From Roads to Returns: India’s Logistics Stocks Making Big Moves

India’s logistics sector is buzzing with activity and is driven by transformative developments and sustained momentum. October 2024 marked a significant milestone with the country generating a record 117.25 million e-way bills, reflecting a 17% year-on-year growth amid festival-driven demand.

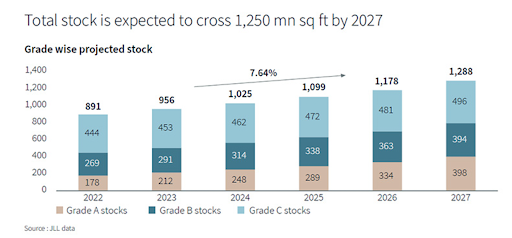

JLL India estimates that demand for warehousing space is projected to reach 1.2 bn sq. ft by 2027

Colliers, a global investment management firm, adds that India’s Industrial & Warehousing sector is witnessing a boom, with 20.2 mn sq ft of leasing activity in the first nine months of 2024, up 17%.

In Q2 2024, India's warehousing sector attracted $2.5 billion in funding, accounting for 61% of the total capital, a three-year high.

A red-hot warehousing market indicates that logistics companies have plenty on their plate.

Let’s unpack what’s cooking-

A thriving economy like India relies on the seamless and timely transportation of goods to meet its rising needs. The logistics sector in India employs about 22 million people and is all set to add another 10 million jobs by 2027.

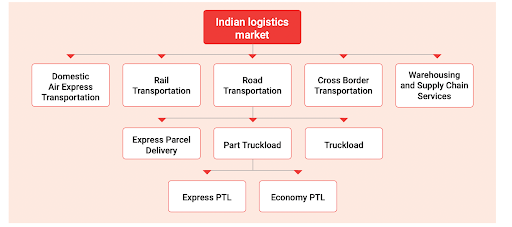

According to a report by Motilal Oswal, the Indian logistics market, valued at $107 billion in FY23, is forecasted to grow to $160 billion by FY28, with an anticipated CAGR of 8-9%.

Data by IBEF shows that the Indian Logistics Market is heavily skewed towards road transportation, which accounts for 66% of the total cargo volume,followed by the railways at 31%, shipping at 3%, and air at 1%.

Source- Delhivery FY24 Annual Report

The National Logistics Policy framed in 2022 chalked out specific focus areas to enhance efficiency, reduce costs, promote sustainability, and build a robust logistics infrastructure, aiming to position India as a global leader in supply chain management.

Its objectives included but were not limited to

- Building Robust Infrastructure—The scheme proposes creating a multimodal logistics network with seamless integration of road, rail, waterways, and air transport. To reduce transportation delays, more logistics parks, freight corridors, and warehousing zones must be developed.

- Optimising Logistics Cost- India’s logistics cost as a percentage of GDP currently stands at 13-14%. The plan is to bring this down to 7-8%, in line with other developed economies.

- Enhancing Logistics Performance- Aim for a top 25 ranking in the Logistics Performance Index by improving customs, infrastructure, shipments, competence, and tracking.

Source- Press Information Bureau

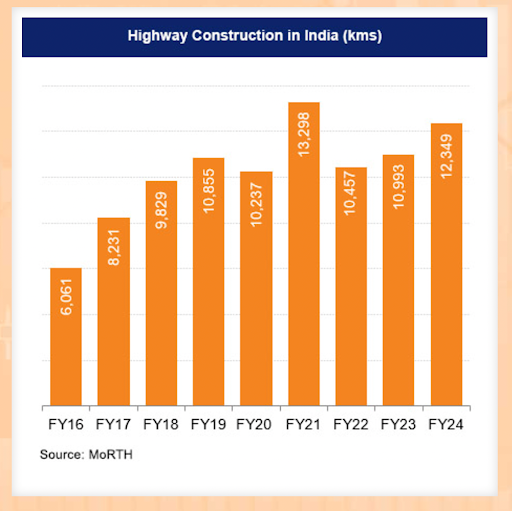

Significant emphasis is placed on developing infrastructure through initiatives like Dedicated Freight Corridors, Bharatmala Project, Sagarmala, and the UDAN scheme. The pace of highway construction has been notably brisk.

