10 Biggest Financial Problems a Millennial Faces

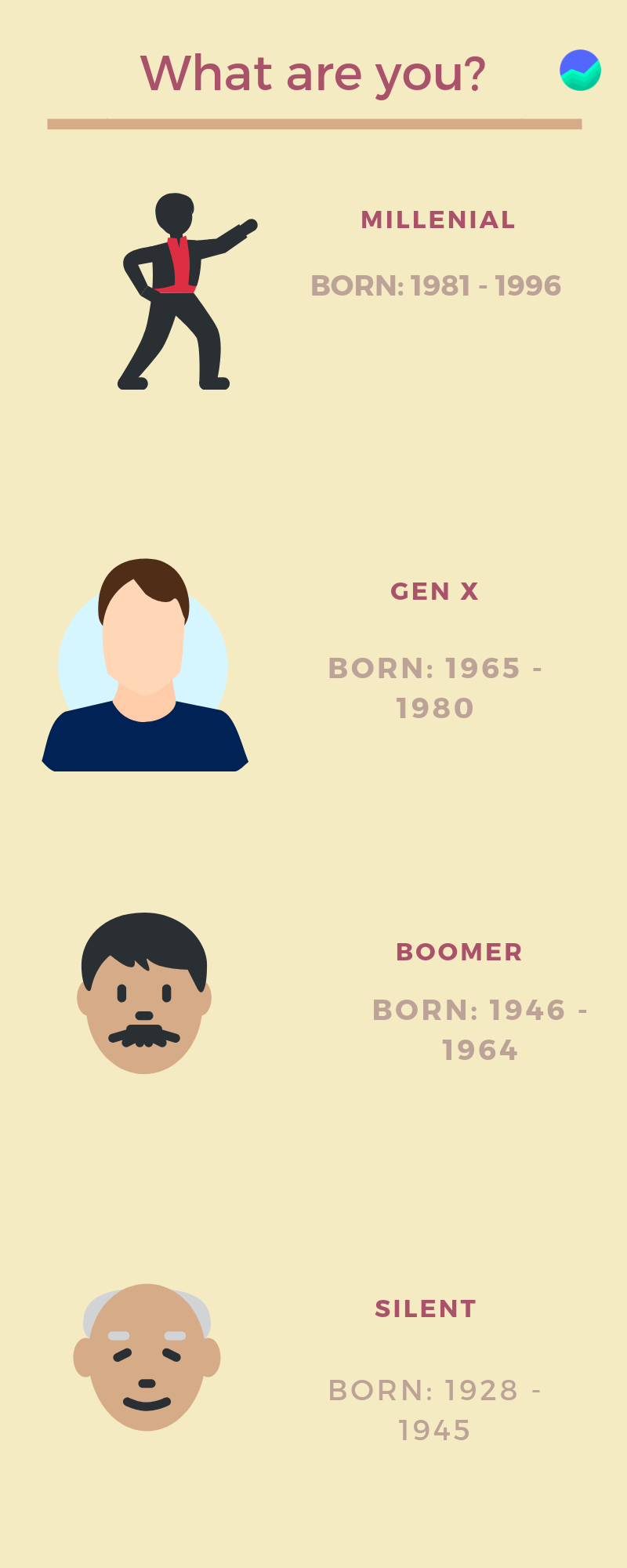

A millennial, also called Gen Y, is someone who has been born in the early 1980s to late 1990s. Doing simple math, a millennial today is someone who is in the age bracket of 20 – 40 years.

According to a financial wellness survey, as many as 84% of the Gen Y or millennials, have some or the other, big or small, financial concern.

Managing money is the biggest. The problem of saving, investing, money management, and planning for the future is a common talk of the town, widely discussed and debated.

In this article, we cover, the common problems which a millennial is likely to encounter and why they do so.

Common Problems Faced by Millennials

1. High Student Education loan

You graduate from college and get a good job, but you’re not entirely happy.

WHY?

Because you have to pay a huge loan!

Most students across domains and specializations have to take a very high education loan. The figures usually run into lakhs for a two-year post-graduate or master’s course.

Education loans are easy to avail of and come with attractive offers such as no collateral, no pre-payment charges, fixed interest rates, etc.

For example, a two-year MBA course from any top institute such as IIM Ahmedabad costs a candidate upwards of ₹20 lakhs. Similarly, a master’s program from abroad could cost a candidate crores of rupees.

A very high education loan, with interest as high as 10% per annum could cost a millennial a monthly EMI as high as ₹40,000 – ₹ 50,000. Such a high-interest payment burden at the start of one’s career can be very difficult.

For someone with a low-paying job, it could take years for him/her to pile up reasonable savings for the future.

2. Mind-Boggling Rents!

Planning to rent a decent house in a city like Mumbai or Bangalore? Get ready to be startled by the rent.

This often adds up with the student education loan burden and eats into the major leftover portion of the salary after deducting for EMI.

Rents have sky-rocketed and are through the roofs in major metropolitan cities in India, where most jobs and education opportunities lie.

I am a millennial and I would like to live in a good house. However, this dream home comes with an expensive rent tag. One must be very careful when planning to rent a home.

