13 Things You Need To Know About Mutual Fund NAV

New mutual fund investors are wanting to know what NAV (Net Asset Value) is. NAV is similar to the price of a share but it isn’t exactly the same thing. There are key differences between the two.

But while many are asking what NAV is, many are also confusing themselves and trying to make investments in funds based on the NAV values of different funds. Read the below points to be absolutely clear about what NAV means.

#1. Understanding Mutual Fund NAV

NAV is the price of 1 unit of a mutual fund.

NAV stand for Net Asset Value.

Mutual funds collect money from retail investors (you) and invest them in various investment vehicles like stocks, bonds, etc. Mutual funds may not necessarily invest all the money that they have with them. Also, since they invest in stocks, the value of these stocks changes with time.

Mutual funds are divided into units. When you invest in a mutual fund, you are given units of mutual funds.

The NAV is a representative of all the assets held by a mutual fund.

#2. Should Mutual Fund Investors Pay Attention to the NAV?

No. In the case of mutual funds, NAV is almost irrelevant.

In India, people do attach a lot of importance to the NAV of a mutual fund. Newer mutual funds have lower NAV than older ones. Most recent mutual fund investors have invested in newer mutual funds corroborating the misconception about lower NAV being better.

In fact, there have been instances of people selling their old mutual fund units to invest in newer mutual fund units.

If you are about to invest in mutual funds and you observe one mutual fund to have a NAV of ₹10 while another one is at ₹20. You should not buy a mutual fund with a lower NAV. You should factor in many details like past performance, AUM size, alpha, beta, etc, while investing in a mutual fund. But NAV shouldn’t be looked at.

#3. Why Should Investors Not Pay Attention to the NAV?

Let’s understand why with the help of the below example.

Let’s consider the example of two mutual funds: mutual fund A (MF-A) and mutual fund B (MF-B). Now, to explain why NAV isn’t important, in our example, we’ll consider every characteristic (fund manager, assets held, investment style, launch date, etc) of two mutual funds to be exactly the same, except for the NAV.

In our example, MF-A has a NAV of ₹20 and MF-B has a NAV of ₹50. Both these mutual funds have 20% of their funds allocated in the shares of company XYZ. If the shares of company XYZ rise 10% in value, the NAV of both MF-A and MF-B will increase by 2%. So, the NAV of MF-A will become ₹20.4. At the same time, the NAV of MF-B will become ₹51.

At this stage, you might think that MF-B increased by a greater margin. That is true. However, you must remember if you had invested in MF-B, you would also have to pay a higher price for each unit of MF-B.

If you had invested ₹100 in the beginning in MF-A, you would have paid ₹20 per unit and gotten 5 units. After the increase in NAV, if you sold these units, you would have gotten back ₹20.4 X 5 = ₹102 back. So you would have made a profit of ₹2.

Instead, if you had invested ₹100 in MF-B, you would have paid ₹50 for 2 units of MF-B. If you sold these units, after the increase in NAV, you would have gotten back ₹51 X 2 = ₹102. Same as MF-A.

But no two mutual funds are ever the same. You must look at several characteristics of a mutual fund before investing. What the above example demonstrates is that the one characteristic that does not matter all that much is the NAV.

#4. How Do I Find the NAV of a Mutual Fund?

You can find that information on the respective page of that mutual fund on groww.in.