Amidst this positive stance on the sector, we came across two relatively lesser-known logistics stocks that are worth researching-

-

SJ Logistics-

|

Company |

S J Logistics (NSE-SM- SJLOGISTIC) |

|

Stock Price |

₹655 |

|

Market Capitalization |

₹948 Cr |

|

52-Week Range (INR) |

₹725 / ₹158 |

|

TTM P/E |

25.8 |

S J Logistics is a two-decade-old company providing logistics & supply-chain solutions across markets such as Europe, South America, the Middle East, and Southeast Asia. Its key services include Project Cargo, Customs Clearance, Ocean & Air Freight Forwarding, Inland transportation Warehousing, Door Delivery & NVOCC.

Since its IPO in December 2023 at an issue price of ₹125, the company’s stock has surged by more than 500%.

A notable trigger for the stock was the preferential fundraising in September, wherein the company raised 80cr by issuing 7L warrants & 6.9L equity shares at a price of ₹576 per share from the promoter group and other public shareholders such as Sandeep Singh, Rakesh Laroia Pooja Kedia, Amit Agarwal, Finavenue Growth Fund & Vikasa India EIF I Fund.

S J Logistics serves industries such as Yarn & Textile commodities, Automobile, Heavy Engineering, Power Transmission, etc. Its key customers include- Trident Group, RSWM, Vardhman Textiles, Skipper, Sterling & Wilson, and Sterlite Power, amongst others.

(Source- DRHP)

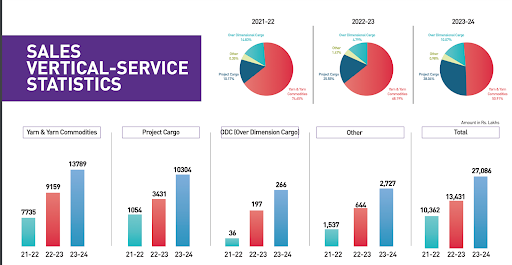

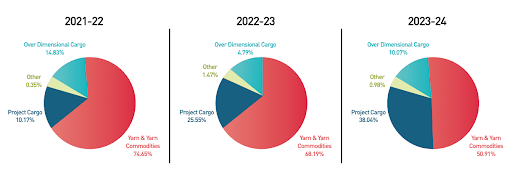

The vertical-wise sales split further breaks down the sales. Observe the swift growth noted by Project Cargo segment- sales herein exceeded ₹100 crores in FY24 from just ₹34.3 crores in FY23, roughly 3x in a year.

That in particular has significantly boosted the EBITDA margin profile since it carries higher margins.

Source-S J Logistics Q1FY25 Investor Presentation

Let’s glance at the financials before discussing the future growth levers in place-

Brisk revenue growth for the company was accompanied by better margins which led to an 11x growth in PAT in just two years. Investors must watch out for the trend of project cargo shipments to gauge future revenue and profitability.

|

FY22 |

FY23 |

FY24 |

|

|

Revenue |

104 |

149 ( ▲44%) |

270 ( ▲82%) |

|

EBITDA |

5 |

13 ( ▲169%) |

29 (▲132%) |

|

PAT |

2 |

8 (▲378%) |

23 (▲174%) |

*All figures are in ₹ crores

Source- Company Filings

The performance was equally noteworthy on an H1FY25 basis. Revenue surged 118%, EBITDA 142%, and PAT 151%.

|

H1FY24 |

H1FY25 |

CHANGE |

|

|

Revenue |

103 |

225 |

▲118% |

|

EBITDA |

13 |

32 |

▲142% |

|

EBITDA Margins |

12.73% |

14.14% |

|

|

PAT |

9 |

23 |

▲151% |

*All figures are in ₹ crores

Source- Company Filings

The ROE & ROCE for FY24 stood at 32% and 33% respectively.

Balance Sheet Check-

Equity Capital and Reserves swelled as the company went for an IPO.

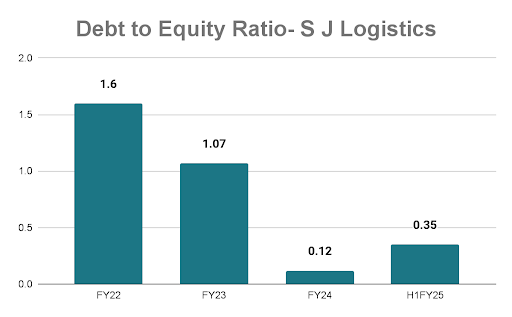

The bright spot has been the debt-equity ratio, which has seen a substantial improvement, reflecting the combined impact of capital infusion and rising earnings.

