NFO Review: Indiabulls Banking And PSU Debt Fund (Open till May 9th, 2019)

Indiabulls Mutual Fund has recently launched a New Fund Offer (NFO) – Indiabulls Banking and Public Sector Undertaking (PSUs) Debt instrument.

The NFO start date was April 25, 2019, and it will close on May 9, 2019.

The primary objective of this fund is to provide its investors with an income over short to medium term. The objective is planned to achieve through investment in debt and money market securities.

Key Details

| NFO Name | Indiabulls Banking and PSU Debt Fund |

| Class | Debt |

| NFO Launch Date | April 25, 2019 |

| Last Date of Application | May 9, 2019 |

| Minimum Investment Amount | SIP: Rs. 500

Lump sum Rs. 5000 |

| Category | Banking and PSU |

| Nature | Open-ended |

| Fund House | Indiabulls Mutual Fund |

| Fund Manager(s) | Vikrant Mehta |

| Risk | Moderately Low |

| Benchmark | Crisil Banking and PSU Debt |

Fund Manager: Vikrant Mehta

Vikrant Mehta is a CFA and has worked in asset management companies, brokerage firms and other financial companies.

He has worked with AIG Global Asset Management Company (India) Pvt. Ltd., AIG India Liaison office, NVS Brokerage, etc. He was also Assistant Vice President at JM Morgan Stanley Fixed Income Securities Pvt. Ltd.

Mr. Mehta has over 19 years of experience in fixed income securities.

Options Available For Indiabulls Banking and PSU Debt Fund

The scheme offers two plans:

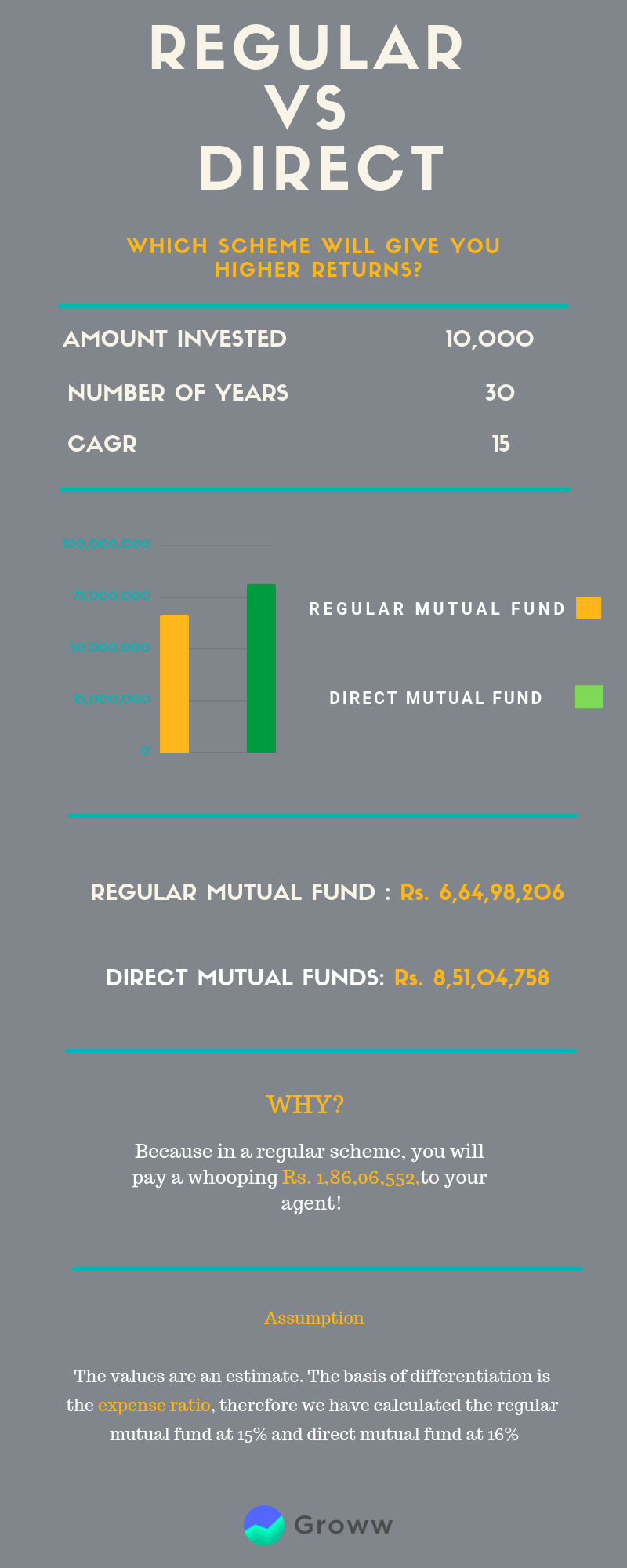

Direct Plan

This scheme is for investors who do not want to route their investment through a distributor. The direct plan shall have a lower expense ratio compared to the regular plan.

