A smarter way to invest in gold: Groww Gold ETF

Groww Mutual Fund has introduced the Groww Gold ETF, which offers a convenient way for investors to invest in gold.

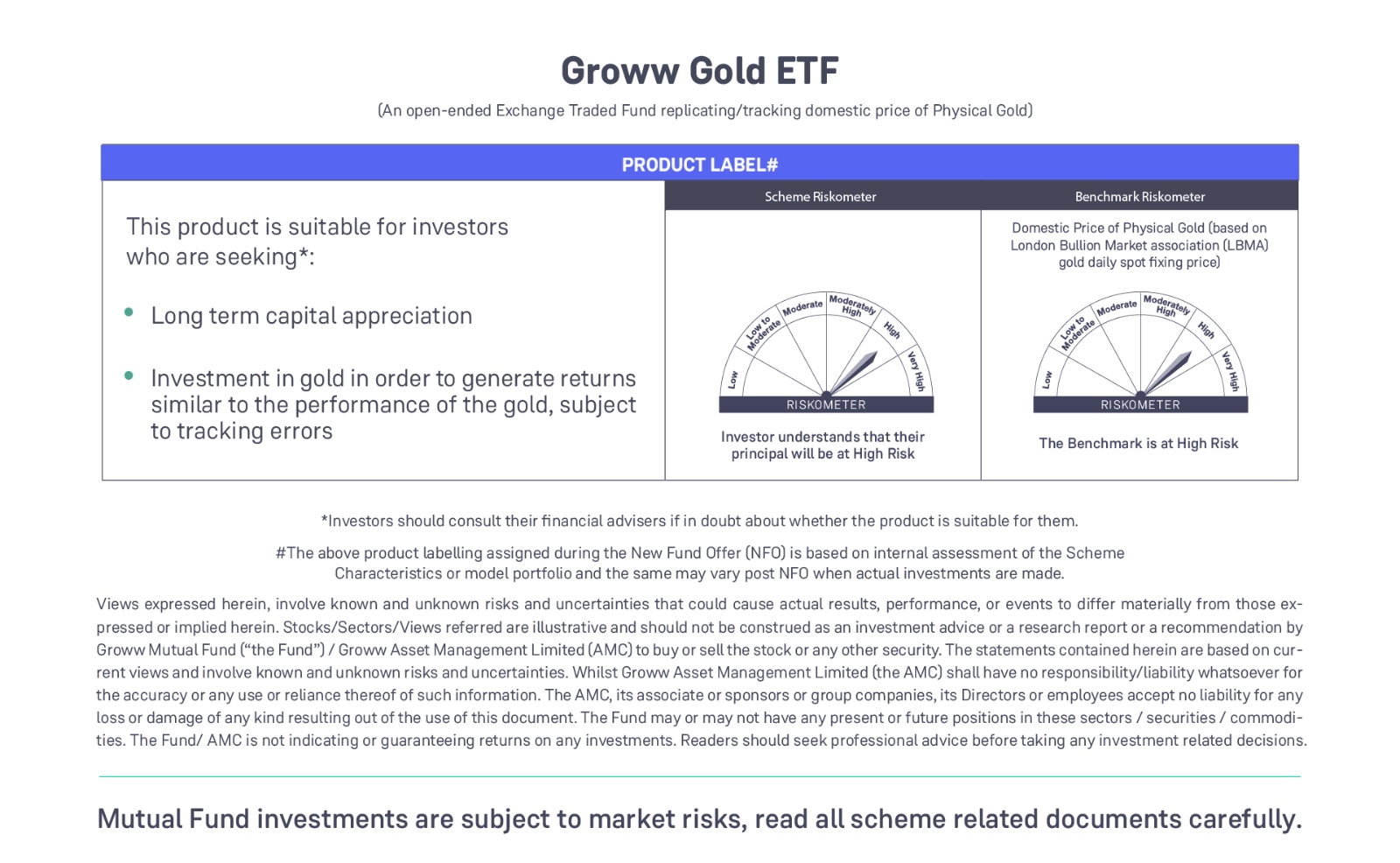

The Groww Gold ETF is an open-ended Exchange Traded Fund (ETF) that replicates the domestic price of physical gold, based on the London Bullion Market Association (LBMA) gold daily spot fixing price. This ETF invests in gold bullion with a purity of 99.5%, enabling investors to participate in the gold market without having to be concerned about buying, storing and insuring physical gold.

