How to Check the Allotment Status of Anupam Rasayan IPO

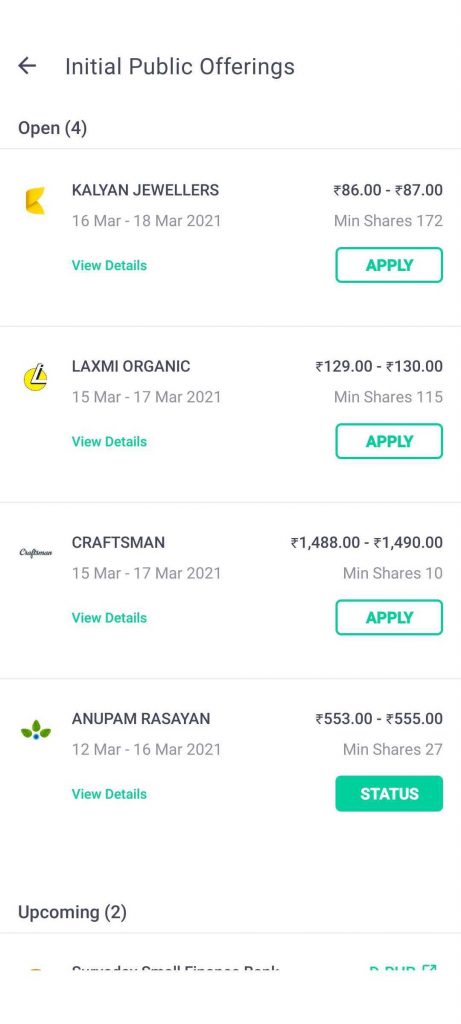

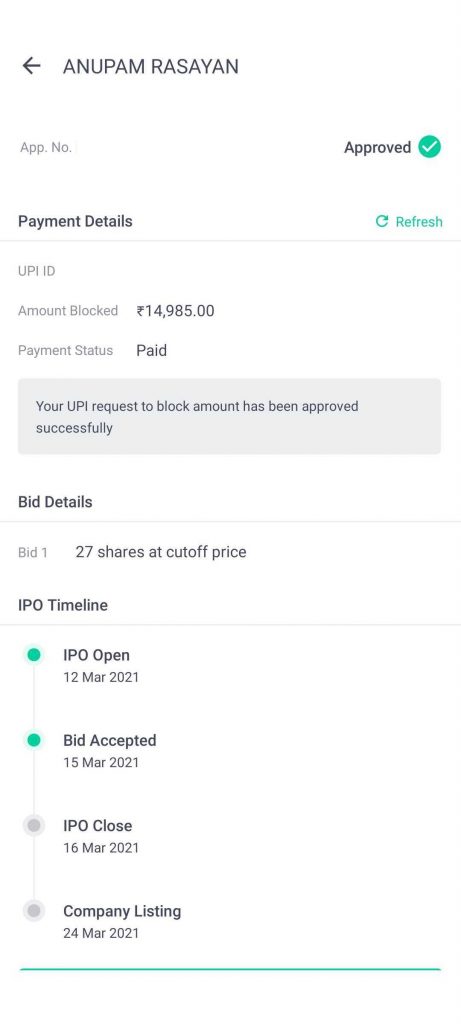

Anupam Rasayan IPO was open for subscription between March 12 and 16. The price band of the IPO was Rs 553 to 555 per share and one market lot consists of 27 shares.

The shares of the company are proposed to be listed on March 24.

The IPO allotment status will be finalised by March 19-20. You will not be able to check the allotment status until then.

