How to Invest in SIP

SIP or Systematic Investment Plan is simply an investment option where money is invested in a scheme periodically over time, at pre-decided intervals (such as a month or quarter), without interruption.

Most importantly, SIP helps investors build wealth through regular investment and compounding returns, even if they start small. This is done through an electronic platform such as the NSE or BSE or even manually by filling in the paperwork and transferring funds each month.

Understanding SIP

How to invest in SIP and what is SIP is a perpetual question. Simply put, SIP is an investment option in Mutual Funds wherein small amounts at regular intervals are invested in different types of mutual funds.

It is a time-tested technique that minimizes the risk of loss and allows the investor to purchase Mutual Funds Units at lower costs by making regular investments.

Systematic investment plans, or SIPs, are one of the most cost-effective ways to invest in mutual funds. If you invest a fixed sum at regular intervals into a mutual fund, you automatically take advantage of market volatility without worrying about timing the market.

SIPs let you put your money to work without sweating the stock market's daily fluctuations.

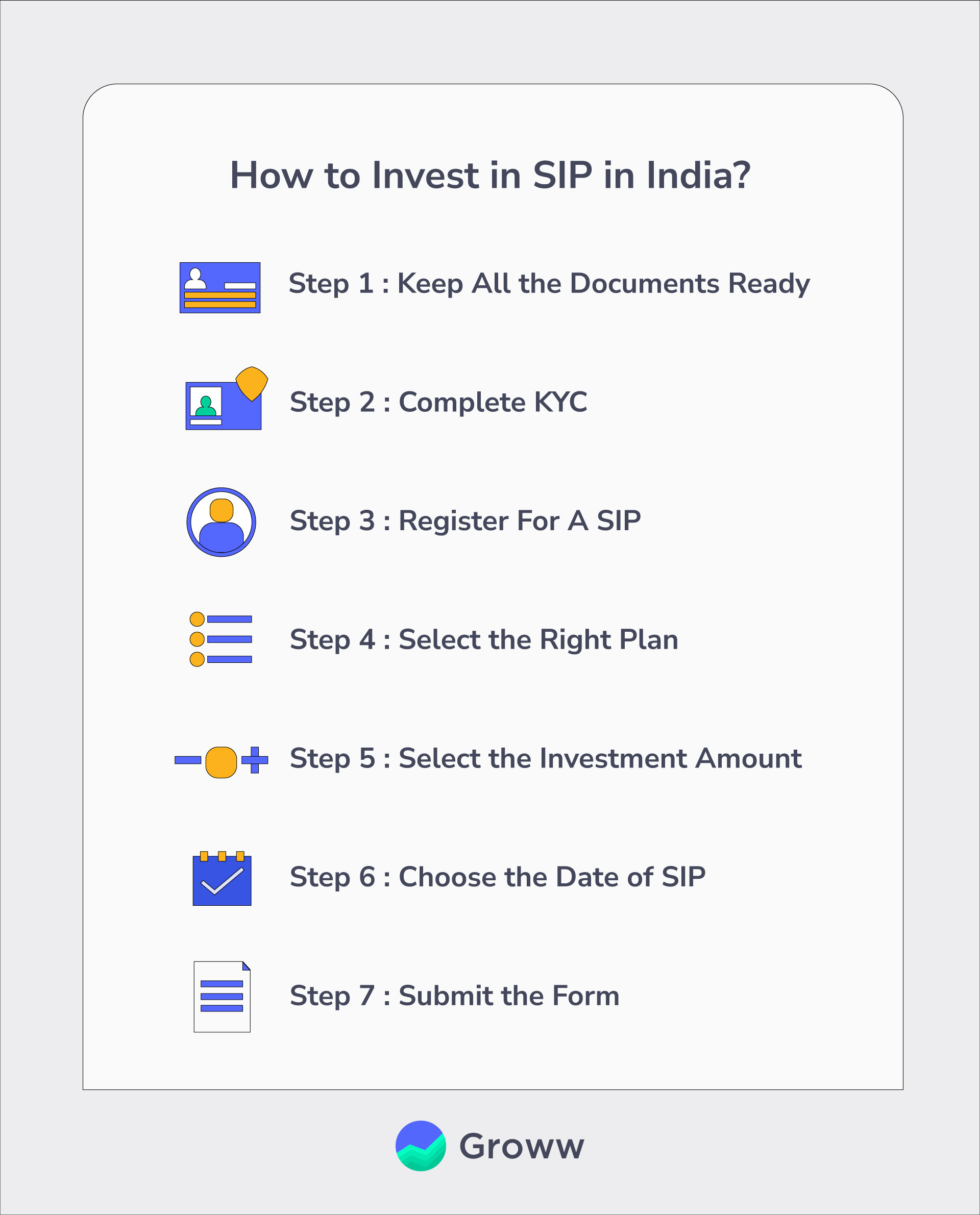

How to Invest in SIP in India?

Here are some easy steps to answer how to start SIP investment in India-

Step 1 - Keep All The Necessary Documents Ready

You will need to make sure that you have all the necessary documents ready before you can invest. Since it is a long process, it is recommended that you start by keeping all the records ready that are required, including-

- ID Proof

- PAN Card

- Address Proof

Also, ensure your account number and bank account details are correct. A copy of your passport or driving license will be required as well. If you plan on making investments other than cash, then make sure that they comply with the current KYC norms the government sets.