Source- Company Filings

The freight forwarding business is built around partnerships with third-party logistics providers and suppliers, leaving the balance sheet with minimal fixed assets.

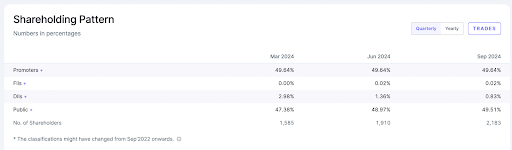

Onto the shareholding pattern- Post IPO, promoter ownership stands close to 50%, Institutional ownership is negligible at 1%, and the public owns the rest.

So, what does the future look like?

In the press note released alongside its Q2 results, The Management reported that the order book is at healthy levels, reflecting strong, robust demand for its services.

Highlighting their outlook, the management committed to maintaining growth by focusing on:

- Further expand our global network to new and emerging markets.

- Invest in cutting-edge technology to enhance operational efficiency and customer experience.

- Foster strong relationships with our partners and stakeholders to drive collaborative innovation.

S J Logistics gained IATA approval in July 2024 to promote, sell, and handle international air cargo transportation operations. Further developments on this front are expected soon.

The management also shared that the company is actively exploring business opportunities with Public Sector Undertakings (PSUs).

Souce- S J Logistics FY24 Annual Report

Risks-

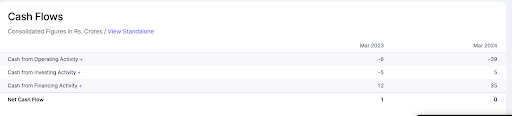

- Negative cash flow from operations-

Despite a sharp increase in turnover and profit figures, the company’s cash flow from operations was in negative territory for the period ending March 2024 due to a significant increase in receivables.

- Dependence on the textile industry-

In FY24, SJ Logistics derived close to 51% of its revenue from yarn and yarn commodities, underscoring its reliance on the textile industry.

Source-S J Logistics Q1FY25 Investor Presentation

-

Tiger Logistics-

|

Company |

Tiger Logistics (BSE- 536264) |

|

Stock Price |

₹72 |

|

Market Capitalization |

₹764 Cr |

|

52-Week Range (INR) |

₹87 / ₹32 |

|

TTM P/E |

38.4 |

The second stock we’ll discuss today is Tiger Logistics, a third-party logistics service provider. The company offers various services, including air and ocean freight for international shipments, project logistics, domestic freight solutions, cold chain logistics, supply chain management, and customs clearance.

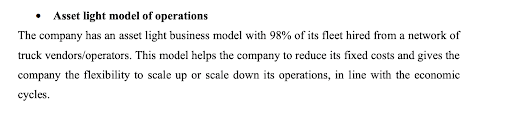

Being a third-party service provider inherently means an asset-light model where the company doesn’t have to block capital upfront. Currently, 98% of the company’s fleet operates under this arrangement.

What stands out?

On an H1FY25 basis, Tiger Logistics recorded a blistering 54% growth in its TEUs.

Note- TEUs, or Twenty-foot Equivalent Units is simply a shipping container with dimensions measuring about 20 feet in lenght, 8 feet in width & 8 feet in height.

Source- Tiger Logistics Q2FY25 Investor Presentation

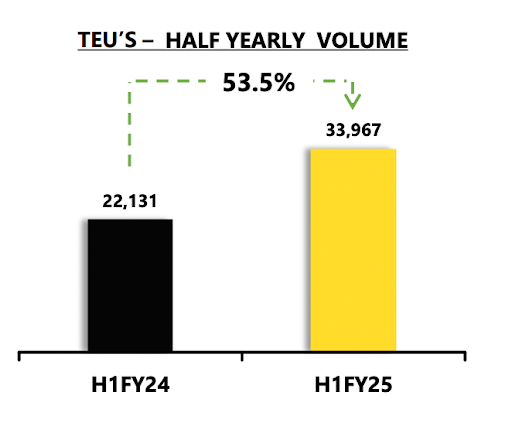

On a macro level, volumes have experienced consistent compounded growth.

