Invest in Direct Mutual Funds.

find the best ones on Groww.

Moving them to Groww is easy.

in your language.

News

More than half of Nifty 50 stocks ended in the green.

7 Nifty sectors ended in the green with bank and financial services stocks gaining the most. Realty, metal, pharma and media stocks ended in the red.

The US markets ended higher on Feb 2 (Thursday). Most Asian markets were down.

NewsWord of the day

Additional Surveillance Measure

The Additional Surveillance Measure (ASM) framework was introduced to protect investors.

View Groww Digest

about Groww

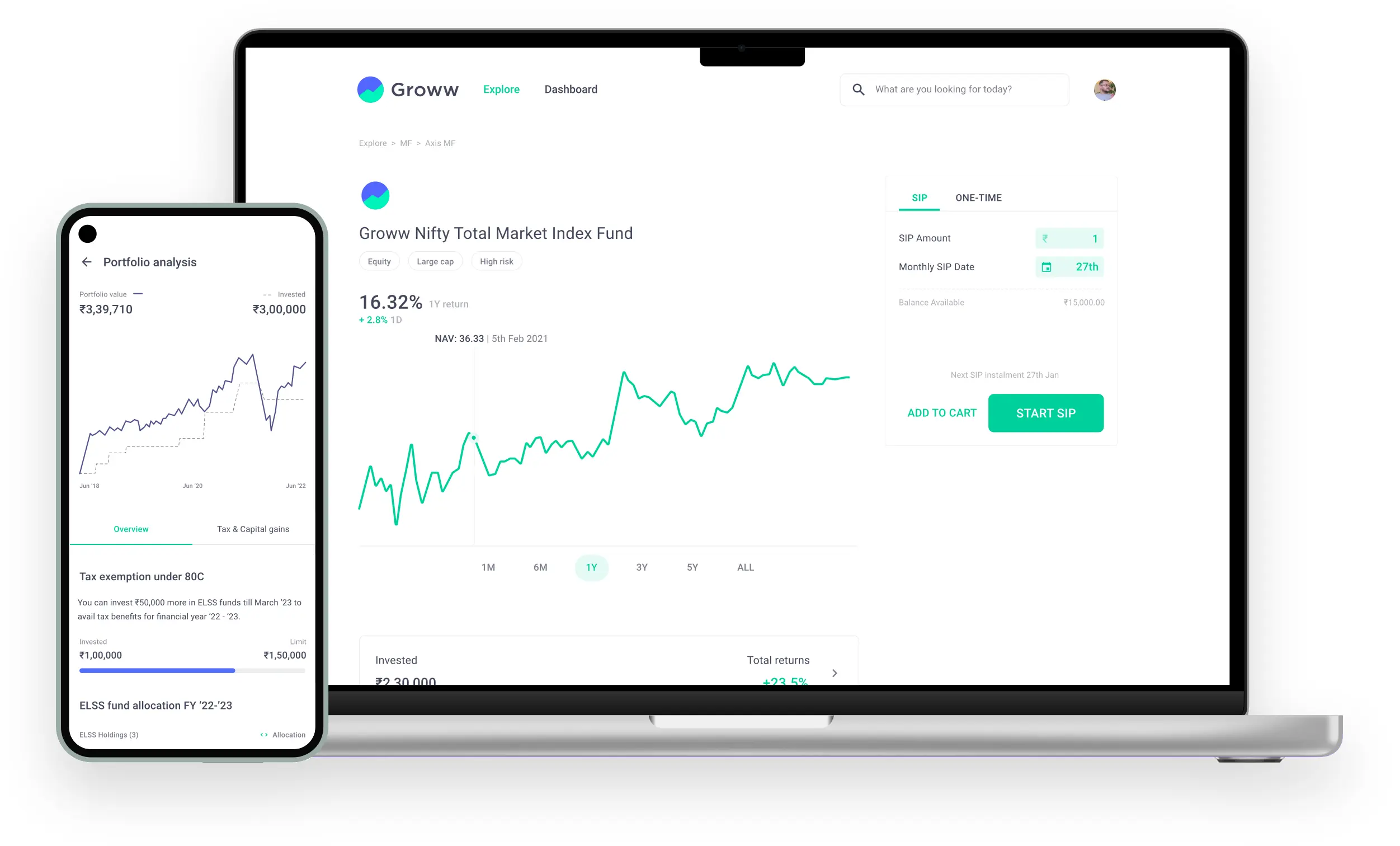

“Groww.in was the platform where I first got onboard to MF and I would have to say, even for a beginner like me it made things quite easier to explore and invest. Groww actually helped me make better-informed decisions.”

“The experience with Groww has been lovely. Investing sounds extremely simple and non-scary to me now. Really smooth.”

“Groww is a great platform for investment. Interactive and clean User Interface. Features like creating your own portfolio are great..I started investing in MF due to Groww only. Very responsive Support team. Always available to help for any query”

“If you are one of those who would like to take control of how you save, use Groww. It’s ridiculously easy portal. It took me 5 mins to set up and 10 mins to find the funds that suited my need and invest.”

“Groww.in was the platform where I first got onboard to MF and I would have to say, even for a beginner like me it made things quite easier to explore and invest. Groww actually helped me make better-informed decisions.”

“The experience with Groww has been lovely. Investing sounds extremely simple and non-scary to me now. Really smooth.”

“Groww is a great platform for investment. Interactive and clean User Interface. Features like creating your own portfolio are great..I started investing in MF due to Groww only. Very responsive Support team. Always available to help for any query”

“If you are one of those who would like to take control of how you save, use Groww. It’s ridiculously easy portal. It took me 5 mins to set up and 10 mins to find the funds that suited my need and invest.”

“Groww.in was the platform where I first got onboard to MF and I would have to say, even for a beginner like me it made things quite easier to explore and invest. Groww actually helped me make better-informed decisions.”

“The experience with Groww has been lovely. Investing sounds extremely simple and non-scary to me now. Really smooth.”

“Groww is a great platform for investment. Interactive and clean User Interface. Features like creating your own portfolio are great..I started investing in MF due to Groww only. Very responsive Support team. Always available to help for any query”

in a minute

ABOUT GROWW

Issued in the interest of Investors