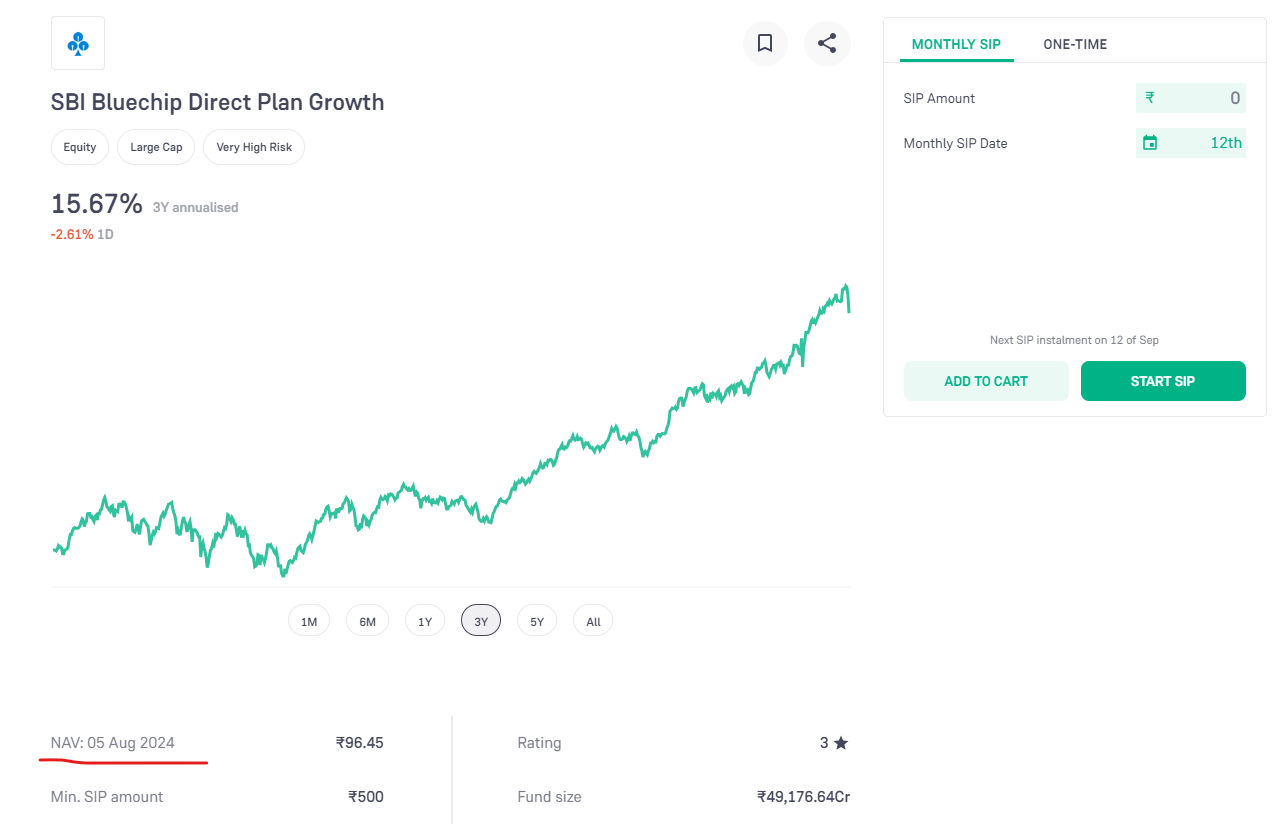

This is best understood with the help of an example. Let’s say you want to know the NAV of the mutual fund SBI Bluechip Fund.

Step 1: Go to groww.in

Step 2: Log in to your Groww account by filling in the necessary details.

Step 3: In the search bar at the top, type ‘SBI Bluechip Fund’ and press enter.

Step 4: Now, the SBI Bluechip Fund page opens.

Under the mutual fund’s name, you can see the NAV of that mutual fund.

#5. Difference Between NAV and AUM?

While investing, you must ignore the NAV but not the AUM.

AUM or Asset Under Management is the total asset being controlled by the mutual fund. It includes all the assets invested by the mutual fund as well as the cash held by it.

NAV or Net Asset Value is the price of each unit of a mutual fund.

#6. Which NAV Value Is Considered When Making a Mutual Fund Purchase in the Evening?

The same day’s NAV is considered if the mutual fund is bought before 2 pm.

If you place the orders for units of any mutual fund before 2 pm on a working day, you will get units at the NAV value of the end of that very day.

If the order is placed after 2 pm, then the NAV at the end of the next day will be considered to be the NAV value for the transaction.

All orders placed on holidays are carried out with the NAV value at the end of the next working day.

#7. Which NAV Value Is Considered When Selling Mutual Fund Units in the Evening?

The same rules apply to what happens when you buy units.

If you place the orders to sell units of any mutual fund before 2:30 pm on a working day, you will sell units at the NAV value of the end of that day.

If the order to sell is placed after 2:30 pm, then the NAV at the end of the next day will be considered to be the NAV value for the transaction.

All selling orders placed on holidays are carried out with the NAV value at the end of the next working day.

#8. When is NAV updated?

NAV is updated at the end of every working day.

The NAV is updated by mutual funds at the end of every day. SEBI mandates mutual funds to update the NAV by 9 pm every day. Most mutual funds update the NAV have their own specific time to update the AUM. This is of course before 9 pm.

The NAV is not updated live because of complications in constantly tracking the value of different assets held by a mutual fund.

#9. Should I Invest in a Mutual Fund With a High NAV?