Source- Tiger Logistics Q2FY25 Investor Presentation

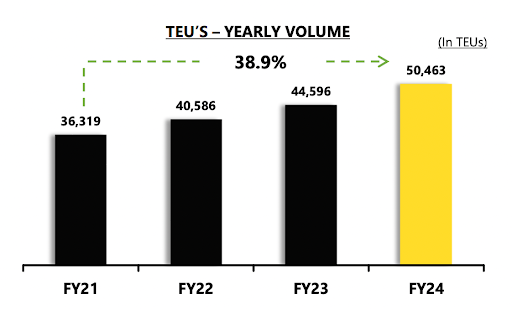

The Air Cargo Vertical is coming up big. For the second quarter, it recorded 4.5x volume growth on a YoY basis. The expansion was remarkable on an H1FY25 basis, too.

Source- Tiger Logistics Q2FY25 Investor Presentation

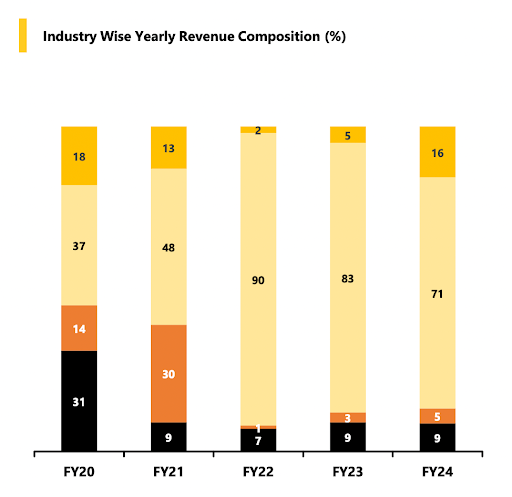

The revenue distribution by industry shows that 71% is generated from automobiles, followed by 16% from project cargo and 5% from commodities, whereas others generated 9%.

Source- Tiger Logistics Q2FY25 Investor Presentation

The client list is impressive, featuring industry bigwigs- Escorts, Hero Moto Corp, Honda, Bajaj Auto, TVS, Piaggio, KTM, Ceat and many more, cementing Tiger Logistics’ status as a company with a worldwide footprint.

Source- Tiger Logistics Q2FY25 Investor Presentation

Source- Tiger Logistics Q2FY25 Investor Presentation

Source- Tiger Logistics Q2FY25 Investor Presentation

Financials-

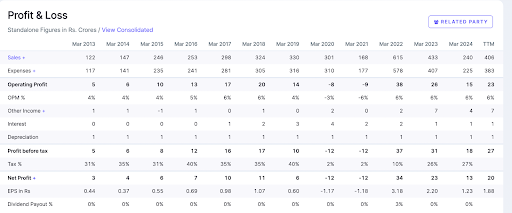

To understand the financial position of Tiger Logistics, we’d be looking at a slightly longer time duration.

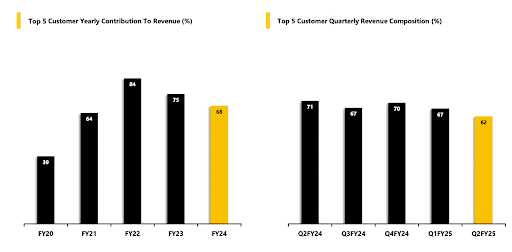

Observe the dip in revenues for FY21. As global trade came to a standstill, Tiger Logistics was severely impacted. Similarly, revenues for FY22 surged by a massive 366%—that was because of trade normalising and freight rates going through the roof.

At that point in time, Tiger Logistics derived 84% of its revenue from the top 5 customers. This figure has now downsized to a more palatable level of 68% for FY24 and 62% for Q2FY25, but it remains high nonetheless.

Source- Tiger Logistics Q2FY25 Investor Presentation

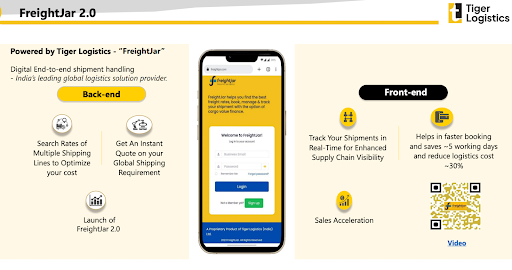

After that, Tiger Logistics underwent a strategy overhaul. It diversified its operations and launched new product offerings (FreightJar).