Step 2 - Get Your KYC Done

Before investing in any financial product, it is critical to comply with KYC norms set by the government. To do so, you must fill out an application form at any of India's authorized banks or post offices where pre-paid cards are issued.

You can also apply online if you don't want to visit a bank branch personally or if there isn't one nearby where you live. The application form includes personal details such as name, address, photo ID proof (passport/driving license), and a declaration about the investment you are making.

Step 3 - Register For A SIP

To start investing in a Systematic Investment Plan (SIP), you first need to register with the Indian broker or financial advisor you wish to work with. Once registered, you can choose from a wide range of investment plans to suit your needs and risk profile.

Step 4 - Choose The Right Plan For Yourself

This is the most crucial step. If you do not choose the right plan, it won't be easy to get a good return on your investment. All plans are different and will have additional features and benefits.

Before choosing a plan, ask yourself-

- How much risk?

- How many units (units = shares) do you want?

- What type of investor are you?

Step 5 - Choose The Amount Which You Want To Invest

Choose the amount you want to invest in the scheme. It is essential to choose how much money you want to invest every month or every week. This will depend on how often you need money and how much it will be worth at any given time.

Step 6 - Choose the Date of Your SIP

Select a date according to your convenience. One can choose multiple dates for various SIPs in a certain month.

Step 7 - Submit Your Form

Once you choose the mutual fund company, start the SIP by submitting the form online or offline (depending on your fund house).

You can submit your SIP online if you have an online Demat account. Alternatively, you can submit it offline through post offices or your bank.

Signing up for a SIP is free and straightforward. Most banks and brokerages offer plans to set up automatic deposits into index or Mutual Funds (which is a great way to go).

In addition, you can start and invest in SIP online on your own using an online investment service or buying individual stocks or bonds directly from an online broker or a financial advisor.

- Online Process

- Create a new account (if you are a new investor) or log in with the credentials of the existing account.

- Fill in the KYC details

- Complete the payment online

- Offline Process

- Fill out the application form and KYC form (paused currently)

- Fill out a cancelled cheque along with ADF (Auto Debit Form)

- Furnish the required identity proofs like utility bills, address proof, etc.

Note, if you choose the online method, you need to fill out the ADF and present it at the nearest bank's branch or choose for e-mandate/billpay /e-nach mode of payment.

Things to Consider Before Investing In SIP

While figuring out how to invest in sip mutual funds, you should consider the following points in advance-

-

Consider Your Financial Goals

Now that you know how to do SIP, the first action to take is to define your financial objectives. Your investment goals can be defined as the long-term financial objective you are trying to achieve with your money. This may include investing for retirement, building an emergency fund, or saving for a significant purchase such as a house or car.

-

Consider Your Investment Horizon

The investment horizon refers to the time frame you intend to invest in.

For example, if you plan on investing with your retirement funds in 10 years, you will likely want more conservative investments than if you have no idea when they will need to be used and need every penny right now.

-

Know Your Risk Appetite

Before you start investing in a systematic investment plan, you must know your risk appetite. This amount of money you are willing to risk every month is based on your investment goals and risk tolerance.

To calculate your risk appetite, add up all your monthly expenses and divide it by 12. The result will give you an estimate of how much money you can afford to lose. For example, if you have $200 per month in expenses, then $50 can be risked each month without affecting your financial goals too much.

-

Calculate your SIP Returns

Once you know your risk appetite, you can use a SIP calculator to estimate how much money you need to invest every month based on our target portfolio size. This calculator considers the initial deposit amount and the years until retirement when calculating how much money needs to be invested every month for each year remaining until retirement.

The best part about using this calculator is that it will show monthly contributions and returns over time so that you can see exactly how long it will take before your investments pay off.

-

Seek Financial Advice

Before you invest in a systematic investment plan, it is essential to seek financial advice.

Many financial professionals can help you find the best investment funds. However, it would be best to consider visiting your local financial advisor or accountant to discuss your goals and determine whether a systematic investment plan would suit you.

Conclusion

A Systematic Investment Plan is an innovative and hassle-free mode for investing money in mutual funds. It allows an investor to invest a fixed amount via monthly or quarterly investments. This mode of investment ensures discipline and regular investments in the best mutual funds, making the entire wealth-creation process easier for the investor.

It is a better way to build wealth than lump-sum investing because it reduces the risk of volatility in investing in stocks. In addition, it provides returns comparable to those delivered by blue-chip stocks, ensuring that your money will grow consistently and predictably.

And to gain a better understanding of the future of the investment you make, you can use a reliable SIP calculator. This calculator allows you to compare the benefits of investing money monthly in a mutual fund through SIP with a lump-sum investment or periodic investments (like ECS). It is helpful for small investors and large ones who prefer systematic investments.

|

You may also want to know |

|

|

1. |

How to Invest in Mutual Funds |

|

2. |

How to Invest in Direct Mutual Funds |

|

3. |

How to Start SIP Online on Groww |

|

4. |

How to Choose Mutual Funds |

|

5. |

|