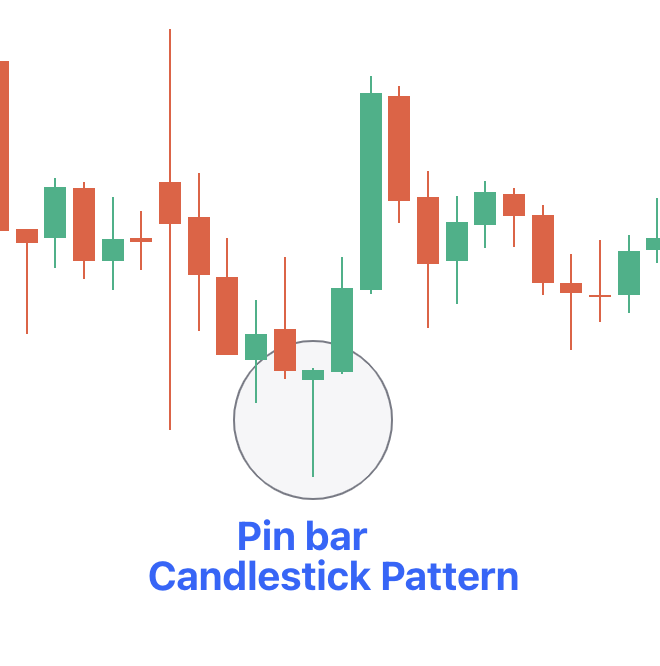

Pin Bar Candlestick Pattern

A pin bar is a single candlestick pattern. It is a candlestick pattern that is easy-to-spot and effective. Traders often look at the pin bar candlestick pattern cautiously as it indicates a trend reversal. This is why it is a must-know for all traders.

In this blog, we will discuss what a pin bar candlestick pattern is, the psychology behind the formation, and a trading setup using the pin bar candlestick pattern.

What is a Pin Bar Candlestick Pattern?

The pin bar candlestick pattern (also known as the Pinocchio Bar) is a popular candlestick pattern used in technical analysis. The formation of a pin bar candlestick at the very top or the bottom suggests a trend reversal.

Main Components of Pin Bar Candlestick Pattern

The formation of a pin bar is easily identifiable and makes it an easily distinguishable pattern on the price charts. Here are the 3 main components of a Pin bar Candlestick pattern:

Body

The body of a pin bar suggests that the price has opened and closed at approximately the same price. This is why the body of a pin bar candlestick pattern is small when compared to its wick. A pin bar’s body can either be bullish or bearish.

Upper Wick

The upper wick of a candle represents the highest price point reached during the candle’s trading period.

In the case of a bullish pin bar, the upper wick of the candle is smaller or equal to the body of the candle. Conversely, a bearish pin bar’s upper wick is bigger than the body and the lower wick combined.

Lower Wick

The lower wick of a candle represents the lowest price point reached during the candle’s trading period.

In the case of a bullish pin bar, the lower wick of the candle is bigger than the body and the upper wick combined. Conversely, a bearish pin bar’s lower wick is smaller or equal to the body of the candle.

Now, let us look at the psychology behind the formation of a pin bar candlestick pattern.

Psychology Behind the Pin bar Candlestick Pattern

If you look closely at the formation of a pin bar candle, it indicates a battle between the buyers and sellers.

In a bullish scenario, the big lower wick suggests that initially, the price was decreasing which attracted more sellers. But, towards the closing of the candle, buyers were able to take control over the sellers and regain power. This inability for the price to further go down indicates a potential trend shift in the market from bearish to bullish.

On the other hand, in a bearish case, the long upper wick suggests that initially, the price rose higher which attracted buyers. However, towards the closing of the candle, sellers stepped in and were able to take control over the buyers which pushed the price lower. This caused the price to close near the opening price or even below it. Buyers were unable to hold the price above and this failure to maintain the price higher suggests a potential trend shift in the market from bullish to bearish.

How to Trade Using Pin bar Candle Patterns?

Let’s talk about a price action trading strategy using the pin bar candle. Before we delve into the strategy, it is important to note that you should not take a trade on any random pin bar candle. A pin bar candlestick pattern is usually effective whenever it has formed at the top or bottom of a price range.

We can buy at the bottom after the pin bar candle has formed, place our stop loss just below the low of the pin bar and aim for at least a 1:2 risk-to-reward ratio.

Conclusion

The Pin bar Candlestick Pattern provides an effective way to analyze potential trend reversals in the market.