Check Allotment Status

Here’s how you can check the allotment status:

There are three primary ways to check the status:

1. Check Allotment Status on Groww

Once the allotment status is finalized, you can check your status on Groww, if you had applied for this IPO on our platform. Here are the steps:-

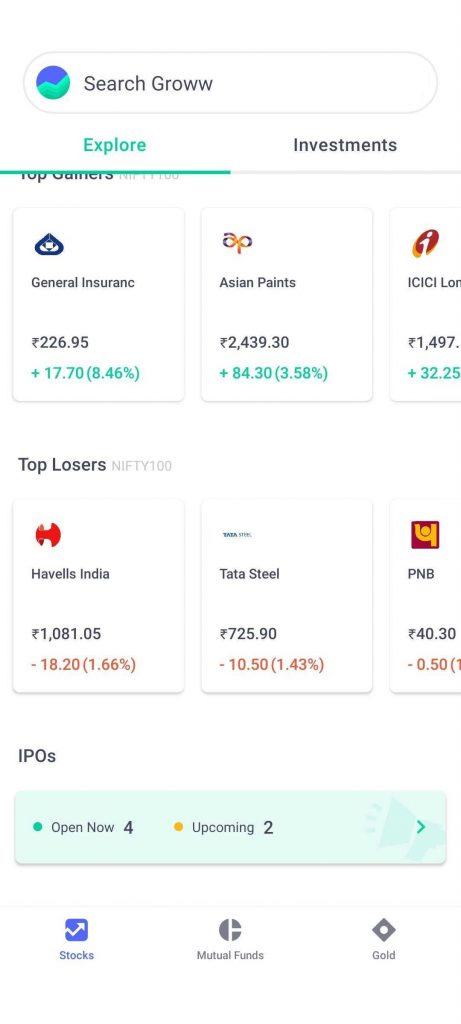

Step 1: Open the Groww App, scroll down the homepage to see the ‘IPOs’ section.

Step 2: Click on IPOs. On the next page click on the ‘Status’ tab next to the Anupam Rasayan IPO (or any other IPO you had applied for). The status tab will not be visible if you have not applied for the IPO.

Step 3: If you have received the allotment in the IPO, ‘Allotted’ will be written next to your application number. Or else, the status will show as ‘Rejected’. It will show as ‘Approved’ till the allotment is finalized.

2. Check Allotment Status on the Registrar’s website

The registrar for the IPO is KFintech Private Limited and the shares are proposed to be listed on the BSE and NSE.

After you land on the website’s IPO status page, you will see a drop-down menu that says ‘Select Menu’.

- Select the IPO allotment status that you want to check.

- Choose one of the three identity options—Application Number, DPID/Client ID, or PAN.

- Select the Application type. If you chose the Application Number in step 2, you can select ASBA or NON-ASBA and then enter the application number. If you chose DPID/Client ID, select NSDL or CDSL and enter the DPID and Client ID. If you selected PAN, enter the PAN number.

- Enter the six-digit Captcha.

- Click “Submit” to generate your IPO allotment status report.

3. Check Allotment Status on BSE/NSE

You can also check the allotment status on the Bombay Stock Exchange’s

Step 1 – Go to link – https://www.bseindia.com/investors/appli_check.aspx

Step 2 – Select Equity

Step 3 – Select Issue Name (Anupam Rasayan IPO)

Step 4- Enter Application Number as well as PAN

Step 5 – Click on the search button to know the Anupam Rasayan IPO Share Allotment Subscription Status

You can also check on NSE by doing a one-time registration.

Companies | Type | Bidding Dates | |

| Regular | Closes Today | ||

| Regular | - | ||

| Regular | - | ||

| Regular | - | ||

| Regular | - |

FAQs on Anupam Rasayan IPO Allotment

1. How do I know if I have received Anupam Rasayan Allotment or not?

We have discussed the steps to know about Anupam Rasayan allotment.

2. What happens to the IPO amount in my bank account?

After applying for an IPO, the required amount is blocked for use from your account. Hence the money is still showing in your balance but is blocked for use.

3. How are the Anupam Rasayan shares being allotted?

If Anupam Rasayan IPO is oversubscribed, the shares will be distributed proportionately among investors so that each investor gets a minimum of one lot. This is done on a lottery basis, so there cannot be a guarantee that you will get the shares. It is possible that few investors do not get any shares at all, in case of over-subscription.

4. Will my money come back if I don’t get Anupam Rasayan IPO allotment?

If you don’t get the allotment in Anupam Rasayan IPO, the amount will be unblocked, and you will be able to use the amount in your bank account.

5. When will Anupam Rasayan IPO get listed?

Nureca shares will get listed on BSE and NSE on March 24, 2021.

Happy Investing!