Understanding unit allotment and NAV process

Lately, some concerns have been raised about the NAV allotment delay for Mutual Fund customers. This has created confusion and misinformation amongst customers.

In the spirit of transparency, we’d like to explain the behind-the-scenes process, which will clarify any misconceptions.

What is NAV?

NAV full form stands for Net Asset Value. It represents the market value per share for a particular mutual fund. NAV is calculated by deducting the liabilities from total asset value divided by the number of shares. SEBI mandates mutual funds to update the NAV by 9 pm every day.

How is NAV allotted?

As per a circular dated September 17, 2020, the Securities and Exchange Board of India (SEBI) stated that mutual fund units will be allotted at the NAV applicable on the day of realization of funds.

Here, ‘realization of funds’ means that the NAV applicable on your transaction will depend on if the fund house has received your money or not. This was implemented in February 2021.

To allow enough time for the chain of events to be successfully completed, cut-off times are applicable for various schemes, which are standard for the entire industry. More details can be found here.

Cut-Off Timings on Groww and NAV Applicability

|

Type of fund |

Order placement on Groww (cut off) |

Payment receipt on Fund House/AMC (cut off) |

NAV applicability |

|

Liquid / Overnight |

12:00 noon |

12:00 noon |

Previous day |

|

Liquid / Overnight |

After 12:00 noon |

After 12:00 noon |

NAV of the day immediately preceding the next business day |

|

All other funds |

2:00 pm |

2:00 pm |

Same-day |

|

All other funds |

After 2:00 pm |

After 2:00 pm |

Next business day |

Note:

Orders placed on Saturdays, Sundays, and other market/public holidays will be treated as orders placed on the next business day.

In some cases, when you might make the purchase before the cut-off time, but funds are not received before the cut-off time, your order is placed on the next business day. Accordingly, you get the next business day NAV.

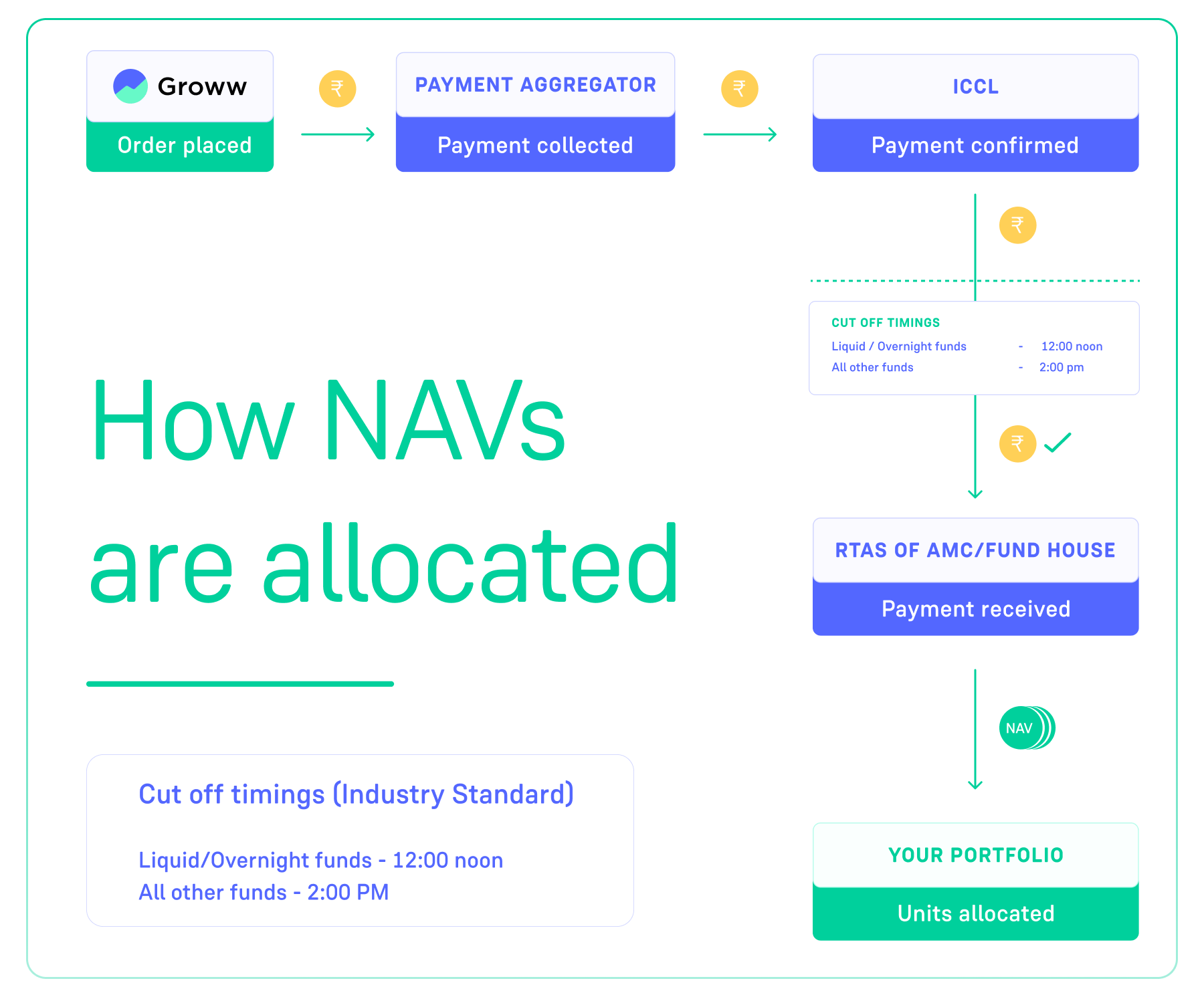

What happens after you place a mutual fund order?

Step 1: Order placed

When you place a mutual fund order on Groww, it is instantly communicated to the exchange.

Step 2: Payment collected

The intermediary (Groww, in this case) initiates payment collection from you via payment gateways. Note: Each payment gateway has an underlying payment aggregator where the money is collected.

Step 3: Payment transferred to ICCL

The collected money is transferred from the payment aggregator to the exchange's clearing corporation (ICCL).

Step 4: Order validated by exchange

The exchange validates your mutual fund order and the money received from the payment aggregators. If it is within the cut-off time, the exchange sends your mutual fund order information and the money to the AMC/fund house.

Step 5: Units allocated by AMC

After doing due diligence of your order, the AMC/fund house allocates units to your portfolio.

Note: The transaction is completed only after realisation of funds by AMCs. The entire process happens under the ambit of SEBI guidelines, to ensure fairness and uniform applicability of NAVs across the industry.

What if NAV is delayed for my order?

While SEBI’s NAV allocation process runs smoothly on any given day, rare instances may occur, when NAV got delayed for a few users.

At Groww, we believe in transparency. If such a delay does happen again, you can be assured that we will keep you informed with timely updates on the app or via email, or via our official social media handles.

If you have any concerns, questions or suggestions, please reach out to us at [email protected].