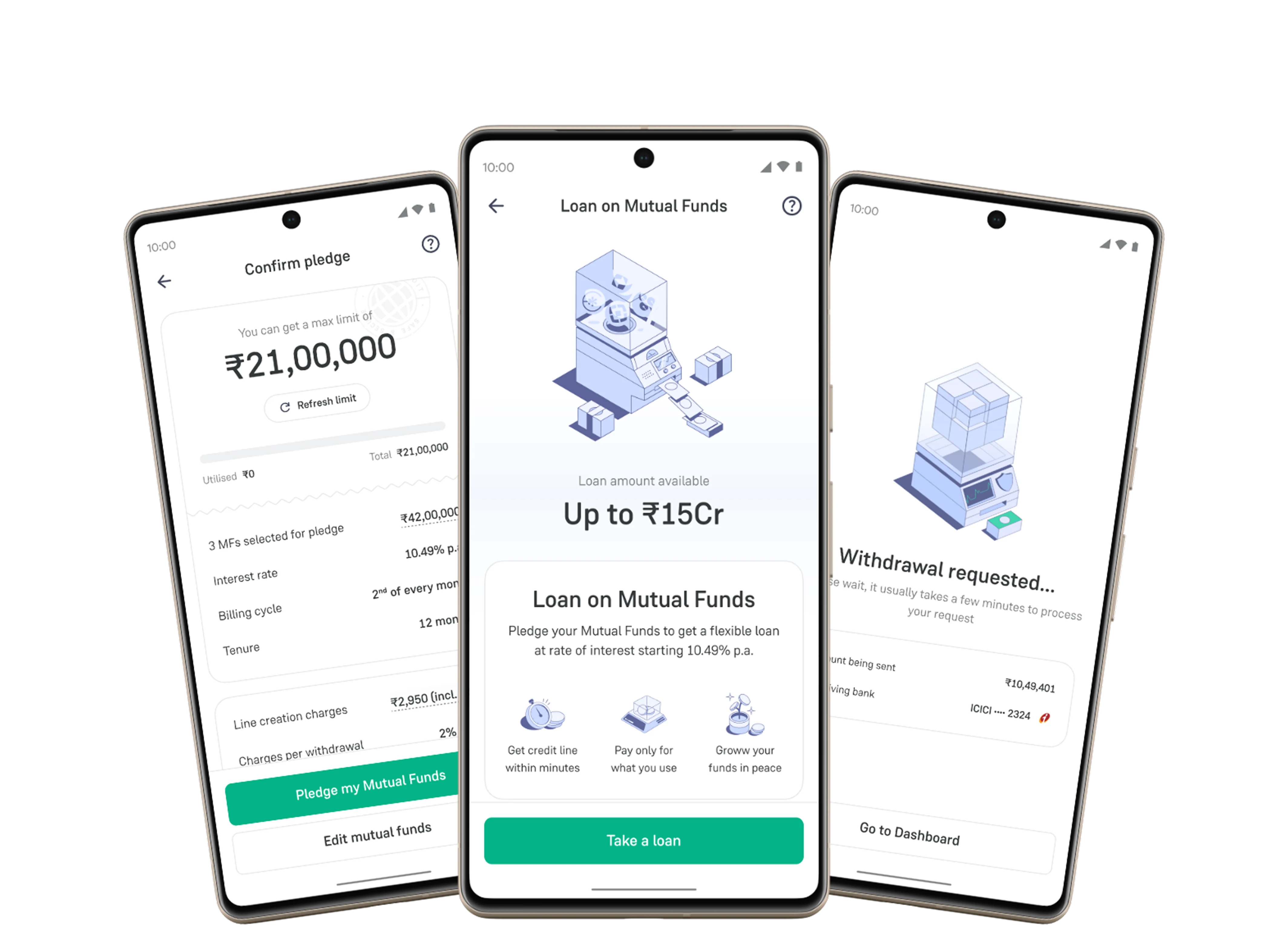

Get Instant Loans

Against Your Mutual Funds

What happens to my funds after taking a loan?

When you take a loan, your mutual fund units are used as collateral by the lender. You still own them and benefit from any growth or income. However, you can't redeem or transfer them until you repay the loan. If the value of your funds drops significantly, you might need to provide more collateral or pay back part of the loan.

What types of funds can be used as collateral?

Typically, you can use the following types of funds as collateral:

- Equity Mutual Funds

- Debt Mutual Funds

- Hybrid Funds

However, please note that ELSS funds or any funds with a lock-in period cannot be pledged as collateral.

Do I have to pay interest on the line amount?

You only need to pay interest on the amount you've actually withdrawn or used from the loan. Interest is charged based on the outstanding balance, not the total loan limit.

Can I withdraw again once I have repaid the whole amount?

Yes, once you repay the full amount or part of it, your available limit will be updated. You can then withdraw up to the refreshed limit.

What is the tenure of a loan?

The loan limit against your mutual funds has a tenure of 12 months. It can be renewed afterward without repaying the principal.

What is shortfall?

A shortfall occurs when the value of your pledged mutual funds falls below the required collateral value or the amount outstanding. This means there is a gap between the value of the pledged assets and the withdrawn amount, potentially leading to a need for additional collateral or partial repayment.