If other characteristics of the mutual fund are good, you should invest in it.

In an example listed above, it was demonstrated how the NAV value is of no relevance if the mutual fund is a good performing mutual fund.

The NAV is not like the price of a stock in the equity market. You don’t have to worry about the NAV being over-valued. The NAV cannot be over-valued or undervalued as the value of NAV is not controlled by demand. In the case of shares, the price is controlled by demand. The NAV is controlled only by the size of the AUM.

#10. How Do Sensex and Nifty Affect the Value of the NAV of a Mutual Fund?

That depends on the type of mutual fund.

Various mutual funds hold various types of assets. Whether a mutual fund’s NAV is affected by Sensex or Nifty depends on the kind of assets held by the given mutual fund. Even the degree to which a mutual fund is affected by Sensex or Nifty depends on the type and quantity of assets held by it.

Sensex: It is also known as BSE 30. Sensex is a free-float market-weighted stock market index of 30 of the biggest companies listed on the Bombay Stock Exchange (BSE). These companies are some of the most financially stable companies in the country.

Nifty: Similar to Sensex, Nifty is a free-float market-weighted stock market index of the biggest companies listed on the National Stock Exchange (NSE). Unlike Sensex though, Nifty counts 50 of the biggest firms. It covers 13 industry sectors. It too is comprised of very stable and financially sound companies.

Effect on NAV: The effect of Sensex and Nifty on any NAV would depend on how much those mutual funds have invested in companies that are part of Sensex, Nifty, or both. The NAV of large-cap mutual funds that invest in the largest companies of the country is greatly affected by changes in Sensex or Nifty.

Multi-cap mutual funds invest in various sizes of companies. They may or may not be affected by changes in Sensex or Nifty depending on the amount of large-cap assets they have.

It must also be noted, many times, the performance of large-cap funds influences the performance of mid-cap and small-cap funds. So it would be unwise to assume changes in Sensex or Nifty wouldn’t affect mid-cap and small-cap companies. And therefore, the NAV of small-cap mutual funds and the NAV of mid-cap mutual funds may also be affected by changes in Sensex and Nifty.

#11. Is NAV Similar to Stock Price?

NAV is immune to demand. Stock prices change depending on the demand for that stock.

It is easy to make comparisons between the NAV of a mutual fund and the stock price of a company. To some extent, they really are similar.

The NAV reflects in effect, the book value of the mutual fund. It is the exact value of the assets held by a mutual fund.

Stock prices are supposed to reflect the book value of a company too. In the case of companies, the book value would include the assets held by the company and the profits it makes. However, the stock price can change based on one more metric: demand. The price of a stock can go up if too many people want it. Conversely, the stock price can fall if too many people start selling that stock. In the former case, the share is said to be over-valued while in the latter, it is said to be under-valued.

Smart and prudent investors strive to make money by selling shares that are over-valued and buying shares that are undervalued.

The NAV of mutual funds is not subject to change based on demand. This is the reason why the NAV can neither be overvalued nor can it be under-valued. And this is precisely why the NAV should not be a factor to consider when buying a mutual fund unit.

#12. What Is the NAV of an SIP?

It is the same as the NAV of a mutual fund.

SIP and lump sum are two methods of investing in a mutual fund.

SIP: It stands for Systematic Investment Plan. Using this method, you can invest a fixed amount of money in a mutual fund of your choice every month. The amount automatically gets deducted from your account every month. It is, therefore, a very disciplined approach to investing in mutual funds.

Lump Sum: In this, you simply invest a relatively large sum of money in a mutual fund in one go.

Most mutual funds allow you to invest using both methods: SIP and lump sum. So no matter which method you choose, the mutual fund characteristics remain the same. The NAV of any given mutual fund remains the same for both SIP and lump sum investments.

#13. Can the Value of a Mutual Fund’s NAV Drop Like in the Case of Stocks?

Yes, the NAV of any mutual fund can drop depending on the value of the assets held by them.

Mutual funds invest in various kinds of investment instruments. These can be stocks of companies, bonds, etc. The value of these changes from time to time. So, on any given day, if the value of the assets held by a mutual fund is lower than the previous day, the NAV will also be lower than the previous day.

However, it must be noted that the NAV is always moving up and down, no matter how good a mutual fund is. It is necessary to not panic and sell mutual fund units the moment the NAV value falls. The decision to sell a mutual fund is much more complicated than that.

Happy investing!

Disclaimer: This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory.