NFO Alert: Groww Banking and Financial Services Fund - Open for Investments

Groww Mutual Fund (formerly known as Indiabulls Mutual Fund) is set to launch Groww Banking & Financial Services Fund - an open ended equity scheme investing in banking and financial services related sectors. The NFO (New Fund Offer) opens on 17 January 2024 and closes on 31 January 2024.

The scheme aims to provide growth opportunities and capital appreciation by strategically investing in the dynamic landscape of the banking and financial services sector.

However, before knowing the scheme in detail, let’s first understand the potential of the BFSI (Banking, Financial Services & Insurance) sector so that you get a holistic idea of the sector you’re investing in. So, let’s dive in!

Banking & Financial Services Sector in a Nutshell

Why Invest in BFSI?

India's Banking, Financial Services, and Insurance (BFSI) sector is reaching new peaks every day! Many different factors have led to this growth. Some of them are:

- New and upgraded digital payment methods have truly helped to transform the traditional financial system by improving the efficiency of transactions.

- Return on Equity (ROE) in the BFSI sector has witnessed significant growth, which usually means improved profitability.**

- Sectors like the insurance and mutual fund industry are fairly untapped, which leaves room for future growth in the long run, isn’t it?

- Low penetration of the insurance and mutual fund industry may potentially offer scope for growth

- Fintech companies expected to form 15% of the total financial services market cap by 2026***

- BFSI stocks are presently priced favourably*

*Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance.

**The sectors referred herein should not be construed as recommendations, advice to buy, sell or in any manner transact in this sector and neither should it be considered as a Research report from GAML/GMF. The scheme may or may not have exposure in those sectors. The Fund Manager may or may not invest in the above scrips basis the Scheme investment strategy please read the SID to know in detail.

***Source: S&P Capital IQ, Tracxn, PitchBook, Accord, India Fintech Report 2022 by Bain & Company as published on 19 October 2022

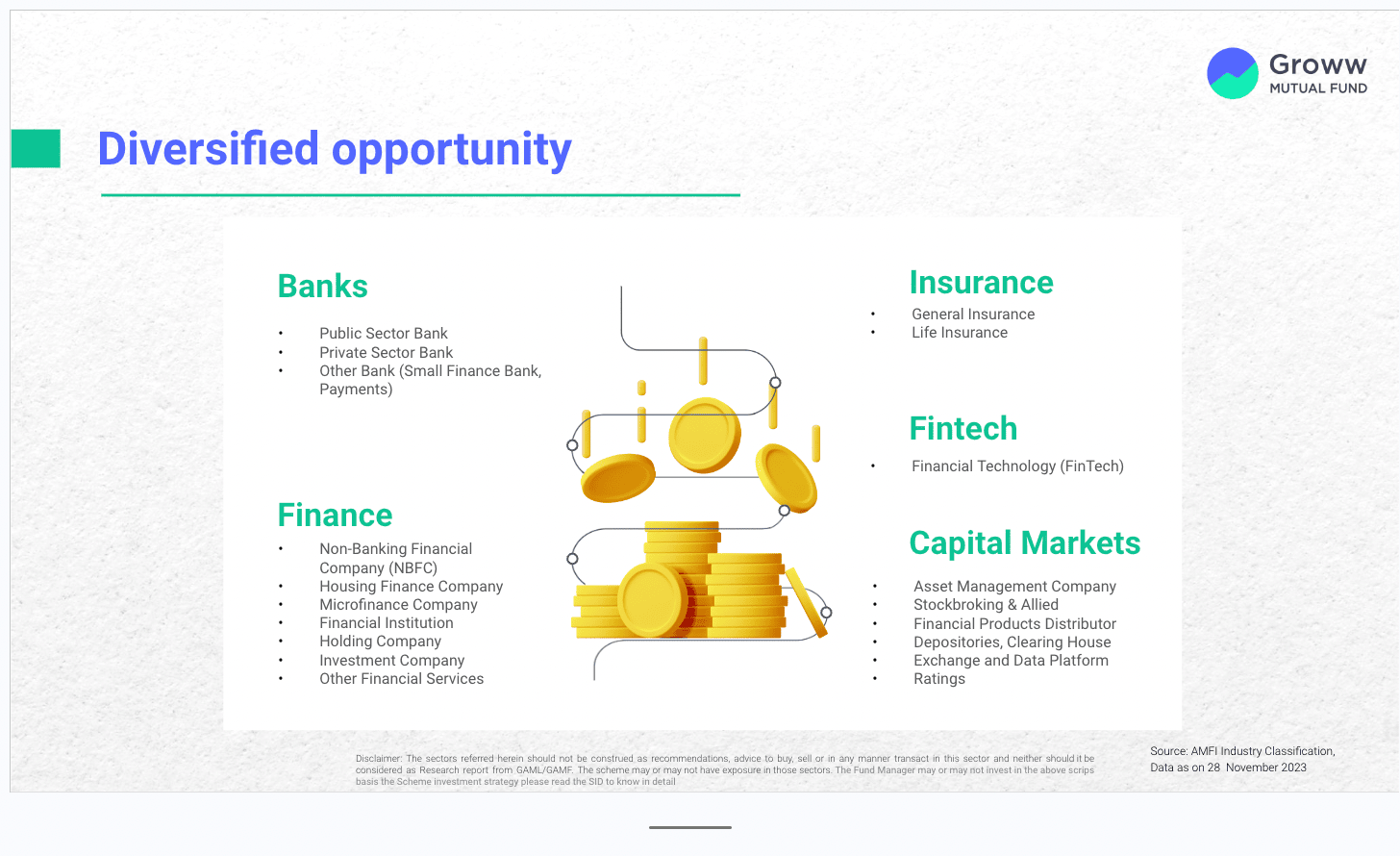

Portfolio Strategy of Groww Banking & Financial Services Fund

The scheme aims to achieve consistent long-term returns by investing in equity and other related instruments in the BFSI and other related sectors/companies.

The Groww Banking & Financial Services Fund has adopted the following investment strategies:

- The scheme has a flexible approach, avoiding style or market cap bias. This is done to adapt to market changes and BFSI sub-sectors, with investments having a time horizon of around 5+ years.

- The emphasis is on large and emerging financial services businesses, utilising both top-down and bottom-up approaches.

- The predominant focus is on equity and equity-related securities in banking and financial services while also allowing up to 20% allocation to other sectors.

- The strategy includes participation in IPOs, emerging sectors, and primary market offerings, alongside potential investments in debt or money market securities within defined limits.

Please read the SID (Scheme Information Document) to know about the scheme in detail.

Intended Portfolio Allocation

Under normal circumstances, the scheme’s allocation should be as follows:

|

Instruments |

Indicative Allocations (% of Total Assets) |

Risk Profile |

|

Equity and equity-related instruments of companies engaged in the financial services sector |

80% - 100% |

Very High |

|

Other equity & equity-related instruments |

0% - 20% |

Very High |

|

Debt and money market instruments |

0% - 20% |

Low to Medium |

|

Units of REITs & InvITs |

0% - 10% |

Very High |

*Please read the SID to know about the Scheme’s asset allocation in detail

The Scheme may also use various derivative and hedging products from time to time in a manner permitted by SEBI to reduce the risk of the portfolio as and when the fund manager is of the view that it is in the best interest of the unit holders. The exposure of the scheme to derivatives will be up to 50% of net assets.

