5 Steps to Reduce Losses When Invested in Small Cap Funds

The BSE small-cap index has lost nearly 19% since January 15, 2018.

Is it too late to recover the notional loss?

Can you still hedge?

Should you add or should you exit your investments?

There are many such questions that we’re asking ourselves.

In this blog, we seek to discuss what should be your approach to market volatility and how you can shield yourself from any such shocks in the future.

The Market Downfall of January – 2018

If you look at the market since January 15, 2018, one thing that emerges quite evidently is that the bull-run in the small-cap and mid-cap category came to an end and there has been a clear trend reversal with large-caps taking the growth lead.

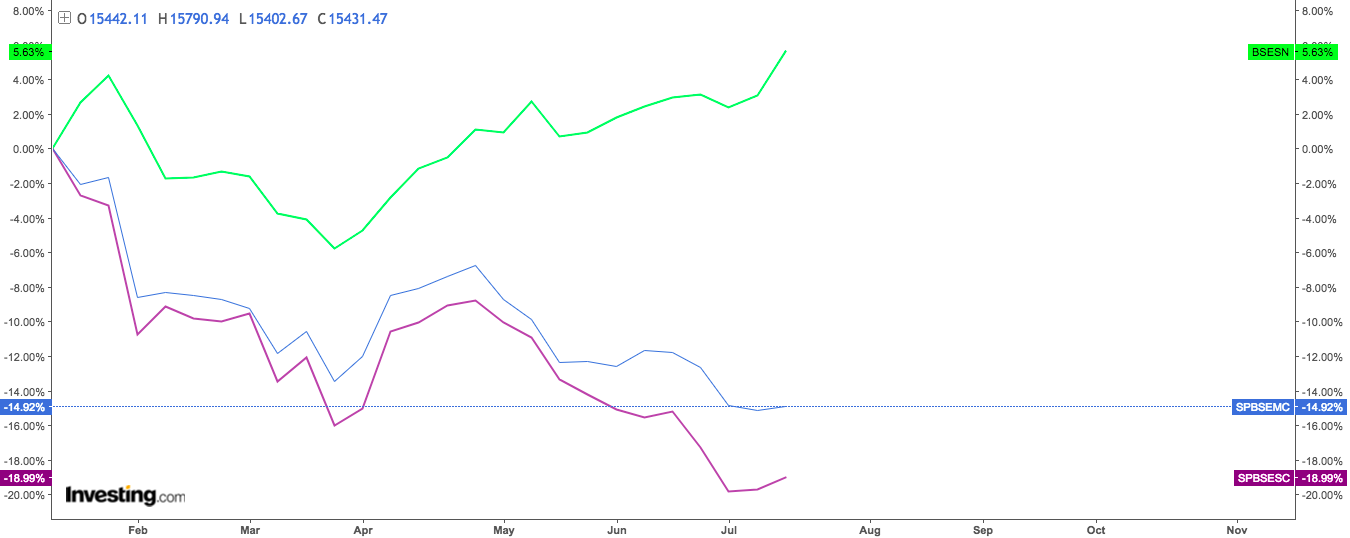

Let us see the chart below to get a more factual picture. The chart shows how the BSE Sensex, BSE Small Cap and BSE Mid-cap performed over the time period since January 15, 2018.

The BSE Sensex has gained 5.6% since January 15, 2018; however, the mid-cap and small-cap indices have corrected over 15% and 19% respectively during this time period.

The real damage is seen in the small-cap and the mid-cap index.

The obvious questions that arise at this point are:

Is it too late to hedge?

Can an investor look to hedge small-cap or mid-cap correction even now?

Well, the clear answer is YES!

While we believe a small-cap and mid-cap segment looks a lot more vulnerable at this stage. Let us see some quick techniques that investors in small-caps can adopt to reduce their losses and salvage value out of their portfolio.

How Can You Reduce Losses When Invested in the Small-Cap Category?

1. Remain Disciplined and Stick to the Plan

When you enter the small-cap segment, you have the right perspective.

The right perspective here means having a well-defined objective and proper diligence with respect to the stocks in the fund, the fund manager experience, tenure of the fund, risk metrics, etc.

You also need to ensure that you are not very aggressive with your portfolio at an overall level and neither very conservative if you have a long-term view.

For example, you’re your overall equity allocation is 75% of the total investments, you can break your investments in large-cap and mid-cap at 30% each, with small-cap at 15%.

If you are an aggressive investor, you can increase your allocation to the small cap by 10% while reducing the same amount from large-cap.

The idea here is to show that a discipline and thoughtful approach is more important than just following the footsteps of other investors.

2. Restructure to Add Tested Names

There is a saying – When in Rome, do as Romans do.

Similarly, within the small-cap space, there are many tired and tested names that have generated healthy returns over the last few years.

An investor can look to invest in these funds if he/she believes that his/her shortlisted investment may go haywire in turbulent times.

3. Diversify Your Portfolio

Ensure you do not put all investment in one fund.

Why?

Because you lose out on diversification.

It is ok to give up on 1% returns from a combination of a portfolio if you can save an additional 1% in the bear market. A better way is to hedge your risk and spread your small-cap risk to a widen your portfolio.

If you have a sizeable investment of more than Rs 15,000 per month for small-cap funds, it makes sense to opt for three funds with varying risk metrics and up-market and down-market capture.

The approach helps you reduce your overall risk in small caps and you can also use this opportunity to restructure and re-allocate a small portion of the small-cap portfolio as and when required.

4. Accumulate in a Planned Manner

One of the best ways to hedge against the small-cap volatility is to adopt a phased approach, also known as Systematic Investment Plan (SIP) approach.

We are sure that you must be aware of SIP and its benefits. Buying in small quantity but buying regularly provides you with faster growth.

5. When Investing in Small-Caps, Remain in Your Comfort Zone!

Creating a safety net around yourself is important when you invest in small-cap funds.

Every investor has an area of specialization. For example, if you are working in the steel industry, then your fundamental understanding of the steel industry will be much stronger and that will work to your advantage.

You will be a good judge of when steel companies are doing well and when they are lagging. You can argue that steel companies are large and they cannot fit into a small-cap portfolio.

That is absolutely fine! If steel companies grow, then you will need more electric arc furnaces and so, graphite companies will benefit. These are small cap stories.

In volatile times, the best hedge is to stick to your circle of competence. It not only reduces your risk but also helps you identify interesting buying opportunities.

Happy Investing!

Disclaimer: The views expressed in this post are that of the author and not those of Groww