Fair Value in Stocks

We often hear the term, ‘stock is overvalued or undervalued’.

What does this indicate?

It merely indicates that an investor puts a value to stock and compares it with the current price. For example, if a stock is trading at Rs. 80 and I as an investor feel that real value for the stock is Rs. 70, I would conclude that the stock is overvalued and I would tend to sell the stock if I am holding it currently.

What is Fair Value?

In simple words, fair value refers to the actual value of an asset.

The asset, in this case, can be anything – a stock, a property, a product. The value is agreed upon by the buyer and the seller and applies to the products that are sold or traded in the market – be it a traditional market, online market, or capital market.

Please note, the fair value is not that value that is assigned to an asset when the asset is being liquidated.

Fair value is also considered as the value that is fair to the buyer without putting the seller on loss.

Example of Fair Value

Let’s say company A sells its stock to company B at Rs.25 per share.

The management of company B believes they could sell the stock at Rs.40 per share after they acquire. Thus, the management decided to buy one lakh shares at the original price.

Therefore, it is considered to be the fair value because the price is agreed upon by both sides.

How Do You Arrive at a Fair Value?

On a stock exchange, millions of stocks trade every day and the price of these stocks is dependent on multiple factors such as demand-supply dynamics, the popularity of a stock, market whim, and value of a stock vis-a-vis current market price.

An investor needs to determine a stock’s fair value, or intrinsic value before they decide to buy it. It’s not an easy task. An equity analyst calculates what they think is the long-term intrinsic value of a stock, helping you see beyond the present market price.

Let us talk only about stocks to keep our discussion simple.

Valuation involves art and science. Art because it understands the company, the product, the customers and the competitive landscape.

Science because it correlates the understanding with the financials. This method is used to assess the future cash flow of a company and eventually, everything boils down to cash flow generation capability.

Have you heard the proverb;

“Cash is king”

So, it is the cash, that comes in and goes out of the company, that helps management attain the milestone. Thus, the focus should be on cash flow while evaluating a company. To understand cash flow better, consider reading more on Cash Flow Statement.

Let us now see some maths on arriving fair value.

While there are multiple methods, let us briefly touch upon one of the most used ways – Discounted Cash Flow or DCF method.

Discounted Cash Flow

The discounted cash flow (DCF) is the present value of the sum of the future free cash flows. Free cash flow is what is of interest to an investor because this is what is used to pay dividends, repay debt, or buy back stocks in the company.

Future cash flows indicate how much cash an analyst believes a company is going to generate in the future after spending the necessary money to keep the company operational and growing.

An analyst believes that over time, the stock price will reflect the intrinsic value of a business that is computed with the help of the DCF method.

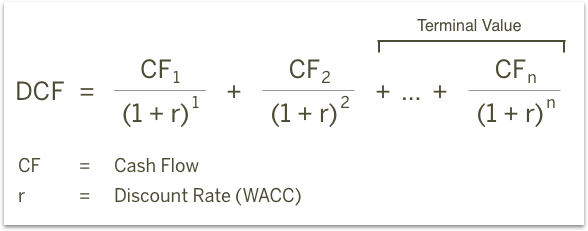

Here is the DCF formula:

DCF Formula =

Where:

- CF = Cash Flow in the Period

- r = the interest rate or discount rate

- n = the period number

Let us now see an example to understand how fair value is determined with the help of the DCF method.

Assume you are evaluating a company that has the following cash flow.

- Cash flow for the first five years starting 2019 – Rs 100

- Discount rate – 10%

- Terminal Growth rate – 5%

The present value of the cash flow generated in 2019 –

= CF / (1+r)^n

= 100/ (1+10%)^1

Thus, the present value is Rs 91

Terminal value is computed as perpetual growth. Formula is –

= {CF*(1+growth rate)}/(discount rate – growth rate)

Thus, the terminal value is

= {100*(1+5%)}/(10%-5%)

= Rs 2100

The present value of the terminal value is calculated using the method shown above.

So, the present value of all future cash flows is shown as –

The present value of future cash flow (including terminal value)

Source: Author’s calculation

Thus, the fair value of the company is Rs.1683 (addition of the present value of all future cash flows).

To conclude, fair value is a critical element of assessing a stock for investment purposes.

There are multiple ways of evaluating the fair amount, and an investor should ensure that he/she employs the best method based on the sector and characteristics of the company which is being evaluated.

Happy Investing!

Disclaimer: The views expressed in this post are that of the author and not those of Groww