SMART Portfolio Construction Framework for BFSI

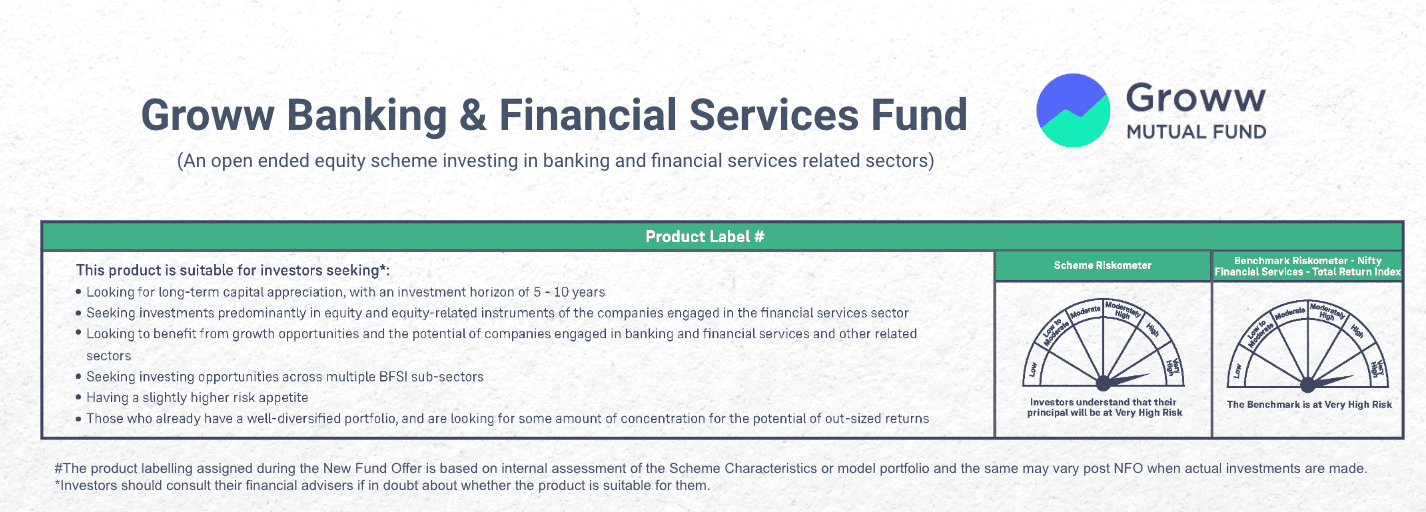

Who May Invest in Groww Banking & Financial Services Fund?

This scheme is probably a fit for those who:

- Seeks to have a goal of long-term capital appreciation, with a targeted investment horizon of 5 to 10 years

- Prefer investments primarily in equity and equity-related instruments of companies in the financial services sector

- Aim to capitalise on the growth potential within banking, financial services, and related sectors

- Are interested in investing across various sub-sectors of the BFSI -sector

- Have a higher risk appetite

- Already maintains a well-diversified portfolio and is seeking some level of concentration for the potential of outsized returns

However, please consult your financial adviser before investing.

Fund Facts

|

Name of Scheme |

Groww Banking & Financial Services Fund |

|

NFO Period |

17 January 2024 - 31 January 2024 |

|

Type of Scheme |

An open ended equity scheme investing in banking and financial services related sectors. |

|

Minimum Investment Amount |

Rs. 500/- and in multiples of Re.1 for purchases and of Re 0.01 for switches. |

|

Minimum SIP Amount |

Rs.100 |

|

Exit Load |

Nil |

|

Fund Manager |

Mr. Anupam Tiwari |

Tax Implications

The tax treatment for this fund is the same as any other equity fund. This means:

-

Short-Term Capital Gains Tax (STCG)

Profits from selling equity funds held for less than 12 months are classified as Short-Term Capital Gains. These gains are taxed at 15%, irrespective of your income tax slab.

-

Long-Term Capital Gains Tax (LTCG)

If you sell equity funds after holding them for more than 12 months, the gains are considered Long-Term Capital Gains. LTCG over ₹1 lakh in a financial year is taxed at 10% without the benefit of indexation.

Conclusion

Groww Banking & Financial Services Fund aims to strategically position itself to capture the growth trends within the BFSI industry. This may help long-term investors to seek growth from a sector that potentially holds future opportunities.

However, please remember that all investments are subject to market risk. Before investing, please consult your financial advisor and make an informed decision.

For more information about the scheme and other details, read our SID or visit www.growwmf.in.

Disclaimer: Groww Asset Management Limited (formerly known as Indiabulls Asset Management Company Limited) Investment Manager to Groww Mutual Fund (formerly known as Indiabulls Mutual Fund) vide SEBI letter dated May 30, 2023 received the approval for change in name of Indiabulls Mutual Fund to Groww Mutual Fund and change in name of the schemes. Please read notice cum addendum no. 11/2023 dated May 31, 2023 for more detail.

Views expressed herein, involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied herein. Stocks/Sectors/Views should not be construed as an investment advice or a research report or a recommendation by Groww Mutual Fund (“the Fund”) / Groww Asset Management Limited (AMC) to buy or sell the stock or any other security. The sector(s) mentioned in this document do not constitute any recommendation of the same and the Fund may or may not have any future position in these sector(s). There is no assurance of any returns/capital protection/capital guarantee to the investors in above mentioned Schemes. The investment approach other data mentioned herein are dated and proposed to be followed by the scheme and the same may change in future depending on market conditions and other factors. The AMC/ trustee/ sponsor / group companies shall have no responsibility/liability whatsoever for the accuracy or any use or reliance thereof of such information.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.