Things have begun stabilising, and the H1FY25 results were a blowout, with sales up by 273%, EBITDA by 142%, and PAT by 151%. Margins came under pressure due to volatility in freight rates but improved sequentially.

|

H1FY24 |

H1FY25 |

CHANGE |

|

|

Revenue |

96 |

261 |

▲273% |

|

EBITDA |

7 |

14 |

▲211% |

|

EBITDA Margins |

6.9% |

5.3% |

|

|

PAT |

5 |

12 |

▲229% |

*All figures are in ₹ crores

Source- Company Filings

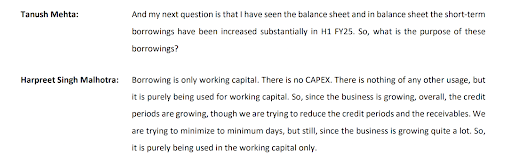

Reserves are on an upward trend on the balance sheet. There has been a slight increase in borrowings, but all of them are short-term in nature.

Management clarified in the conference call that all the additional borrowings are being used purely for working capital purposes since the business is expanding at a fast pace.

Source- Tiger Logistics Q2FY25 Conference Call

Fixed Assets are a paltry ₹9 crore, given the company’s focus on building an asset-light model.

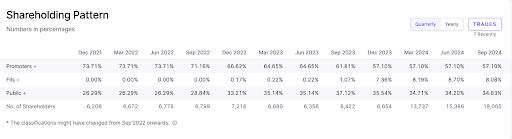

Shareholding Pattern—Promoters own 57% of the stake, FIIs own around 8%, and the public owns 35%.

So, what lies in store ahead?

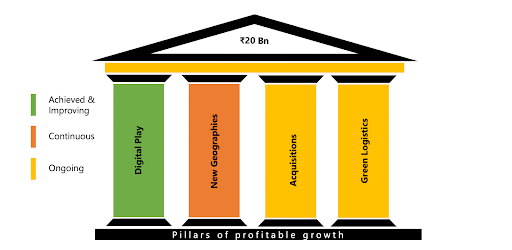

The management targets 2,000 crore worth of revenues in 2027- implying 100% CAGR growth over the next three years. This ambitious plan hinges on four pillars- digital play, new geographies, acquisitions and green logistics. Let’s discuss them individually-

Source- Tiger Logistics Q2FY25 Investor Presentation

- Digital Play-

FreightJar 2.0- a digital end-to-end shipment handling platform that promises faster booking and reduces logistics costs by ~30%

Source- Tiger Logistics Q2FY25 Investor Presentation

- New Geographies- Tapping into newer markets is another focus area for the company

- Acquisitions—Management shared their strategy on the conference call to leverage inorganic growth opportunities to establish a stronger position in the less-than-container-load (LCL) market.

Source- Tiger Logistics Q2FY25 Conference Call

- Green Logistics-Tiger Logistics is planning to set up a green logistics division, leveraging EV trailers to move export containers.

Risks-

- Negative Cash Flow from Operations- Much alike its peer S J Logistics, Tiger Logistics is grappling with negative operating cash flows driven by increasing trade receivables.

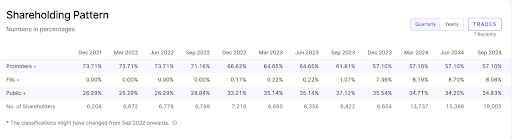

- Promoter share sales—The company's founder-promoters have gradually reduced their ownership, decreasing their stake from 73.71% in Q3FY22 to 57.1% in Q2FY25.

Well, that’s a wrap for today on Stock Scoop! The broad takeaway is that logistics as a sector is expected to thrive—there is a whole lot of focus on operational efficiency, with buzzwords like AI, Automation, and EVs coming into the fray. As companies embrace these innovations, they are poised to streamline operations, reduce costs, and enhance sustainability. With ongoing advancements in technology and infrastructure, the logistics sector is primed for significant growth in the years ahead.