How to Apply for Rights Issue

Rights issue is when the company gives rights to its existing shareholders to purchase new shares of the company based on their previous or existing holding at a discounted price.

It is not mandatory for the shareholder to apply for this. The company is giving them a choice to apply.

Why Does a Company Announce Rights Issue?

Companies usually announce rights issues predominantly to raise more capital. Additionally, they could also announce it in cases of any mergers or acquisitions deals, share price dilution to increase higher participation.

While the company can get the money directly from the public as an IPO or as an FPO, it is relatively expensive when compared to a rights issue. Therefore, these companies prefer to raise the requisite amount from their existing shareholders.

How to Apply for a Rights Issue?

The company will send a form to every shareholder entitled to receive the rights issue. The process is completed either in online or offline modes.

Investors may receive a Rights Entitlement (RE) intimation in their email that is a temporary form of Demat securities. This lets an investor ascertain the eligibility to apply for the rights issue. If they don’t want to apply, they can even sell their RE to other investors in the secondary market.

-

ASBA/Net Banking Process

Application forms can be submitted in physical mode at bank branches or through net banking. Most large banks, including Axis, HDFC Bank, ICICI Bank, SBI, and Kotak Mahindra Bank, have enabled applications through net banking platforms. It is very similar to an IPO application.

1) Investors can visit their brokerage account online, go to the ASBA services option

2) Select the IPO/FPO/BUYBACK option that will show all the Rights issues available

3) Fill in the quantity you want to buy and submit the application

4) Check the terms and conditions box

5) Make sure you have sufficient funds to process the transaction

6) Process the transaction and check the order book

There is also an RTA (Registrar and Transfer Agent) website where you can submit your application.

-

Via RTA

CAMS and KFin Technologies Limited are examples of RTAs (Registrar and Transfer Agents) in India. We have used KFin Technologies Limited as an example to explain the process below.