3. Saving for Retirement

This is one of the major contributors to stress for most millennials today. They are aware of the need and importance of creating savings to sustain their retirement at the desired lifestyle.

Early retirement is becoming a growing trend, particularly amongst the millennials.

This has resulted in millennials, like you and me, thinking of early retirement as we believe we can put to use investment management and wealth management in our favor and can afford early retirement.

Another important angle in this regard is inflation. Everyone knows that the value of, say, ₹100 tomorrow will be less than the value of the same ₹100 today.

Similarly, the value of the corpus created today will be much less than the actual of the said corpus, say 15-20 years down the line.

4. Debt Management

Many studies indicate that more than half the millennial population has at least one form of long-term debt. It may be in the form of a home loan, an auto loan, a personal loan, or the above-mentioned education loan.

Many millennials accumulate a lot more debt than they are sure of repaying. The desire to maintain a certain lifestyle has got a major role to play in this cause.

During phases of regular cash flow, everything seems as bright as day. However, any event which creates any sort of financial stress brings a lot of problems.

It is general advice to everyone, to borrow according to one’s cash flow ability, that too in a prudent and conservative manner. Usually only a certain % of one’s disposable income.

5. Creating an Emergency Fund

The creation of an emergency fund is directly linked with the attitude towards savings. Many millennials live by spending all the cash inflows, without saving anything for the future.

All this is good until some major life event requires a huge amount of money in one go.

An example of a life event that could require a lump-sum fund could be a medical emergency, a misfortunate event such as robbery, fire, or a natural calamity that causes major financial losses.

Lack of an emergency fund can cause major stress during an unfortunate event that requires a large amount of money. It is advised to set aside 5% – 10% of the monthly income towards setting up an emergency fund.

6. Following a Financial Budget

It is a good habit to create a financial budget, which accounts for all the expected cash inflows and outflows. It helps inculcate discipline in the area of money management.

Setting up a budget helps keep track of whether the debt is capable of being repaid or not, where the major portion of the money is going, and what is left at the end of each month in the form of savings or emergency funds.

7. Ignoring Your Credit score

A credit score is often given less importance than what it deserves.

Simply put, a low credit score results in a higher borrowing cost in the form of a higher rate of interest on your next loan.

In certain extreme cases, a poor credit score may also result in denial of a loan by many leading financial institutions. A low credit score could also be due to insufficient credit history.

8. Not Being Insured

Insurance is one of the most important expenses that each and every millennial must subscribe to. Often touted as one of the most boring expenditures incurred periodically, usually each month, it is of extreme importance to all of us.

Whatever be the age of the individual, young or old, millennial or not, insurance is a must. Life is uncertain and you never know when you might need insurance.

Sometimes, even though you are insured, it would be insufficient to cover the amount required.

It is advised not to compromise in any aspect related to insurance, both life insurance as well as health insurance. Moreover, the insurance for each and every member of the family is of utmost importance.

9. Living Hand-to-Mouth

This problem is closely linked with the problem of not developing an emergency or savings fund. Millennials like to live life to the fullest and in this process, they spend all their earnings.

Consequently, they do not save anything for future events, unforeseen circumstances, and payment obligations.

This goes well until something drastic happens, especially an event which involves payment of a large sum of money.

10. Unwillingness to Consult a Financial Adviser

Most millennials believe that they possess sufficient knowledge to manage their own funds. However, more often than not, this is not true.

A financial planner is skilled at advising clients to make suitable investments with the objective to meet a desired financial target.

The expertise is often very beneficial, especially for those who do not possess the professional expertise or time required to plan their finances.

So, Why Do Millennials Face Financial Problems?

Lifestyle is a major reason behind a lot of problems that millennials face today. It is a major determinant in how each and every individual lives his/ her life and behind the choices he/ she makes.

Overspending on unnecessary shopping, luxurious dinners, and outings adds to the financial problem.

Lack of detailed planning can be one of the most common yet unacknowledged problems that most millennials face today. This includes not saving for future unforeseen events, spending beyond one’s means, and borrowing more than one can afford to repay.

Many youngsters who see a steady stream of income and get used to a particular lifestyle tend to over-borrow. During times of financial distress, this loan becomes one of their greatest source of stress.

Potential Investment Solutions

It is advisable to make it a habit for all millennials to set aside a fixed amount of salary the day it is credited to one’s account. SIP helps in this regard. This fund could ideally be divided into multiple things, such as

1. Emergency Fund

These will be liquid funds primarily and will help you shield yourself from any emergency.

2. Investments for Long-Term

This will be your main source of capital generation.

You should invest in equity funds, particularly funds that invest in small-cap stocks.

3. Investments for Short-Term

These are investments that would help you book profit at regular intervals and they come with a moderate risk profile and/or tax benefits. This should include hybrid funds or debt funds.

Conclusion

Financial planning such as consulting an expert, making and adhering to a financial budget, subscribing to an insurance plan, and inculcating the habit of savings are a few must-have habits.

These are very important for each and every individual, no matter who he/ she is. Investing in meeting future needs is a very important component of financial planning.

To meet your long and short-term financial goals, SIP or Systematic Investment Plan is a very good investment option as it provides the benefits of rupee cost averaging and compounding from a disciplined long-term investing.

Happy investing!!