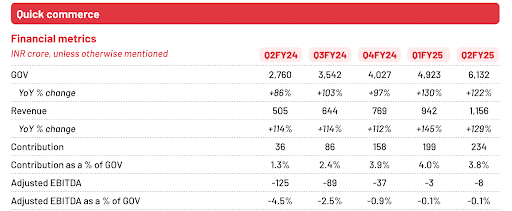

Financials blue print wise, notice the positive trend in contribution margins. Nonetheless, Adjusted EBITDA figures remain in the red though it is negligible

Source- Zomato Q2FY25 Investor Presentation

Now, Zomato has other businesses too- Dining out, Hyperpure, the newly launched District and who knows if another one is to crop up/get acquired in due course of time but we’ll stick our course to discussion to these two only.

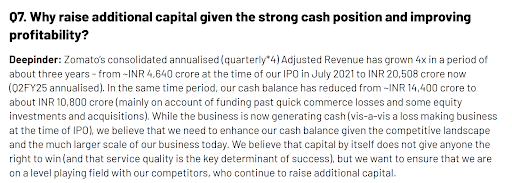

Hence, the question begets- Why did Zomato choose to raise additional capital when it is already sitting on a cash pile of 10,800 crores.

As they say, the devil lies in the details-

For Q2FY25, Zomato’s Operating Profit stood at ₹226 crores. A closer look reveals that the treasury income it is generating from this cash pile is ₹221 crores- this is likely the cash pile which Zomato raised from its IPO since Cash Flow from Operations was less than ₹700 crores in March 2024.

Furthermore, big ticket acquisitions like that of Paytm’s Ticketing business for ₹2,048 crores took a toll on the cash pile.

In a letter to shareholders, Deepinder Goyal remarked that the primary reason for raising additional capital was to “have a level playing field with our competitors”

Source- Zomato Q2FY25 Investor Presentation

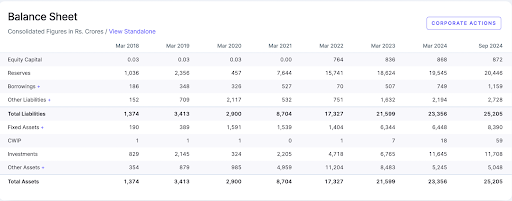

Indeed, the QCom race isn’t entirely a tech battle like the food delivery business. Setting up dark stores involves investments, a lot of it. Do notice the sharp jump in fixed assets from March 2023 onwards.

Source- Screener

In just Q2FY25, Blinkit added 152 stores which is more than 5x of what it did in the same time period a year ago.

Source- Zomato Q2FY25 Investor Presentation

Amazon, Flipkart, Bigbasket, Reliance- the deep pocketed folks have ambitious plans to tap this opportunity and the incumbent folks are going all out to protect their turf and hence retain the first mover advantage.

Disclaimer: This news is solely for educational purposes. The securities/investments quoted here are not recommendatory.

To read the RA disclaimer, please click here