Groww’s Fund Selection Criteria for Popular Funds Category

Greetings investors!

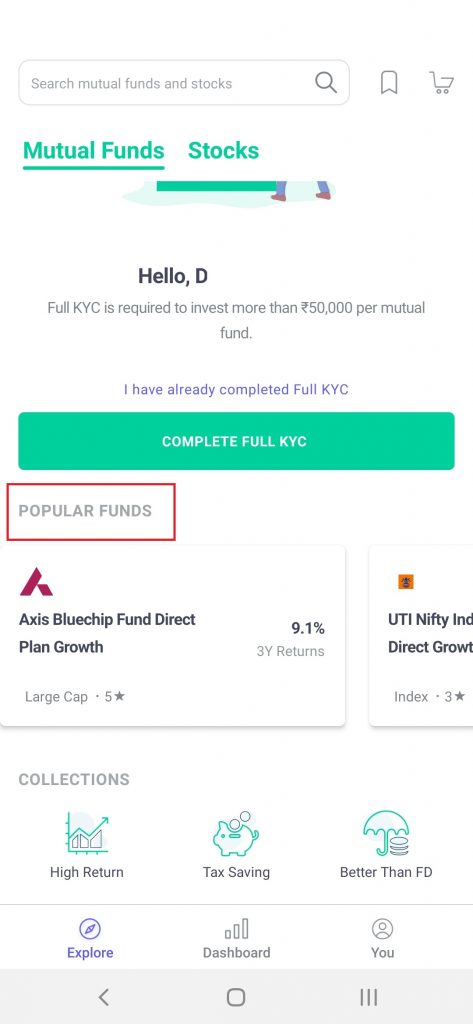

While exploring the Groww app, you may have come across ‘popular funds’.The question is, why are certain funds shown in the list and others don’t make the cut? What are the selection criteria based on which the fund list is displayed? All this and more is covered in the blog ahead. Read on to know how Groww selects top Mutual funds under the popular fund’s category.

The Selection Criteria

As you must be aware, Groww does not offer advisory as we strongly encourage independent research for fund selection. Groww simply follows an algorithm that displays updated fund lists based on certain filtering criteria. This is the step by step process followed by the inbuilt algorithm.

Step 1: The first filter is based on popularity. Top 50 funds based on the search volume in the past 7 days are selected and fed into the algorithm.

Step 2: Fund list is further refined based on certain qualifiers, these are:-

- The Asset under management (AUM) of the fund must be more than Rs 500 crores

- The fund must accept both modes of investments – SIP and lump sum

- Only one fund per AMC will be displayed

Step 3: Once the top 4 funds satisfying the above criteria are finalized, they are displayed under the popular fund’s category.

These funds are in no way a recommendation. They are simply placed based on the criteria specified above and it’s absolutely at your discretion to choose them for your portfolio or not.

The important thing to note here is that we may change our selection criteria from time to time, as we deem fit and hence it is highly advised that you carry out the due diligence before investing in a fund. You can find the fund’s updated information as well as use the compare feature to gauge its performance in comparison with peers in the same category, for a holistic understanding.

Hope this blog was able to create more transparency around the process.

Happy Investing!