Recently, India has been witnessing a surge in interest in gold ETFs, driven by perceived safety, potential returns and possible convenience.

Investments in gold ETFs reached ₹1,337.4 crore in July 2024 - the highest monthly net flows since February 2020. After experiencing an outflow of ₹395.7 crore in April, gold ETFs rebounded with an impressive inflow of ₹2,890.9 crore from May to July. Furthermore, a recent reduction in customs duty has led to a 9% decrease in gold prices, presenting an opportune moment for investors.

Why Consider the Groww Gold ETF?

Returns aligned with gold performance: The Groww Gold ETF aims to closely mirror the price movements of gold, allowing investors to benefit from the metal’s performance.

Regulated and transparent: Governed by SEBI, this ETF aims to ensure transparency and security, with units held in demat accounts.

Diversification and currency hedging: Gold has historically served as a hedge against inflation and currency depreciation, making it an essential asset for portfolio diversification.

Convenient and accessible: Investors can buy and sell ETF units on the stock exchange during market hours, which may provide liquidity and price transparency.

Small unit flexibility: With each unit representing 0.01 grams of gold, the ETF is accessible to a wider range of investors.

Collateral for loans: The Groww Gold ETF can be used as collateral for loans, adding financial utility for investors.

Potential tax efficiency: Offering long-term capital gains (LTCG) tax advantages, the ETF may be more tax-efficient than investing in physical gold.

Potentially Tax-Efficient: LTCG (Long-Term Capital Gains) is applicable after a 12-month holding period at 12.5% without indexation, while STCG (Short-Term Capital Gains) is applicable according to the investor's income tax slab.

Gold as a hedge: Gold has proven to perform potentially better during financial crises. For instance, during the 2008 financial crisis, gold yielded a positive return of 5.8%, while major stock indices experienced significant declines.

From 2014 to 2024, gold provided impressive returns of 106.76% in USD terms, despite the depreciation of the INR. This translates to a remarkable 181.62% return in INR terms, demonstrating gold’s effectiveness as a hedge against currency depreciation and inflation.

During the COVID-19 pandemic, gold delivered a return of 25.1% in 2020, further cementing its role as a hedge asset.

|

Calendar Year |

Returns Gold |

Returns S&P 500 Index |

Returns Nifty 50 |

Events |

|

1978 |

37.00% |

1.10% |

1979 Oil Energy Crisis |

|

|

1979 |

126.60% |

12.20% |

||

|

1986 |

19.00% |

15.50% |

Japanese asset price bubble & Black Monday of 1987 |

|

|

1987 |

24.50% |

1.50% |

||

|

1993 |

16.80% |

6.30% |

Black Wednesday (Sep 1992 Sterling Crisis) |

|

|

2001 |

2.50% |

-13.00% |

-15.05% |

Dotcom Bubble (US Tech Crisis) |

|

2002 |

24.80% |

-23.40% |

5.34% |

|

|

2008 |

5.80% |

-38.50% |

-51.27% |

Global Financial crisis (2008 - 2009 |

|

2020 |

25.10% |

16.30% |

16.14% |

COVID - 19 Crisis Inflation and Fed Tightening |

|

2022 |

-0.30% |

-19.40% |

5.69% |

Source - NSE, Bloomberg, Investing.com, September 27, 2024

Past performance may or may not be sustained in future and is not a guarantee of any future returns. The Fund Manager may or may not invest in the above scrips basis the Scheme investment strategy please read the SID to know in detail. Please consult your financial advisor before investing.

The minimum investment amount is ₹500, and there is no exit load. The fund is managed by Mr. Wilfred Gonsalves.For more information, investors are encouraged to consult their financial advisors and refer to the Scheme Information Documents (SID) available on

.