Also, the returns are always higher, via the direct plan.

Regular Plan

This plan is for investors who wish to route their investments through the distributor. This plan will have a higher expense ratio compared to the Direct plan. Also, the payment of commission is included.

Both Direct and Regular shall have separate NAVs for the common portfolio. Both shall have Growth and Dividend options. Thus following options are available

- Indiabulls Banking and PSU Debt Fund-Direct Plan (Growth Option)

- Indiabulls Banking and PSU Debt Fund-Direct Plan (Dividend Option – Payout)

- Indiabulls Banking and PSU Debt Fund-Direct Plan (Dividend Option -Sweep)

- Indiabulls Banking and PSU Debt Fund-Direct Plan (Dividend Option -Reinvestment)

- Indiabulls Banking and PSU Debt Fund-Regular Plan (Growth Option)

- Indiabulls Banking and PSU Debt Fund-Regular Plan (Dividend Option – Payout)

- Indiabulls Banking and PSU Debt Fund-Regular Plan (Dividend Option -Sweep)

- Indiabulls Banking and PSU Debt Fund-Regular Plan (Dividend Option -Reinvestment)

One thing to be noted in this scheme is that if dividend payable is equal to or less than Rs. 250 under the dividend payout option, the dividend would then be compulsorily reinvested in the option.

Asset Allocation

Indiabulls Banking and PSU debt fund will be investing in various assets or instruments types, as mentioned below.

| Instruments | Indicative allocation (% of Net Assets)

(Min-Max) |

Risk Profile (High/ Medium/ Low) |

| Debt and Money Market Instruments issued by banks, public sector undertakings (PSUs), public financial institutions (PFIs) and municipal bonds | 80% to 100% | Low to Medium |

| Debt and money market instruments issued by other entities, government securities issued by the central & state government | 0 % to 20% | Low to Medium |

| Units issued by REITs and InvITs | 0% to 10% | Low to Medium |

The above table shows the investment allocation in various instruments under normal circumstances.

*REIT: Real Estate Investment Trust

*InvITs: Infrastructure Investment Trust

The fund may also invest in derivatives. Also, the scheme may invest in repo/ reverse repo in corporate debt securities or government debt securities.

The scheme does not aim to invest in credit default swaps or equity-linked debentures.

Investment Strategy by Indiabulls AMC

The fund seeks to maximize risk-adjusted returns by active management of the portfolio.

This will be done by elongating or shrinking the time duration of debt instruments. In the time of falling interest rates, the duration of investment will be increased.

Whereas, in the time of rising interest rates the duration of investment will be reduced.

Benchmark Performance

The benchmark for Indiabulls Banking and PSU Debt fund will be Crisil Banking and PSU Debt fund. Let’s look at the performance of this benchmark.

| Index | 1 Year Return | 3 Year Return | 5 Year Return |

| CRISIL Banking & PSU Debt Index | 7.24% | 8.07% | 9.02% |

Thus, the benchmark fund has performed better than Bank’s Fixed Deposit given the minimal risk it carries.

Who Should Invest in this Fund?

As the fund involves low to moderate risk, this type of investment typically suits an investor who is taking a little to minimal risk to earn more than a bank’s fixed deposit.

The default risk is minimal in these schemes. Also, we can expect very low volatility on the returns. Thus, this forms a stable return giving portfolio.

Exit load

The scheme states that if investors redeem within 3 days from the date of subscription then an exit load of 0.25% will be charged. Also, if the scheme is redeemed after 3 days of completion then no exit load will be charged.

About Indiabulls Mutual Fund

Indiabulls Mutual fund is a registered mutual fund house with SEBI.

It was established as a trust with Indiabulls Housing Finance Limited and Indiabulls Trustee Company Ltd as its trustee. It was incorporated on April 10, 2008.

The company is now being headed by Raghav Iynger.

The fund house has options in debt, equity and also hybrid. These funds from the inception have seen decent growth in the fund size. This signals the likelihood of investors investing with Indiabulls Mutual Fund.

The fund house’s mission statement is to create a fine balance between safety, liquidity and return in the most ethical and transparent manner. Thus, creating value to the investors.

Happy Investing!

Disclaimer: The views expressed in this post are that of the author and not those of Groww