Should I pre-pay a home loan or invest in mutual funds?

This is the dilemma everyone faces when their monthly income can service pre-payment of the home loan. But you should take note of the Pros and Cons associated with pre-payment and investments in mutual funds.

Pros

- Interest rate- By prepaying your home loan, you are effectively saving the interest which you would have been paying with your EMI. In fact, any prepayments of home loan will be considered for tax benefit under Section 80C up to 1.5 lakhs. Let’s take an example of Birbal who is considering to prepay his home loan.

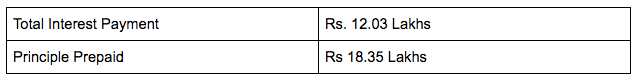

The following table shows the bifurcation of Principle and Interest Component

Birbal can service 3 additional EMI every year. Hence his prepayment liability are as follows

Birbal here is effectively saving 9 lakhs from interest if he opts for prepayment.

- Psychological Barrier– For some, debt is more like a hanging sword and they want to get away with it as early as possible. Indeed, debt is a big liability.

Cons

- Penalties– Banks do charge prepayment penalty (2-3% of outstanding home loan value) after a certain limit. The limit varies from bank to bank.

- Tax Benefits– The principal component of your EMI of home loan will be considered for tax benefit under Section 80C. Whereas you get exemption of up to 2 lakhs on your interest payments every year under Section 24. This is only applicable for a self-occupied house. Hence, if you opt for prepayment, you won’t be able to avail these tax benefits.

- Interest Rates– The risks associated with fixed interest rates loans are high in a falling interest rate environment i.e. current economic conditions because of high-interest liability.

- Contingencies– Full pre-payment of home loans requires a huge sum of money. Hence, you should always make sure that you have enough surplus after prepayment to fulfill any future contingencies like health issues or any emergencies.

Opportunity Cost

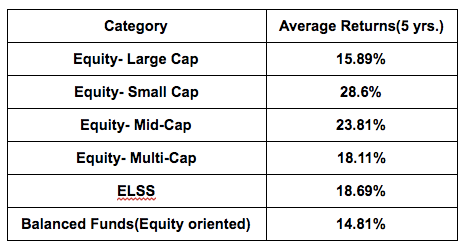

It refers to the loss from other alternatives when one alternative is chosen. In this case, the opportunity cost of not prepaying your home loan is the returns which you can earn from investing in Mutual Funds. Returns on mutual funds depend on the scheme in which you have invested.

The following table looks at average 5-year returns as per different categories

If you don’t prepay your home loan and start investing in mutual funds. Then, I assume you are looking for long term investments. Hence, the following portfolio will work fine for capital appreciation and decent returns going forward.

Bottomline

One should compare the tax benefits and effective interest rate after taxes of pre-payment with the returns of mutual fund scheme you wish to invest. If the benefits of pre-payment outweigh that of the returns from the mutual fund. Go for a pre-payment, else continue with regular EMI. Also, keep in mind the others points mentioned above

Happy Investing