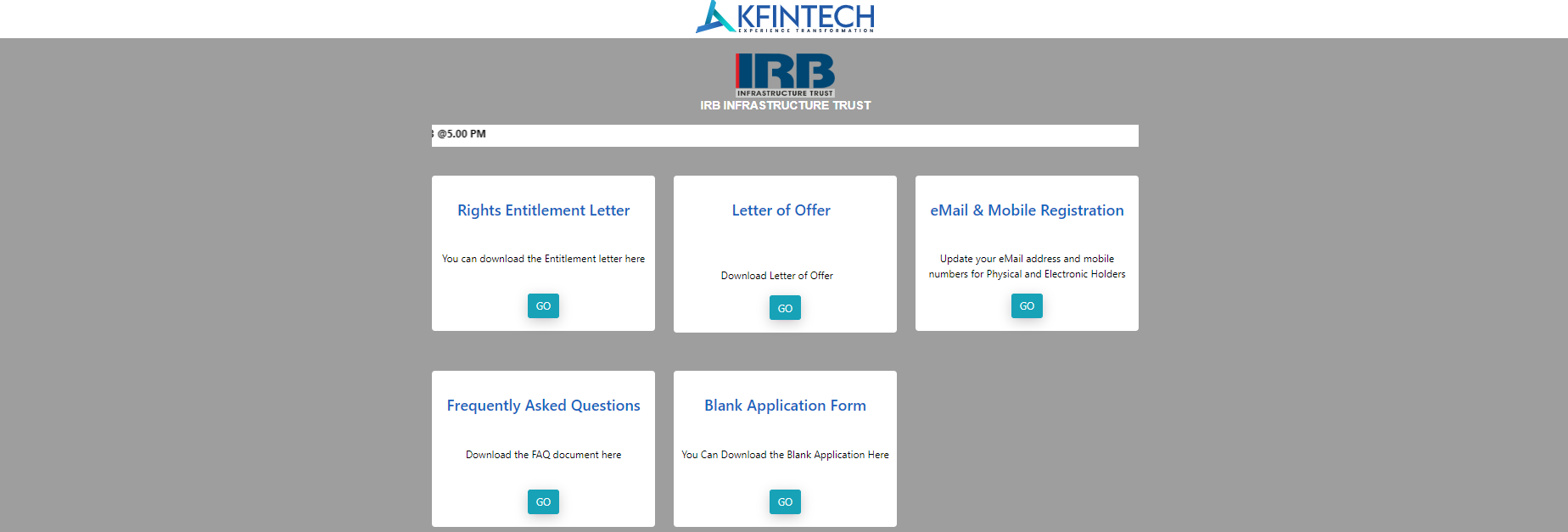

Step 1: Visit the KFin Technologies Limited RTA website (https://rights.kfintech.com/). You will see the option to apply only when the rights issue is open. Here is an example-

You will have to click on the option “ Apply for rights issue”, which will get enabled on the date of opening. But before that, click on the “email and Mobile registration”.

Step 2: Select whether you have physical shares or select the depository with which you have an account.

Step 3: Enter basic details such as DP ID, client ID, and Captcha and click on Submit.

Step 4: Register your email ID and mobile number on the next page.

Registering your mobile number and email ID will ensure all the allotment details reach you.

Now in case you have already opened your Demat account, but are holding RIL shares in physical form, then click on the next tab, which is Demat Account Number Information Registration and follow the instructions mentioned on the screen. Once you click on proceed, you will be asked to enter your PAN number, Demat account number, etc.

And that’s it, the next thing you need to do to apply for the rights issue when the option is available on May 20. You can then make payment for your order via UPI or NEFT.

Please note the UPI limit is Rs 2 lakh, and Rs 314.25 for every share you place an order for, will be debited immediately from your bank account. In case you receive fewer shares than you applied for, the excess amount will be refunded to your bank account.

|

Take Note Once your order for the rights is placed successfully, the order amount will get blocked in your bank account. The amount blocked in the bank account cannot be used for other purposes, which means you can’t withdraw. The money is safe in your account. If you are not allotted the share, the amount for which you have applied for the rights issue will be unblocked and can be withdrawn by you. So plan your liquidity needs accordingly. |

How Does Rights Issue Work?

Let us understand with an example.

Suppose you are an investor who owns 100 shares of XZ company, and it comes out with a rights issue to bring down its debt level. As you are already a shareholder, you are eligible for XZ’s rights entitlement in proportion to your existing holding. Suppose the company offers 30 shares for every 100 shares held at a discounted price of Rs 20 per share. Let’s assume the current value in the market is Rs 50 per share.

So you will be able to apply for 30 shares at Rs 20 per share. In case you held 200 shares of the company, you are eligible to apply for 60 shares in the rights issue.

Rights Entitlement is a temporary credit of shares of XZ company in your demat account. It allows you to apply or trade in those entitled shares. Note that the credit of rights entitlement doesn’t mean that you have to compulsorily buy or subscribe for the rights issue. You can sell your rights in the market. Every shareholder can accept or sell off their rights issue.

Investors find this as a great investment option due to the reduction of share price value compared to its actual price in the market and thus invest in the rights issue. Now, let us look at the process of applying for the rights issue.

Should You Apply for Rights Issue?

Though the rights issue has its benefits, one should be cautious while applying for such issues. There can be several red flags. For instance, the company may not be in a good financial condition to go for a public offer. Or the company could be low on cash and in need of funds to pay debts.

As tempting as it may sound, investing all the hard-earned money without proper research won’t be a wise decision. Rights issue is a good deal for the investor, but if the financials of the company are shaky, then it could be a desperate move by the company to get funding.

On the other hand, if the company has been a good dividend payer and the stock price is always high for you to invest, then rights issues are the opportune time for you to invest.

So, as an investor of a company, you have the right to sell your entitlement and make money.

|

You may also want to know |

|

|

1. |

How to Invest in Share Market |

|

2. |

How to Open a Demat Account Online |

|

3. |

How to Buy Stocks Online |

|

4. |

How to Select Stocks for Intraday Trading |

|

5. |

How Much Money Can You Make in Trading Stocks |